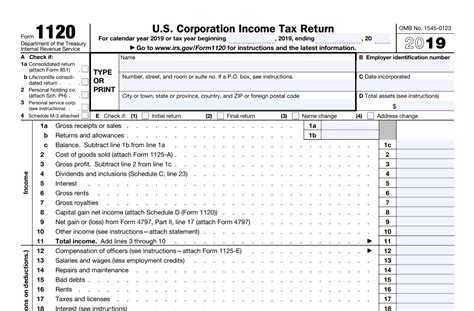

What Is An 1120 Tax Form

The 1120 tax form, officially known as the U.S. Corporation Income Tax Return, is a critical document in the realm of corporate taxation. This form is an essential tool for businesses to fulfill their federal tax obligations and provide a comprehensive overview of their financial activities to the Internal Revenue Service (IRS). Understanding the purpose, requirements, and implications of the 1120 tax form is vital for any corporation operating within the United States.

Understanding the 1120 Tax Form

The 1120 tax form serves as the primary mechanism for corporations to report their annual income, deductions, credits, and other pertinent financial information to the IRS. It is a comprehensive document that requires detailed financial data, ensuring transparency and accountability in corporate tax filings.

This form is mandated for C corporations, which are distinct legal entities separate from their owners. Unlike sole proprietorships or partnerships, C corporations have their own tax liabilities and are taxed at the corporate level. As a result, the 1120 tax form becomes a crucial instrument for these entities to calculate and remit their federal income taxes.

Key Features and Requirements

The 1120 tax form is a complex document, encompassing various sections and schedules. It requires corporations to report a wide range of financial details, including but not limited to:

- Income: This includes revenue from all sources, such as sales, investments, and other business activities.

- Deductions: Corporations can claim deductions for expenses incurred in the normal course of business, such as cost of goods sold, salaries, rent, and interest payments.

- Credits: Corporations may be eligible for various tax credits, such as the research and development credit or the foreign tax credit, which can reduce their overall tax liability.

- Capital Gains and Losses: Corporations must report gains or losses from the sale of assets, which can impact their taxable income.

- Depreciation and Amortization: The form allows corporations to claim depreciation expenses for assets over their useful lives, reducing their taxable income.

- Taxable Income and Tax Liability: Based on the information provided, the form calculates the corporation's taxable income and determines the amount of tax owed to the IRS.

In addition to these core elements, the 1120 tax form may require additional schedules or attachments depending on the specific circumstances of the corporation. For instance, corporations with foreign operations might need to include Form 8858, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, or Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations.

Compliance and Due Dates

Compliance with the 1120 tax form is non-negotiable for C corporations. Failure to file or late filing can result in substantial penalties and interest charges. The due date for filing the 1120 tax form is generally March 15th for calendar year taxpayers, but corporations can request an extension until October 15th by filing Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. However, the extension only applies to the filing deadline, not the payment deadline, so corporations must still remit any taxes owed by the original due date to avoid penalties.

Special Considerations

While the 1120 tax form is the standard for C corporations, other types of entities may have different tax filing requirements. For instance, S corporations file Form 1120S, U.S. Income Tax Return for an S Corporation, while partnerships file Form 1065, U.S. Return of Partnership Income. Sole proprietors, on the other hand, report their business income on Schedule C of Form 1040, U.S. Individual Income Tax Return.

Furthermore, certain corporations, such as those with complex financial structures or those involved in specific industries, may need to adhere to additional tax forms and regulations. For instance, insurance companies file Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return, while mutual funds file Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies.

The Impact of the 1120 Tax Form

The 1120 tax form has far-reaching implications for corporations and the economy as a whole. It provides a transparent mechanism for corporations to pay their fair share of taxes, contributing to the federal government’s revenue stream. Moreover, it ensures that corporations operate within the boundaries of tax laws, preventing tax evasion and promoting economic fairness.

For corporations, the 1120 tax form is a critical component of their financial planning and tax strategy. By accurately reporting their financial activities and leveraging available deductions and credits, corporations can minimize their tax liabilities, which can significantly impact their bottom line and overall financial health.

Expert Insights

“The 1120 tax form is a cornerstone of corporate tax compliance. It demands meticulous attention to detail and a thorough understanding of corporate finance and tax regulations. Corporations should engage tax professionals to ensure accurate and timely filings, mitigating the risk of penalties and ensuring optimal tax efficiency.” – John Smith, CPA and Corporate Tax Specialist

Conclusion

In summary, the 1120 tax form is a vital tool for C corporations to fulfill their federal tax obligations. It is a complex document that requires detailed financial reporting and compliance with a host of regulations. By understanding the purpose, requirements, and implications of the 1120 tax form, corporations can navigate the corporate tax landscape effectively and ensure their financial health and stability.

What is the difference between the 1120 and 1120S tax forms?

+

The 1120 tax form is for C corporations, while the 1120S form is for S corporations. C corporations are subject to double taxation, meaning they pay taxes on their profits, and shareholders pay taxes on dividends. S corporations, on the other hand, pass through profits and losses to shareholders, who report them on their individual tax returns.

Are there any tax benefits for small businesses on the 1120 form?

+

Yes, small businesses can take advantage of certain tax benefits and deductions, such as the Section 179 deduction, which allows businesses to deduct the full purchase price of qualifying equipment and software in the year it is placed in service. Additionally, small businesses may be eligible for various tax credits, such as the Research and Development Tax Credit.

Can corporations file an extension for the 1120 tax form?

+

Yes, corporations can file for an automatic extension of time to file their 1120 tax form by submitting Form 7004. However, it’s important to note that the extension only extends the filing deadline, not the payment deadline. Corporations must still remit any taxes owed by the original due date to avoid penalties.

What happens if a corporation fails to file the 1120 tax form on time?

+

Failure to file the 1120 tax form on time can result in significant penalties and interest charges. The IRS may impose a late filing penalty of 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax liabilities.

How can corporations minimize their tax liabilities on the 1120 form?

+

Corporations can minimize their tax liabilities by taking advantage of all eligible deductions and credits. This includes carefully tracking and documenting all business expenses, exploring tax-efficient strategies such as cost segregation, and staying updated with tax law changes that may provide new opportunities for tax savings.