Tax Nevada Las Vegas

In the bustling city of Las Vegas, Nevada, where the lights never dim and excitement is always in the air, understanding the intricacies of taxation is crucial for both residents and businesses alike. From the dazzling casinos lining the Strip to the vibrant downtown districts, the Silver State's unique tax landscape offers both challenges and opportunities. This article aims to delve into the specific aspects of taxation in Nevada's largest city, providing a comprehensive guide for anyone navigating the financial intricacies of this vibrant metropolis.

Taxation in the Entertainment Capital

Las Vegas, a city synonymous with entertainment, offers a distinct tax environment that reflects its diverse economy. Beyond the glitz and glamour, understanding the tax structure is essential for maintaining financial stability and compliance.

The Nevada Tax System

Nevada’s tax system is designed to support its unique industries and promote economic growth. With a focus on tourism and hospitality, the state has crafted a tax structure that caters to these sectors while ensuring stability and fairness.

At the heart of Nevada's tax system is the Modified Business Tax (MBT), a key revenue generator for the state. This tax, applied to businesses based on their gross revenue, is a crucial component of Nevada's fiscal strategy. It's particularly significant in Las Vegas, where the tourism industry dominates.

For businesses operating in the city, understanding the nuances of the MBT is vital. The tax rate varies based on the type of business and its revenue, with certain industries enjoying reduced rates. For instance, casinos and gaming establishments contribute a substantial portion of their gross revenue to the state through this tax.

| Industry | Modified Business Tax Rate |

|---|---|

| Gaming (Casinos) | 6.75% of Gross Revenue |

| Hotels & Resorts | 4% of Gross Revenue |

| Retail | 0.375% of Gross Revenue |

| Service Businesses | 0.25% of Gross Revenue |

Additionally, Las Vegas has a Business License Fee, a one-time fee paid by all businesses upon establishment. This fee varies based on the type of business and its expected revenue. It's a crucial step for any new venture in the city, ensuring compliance from the outset.

For residents, Nevada's lack of personal income tax is a significant draw. This means that individuals do not pay state tax on their wages, salaries, or other income sources, making it a tax-friendly environment for individuals and families.

Property Taxes in Las Vegas

Property ownership in Las Vegas comes with its own set of tax considerations. The city has a Property Tax Rate that is applied to the assessed value of both residential and commercial properties. This tax is a crucial source of revenue for the city and is used to fund essential services and infrastructure.

The Property Tax Rate in Las Vegas is relatively moderate compared to other states. It's calculated as a percentage of the property's assessed value, which is determined by the Clark County Assessor's Office. The rate can vary slightly depending on the specific location within the city.

| Property Type | Property Tax Rate |

|---|---|

| Residential | 0.82% of Assessed Value |

| Commercial | 0.87% of Assessed Value |

It's important to note that the assessed value of a property can change over time, typically increasing with improvements or renovations. This means that property taxes can fluctuate, so it's beneficial for homeowners and business owners to stay informed about any potential changes.

Additionally, Las Vegas offers a Homestead Exemption, which provides a tax reduction for eligible homeowners. This exemption is designed to assist residents in maintaining their properties and can significantly reduce the overall property tax burden.

Sales and Use Taxes

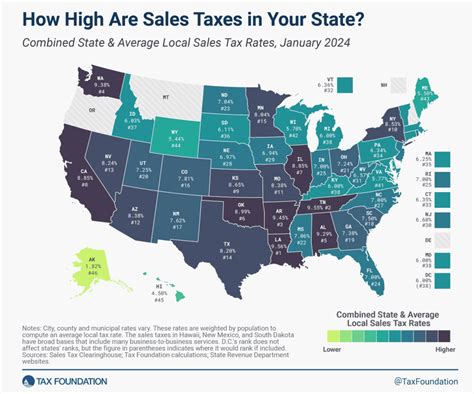

When it comes to consumer transactions, Las Vegas, like the rest of Nevada, applies a Sales and Use Tax to most goods and some services. This tax is collected by businesses and remitted to the state, with rates varying slightly based on the specific county.

In Las Vegas, the Sales Tax Rate is a combination of the state and local rates, totaling 8.25%. This tax is applied to the purchase price of goods and certain services, such as hotel stays and restaurant meals. It's an essential revenue source for the city and the state, contributing to public services and infrastructure development.

Additionally, Nevada has a Use Tax, which is applicable when goods are purchased from out-of-state vendors and used or consumed within the state. This tax ensures fairness and compliance, even for online purchases or goods acquired outside of Nevada's traditional sales tax framework.

Navigating Tax Compliance in Las Vegas

With its unique tax structure, Las Vegas presents both advantages and complexities for businesses and residents. Understanding the city’s tax obligations and staying informed about changes is crucial for financial stability and compliance.

Tax Obligations for Businesses

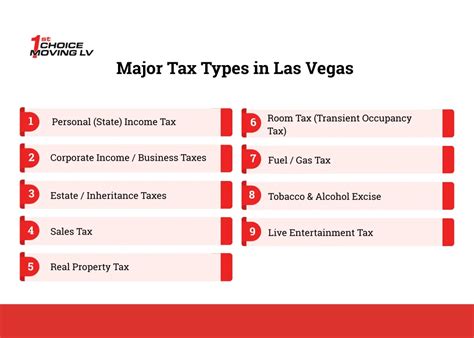

Businesses operating in Las Vegas have a range of tax obligations to navigate. These include the aforementioned Modified Business Tax, Sales and Use Taxes, and potential payroll taxes if the business has employees.

The Modified Business Tax is a significant consideration for businesses, particularly those in the tourism and hospitality sectors. This tax is often a major expense and must be carefully managed to ensure financial stability. Businesses must stay informed about any changes to the tax rates and ensure accurate reporting.

