Wyoming Sales Tax

In the vast and rugged state of Wyoming, where wide-open spaces and a rich western heritage thrive, the topic of sales tax is an essential part of the economic landscape. Wyoming, known for its beautiful national parks, vibrant cities, and thriving industries, has a unique approach to sales taxation. This article delves into the intricacies of Wyoming's sales tax system, exploring its rates, exemptions, and the impact it has on businesses and consumers within the state.

Understanding Wyoming’s Sales Tax Structure

Wyoming’s sales tax system is a vital component of the state’s revenue stream, contributing significantly to its economic growth and development. The state’s sales tax is a consumption tax levied on the sale of tangible personal property and certain services. It is an essential tool for generating revenue, funding public services, and maintaining the state’s infrastructure.

The sales tax in Wyoming operates on a state-local partnership model. The state government sets the base sales tax rate, which is then supplemented by local option taxes imposed by counties and municipalities. This collaborative approach allows local governments to address their specific financial needs while contributing to the state's overall revenue pool.

Statewide Sales Tax Rates

Wyoming’s base sales tax rate is 4%, which is applied uniformly across the state. This rate is a foundational element of the sales tax system and is the starting point for calculating sales tax liabilities.

| Sales Tax Type | Rate |

|---|---|

| Base Sales Tax | 4% |

| State Lodging Tax | 5% |

| State Alcoholic Beverage Tax | 15% |

In addition to the base rate, Wyoming imposes specific taxes on certain goods and services. For instance, a state lodging tax of 5% is applied to hotel and motel stays, contributing to the state's tourism industry. Similarly, the state alcoholic beverage tax of 15% is levied on the sale of alcohol, providing additional revenue for the state.

Local Option Taxes

Wyoming’s counties and municipalities have the authority to impose local option sales taxes to address their unique financial requirements. These taxes can vary significantly across the state, resulting in a diverse landscape of sales tax rates. For instance, while some counties may have a local sales tax rate of 0%, others can impose rates as high as 3%, leading to a combined state-local sales tax rate of 7% in certain areas.

The flexibility provided by local option taxes allows communities to fund specific projects, such as infrastructure development, education initiatives, or public safety improvements. It empowers local governments to tailor their tax policies to meet the needs of their residents and businesses, fostering a sense of local control and engagement.

Sales Tax Exemptions and Special Considerations

Wyoming’s sales tax system is not without its exemptions and special considerations. These provisions aim to alleviate the tax burden on certain sectors, promote economic development, and support specific industries.

Exemptions for Food and Groceries

One notable exemption in Wyoming’s sales tax regime is the exclusion of food and groceries from taxation. This exemption extends to a wide range of food items, including staples like bread, milk, and eggs, as well as prepared foods and restaurant meals. By exempting food from sales tax, Wyoming aims to reduce the tax burden on essential goods, making them more affordable for residents and visitors alike.

Sales Tax Holidays

Wyoming occasionally hosts sales tax holidays, during which certain items are exempt from sales tax for a limited period. These holidays typically coincide with major shopping seasons, such as back-to-school or holiday sales events. By offering temporary tax relief, the state encourages consumer spending, boosts economic activity, and provides a welcome break for shoppers.

Agricultural Sales Tax Exemption

Wyoming recognizes the importance of its agricultural sector and offers an agricultural sales tax exemption. This exemption applies to the sale of agricultural equipment, machinery, and supplies, providing a significant tax relief to farmers and ranchers. By reducing the financial burden on these essential industries, Wyoming supports its agricultural economy and promotes the sustainability of its farming communities.

Sales Tax Registration and Compliance

For businesses operating in Wyoming, understanding the state’s sales tax registration and compliance requirements is crucial. The Wyoming Department of Revenue is responsible for administering and enforcing sales tax regulations, ensuring that businesses collect and remit sales tax accurately and timely.

Sales Tax Registration Process

Businesses engaged in taxable activities in Wyoming must register for a sales tax permit with the Department of Revenue. The registration process involves completing an application, providing relevant business information, and understanding the tax obligations associated with their specific industry. Once registered, businesses are issued a unique sales tax permit number, which must be displayed prominently at their place of business.

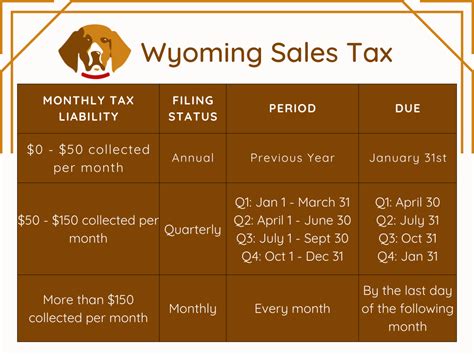

Sales Tax Filing and Remittance

Registered businesses in Wyoming are required to file sales tax returns on a regular basis, typically monthly or quarterly, depending on their sales volume and type of business. These returns involve calculating the sales tax liability based on the applicable rates and exemptions, and remitting the tax amount to the Department of Revenue by the due date. Late filings and non-compliance can result in penalties and interest charges, so timely and accurate reporting is essential.

