Tax Deduction For Medical Expenses

When it comes to navigating the intricate world of personal finance, understanding the intricacies of tax deductions is crucial, especially for medical expenses. The ability to reduce one's taxable income by claiming eligible medical costs can provide a significant financial relief, making it an important aspect to explore and optimize. This article aims to delve into the specifics of claiming tax deductions for medical expenses, offering a comprehensive guide for individuals looking to maximize their tax benefits.

Understanding Tax Deductions for Medical Expenses

Tax deductions for medical expenses are a vital component of financial planning, especially for individuals and families with substantial healthcare needs. This strategy allows taxpayers to reduce their taxable income by claiming eligible out-of-pocket medical costs, thereby lowering their overall tax liability. The Internal Revenue Service (IRS) provides guidelines on which expenses qualify for deduction, offering a pathway to potential financial relief.

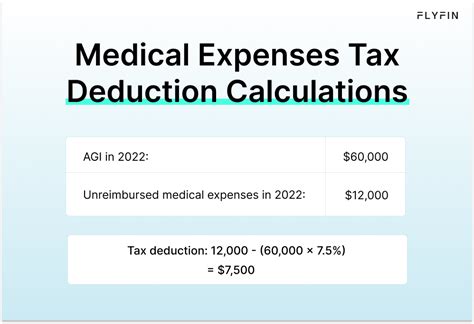

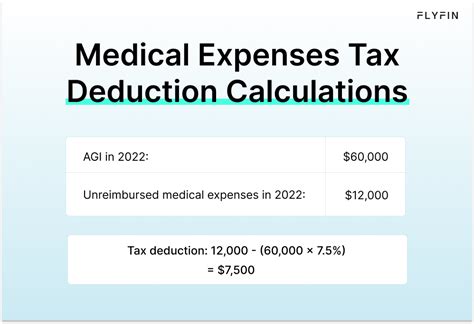

To qualify for a tax deduction, medical expenses must exceed a certain threshold of the taxpayer's adjusted gross income (AGI). This threshold, known as the medical expense deduction floor, is set at 7.5% for the 2022 tax year, a significant decrease from the previous floor of 10% in 2021. This change means that taxpayers can begin deducting their eligible medical expenses once they exceed 7.5% of their AGI, making it easier to claim these deductions.

Eligible Medical Expenses

The IRS has outlined a comprehensive list of eligible medical expenses that taxpayers can claim as deductions. These expenses include:

- Doctor and dentist fees: This covers the cost of consultations, procedures, and treatments provided by medical professionals.

- Hospital expenses: Includes charges for hospital stays, emergency room visits, and surgical procedures.

- Prescription medications: The cost of prescription drugs, including insulin and other medical supplies, is deductible.

- Medical equipment: This category encompasses durable medical equipment such as wheelchairs, crutches, and oxygen equipment.

- Transportation costs: Travel expenses to and from medical facilities for treatment are deductible, including mileage.

- Insurance premiums: Payments for health insurance plans, including Medicare, Medicaid, and long-term care insurance, are eligible for deduction.

- Preventive care: Expenses for preventive measures such as vaccinations, annual check-ups, and screenings are also deductible.

| Eligible Medical Expenses | Description |

|---|---|

| Doctor and Dentist Fees | Consultation, procedures, and treatments. |

| Hospital Expenses | Hospital stays, ER visits, and surgeries. |

| Prescription Medications | Includes insulin and medical supplies. |

| Medical Equipment | Wheelchairs, crutches, and oxygen equipment. |

| Transportation Costs | Travel expenses to medical facilities, including mileage. |

| Insurance Premiums | Health insurance plans, Medicare, Medicaid, and long-term care insurance. |

| Preventive Care | Vaccinations, check-ups, and screenings. |

Maximizing Tax Benefits: Strategies for Medical Expense Deductions

Maximizing tax benefits through medical expense deductions requires careful planning and record-keeping. Here are some strategies to help taxpayers make the most of this opportunity:

Keep Detailed Records

Maintaining meticulous records of all medical expenses is essential. This includes keeping receipts, invoices, and statements for all eligible expenses. Digital records can be particularly useful for easy access and organization.

Bundle Expenses

Bundling medical expenses can help taxpayers reach the medical expense deduction floor more quickly. By grouping expenses from the same year, taxpayers can potentially deduct a larger portion of their medical costs.

Consider Flexible Spending Accounts (FSAs)

Flexible Spending Accounts allow employees to set aside pre-tax dollars to pay for eligible medical expenses. These accounts offer a tax-efficient way to cover medical costs, as the money contributed is not subject to federal income tax, Social Security tax, or Medicare tax.

Review Insurance Coverage

Taxpayers should regularly review their health insurance coverage to ensure it aligns with their medical needs and budget. Higher-premium plans may offer more comprehensive coverage, which can reduce out-of-pocket expenses and potentially increase tax-deductible items.

Explore Tax Preparation Software

Tax preparation software can simplify the process of claiming medical expense deductions. These tools often guide users through the necessary steps, ensuring that eligible expenses are not overlooked and that the taxpayer receives the maximum benefit.

Future Implications and Policy Considerations

The landscape of tax deductions for medical expenses is subject to change, influenced by shifts in healthcare policies and tax reforms. As such, taxpayers should remain vigilant about updates to ensure they are maximizing their deductions under the current guidelines.

Additionally, policy discussions surrounding healthcare and tax reform often propose changes to the medical expense deduction. These proposed changes can have significant implications for taxpayers, potentially altering the eligibility criteria and the overall impact of these deductions. Staying informed about these discussions is crucial for financial planning.

Conclusion: Navigating the Complexity of Tax Deductions

Understanding and utilizing tax deductions for medical expenses is a critical aspect of financial management. By staying informed about eligible expenses, keeping detailed records, and employing strategic planning, taxpayers can effectively reduce their taxable income and optimize their financial situation. As the tax landscape continues to evolve, staying abreast of changes is essential to ensuring that one’s financial strategies remain effective and beneficial.

What is the medical expense deduction floor, and how does it impact my deductions?

+The medical expense deduction floor is the threshold at which taxpayers can begin deducting their eligible medical expenses. For the 2022 tax year, this floor is set at 7.5% of the taxpayer’s adjusted gross income (AGI). This means that medical expenses exceeding 7.5% of the AGI can be deducted from the taxpayer’s taxable income, potentially reducing their tax liability.

Are there any expenses that are not eligible for medical expense deductions?

+Yes, there are certain expenses that are not eligible for medical expense deductions. These include cosmetic surgeries and procedures that are not medically necessary, as well as expenses that were reimbursed by insurance or other sources. It’s important to review the IRS guidelines to ensure that only eligible expenses are claimed.

How can I keep track of my medical expenses for tax purposes?

+Keeping detailed records of all medical expenses is crucial. This includes saving receipts, invoices, and statements for eligible expenses. Consider using a digital system or app to organize and store these records, making it easier to track and reference your expenses when filing your taxes.