Vat Vs Sales Tax

Welcome to an insightful exploration of the intricate world of taxation systems! This comprehensive article aims to shed light on the differences between two widely used tax mechanisms: Value Added Tax (VAT) and Sales Tax. As an expert in the field, I will guide you through the complexities of these taxation systems, providing a detailed analysis and real-world examples to enhance your understanding.

In today's global economy, businesses and individuals navigate a complex web of tax regulations, and it is crucial to grasp the nuances of these systems to make informed financial decisions. Whether you are a business owner, an accountant, or simply an individual curious about the inner workings of taxation, this article will offer valuable insights and practical knowledge.

Unraveling the VAT and Sales Tax Enigma

In the realm of taxation, VAT and Sales Tax stand as two distinct pillars, each with its own set of characteristics and implications. Let's delve into the core differences and understand how these systems operate in practice.

Defining VAT: The Multistage Tax System

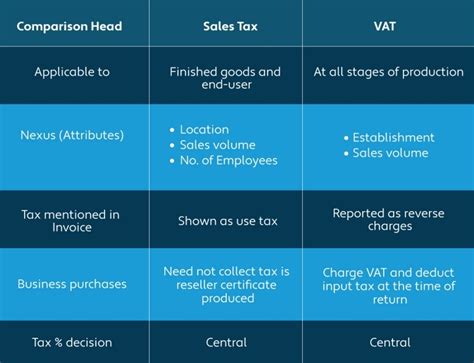

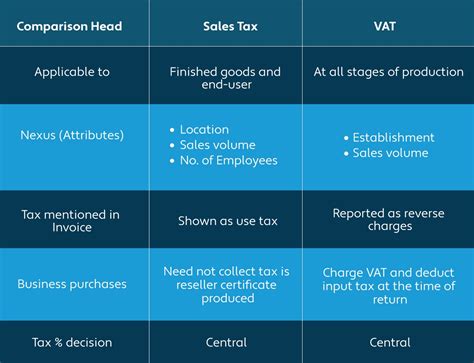

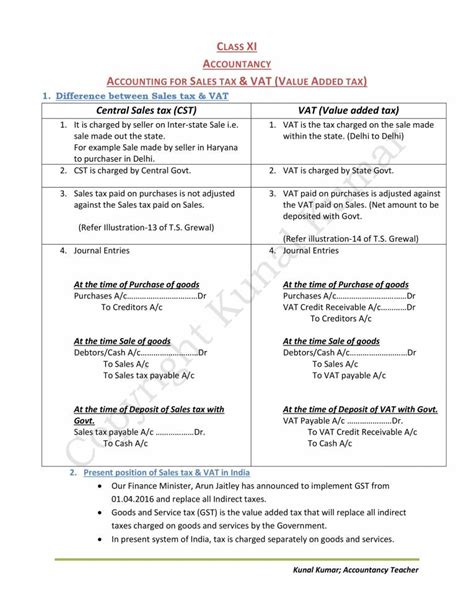

Value Added Tax, often abbreviated as VAT, is a consumption tax applied to the supply of goods and services at each stage of production and distribution. It is an indirect tax that is ultimately borne by the end consumer, but it is collected and remitted to the government by businesses at each stage of the supply chain.

One of the key advantages of VAT is its multistage nature. It ensures that the tax is collected progressively, with businesses acting as tax collectors on behalf of the government. This mechanism helps to prevent tax evasion and provides a more stable revenue stream for governments.

| VAT Feature | Description |

|---|---|

| Tax Base | VAT is applied to the value added at each stage, hence the name. It ensures businesses pay tax on their incremental contribution to the product or service. |

| Input Tax Credit | Businesses can claim credit for the VAT they pay on purchases, ensuring they only pay tax on their value addition, not the entire supply chain. |

| Final Consumer Tax | The end consumer bears the final burden of VAT, as it is included in the product's or service's final price. |

Sales Tax: A Single-Stage Transaction Tax

Sales Tax, on the other hand, is a direct tax levied on the sale of goods and services, typically collected at the point of sale. Unlike VAT, it is a single-stage tax, meaning it is applied only once, at the final transaction between the retailer and the consumer.

Sales Tax is a more straightforward system, often preferred for its simplicity and ease of administration. However, it can be more susceptible to evasion and may not capture the entire supply chain's value addition.

| Sales Tax Feature | Description |

|---|---|

| Taxable Event | Sales Tax is triggered by a sale, whether it's a retail sale or a wholesale transaction. |

| Point of Collection | Tax is collected at the point of sale, making it easier to track and manage for tax authorities. |

| Consumer Responsibility | The burden of Sales Tax falls solely on the consumer, as businesses do not have the input tax credit mechanism. |

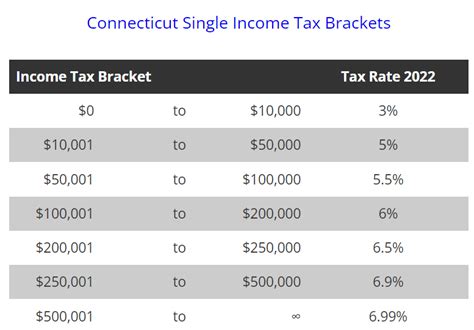

Comparative Analysis: VAT vs Sales Tax

Now, let's delve deeper into the key differences between these two taxation systems and explore their implications for businesses and consumers.

