Effective Versus Marginal Tax Rate

In the world of personal finance and tax management, understanding the difference between effective and marginal tax rates is crucial. These concepts play a significant role in shaping an individual's financial strategy and can have a direct impact on their overall tax liability. This comprehensive guide aims to delve into the intricacies of effective and marginal tax rates, offering a detailed analysis and practical insights for taxpayers.

Unraveling the Complexity of Tax Rates

Tax systems are intricate, and the rates at which individuals are taxed can vary based on numerous factors. Effective and marginal tax rates are two fundamental concepts that help taxpayers comprehend the nuances of their tax obligations.

Marginal Tax Rate: A Step-by-Step Exploration

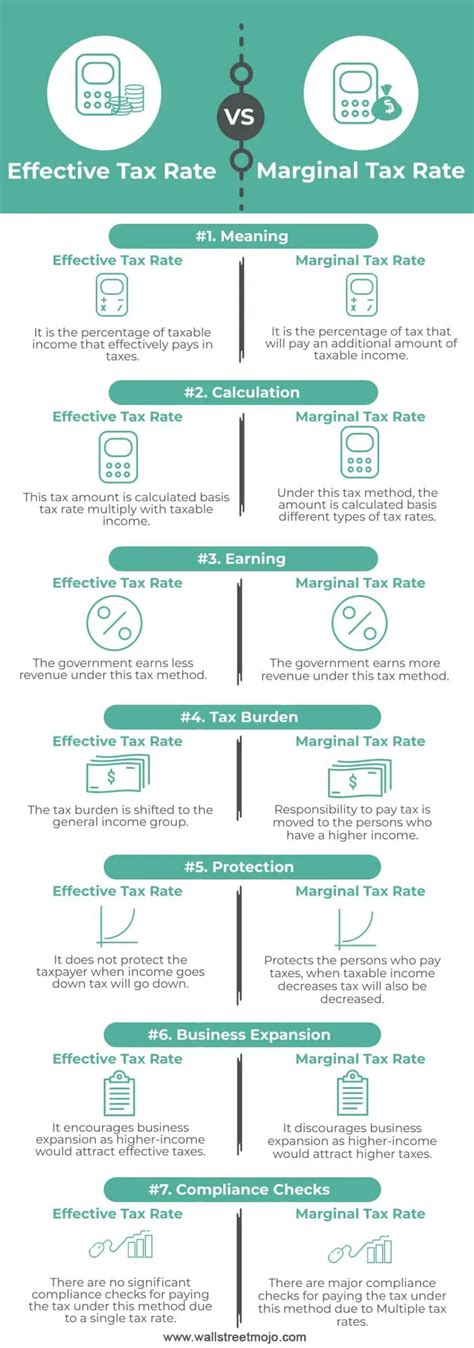

The marginal tax rate is the rate at which an individual’s income is taxed in the highest tax bracket they fall into. It represents the tax rate applicable to the last dollar of income earned. In simpler terms, it’s the rate at which additional income is taxed. For instance, consider an individual who earns 75,000 and falls into a 25% tax bracket. If they receive a bonus of 5,000, the marginal tax rate for this bonus is 25%, meaning they pay $1,250 in taxes on this additional income.

The marginal tax rate is crucial when making financial decisions, especially those that involve potential income increases. It allows individuals to estimate the tax impact of various choices, such as accepting a higher-paying job or selling investments at a profit. Understanding the marginal tax rate can help individuals optimize their tax strategies and make informed financial decisions.

Effective Tax Rate: Beyond the Basics

The effective tax rate, on the other hand, represents the actual percentage of an individual’s income that goes towards taxes. It’s calculated by dividing the total tax paid by the total income earned. For example, if an individual earns 100,000 and pays 20,000 in taxes, their effective tax rate is 20%. This rate provides a holistic view of an individual’s tax burden and can vary significantly from the marginal tax rate.

The effective tax rate is a more comprehensive metric as it considers all sources of income and deductions. It helps individuals assess their overall tax liability and can be a valuable tool for comparing tax burdens across different income levels and tax systems. Additionally, the effective tax rate can highlight the impact of tax deductions, credits, and exemptions on an individual's tax obligation.

The Impact of Tax Brackets and Income Levels

Tax brackets play a pivotal role in determining an individual’s tax liability. These brackets are income ranges associated with specific tax rates. As income increases, individuals may move into higher tax brackets, resulting in a higher marginal tax rate. However, it’s essential to note that the effective tax rate may not increase proportionally with income.

