Property Tax Relief New Jersey

Navigating Property Tax Relief in New Jersey: A Comprehensive Guide

Property taxes are a significant expense for homeowners, and understanding the various relief programs and exemptions available can make a substantial difference in managing your financial obligations. New Jersey, known for its high property tax rates, offers a range of options to provide relief to its residents. This guide aims to provide an in-depth analysis of these programs, offering a comprehensive understanding of how you can benefit from them.

In New Jersey, property taxes contribute to funding local government services, including schools, police departments, and infrastructure. The state's tax system is complex, with tax rates varying significantly between municipalities. As a result, homeowners often seek ways to reduce their tax burden, and the state has responded by implementing several initiatives.

Understanding Property Tax Relief in New Jersey

Property tax relief in New Jersey takes various forms, including senior citizen and disability exemptions, homestead rebates, and tax abatement programs. These initiatives aim to ease the financial burden on homeowners, particularly those who are elderly, disabled, or facing economic hardships.

Senior Citizen Tax Relief

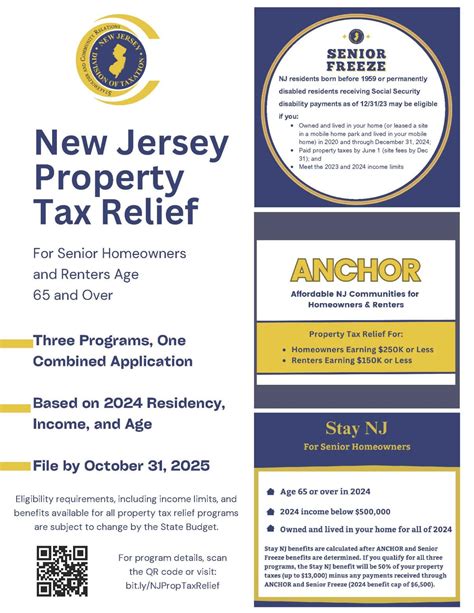

The Senior Freeze Program, officially known as the Property Tax Reimbursement Program, provides an annual reimbursement to eligible senior citizens for property tax increases. To qualify, homeowners must be at least 65 years old, have a gross household income below a specified threshold, and have lived in their home for at least three consecutive years. The program aims to stabilize the property tax burden for seniors, ensuring they are not priced out of their long-term residences.

| Program Name | Eligibility Criteria |

|---|---|

| Senior Freeze Program | Age 65+, Gross Income below $100,000, and 3-year residency |

In the most recent tax year, the program reimbursed seniors up to $965, a substantial relief for many elderly homeowners.

Homestead Rebate Program

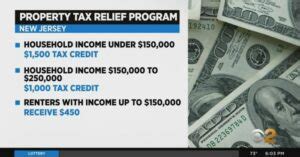

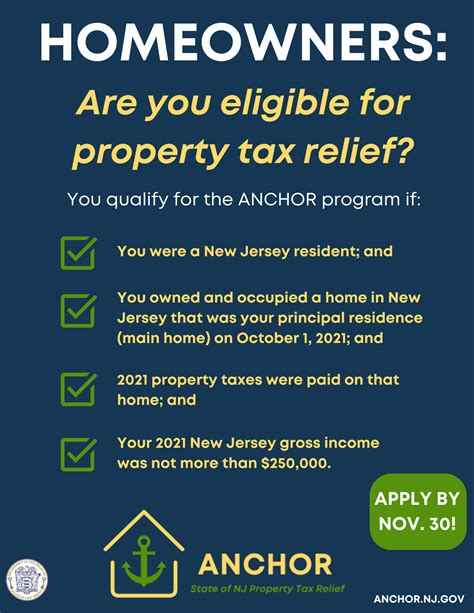

The Homestead Benefit Program offers a direct rebate to eligible homeowners. To qualify, homeowners must meet specific income requirements and own their home as their primary residence. The rebate amount is determined by a complex formula that considers the homeowner’s income, the assessed value of the property, and the local tax rate. In the past tax year, the program provided rebates ranging from a few hundred to over a thousand dollars, significantly reducing the property tax burden for many New Jersey residents.

| Program Name | Rebate Range |

|---|---|

| Homestead Benefit Program | $300 - $1,000 |

Veterans and Disabled Exemptions

New Jersey offers several exemptions for veterans and disabled residents. The Veterans’ Property Tax Deduction program provides a deduction from assessed value for qualifying veterans, which directly reduces their property tax bill. Additionally, the Disabled Veterans’ Exemption program offers a full exemption from property taxes for eligible disabled veterans. These programs honor the service and sacrifice of veterans and provide a much-needed financial benefit.

| Program Name | Description |

|---|---|

| Veterans' Property Tax Deduction | Deduction from assessed value for qualifying veterans |

| Disabled Veterans' Exemption | Full exemption for eligible disabled veterans |

Other Tax Relief Programs

New Jersey also has initiatives like the Farmland Assessment Program, which provides lower property tax assessments for farmland, and the Urban Enterprise Zone (UEZ) Tax Incentive Program, which offers reduced sales tax rates in designated urban areas to encourage economic growth and provide tax relief to local businesses and residents.

