Aarp Tax Preparation Locations 2025

Welcome to our in-depth guide on AARP's tax preparation services and the locations where you can access their expert assistance for the 2025 tax season. AARP, the leading organization dedicated to empowering Americans aged 50 and over, offers a range of valuable resources and services, including tax preparation. In this article, we will explore the significance of AARP's tax preparation program, its benefits, and the locations where you can find their tax preparation sites across the United States.

The Importance of AARP Tax Preparation

As we navigate the complex world of tax filing, having access to reliable and affordable tax preparation services becomes crucial, especially for individuals who may face unique challenges or have specific needs. AARP recognizes this need and has established a robust tax preparation program to assist taxpayers, particularly those aged 50 and above, in managing their tax obligations effectively.

AARP's tax preparation services provide a comprehensive range of benefits, ensuring that taxpayers receive accurate and up-to-date information while also offering a personalized experience. Their program is designed to cater to the diverse needs of taxpayers, offering guidance on various tax-related matters, from claiming eligible deductions and credits to understanding tax laws and regulations.

By leveraging the expertise of AARP's trained and certified tax preparers, individuals can navigate the often daunting task of tax filing with confidence and peace of mind. AARP's tax preparation program not only simplifies the tax filing process but also helps taxpayers maximize their tax refunds and minimize their tax liabilities, ensuring they receive the financial benefits they are entitled to.

AARP Tax Preparation Locations: A Nationwide Network

AARP’s commitment to serving taxpayers across the United States is evident in its extensive network of tax preparation locations. With a presence in numerous states and communities, AARP ensures that its tax preparation services are accessible to a wide range of taxpayers, regardless of their geographical location.

As of the 2025 tax season, AARP's tax preparation sites will be strategically located to provide convenient access to taxpayers in both urban and rural areas. These sites are carefully selected to ensure proximity to residential areas, making it easy for taxpayers to visit and receive the assistance they need. Whether you reside in a bustling city or a remote town, AARP aims to bring its tax preparation services closer to you.

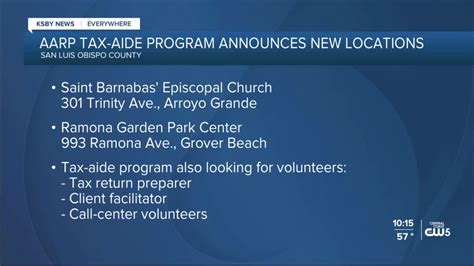

To illustrate the widespread reach of AARP's tax preparation program, let's take a look at some key states and their respective tax preparation locations:

California

With its diverse population and extensive geographical coverage, California plays a significant role in AARP’s tax preparation network. AARP has established multiple tax preparation sites across the state, including major cities like Los Angeles, San Francisco, and San Diego, as well as smaller communities such as Sacramento, Fresno, and Bakersfield. These locations provide convenient access to taxpayers throughout California, ensuring that no one is left behind when it comes to tax assistance.

Texas

Texas, known for its vast size and diverse population, is another state where AARP has a strong presence with its tax preparation services. AARP’s tax preparation sites in Texas are strategically located to cater to taxpayers in various regions. Major cities like Houston, Dallas, Austin, and San Antonio are well-served by AARP’s tax preparation centers, while smaller cities like El Paso, Lubbock, and Corpus Christi also have access to these valuable services.

Florida

Florida, a popular destination for retirees and those seeking a warm climate, is an essential state in AARP’s tax preparation network. AARP has established tax preparation sites in key cities like Miami, Tampa, Orlando, and Jacksonville, ensuring that taxpayers in these areas have easy access to expert tax assistance. Additionally, AARP’s presence extends to smaller cities and towns like Fort Myers, Sarasota, and Tallahassee, showcasing its commitment to reaching all taxpayers in Florida.

New York

In the bustling state of New York, AARP’s tax preparation services are available in several locations, including New York City, Buffalo, Rochester, and Syracuse. AARP’s tax preparation sites in New York cater to the diverse needs of taxpayers, offering guidance and support in navigating the complex tax landscape of the state.

These examples demonstrate AARP's dedication to providing tax preparation services across various states, ensuring that taxpayers have access to expert assistance regardless of their location. AARP's nationwide network of tax preparation sites is a testament to its commitment to empowering individuals aged 50 and over, helping them manage their tax obligations with confidence and ease.

AARP Tax Preparation Services: A Comprehensive Overview

AARP’s tax preparation services go beyond mere tax filing assistance. They offer a comprehensive range of services designed to meet the unique needs of taxpayers, providing them with the support and guidance they require to navigate the tax landscape effectively.

Here's an overview of the key services and benefits you can expect from AARP's tax preparation program:

Expert Tax Preparation Assistance

AARP’s tax preparation program is led by a team of highly trained and certified tax preparers. These professionals have extensive knowledge of tax laws, regulations, and best practices, ensuring that taxpayers receive accurate and up-to-date guidance. Whether you have a simple tax return or a more complex filing situation, AARP’s tax preparers are equipped to handle it all.

Personalized Tax Planning

AARP’s tax preparation services go beyond the standard tax filing process. Their tax preparers work closely with taxpayers to understand their unique financial circumstances and goals. By analyzing their financial situation, AARP’s experts can provide personalized tax planning advice, helping taxpayers make informed decisions to maximize their tax benefits and minimize their tax liabilities.