For instance, let's consider a hypothetical tax system with three brackets: 10%, 20%, and 30%. If an individual's income is $50,000, they fall into the 20% bracket. However, if their income increases to $70,000, they may move into the 30% bracket, resulting in a higher marginal tax rate. Despite this, their effective tax rate may remain relatively stable due to deductions and credits, which can offset the higher marginal rate.

Income Level and Tax Planning

Income level is a critical factor in tax planning. As individuals earn more, they often face a higher marginal tax rate, which can significantly impact their financial decisions. Understanding how income level affects tax liability is essential for effective tax management.

For high-income earners, strategies such as tax-loss harvesting, retirement planning, and optimizing investment strategies can help reduce the impact of high marginal tax rates. On the other hand, individuals with lower incomes may benefit from maximizing deductions and credits to lower their effective tax rate. The key is to tailor tax planning strategies to one's specific income level and tax situation.

Maximizing Tax Benefits: Strategies and Tips

Maximizing tax benefits is a crucial aspect of financial planning. By understanding how effective and marginal tax rates work, individuals can employ various strategies to reduce their tax liability and optimize their financial position.

Deductions and Credits: A Powerful Duo

Deductions and credits are powerful tools for reducing tax liability. Deductions reduce the amount of income subject to taxation, while credits directly reduce the tax owed. For instance, mortgage interest deductions and charitable contribution deductions can significantly lower an individual’s taxable income, resulting in a lower effective tax rate.

Additionally, tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, can provide substantial benefits to eligible taxpayers. By taking advantage of these deductions and credits, individuals can lower their tax burden and increase their overall financial well-being.

Tax-Efficient Investing and Retirement Planning

Investing and retirement planning are integral parts of financial strategy, and tax efficiency is a key consideration in these areas. By utilizing tax-advantaged accounts, such as 401(k)s or IRAs, individuals can reduce their tax liability in the present while building wealth for the future.

For example, contributing to a traditional 401(k) allows individuals to reduce their taxable income in the current year, lowering their effective tax rate. Additionally, investments within these accounts grow tax-free, providing significant tax advantages over the long term. Proper retirement planning and tax-efficient investing can help individuals maximize their financial gains while minimizing their tax obligations.

Future Implications and Tax Reform

The landscape of taxation is ever-evolving, and future tax reforms can significantly impact effective and marginal tax rates. Understanding the potential implications of tax policy changes is crucial for long-term financial planning.

Potential Tax Reform Scenarios

Tax reforms can lead to changes in tax brackets, rates, and deductions, which directly affect effective and marginal tax rates. For instance, a proposed flat tax system would eliminate progressive tax brackets, potentially simplifying tax calculations but also altering the tax landscape for individuals across all income levels.

Additionally, changes in tax credits and deductions can have a significant impact on tax liability. The expansion or reduction of certain credits, such as the Child Tax Credit, can affect a large portion of the population, especially those with families. Staying informed about potential tax reforms is essential for individuals to adapt their financial strategies accordingly.

Long-Term Financial Planning

Long-term financial planning should consider the potential impact of tax reforms. By anticipating changes in tax rates and brackets, individuals can make more informed decisions about their investments, retirement savings, and overall financial strategy. For example, if a tax reform proposal includes an increase in capital gains taxes, individuals may consider adjusting their investment strategies to minimize the impact of these changes.

Furthermore, understanding the historical context of tax reforms can provide valuable insights. Analyzing past tax changes and their effects on different income levels can help individuals gauge the potential impact of future reforms. This knowledge can guide financial decisions and ensure a more resilient financial plan in the face of tax policy fluctuations.

Conclusion

Understanding the difference between effective and marginal tax rates is essential for individuals to navigate the complex world of taxation. By grasping these concepts, taxpayers can make informed financial decisions, optimize their tax strategies, and maximize their financial well-being.

From income level considerations to tax reform implications, effective tax management is a dynamic process that requires ongoing education and adaptation. By staying informed and utilizing the right strategies, individuals can take control of their financial future and ensure they are making the most of their hard-earned income.

How do effective and marginal tax rates differ, and why are they important to understand?

+Effective tax rate represents the actual percentage of income paid in taxes, while marginal tax rate is the rate applied to the last dollar earned. Understanding these rates helps individuals optimize financial decisions and tax strategies.

Can the effective tax rate be lower than the marginal tax rate, and if so, why?

+Yes, the effective tax rate can be lower due to deductions, credits, and progressive tax systems. These factors can offset the impact of higher marginal rates, resulting in a lower overall tax burden.

What strategies can individuals employ to reduce their tax liability and maximize benefits?

+Individuals can maximize tax benefits by utilizing deductions, credits, and tax-advantaged accounts. Strategies like tax-loss harvesting, retirement planning, and investing in tax-efficient vehicles can lower tax liability and increase financial gains.