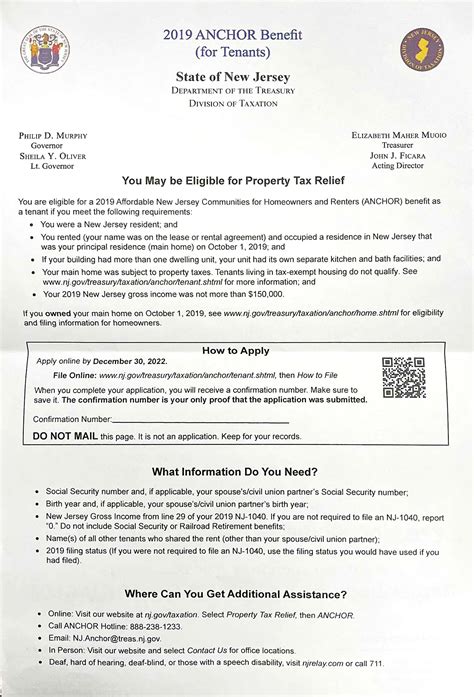

Applying for Property Tax Relief

The application process for property tax relief programs in New Jersey can be complex and varies depending on the specific program. Generally, homeowners need to complete an application form, provide supporting documentation, and meet the eligibility criteria. It’s crucial to carefully review the requirements for each program and ensure that all necessary information is submitted accurately and on time.

Key Application Steps

- Review the eligibility criteria for the desired program.

- Gather all required documents, including income statements, property records, and proof of residency.

- Complete the application form accurately and thoroughly.

- Submit the application by the specified deadline.

- Follow up with the relevant government agency to ensure your application is received and processed.

Maximizing Your Property Tax Relief

Navigating the various property tax relief programs in New Jersey can be challenging, but understanding your options and taking advantage of the available benefits can significantly reduce your tax burden. It’s essential to stay informed about the latest changes to these programs and to ensure you meet all the necessary criteria to qualify.

Additionally, keeping your property records up-to-date and understanding the assessed value of your home can help you make informed decisions about the programs that best suit your needs. Remember, every dollar saved on property taxes is a step towards financial security and peace of mind.

Expert Tips for Optimal Relief

- Stay informed about program changes and updates.

- Keep accurate records of your property’s assessed value and any relevant documentation.

- Consider consulting a tax professional for personalized advice on maximizing your tax relief.

- Don’t hesitate to reach out to government agencies for clarification on program details.

The Future of Property Tax Relief in New Jersey

The landscape of property tax relief in New Jersey is ever-evolving, with the state continuously working to improve and expand its programs to better serve its residents. While the current initiatives provide significant relief, there is ongoing discussion and advocacy for further reform to make these programs more accessible and beneficial.

Proposed changes include expanding eligibility criteria, increasing rebate amounts, and introducing new initiatives to support a broader range of homeowners. These potential reforms aim to address the diverse needs of New Jersey's residents and ensure that property taxes remain manageable for all.

As the state moves forward with these initiatives, it's crucial for homeowners to stay informed and engaged. By understanding the potential changes and advocating for their needs, residents can play an active role in shaping the future of property tax relief in New Jersey.

Advocacy and Engagement

Getting involved in the discussion about property tax relief can make a significant difference. Here are some ways you can contribute:

- Attend local government meetings to voice your concerns and suggestions.

- Connect with community organizations focused on tax relief advocacy.

- Stay updated on proposed legislation and share your feedback with your local representatives.

- Spread awareness about existing programs to ensure all eligible residents can access the benefits.

Conclusion

In conclusion, navigating property tax relief in New Jersey requires a deep understanding of the available programs and a proactive approach to ensuring you receive the benefits you’re entitled to. By staying informed, advocating for your needs, and taking advantage of the various relief initiatives, you can significantly reduce your property tax burden and secure your financial future.

Remember, every step towards financial stability is a step towards a brighter future. Keep learning, keep advocating, and keep making the most of the resources available to you.

How often do property tax relief programs change in New Jersey?

+Property tax relief programs in New Jersey undergo periodic reviews and updates. While some programs have remained relatively stable, others are subject to annual or biennial changes. It’s essential to stay informed about these changes to ensure you meet the most current eligibility criteria and take advantage of any program enhancements.

Can I apply for multiple property tax relief programs simultaneously?

+Yes, you can apply for multiple programs, but each application must be completed separately and meet the specific eligibility criteria for that program. It’s crucial to carefully review the requirements for each program to ensure you qualify and to understand how the benefits of each program may interact.

Are there any programs specifically for first-time homebuyers in New Jersey?

+Yes, New Jersey offers the First-Time Homebuyer Tax Credit Program, which provides a tax credit of up to $5,000 for eligible first-time homebuyers. This program aims to make homeownership more accessible and affordable for New Jersey residents. However, there are specific income and purchase price limits, so it’s important to review the criteria carefully.