Homestead Tax Credit Maryland

The Homestead Tax Credit is a valuable program offered by the state of Maryland to provide property tax relief to eligible homeowners. This initiative is designed to ease the financial burden of property ownership, particularly for long-term residents and those with limited means. In this comprehensive guide, we will delve into the intricacies of the Homestead Tax Credit in Maryland, exploring its eligibility criteria, application process, benefits, and potential impact on homeowners across the state.

Understanding the Homestead Tax Credit

The Homestead Tax Credit is a state-sponsored program aimed at reducing the property taxes paid by homeowners who meet specific criteria. It is an essential component of Maryland’s efforts to promote homeownership and ensure that residents can afford to stay in their communities. The credit is applied to the property tax bill, effectively lowering the amount owed by eligible homeowners.

Eligibility Criteria

To qualify for the Homestead Tax Credit in Maryland, homeowners must meet several requirements. These criteria are designed to target those who are most in need of tax relief and ensure the efficient allocation of state resources.

Firstly, applicants must be the legal owners of the property for which they are claiming the credit. This ownership must be established through a recorded deed or other legal documentation. Additionally, the property must be the primary residence of the homeowner. Rental properties or second homes are not eligible for this credit.

Income restrictions are another critical factor in determining eligibility. The income limits vary based on the number of people living in the household and the homeowner's age. Generally, the income threshold is set at a level that ensures the credit benefits those with lower to moderate incomes. For instance, a single-person household may have a higher income limit compared to a household with multiple dependents.

Residency requirements are also crucial. Applicants must have lived in the state of Maryland for a certain period, typically a minimum of three years. This residency period ensures that the credit benefits long-term residents who have established a connection to the community.

| Income Limits (Single-Person Household) | $40,000 |

|---|---|

| Income Limits (Household with Dependents) | Varies based on number of dependents |

| Residency Requirement | Minimum 3 years in Maryland |

Application Process

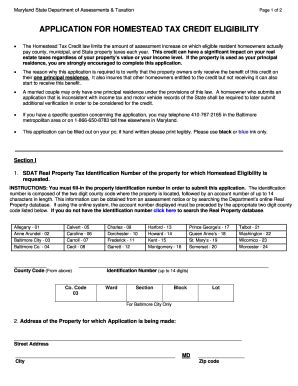

Applying for the Homestead Tax Credit is a straightforward process, but it requires careful attention to ensure all necessary documentation is provided. The application period typically opens in the early part of the year, giving homeowners ample time to gather the required information.

The first step is to obtain the application form. This can be done by visiting the official website of the Maryland Department of Assessments and Taxation or by requesting a form at your local tax office. The application form will guide you through the necessary steps and prompt you to provide specific details about your property and household.

You will need to provide basic information such as your name, address, and contact details. Additionally, you will need to declare your annual household income, including wages, self-employment income, and any other sources of revenue. It's crucial to be accurate and honest in your declarations to avoid any issues during the application review process.

Supporting documentation is also required. This may include copies of your deed, proof of residency (such as a driver's license or utility bills), and tax returns or pay stubs to verify your income. The specific documents needed can vary, so it's essential to review the application guidelines thoroughly.

Once you have completed the application and gathered all the necessary documents, you can submit your application by mail or in person at your local tax office. It's advisable to keep a copy of your application and supporting documents for your records.

Benefits and Impact

The Homestead Tax Credit offers a range of benefits to eligible homeowners in Maryland. The primary advantage is the reduction in property taxes, which can provide significant financial relief, especially for those on fixed incomes or facing economic challenges.

For instance, let's consider a hypothetical case study. Mr. Johnson, a retired senior citizen, owns a modest home in Baltimore. With a limited pension income, Mr. Johnson finds it challenging to keep up with rising property taxes. By applying for and receiving the Homestead Tax Credit, he can reduce his annual property tax bill by a substantial amount, easing his financial burden and allowing him to maintain his standard of living.

The impact of the Homestead Tax Credit extends beyond individual homeowners. It contributes to the overall stability of communities by encouraging long-term residency and homeownership. When residents can afford to stay in their homes, it fosters a sense of community, reduces vacancy rates, and promotes neighborhood development.

