Ct Tax Payment

For Connecticut residents and businesses, understanding the process and options for tax payment is crucial. The state offers a range of methods to fulfill this financial obligation, catering to different preferences and circumstances. This article aims to provide a comprehensive guide, detailing the various ways to pay taxes in Connecticut, along with relevant tips and insights to ensure a smooth and efficient process.

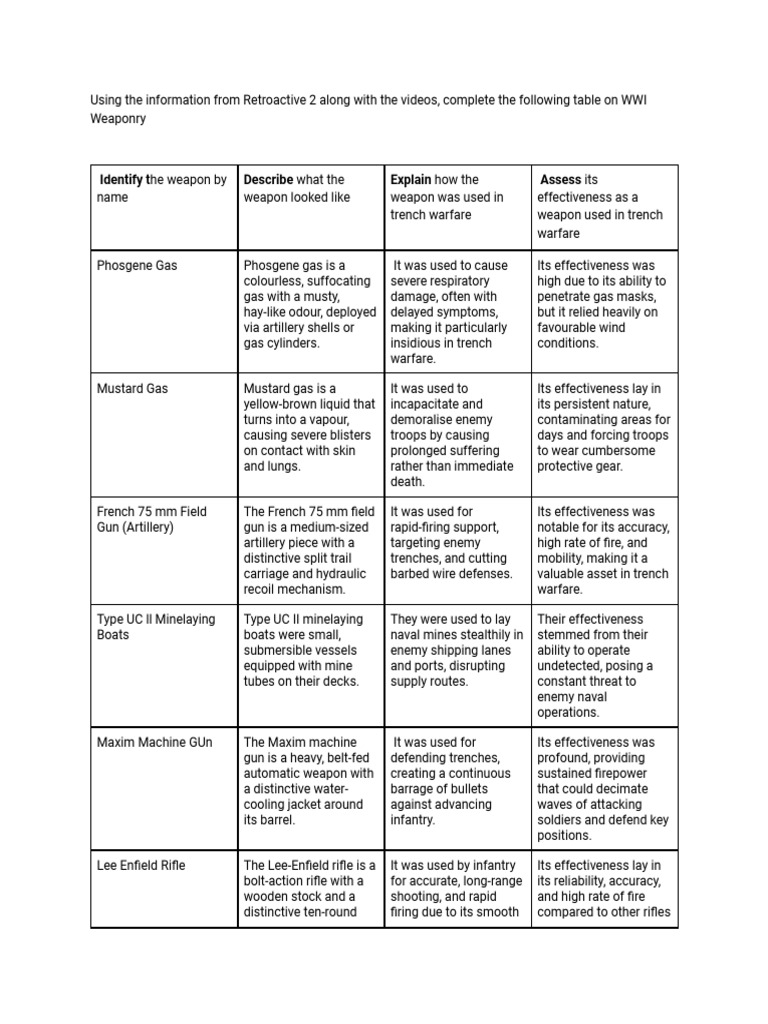

Online Tax Payment: The Digital Advantage

In today’s digital age, the Connecticut Department of Revenue Services (CT DRS) offers a convenient online platform for taxpayers to manage their obligations. This method is not only time-efficient but also provides a secure and transparent process, ensuring peace of mind for those paying their taxes.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer is a popular choice for taxpayers looking for a direct and secure method. With EFT, taxpayers can authorize the CT DRS to directly withdraw the tax amount from their bank account. This method eliminates the need for physical checks and reduces the chances of errors or delays.

To set up EFT, taxpayers need to provide their banking details, including account and routing numbers, through the CT DRS website. The service is free, and taxpayers can choose the date for the withdrawal, giving them control over their finances.

Credit Card Payments

For those who prefer the convenience of credit card payments, CT DRS has partnered with official payment processors to offer this option. While a convenience fee is applied, this method allows taxpayers to pay their taxes quickly and easily without the need for traditional banking methods.

To make a credit card payment, taxpayers can visit the CT DRS website and select the relevant option. The site will redirect them to a secure payment gateway, where they can enter their card details and complete the transaction.

Online Banking Payments

Many banks now offer the convenience of online bill pay services, which can be utilized for tax payments as well. Taxpayers can log into their online banking platform, select CT DRS as a payee, and schedule the payment for a future date or pay immediately. This method offers flexibility and can be especially useful for those who manage their finances primarily through online banking.

| Payment Method | Convenience Fee |

|---|---|

| Credit Card | 2.35% of the transaction amount, with a minimum of $3.95 |

| Electronic Check | None |

Traditional Payment Methods: Checks and Money Orders

While online methods are efficient, some taxpayers may prefer the traditional route. Connecticut still accepts checks and money orders as valid forms of payment for taxes.

