Anderson County Tax Records

Welcome to a comprehensive exploration of the Anderson County Tax Records, a critical component of local governance and community management. In this in-depth analysis, we will delve into the intricate world of tax records, uncovering their significance, functionality, and impact on the residents and businesses of Anderson County. From the historical context to the modern digital transformations, we will navigate through the complex landscape of taxation, offering a clear and informative guide for all stakeholders.

Unveiling the Anderson County Tax Records System

The Anderson County Tax Records System is a sophisticated framework designed to manage and process the tax obligations of the county’s residents and businesses. It serves as the backbone of the county’s financial infrastructure, ensuring the efficient collection of taxes and the accurate allocation of resources for public services.

With a rich history dating back to the establishment of Anderson County, the tax record system has evolved significantly over the years. Initially, tax records were maintained manually, with meticulous record-keeping practices ensuring the accuracy of property assessments and tax calculations. These early records, often stored in leather-bound ledgers, provide a fascinating glimpse into the historical development of the county.

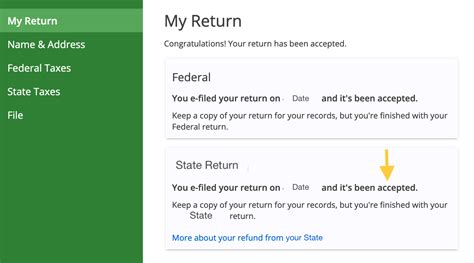

However, the system has since undergone a digital revolution. Modern technology has transformed the way tax records are managed, with innovative software solutions enhancing efficiency, accuracy, and accessibility. The adoption of digital platforms has not only streamlined the tax collection process but has also opened up new avenues for public engagement and transparency.

Key Features and Functionality

The Anderson County Tax Records System boasts a range of features designed to cater to the diverse needs of taxpayers and tax administrators alike. These include:

- Property Assessment Database: A comprehensive digital repository containing detailed information on all taxable properties within the county. This database includes critical data such as property value, ownership details, and historical tax records, enabling accurate assessments and efficient record-keeping.

- Online Tax Payment Portal: A user-friendly online platform that allows taxpayers to pay their property taxes securely and conveniently. This portal offers various payment options, real-time transaction tracking, and a history of tax payments, providing taxpayers with control and transparency over their financial obligations.

- Tax Calculation Engine: An advanced algorithm-based system that automatically calculates tax liabilities based on property assessments and applicable tax rates. This ensures accuracy and consistency in tax calculations, reducing the potential for errors and disputes.

- Tax Notice Generation: An automated process that generates and distributes tax notices to taxpayers. These notices provide detailed information on tax liabilities, due dates, and payment options, ensuring taxpayers are well-informed and have ample time to make their payments.

- Tax Record Archival: A robust archival system that securely stores historical tax records, ensuring long-term data retention and easy access for reference and audit purposes. This feature is critical for maintaining the integrity of the tax record system and facilitating historical analysis and trend identification.

These features, among others, contribute to the overall efficiency and effectiveness of the Anderson County Tax Records System, making it a model for modern tax administration.

| Feature | Description |

|---|---|

| Property Assessment Database | Comprehensive digital repository for property details and tax history. |

| Online Tax Payment Portal | Secure, user-friendly platform for online tax payments. |

| Tax Calculation Engine | Automated system for accurate tax liability calculations. |

| Tax Notice Generation | Automated process for generating and distributing tax notices. |

| Tax Record Archival | Robust system for long-term storage and access to historical tax records. |

The Impact on Anderson County Residents and Businesses

The Anderson County Tax Records System has a profound impact on the lives and operations of the county’s residents and businesses. By providing a streamlined and efficient tax administration process, the system ensures that taxpayers can fulfill their obligations with ease and convenience.

For residents, the online tax payment portal offers a significant improvement in the tax payment experience. No longer do taxpayers need to navigate complex paperwork or wait in long lines at government offices. Instead, they can access their tax records and make payments from the comfort of their homes or offices, saving time and effort.

Businesses, too, benefit from the system's efficiency. The accurate tax calculation engine ensures that businesses are assessed fairly, reducing the risk of over-taxation and associated disputes. Additionally, the online payment portal allows businesses to manage their tax obligations seamlessly, integrating tax payments into their financial management processes.