For businesses selling goods or services, the Sales and Use Tax is a critical component of their financial strategy. They must collect and remit this tax accurately, ensuring compliance with the state and local authorities. This involves understanding the tax rates, exemptions, and potential penalties for non-compliance.

Additionally, businesses with employees must navigate payroll taxes, including federal, state, and local income tax withholdings, Social Security and Medicare taxes, and potential unemployment taxes. These obligations can be complex, and businesses often seek professional guidance to ensure accurate reporting and compliance.

Tax Considerations for Residents

For individuals residing in Las Vegas, the tax landscape is relatively straightforward due to Nevada’s lack of personal income tax. However, residents still have tax obligations, primarily through property taxes and sales taxes on purchases.

Property ownership in Las Vegas comes with the responsibility of paying Property Taxes, which are based on the assessed value of the property. This tax is a significant expense for homeowners and must be budgeted for accordingly. Understanding the assessment process and staying informed about potential changes is crucial for financial planning.

Additionally, residents must navigate the Sales and Use Tax when making purchases. This tax is applied to most goods and some services, and it's important for residents to be aware of the rates to make informed purchasing decisions. It's also beneficial to understand the exemptions and rules surrounding the Use Tax for out-of-state purchases.

The Future of Taxation in Las Vegas

As Las Vegas continues to evolve, its tax landscape is also likely to see changes and adaptations. The city’s unique economy and its reliance on tourism and hospitality make it a dynamic environment for tax policy.

Potential Tax Changes

In recent years, there have been discussions and proposals for tax reforms in Nevada. These include potential changes to the Modified Business Tax, with suggestions to simplify the tax structure and make it more predictable for businesses.

Additionally, there have been considerations for introducing a statewide property tax, which would provide a more stable revenue source for the state. This could impact Las Vegas residents and businesses, potentially shifting the tax burden and affecting financial planning.

Furthermore, as online commerce continues to grow, there may be changes to the Use Tax to ensure fair taxation of out-of-state purchases. This could have implications for both businesses and residents, particularly those who frequently shop online.

The Impact of Economic Shifts

Las Vegas’s economy is closely tied to tourism and entertainment. Any shifts in these industries, whether due to economic downturns or external factors like the recent global pandemic, can significantly impact the city’s tax revenue.

During periods of economic downturn, the city may face challenges in maintaining its tax revenue, particularly from the Modified Business Tax and Sales Tax. This could lead to potential budget adjustments and changes in tax policies to stimulate economic growth.

Conversely, during periods of economic prosperity, Las Vegas may see increased tax revenue, allowing for investments in infrastructure and public services. This cycle of economic shifts and tax revenue fluctuations is a dynamic aspect of the city's financial landscape.

Conclusion

In conclusion, understanding the tax landscape in Las Vegas is essential for both businesses and residents. The city’s unique tax structure, particularly its absence of personal income tax and reliance on tourism-related taxes, presents both advantages and complexities.

For businesses, managing taxes effectively is crucial for financial stability and compliance. This includes staying informed about tax rates, exemptions, and potential reforms. For residents, navigating property taxes and sales taxes is essential for financial planning and ensuring compliance.

As Las Vegas continues to evolve, its tax landscape will likely undergo changes to adapt to economic shifts and emerging trends. Staying informed and proactive in tax planning is key to navigating these changes successfully.

FAQs

What is the Modified Business Tax (MBT) in Las Vegas, and how does it affect businesses?

+

The Modified Business Tax (MBT) is a tax imposed on businesses based on their gross revenue. It’s a significant revenue generator for the state of Nevada and is particularly important in Las Vegas, where the tourism and hospitality industries dominate. The tax rate varies depending on the type of business and its revenue, with certain industries, such as casinos and gaming establishments, contributing a larger portion of their gross revenue. For businesses, the MBT can be a major expense, and accurate reporting and compliance are essential to avoid penalties.

Are there any tax advantages for individuals living in Las Vegas?

+

Yes, one of the key tax advantages for individuals living in Las Vegas is the absence of a personal income tax. This means that wages, salaries, and other income sources are not taxed by the state, making it a tax-friendly environment for individuals and families. However, residents still have tax obligations, primarily through property taxes and sales taxes on purchases.

How does the Sales and Use Tax work in Las Vegas, and what should businesses and residents know about it?

+

The Sales and Use Tax is a tax applied to most goods and some services in Las Vegas. It’s collected by businesses and remitted to the state and local authorities. The rate is 8.25% in Las Vegas, which includes both the state and local rates. For businesses, it’s essential to collect and remit this tax accurately to avoid penalties. Residents should be aware of this tax when making purchases and understand the rates to make informed decisions. Additionally, the Use Tax applies to out-of-state purchases, so it’s important for both businesses and residents to be aware of this tax to ensure compliance.

What potential tax changes are being discussed in Nevada, and how might they impact Las Vegas residents and businesses?

+

There have been discussions and proposals for tax reforms in Nevada, including potential changes to the Modified Business Tax to simplify the structure and make it more predictable for businesses. Additionally, there are considerations for introducing a statewide property tax, which could impact Las Vegas residents and businesses by potentially shifting the tax burden. As for online commerce, there may be changes to the Use Tax to ensure fair taxation of out-of-state purchases, which could affect both businesses and residents who shop online.

How do economic downturns or shifts in the tourism industry impact Las Vegas’s tax revenue and financial landscape?

+

Economic downturns or shifts in the tourism industry can significantly impact Las Vegas’s tax revenue, particularly from the Modified Business Tax and Sales Tax. During these periods, the city may face challenges in maintaining its tax revenue, potentially leading to budget adjustments and changes in tax policies to stimulate economic growth. Conversely, periods of economic prosperity can result in increased tax revenue, allowing for investments in infrastructure and public services.