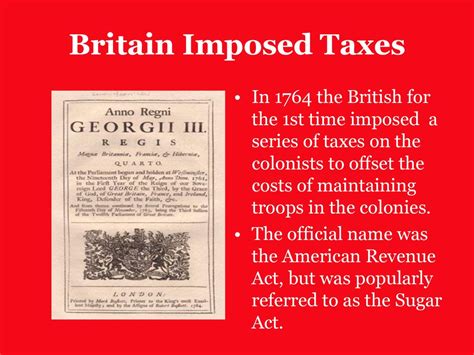

New Britain Taxes

Welcome to an in-depth exploration of the tax landscape in New Britain, a vibrant city nestled in the heart of Connecticut. This comprehensive guide will delve into the intricacies of the local tax system, offering a detailed understanding of the taxes that impact residents, businesses, and property owners in the region. From the unique challenges posed by the city's diverse economic sectors to the opportunities for tax optimization, we'll navigate through the complexities to provide a clear and actionable overview.

Navigating the Tax Terrain in New Britain

The tax environment in New Britain is a dynamic interplay of state, local, and federal regulations, each with its own set of rules and implications. Understanding this landscape is crucial for individuals and entities operating within the city limits. Let’s break down the key components and explore the nuances of the tax system.

Residential Taxes: A Comprehensive Overview

For homeowners in New Britain, taxes are an integral part of the cost of living. The city’s tax structure is designed to support local services and infrastructure, impacting the overall quality of life for residents. Here’s a detailed look at the residential tax scenario:

- Assessment Process: The city employs a standardized assessment method to determine the value of residential properties. This process takes into account factors such as location, size, age, and recent improvements, ensuring a fair and equitable valuation for tax purposes.

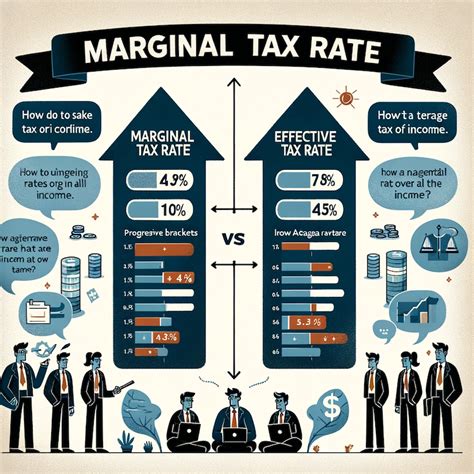

- Tax Rates: New Britain operates with a progressive tax system, meaning tax rates increase with the assessed value of the property. The current tax rates are set at [insert tax rates], with adjustments made annually to account for inflation and budget requirements.

- Tax Due Dates: Residential tax payments are due in two installments, typically in July and January. Late payments may incur penalties and interest, so it's essential for homeowners to stay informed and plan their finances accordingly.

- Tax Relief Programs: The city offers several tax relief programs aimed at assisting seniors, veterans, and low-income residents. These programs provide exemptions or reductions based on specific eligibility criteria, helping to ease the tax burden for vulnerable populations.

Business Taxes: Fostering a Competitive Environment

New Britain’s business tax structure is designed to encourage economic growth and attract investments. The city offers a range of incentives and tax benefits to businesses, creating a competitive environment that fosters innovation and job creation. Here’s an insight into the business tax landscape:

- Corporate Income Tax: New Britain, in line with state regulations, imposes a corporate income tax on businesses operating within its borders. The tax rate is set at [insert rate], with provisions for deductions and credits based on business size and sector.

- Sales and Use Tax: Sales tax is applicable to most transactions within the city, with a standard rate of [insert rate]. Additionally, a use tax is imposed on goods purchased outside the city but used within New Britain, ensuring a level playing field for local businesses.

- Property Taxes for Businesses: Business owners are subject to property taxes on their commercial real estate holdings. The assessment and tax rate calculation process is similar to residential properties, ensuring fairness and consistency across the board.

- Tax Incentives and Grants: The city actively promotes business growth through a range of tax incentives and grants. These include tax abatements for new construction, tax credits for job creation, and targeted incentives for specific industries, such as renewable energy and technology startups.