Enhancing Transparency and Trust

The Anderson County Tax Records System also plays a critical role in fostering transparency and trust between the government and its taxpayers. By providing an accessible platform for tax-related information, the system empowers taxpayers to understand their obligations and rights.

Taxpayers can easily access their property assessment details, historical tax records, and tax calculation methodologies. This transparency reduces the perception of ambiguity and potential for misuse of tax funds, fostering a culture of trust between the government and its citizens.

Furthermore, the system's automated tax notice generation ensures that taxpayers receive timely and accurate information about their tax liabilities. This proactive approach reduces the likelihood of missed payments and associated penalties, further enhancing the trust relationship between taxpayers and the government.

Future Outlook and Innovations

As technology continues to advance, the Anderson County Tax Records System is poised for further innovation and improvement. The county’s tax administration team is actively exploring new technologies and strategies to enhance the system’s capabilities and user experience.

Potential Future Developments

Some of the potential future developments for the Anderson County Tax Records System include:

- AI-Assisted Tax Assessment: Integrating artificial intelligence (AI) into the property assessment process can enhance accuracy and efficiency. AI algorithms can analyze a wide range of data, including property images, market trends, and historical data, to provide more precise property value assessments.

- Blockchain for Secure Record-Keeping: Adopting blockchain technology can enhance the security and transparency of tax record-keeping. Blockchain's decentralized nature ensures the integrity of tax records, making it virtually impossible to alter or manipulate data without detection.

- Mobile Tax Payment Apps: Developing mobile applications for tax payments can further improve accessibility and convenience. Taxpayers can then make payments on the go, receive real-time notifications, and access their tax records and payment history from their mobile devices.

- Data Analytics for Tax Policy Optimization: Leveraging data analytics can provide valuable insights into tax trends, taxpayer behavior, and the effectiveness of tax policies. This information can guide the county in making informed decisions to optimize tax policies and improve revenue collection.

- Digital Identity Verification: Implementing digital identity verification processes can enhance security and streamline the taxpayer registration process. This would reduce the risk of identity theft and fraud, ensuring that only legitimate taxpayers can access and manage their tax records.

These future innovations not only improve the efficiency and effectiveness of the tax record system but also contribute to the overall digital transformation of Anderson County's governance and public services.

Conclusion

The Anderson County Tax Records System stands as a testament to the power of technology in modern tax administration. By leveraging digital platforms and innovative solutions, the system has transformed the tax experience for residents and businesses, making it more efficient, transparent, and accessible.

As Anderson County continues to innovate and adapt, its tax records system will undoubtedly play a pivotal role in the county's growth and development. With a commitment to technological advancement and a focus on taxpayer convenience, the system is poised to set new standards for tax administration excellence.

For those interested in learning more about Anderson County's tax records system or seeking further insights into tax administration, the county's official website offers a wealth of resources and information. Visit Anderson County Tax Records to explore the system's features, access tax records, and stay informed about the latest developments.

How can I access my Anderson County tax records online?

+You can access your Anderson County tax records online by visiting the official Anderson County Tax Records website at https://andersoncountytaxrecords.org. Create an account or log in if you already have one. From there, you can search for your property using your address or parcel number and view your tax records, including assessments, tax payments, and historical data.

What if I disagree with my property assessment?

+If you believe your property assessment is inaccurate, you have the right to appeal. The Anderson County Tax Assessor’s Office provides a detailed process for property assessment appeals. Visit their website or contact them directly for guidance on how to initiate an appeal. You’ll need to provide supporting evidence and documentation to support your case.

Are there any tax exemptions or discounts available in Anderson County?

+Yes, Anderson County offers various tax exemptions and discounts to eligible taxpayers. These include senior citizen exemptions, military veteran discounts, and homestead exemptions for primary residences. Check the Anderson County Tax Assessor’s website for detailed information on eligibility criteria and application processes for these tax benefits.

Can I make partial tax payments?

+While the Anderson County Tax Office encourages full and timely tax payments, they do offer the option for partial payments. This can be especially helpful for taxpayers facing financial difficulties. However, there may be certain conditions and requirements associated with partial payments, so it’s best to contact the tax office directly to discuss your options and ensure compliance with any applicable rules.

What happens if I fail to pay my property taxes on time?

+Late payment of property taxes can result in penalties and interest charges. The Anderson County Tax Office may also initiate collection actions, including placing a lien on your property. To avoid these consequences, it’s crucial to make timely tax payments or explore available payment plans if you’re facing financial challenges.