Check or Money Order Payment

Taxpayers can make their tax payments via check or money order by simply filling out the payment voucher provided with their tax return and mailing it to the address specified by the CT DRS. It’s important to ensure that the payment is made payable to the correct entity, usually the “Connecticut Department of Revenue Services.”

For those who prefer to deliver the payment in person, the CT DRS has designated drop-off locations across the state. This method is especially useful for taxpayers who want immediate confirmation of their payment.

Important Note on Checks

When using checks for tax payments, it’s crucial to ensure that the check has sufficient funds and is not post-dated. Post-dated checks can lead to delays in processing and may result in additional fees or penalties. Always ensure that the check amount matches the tax due, and consider adding a void after the date to prevent any potential misuse.

Payment Plans and Options for Special Circumstances

Connecticut understands that not all taxpayers can pay their taxes in full at once. For those facing financial hardships or unique circumstances, the CT DRS offers various payment plans and options to ensure compliance without causing undue burden.

Payment Plans

Taxpayers who cannot afford to pay their taxes in full can apply for a payment plan with the CT DRS. These plans allow for the payment of taxes over an extended period, making it more manageable for those with financial constraints. The CT DRS offers both short-term and long-term payment plans, depending on the taxpayer’s situation.

To apply for a payment plan, taxpayers need to provide financial documentation and a valid reason for their request. The CT DRS will review the application and determine the terms of the plan, including the monthly payment amount and any associated fees.

Special Circumstances

In cases of natural disasters, severe illness, or other unforeseen events, the CT DRS may offer special consideration for taxpayers. These situations may lead to temporary hardship, making it difficult to meet tax obligations. Taxpayers facing such circumstances should contact the CT DRS as soon as possible to discuss their options and potentially arrange for a temporary delay or alternative payment plan.

Understanding Penalties and Interest

While the CT DRS aims to provide flexible payment options, taxpayers should be aware of the potential penalties and interest that can accrue if payments are not made on time or in full.

Late Payment Penalties

Taxpayers who fail to pay their taxes by the due date may be subject to a late payment penalty. This penalty is calculated as a percentage of the unpaid tax and can quickly add up over time. It’s important to note that the penalty applies even if the taxpayer has a valid reason for the late payment, such as awaiting a refund or correction from a previous return.

Interest on Unpaid Taxes

In addition to late payment penalties, taxpayers may also accrue interest on any unpaid taxes. The interest is calculated daily on the outstanding balance and can significantly increase the overall amount owed. To avoid interest charges, it’s crucial to pay taxes on time or arrange for a payment plan if needed.

Tips for a Seamless Tax Payment Experience

To ensure a smooth and stress-free tax payment process, consider the following tips:

- Keep track of important dates: Mark your calendar with tax due dates to ensure you don't miss any deadlines.

- Stay organized: Keep all tax-related documents and records in one place for easy reference.

- Review your return: Before making a payment, carefully review your tax return to ensure accuracy and completeness.

- Choose the right payment method: Consider your financial situation and choose a payment method that works best for you, whether it's online or traditional.

- Seek assistance: If you have questions or need help, don't hesitate to contact the CT DRS or a tax professional.

Conclusion: A Smooth Journey to Tax Compliance

Understanding the various methods of tax payment in Connecticut is an essential step towards fulfilling your financial obligations as a resident or business owner. With a range of options available, from online payments to traditional methods and even payment plans, the CT DRS aims to make the process as convenient and accessible as possible.

By staying informed and taking advantage of the resources and flexibility offered, taxpayers can navigate the tax payment process with confidence. Remember, while taxes are a necessary part of our society, the journey to compliance can be made smoother with the right knowledge and tools.

What happens if I miss the tax payment deadline in Connecticut?

+Missing the tax payment deadline can result in late payment penalties and interest charges. It’s important to pay your taxes on time to avoid additional costs and potential legal consequences.

Can I pay my taxes in installments without a payment plan?

+While the CT DRS offers payment plans for those who cannot pay their taxes in full, it’s important to note that late payment penalties and interest will still apply. It’s best to contact the CT DRS to discuss your options and potentially arrange for a more manageable payment schedule.

Are there any tax payment options for low-income individuals or families?

+Yes, the CT DRS offers various programs and initiatives to support low-income taxpayers. These include the Earned Income Tax Credit (EITC) and other tax credits and deductions. It’s worth exploring these options to reduce your tax liability and potentially receive a refund.