- Revenue Generation: VAT has a broader tax base and can generate significant revenue for governments, especially in countries with well-developed supply chains. Sales Tax, while simpler, may not capture the entire supply chain's value, leading to potentially lower revenue.

- Complexity: VAT is a more complex system due to its multistage nature and the input tax credit mechanism. Businesses need robust accounting systems to manage VAT, while Sales Tax is generally simpler to administer.

- Tax Evasion: VAT's progressive collection at each stage reduces the risk of tax evasion. Sales Tax, being a single-stage tax, is more susceptible to evasion, especially in cash-based economies.

- Compliance Burden: Businesses face a higher compliance burden with VAT, as they must track and report tax liabilities at each stage. Sales Tax compliance is generally simpler, with fewer reporting requirements.

- International Trade: VAT is widely used globally and is more compatible with international trade. Sales Tax, being a single-stage tax, may create complexities when goods cross borders.

Real-World Examples and Case Studies

To illustrate the practical differences between VAT and Sales Tax, let's explore some real-world scenarios:

Case Study 1: Manufacturing Industry

Consider a manufacturing company that produces and sells electronic devices. In a VAT system, the company would pay VAT on its raw material purchases, then add VAT to the selling price of its devices. The VAT collected on sales would be offset by the VAT paid on purchases, ensuring the company only pays tax on its value addition.

In a Sales Tax system, the company would only pay tax on the final sale of the devices, with no input tax credit mechanism. This can lead to a higher tax burden for the company, especially if it imports raw materials or components from abroad.

Case Study 2: Retail Sector

For a retail store selling a wide range of products, the impact of VAT and Sales Tax can be significant. In a VAT system, the store would collect VAT on its sales and remit it to the government. However, it would also have the benefit of claiming input tax credit on its purchases, reducing its overall tax liability.

Under a Sales Tax system, the store would simply add the tax to the selling price, with no opportunity for input tax credit. This can result in a higher tax burden for the store, which may be passed on to consumers in the form of higher prices.

The Future of Taxation: VAT and Sales Tax Evolution

As economies evolve and technology advances, the landscape of taxation is also transforming. Let's explore some future implications and potential developments for VAT and Sales Tax systems.

Digital Economy and E-Commerce: With the rise of e-commerce and digital transactions, tax authorities face new challenges in tracking and taxing online sales. Both VAT and Sales Tax systems are adapting to these changes, with initiatives like digital VAT and online Sales Tax collection.

Simplification and Reform: Many countries are considering tax reforms to simplify their systems and reduce the compliance burden on businesses. This may involve streamlining VAT or exploring alternative tax systems that combine elements of both VAT and Sales Tax.

International Cooperation: In an increasingly globalized world, international cooperation on tax matters is crucial. Efforts to harmonize VAT systems and combat tax evasion are ongoing, with initiatives like the VAT Information Exchange System (VIES) and the Common Reporting Standard (CRS) gaining traction.

Conclusion: Navigating the Tax Landscape

In conclusion, the choice between VAT and Sales Tax depends on various factors, including the country's economic structure, tax policies, and business environment. Both systems have their strengths and weaknesses, and a comprehensive understanding of these systems is essential for businesses and individuals alike.

As we navigate the complex world of taxation, it is crucial to stay informed, seek expert advice, and adapt to the evolving landscape. Whether you are a business owner, an accountant, or an individual taxpayer, knowledge is power when it comes to managing your tax obligations effectively.

FAQ

How does VAT differ from Sales Tax in terms of tax liability for businesses?

+

VAT provides businesses with the opportunity to claim input tax credit, reducing their overall tax liability. In contrast, Sales Tax is a single-stage tax, meaning businesses do not have the benefit of input tax credit and bear a higher tax burden.

What are the key advantages of a VAT system over Sales Tax?

+

VAT has a broader tax base, capturing value addition at each stage of production and distribution. It also reduces tax evasion risks and provides a more stable revenue stream for governments. Additionally, VAT’s input tax credit mechanism can lower the tax burden for businesses.

How do consumers perceive VAT and Sales Tax differently?

+

Consumers often perceive VAT as a more transparent tax, as it is typically displayed separately on invoices and receipts. Sales Tax, on the other hand, may be less noticeable, as it is often included in the final price. However, both taxes ultimately impact the consumer’s purchasing power.