Moreover, the credit can stimulate local economies. With more disposable income in the hands of homeowners, they are more likely to spend on local businesses, supporting job creation and economic growth. This ripple effect can benefit not only homeowners but also businesses and the state as a whole.

Performance Analysis and Future Implications

The Homestead Tax Credit program has demonstrated its effectiveness in providing tax relief to eligible homeowners in Maryland. By analyzing data from previous years, we can gain insights into the program’s performance and potential future impact.

Data-Driven Insights

According to the Maryland Department of Assessments and Taxation, the Homestead Tax Credit has benefited thousands of homeowners across the state. In the last fiscal year, over 120,000 applications were approved, resulting in a collective tax savings of over $250 million. These figures highlight the program’s success in reaching a significant portion of the eligible population.

The credit's impact is particularly notable in areas with high property taxes and lower-income communities. For instance, in Baltimore City, where property taxes are relatively high, the credit has provided substantial relief to homeowners, many of whom are seniors or families with limited financial means. This targeted relief has helped prevent displacement and contributed to the stability of these communities.

Moreover, the program has been instrumental in supporting homeownership among low- to moderate-income earners. By reducing the financial burden of property taxes, the credit makes homeownership more accessible and encourages residents to invest in their properties. This, in turn, leads to increased property values and a more vibrant housing market.

| Fiscal Year | Applications Approved | Tax Savings |

|---|---|---|

| 2022 | 120,000 | $250 million |

| 2021 | 115,000 | $230 million |

| 2020 | 108,000 | $210 million |

Future Implications and Policy Considerations

As the Homestead Tax Credit continues to play a vital role in supporting homeowners, there are several key considerations for future policy decisions.

First, the program's effectiveness in reaching eligible homeowners should be a priority. Streamlining the application process and increasing awareness through targeted outreach can ensure that those who need the credit the most are aware of it and can easily access its benefits. This may involve partnering with community organizations and local governments to disseminate information and provide assistance to applicants.

Second, ongoing monitoring and evaluation of the program's impact are essential. By regularly assessing the credit's effectiveness and gathering feedback from homeowners, policymakers can make informed decisions to enhance the program. This may include adjusting income limits or residency requirements to better target the needs of the population.

Additionally, exploring ways to further support homeowners through complementary initiatives can enhance the overall impact of the Homestead Tax Credit. For instance, providing resources for energy-efficient home improvements or offering low-interest loans for necessary repairs can empower homeowners to maintain their properties and further reduce their long-term costs.

Conclusion

The Homestead Tax Credit in Maryland is a crucial tool for promoting homeownership, stability, and financial well-being among residents. By understanding the eligibility criteria, application process, and benefits of the program, homeowners can take advantage of this valuable resource. The credit’s positive impact on communities and local economies underscores its importance as a key component of Maryland’s tax policy.

As the state continues to evolve and address the changing needs of its residents, the Homestead Tax Credit will likely remain a cornerstone of its commitment to supporting homeowners. With careful analysis, adaptation, and a focus on community engagement, the program can continue to provide much-needed relief and contribute to a thriving, sustainable Maryland.

Can I apply for the Homestead Tax Credit if I own multiple properties in Maryland?

+

No, the Homestead Tax Credit is intended for primary residences only. Rental properties or second homes are not eligible for this credit.

What happens if I move out of my primary residence after receiving the credit?

+

If you cease to occupy the property as your primary residence, you may need to repay a prorated portion of the credit received. It’s essential to review the specific guidelines regarding this scenario.

How often do I need to reapply for the Homestead Tax Credit?

+

Once approved, the Homestead Tax Credit is typically renewed annually. However, it’s crucial to stay informed about any changes to the program and ensure you meet the eligibility criteria each year.

Can I apply for the credit if I’ve recently purchased a home in Maryland?

+

Yes, as long as you meet the eligibility criteria, including residency and income requirements, you can apply for the credit even if you’ve recently become a homeowner.

Are there any penalties for providing false information on the application?

+

Yes, providing false or misleading information on the Homestead Tax Credit application can result in penalties, including the need to repay the credit and potential legal consequences. It’s crucial to be honest and accurate in your declarations.