Property Taxes: A Comprehensive Guide

Property taxes in New Britain are a significant component of the city’s tax revenue. The system is designed to ensure fair taxation based on the value of the property, with rates varying depending on the type of property and its intended use. Here’s a detailed look:

- Assessment Methodology: Property assessments are conducted by a team of professionals who evaluate the market value of each property. This process considers factors such as location, recent sales data, and improvements made to the property, ensuring an accurate valuation.

- Tax Rates for Different Property Types: New Britain differentiates tax rates based on property type. Residential properties, commercial real estate, and vacant land are subject to different tax rates, with the latter typically facing a higher tax burden.

- Appealing Property Assessments: Property owners have the right to appeal their assessments if they believe the valuation is inaccurate. The process involves submitting an appeal to the Board of Assessment Appeals, providing evidence to support the claim, and potentially attending a hearing to present their case.

- Tax Exemptions and Abatements: The city offers certain tax exemptions and abatements to promote specific goals. For instance, there may be exemptions for historical properties, agricultural lands, or properties used for charitable purposes. Additionally, the city may offer tax abatements to encourage redevelopment in specific areas.

The Role of Tax Professionals in New Britain

Navigating the tax landscape in New Britain can be complex, especially for those new to the city or those with unique tax situations. This is where tax professionals, such as certified public accountants (CPAs) and tax attorneys, play a crucial role. These experts provide invaluable guidance and support, ensuring that individuals and businesses comply with tax regulations while optimizing their tax strategies.

Tax professionals in New Britain offer a range of services, including tax planning, preparation, and representation. They stay abreast of the ever-changing tax laws and regulations, ensuring their clients are informed and prepared. Whether it's filing tax returns, claiming deductions, or navigating complex tax issues, these professionals provide the expertise needed to make informed decisions.

Staying Informed: Tax Resources and Support in New Britain

For residents and businesses in New Britain, staying informed about tax regulations and updates is essential. The city provides various resources to ensure transparency and accessibility. Here are some key resources to keep in mind:

- City Website: The official New Britain city website is a valuable source of information, offering detailed explanations of tax policies, due dates, and payment options. It also provides access to tax forms and guides, making it a one-stop shop for tax-related queries.

- Taxpayer Assistance Centers: The city operates taxpayer assistance centers, staffed by knowledgeable professionals who can provide guidance and support. These centers offer personalized assistance, helping residents and businesses navigate the tax process and address any concerns.

- Community Workshops and Seminars: Throughout the year, the city organizes workshops and seminars focused on tax topics. These events provide an opportunity for residents and businesses to learn about tax updates, ask questions, and connect with tax professionals. They are a great way to stay informed and engage with the local tax community.

Conclusion: Embracing a Tax-Smart Approach in New Britain

Understanding the tax landscape in New Britain is the first step towards making informed financial decisions. Whether you’re a homeowner, a business owner, or a property investor, the city’s tax system offers both challenges and opportunities. By staying informed, seeking professional guidance, and leveraging the available resources, individuals and businesses can navigate the tax terrain with confidence, ensuring compliance and optimizing their financial strategies.

As New Britain continues to evolve and adapt to economic changes, its tax system will play a pivotal role in shaping the city's future. By fostering a tax-smart environment, the city can attract investments, support local businesses, and provide essential services to its residents, contributing to the overall growth and prosperity of the community.

FAQ

What is the current sales tax rate in New Britain, CT?

+

The current sales tax rate in New Britain, CT, is 6.35%. This rate includes both the state sales tax and the local tax imposed by the city.

Are there any property tax exemptions available for seniors in New Britain?

+

Yes, New Britain offers property tax exemptions for eligible senior citizens. The program provides a partial or full exemption based on certain criteria, including age, income, and length of residency. It’s recommended to check with the city’s tax assessor’s office for detailed information and eligibility requirements.

How often are property assessments conducted in New Britain, and can they be appealed?

+

Property assessments in New Britain are typically conducted every two years. However, certain changes, such as significant improvements or damage to a property, may trigger a reassessment. If a property owner believes their assessment is inaccurate, they have the right to appeal the decision. The appeal process involves submitting a formal request and, if necessary, attending a hearing to present their case.