Deductions and Credits Optimization

AARP’s tax preparation program ensures that taxpayers are aware of all eligible deductions and credits they can claim. Their tax preparers are well-versed in the various tax incentives available, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and various deductions for healthcare expenses, retirement contributions, and more. By maximizing these deductions and credits, taxpayers can significantly increase their tax refunds or reduce their tax liabilities.

E-filing and Tax Refund Options

AARP’s tax preparation services utilize modern technology to streamline the tax filing process. They offer e-filing options, allowing taxpayers to file their tax returns electronically, which is not only more convenient but also faster and more secure. Additionally, AARP provides various tax refund options, including direct deposit, check, or even prepaid debit cards, giving taxpayers flexibility in how they receive their refunds.

Free Tax Preparation for Eligible Individuals

AARP is committed to making tax preparation services accessible to all, especially those who may have limited financial means. As such, AARP offers free tax preparation services to eligible individuals, including those with low to moderate incomes, the elderly, and individuals with disabilities. This initiative ensures that everyone has the opportunity to receive expert tax assistance without financial barriers.

Additional Tax Resources and Support

AARP’s tax preparation program is backed by a wealth of additional resources and support. Taxpayers can access informative articles, videos, and webinars on various tax-related topics, helping them stay informed and educated. Additionally, AARP provides access to tax calculators, tax estimators, and other tools to assist taxpayers in understanding their tax obligations and potential refunds.

AARP Tax Preparation: Enhancing Financial Well-being

AARP’s tax preparation services play a crucial role in enhancing the financial well-being of taxpayers, especially those aged 50 and over. By offering expert guidance and assistance, AARP empowers individuals to make informed financial decisions, maximize their tax benefits, and achieve greater financial stability.

Here's how AARP's tax preparation services contribute to the financial well-being of taxpayers:

Maximizing Tax Refunds

AARP’s tax preparation program helps taxpayers identify and claim all eligible deductions and credits, ensuring they receive the maximum tax refund they are entitled to. By maximizing tax refunds, individuals can use this additional income to pay off debts, save for the future, or invest in their financial goals, ultimately improving their overall financial health.

Minimizing Tax Liabilities

AARP’s tax preparers provide valuable guidance on minimizing tax liabilities. By analyzing taxpayers’ financial situations and understanding their goals, AARP’s experts can offer strategies to reduce tax obligations. This may include recommending tax-efficient investment options, utilizing tax-advantaged retirement plans, or exploring other tax-saving opportunities. By reducing tax liabilities, individuals can retain more of their income, leading to improved financial stability.

Financial Education and Planning

AARP’s tax preparation services are not limited to tax filing assistance. They also provide valuable financial education and planning resources. AARP’s experts can guide taxpayers on various financial topics, such as retirement planning, estate planning, and investment strategies. By offering comprehensive financial advice, AARP empowers individuals to make informed decisions, build wealth, and achieve their long-term financial goals.

Access to Additional AARP Benefits

By utilizing AARP’s tax preparation services, individuals can also gain access to a range of additional benefits offered by AARP. These benefits may include discounts on various products and services, access to healthcare resources, and opportunities to connect with a supportive community of like-minded individuals. AARP’s comprehensive suite of benefits enhances the overall financial and well-being of its members, providing them with valuable resources and support.

Conclusion: Empowering Taxpayers with AARP

AARP’s tax preparation services are a vital resource for taxpayers, particularly those aged 50 and over. By offering expert guidance, personalized assistance, and a range of valuable benefits, AARP empowers individuals to navigate the complex world of taxes with confidence and ease. With its extensive network of tax preparation locations across the United States, AARP ensures that taxpayers have access to the support they need, regardless of their geographical location.

As we approach the 2025 tax season, AARP's tax preparation program will continue to play a crucial role in assisting taxpayers in managing their tax obligations. Whether you are a first-time taxpayer or a seasoned filer, AARP's tax preparation services offer the expertise and support you need to maximize your tax benefits and achieve financial well-being. So, if you are looking for reliable tax preparation assistance, consider turning to AARP and their dedicated team of tax professionals.

How do I find an AARP tax preparation location near me?

+To find an AARP tax preparation location near you, you can visit the AARP website and use their online locator tool. Simply enter your zip code or city and state, and the locator will provide you with a list of nearby tax preparation sites. You can also call AARP’s helpline for assistance in finding the closest location to your residence.

What are the eligibility criteria for AARP’s free tax preparation services?

+AARP offers free tax preparation services to individuals who meet certain eligibility criteria. These criteria typically include having a low to moderate income, being aged 50 or older, or having a disability. You can check the AARP website or contact their helpline to learn more about the specific eligibility requirements for their free tax preparation program.

Can I file my taxes online through AARP’s tax preparation program?

+Yes, AARP offers online tax filing services as part of their tax preparation program. You can visit their website and follow the step-by-step instructions to file your taxes electronically. AARP’s online tax filing platform is secure and user-friendly, making it convenient for taxpayers to complete their tax returns from the comfort of their homes.

What documents do I need to bring to an AARP tax preparation site?

+When visiting an AARP tax preparation site, it’s important to bring all relevant documents and information to ensure a smooth tax filing process. This may include your W-2 forms, 1099 forms, interest and dividend statements, tax records from the previous year, and any other documentation related to your income, deductions, and credits. AARP’s website provides a comprehensive checklist of required documents to help you prepare.

How can I schedule an appointment with an AARP tax preparer?

+To schedule an appointment with an AARP tax preparer, you can visit their website or call their helpline. The website often provides an online scheduling tool where you can choose a convenient date and time for your appointment. Alternatively, you can speak with a representative over the phone to arrange an appointment that suits your availability.