Sales Tax Audits

The Wyoming Department of Revenue conducts periodic sales tax audits to ensure compliance with tax laws and regulations. These audits involve a thorough review of a business’s sales records, tax returns, and financial documents. Businesses selected for audit must cooperate and provide the necessary documentation to support their sales tax filings. Failure to comply with audit requirements can lead to penalties and legal consequences.

Impact on Businesses and Consumers

Wyoming’s sales tax system has a direct impact on both businesses and consumers within the state. Understanding these implications is crucial for making informed decisions and navigating the economic landscape effectively.

Business Considerations

For businesses, Wyoming’s sales tax system presents both opportunities and challenges. The state’s relatively low base sales tax rate of 4% can be advantageous, making it more attractive for businesses to establish their operations within the state. However, the addition of local option taxes can increase the overall tax burden, especially in areas with higher local tax rates.

Businesses must also navigate the complex web of sales tax exemptions and special considerations. While these exemptions can provide tax relief, they also add complexity to sales tax calculations and compliance. Accurate record-keeping and understanding of tax regulations are essential for businesses to avoid compliance issues and maintain a positive relationship with the state.

Consumer Perspective

From a consumer’s perspective, Wyoming’s sales tax system can have both positive and negative impacts. The low base sales tax rate of 4% can make Wyoming a more affordable place to shop, especially when compared to states with higher sales tax rates. This can encourage consumer spending and boost the state’s economy.

However, the variability in local option taxes can lead to inconsistencies in prices across different regions of the state. Consumers may find that the same product has a different sales tax rate depending on their location, which can be confusing and potentially impact their purchasing decisions.

The Future of Wyoming’s Sales Tax

As Wyoming’s economy continues to evolve, the state’s sales tax system will likely undergo changes and adaptations to meet the needs of its residents and businesses. Here are some potential future implications and considerations:

Modernization and Technology

With the rapid advancement of technology, Wyoming’s sales tax system may embrace digital solutions to streamline registration, filing, and compliance processes. Online platforms and digital tools could enhance the efficiency and convenience of sales tax administration, benefiting both businesses and tax authorities.

Economic Development Initiatives

Wyoming may explore additional sales tax exemptions or incentives to support economic development initiatives. Targeted tax relief for specific industries or geographic regions could attract new businesses, create jobs, and stimulate economic growth. These initiatives could focus on sectors such as technology, renewable energy, or tourism, depending on the state’s strategic priorities.

Sales Tax Reform and Simplification

There is a growing trend among states to simplify their sales tax systems to reduce complexity and administrative burdens. Wyoming could consider consolidating or standardizing sales tax rates across the state, eliminating local option taxes, or implementing a uniform sales tax rate to create a more straightforward and predictable tax environment.

Expanding Taxable Services

As the economy shifts towards a service-based model, Wyoming may explore expanding its sales tax base to include a broader range of services. This could involve taxing digital services, remote transactions, or professional services, aligning with the evolving nature of the economy and ensuring a more sustainable revenue stream.

Environmental and Social Initiatives

Wyoming could leverage its sales tax system to support environmental and social initiatives. For instance, the state could implement a carbon tax or impose higher sales taxes on environmentally harmful products to encourage sustainable practices. Additionally, targeted tax relief or incentives could be offered to promote social initiatives, such as affordable housing or community development projects.

What is the current sales tax rate in Wyoming for online purchases?

+The sales tax rate for online purchases in Wyoming is determined by the location of the buyer. If the buyer resides in a jurisdiction with a higher local option tax rate, the higher rate will apply to their online purchases. This means that online retailers must consider the buyer’s shipping address to accurately calculate the applicable sales tax.

Are there any special considerations for remote sellers in Wyoming?

+Yes, remote sellers with substantial nexus in Wyoming, such as those with a physical presence or a certain level of sales volume, are required to register for a sales tax permit and collect sales tax on their transactions. The state provides guidance and resources to assist remote sellers in understanding their tax obligations.

How does Wyoming handle sales tax on interstate commerce?

+Wyoming follows the principles of the Commerce Clause of the U.S. Constitution, which limits the ability of states to impose taxes on interstate commerce. As a result, Wyoming does not impose sales tax on transactions that occur entirely outside its borders, such as sales to out-of-state buyers who take possession of the goods outside Wyoming.