Ar Tax Return Status

Tax season is a critical period for individuals and businesses, as it marks the time when they must settle their financial obligations with the government. One of the most important aspects of this process is understanding the status of one's tax return. In this comprehensive guide, we will delve into the intricacies of the AR Tax Return Status, shedding light on its significance, how it works, and what it means for taxpayers.

Understanding AR Tax Return Status

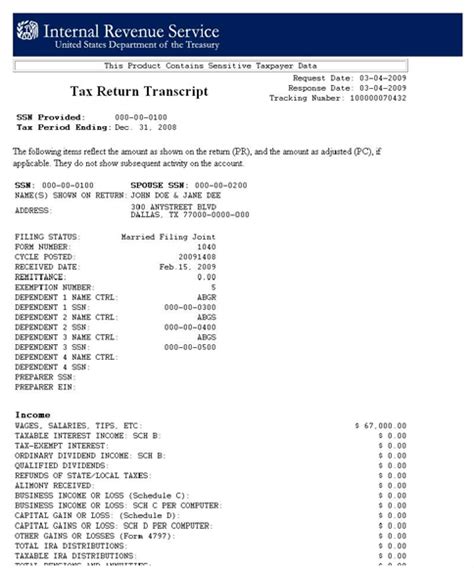

The AR in AR Tax Return Status stands for Acknowledgement Receipt. It is a crucial step in the tax return process, serving as an official acknowledgment from the tax authorities that they have received your tax return submission. This status plays a vital role in providing taxpayers with assurance and clarity regarding their tax obligations.

When you submit your tax return, whether it's through electronic filing or traditional mail, the tax authorities process the information and issue an AR, confirming that they have successfully received and accepted your return. This acknowledgment serves as the first step in the tax return journey, indicating that your tax return is being processed further.

The Significance of AR Status

The AR Tax Return Status holds significant importance for taxpayers for several reasons. Firstly, it provides a sense of relief and certainty, assuring individuals and businesses that their tax return has been successfully received by the authorities. This acknowledgment alleviates concerns about potential delays or errors in the submission process.

Secondly, the AR status serves as a foundation for subsequent processing steps. Once the tax authorities acknowledge your return, they proceed with further scrutiny, verification, and calculation of any tax liabilities or refunds. The AR status indicates that your return has entered the official tax processing pipeline, moving towards resolution.

Moreover, the AR status is often a prerequisite for various tax-related actions. For instance, if you need to make any amendments to your tax return, the AR ensures that your original submission is on record, facilitating the amendment process. Additionally, certain tax-related benefits or programs may require proof of AR status, making it a crucial document for taxpayers to possess.

The AR Tax Return Process

The AR Tax Return process involves several key steps, each playing a crucial role in ensuring the accurate and timely acknowledgment of tax returns.

Submission and Receipt

The process begins with taxpayers submitting their tax returns through the designated channels, such as online filing platforms or physical mail. Upon receipt of the return, the tax authorities initiate the acknowledgment process.

For electronic filings, the system automatically generates an AR once the submission is complete and successful. The AR is typically sent to the taxpayer's registered email address or made available through their online tax account. For paper returns, the AR is generated and mailed to the taxpayer's address once the physical document is received and processed.

Verification and Review

Once the AR is issued, the tax authorities initiate a thorough verification and review process. This step involves checking the accuracy and completeness of the information provided in the tax return. The authorities scrutinize the details, ensuring that all required information is present and that the calculations are correct.

During this phase, the tax authorities may identify any discrepancies or errors in the return. In such cases, they may reach out to the taxpayer for clarification or additional information. It is crucial for taxpayers to respond promptly to such requests to avoid any delays in the processing of their tax return.

Processing and Calculations

After the verification process, the tax authorities proceed with the actual processing of the tax return. This involves calculating the taxpayer's tax liability or refund, based on the information provided and applicable tax laws. The authorities use specialized software and algorithms to ensure accuracy and efficiency in these calculations.

During this stage, the tax authorities may also apply any applicable tax credits, deductions, or exemptions, further impacting the final tax outcome. The processing time can vary depending on factors such as the complexity of the return, the volume of returns being processed, and the taxpayer's filing status.

Finalization and Outcome

Once the processing is complete, the tax authorities finalize the tax return and determine the outcome. If the taxpayer has a tax liability, the authorities issue a notice of assessment, specifying the amount owed and the payment due date. Taxpayers are expected to settle their liabilities within the specified timeframe to avoid penalties and interest charges.

On the other hand, if the taxpayer is entitled to a refund, the authorities initiate the refund process. Refunds are typically issued through the taxpayer's preferred method of payment, such as direct deposit or check. The refund amount and processing time may vary depending on factors like the tax return complexity and the taxpayer's financial situation.

AR Tax Return Status: Real-World Scenarios

Let's explore some real-world scenarios to better understand how the AR Tax Return Status impacts taxpayers in various situations.

Scenario 1: Late Filing

Imagine a taxpayer, John, who realizes he has missed the tax filing deadline. He quickly prepares and submits his tax return, hoping to avoid any penalties. Upon submission, John receives an AR, providing him with instant relief and confirmation that his late return has been accepted.

The AR status allows John to track the progress of his return, giving him peace of mind while the tax authorities process his late filing. This status also ensures that John's return is not overlooked or lost in the system, allowing him to take the necessary steps to settle any potential late filing fees or penalties.

Scenario 2: Amending a Return

Sarah, a small business owner, discovers an error in her previously filed tax return. She needs to amend her return to ensure accuracy and avoid any legal consequences. The AR status from her original return serves as a crucial reference point for the amendment process.

With the AR in hand, Sarah can easily locate her original return and identify the specific section or calculation that requires amendment. This status ensures that Sarah's amendment is properly associated with her original return, facilitating a seamless correction process.

Scenario 3: Complex Tax Returns

Complex tax returns, such as those for high-net-worth individuals or multinational corporations, often involve intricate calculations and numerous supporting documents. In such cases, the AR status becomes even more critical.

For complex returns, the AR serves as a confirmation that the tax authorities have received and accepted the voluminous documentation. It provides a sense of assurance to taxpayers, indicating that their detailed submissions are being processed and that the tax authorities are aware of the complexity of their tax situation.

AR Tax Return Status: Frequently Asked Questions

How long does it take to receive an AR Tax Return Status after filing?

+The time it takes to receive an AR status can vary depending on the filing method and the volume of returns being processed. For electronic filings, AR status is typically received within minutes to a few hours. For paper returns, it may take several days to weeks, depending on postal services and processing times.

What if I don't receive an AR Tax Return Status?

+If you don't receive an AR status within a reasonable timeframe, it is advisable to contact the tax authorities. They can help you track your return and provide an update on its status. In some cases, resubmission may be necessary if the original return was not successfully received.

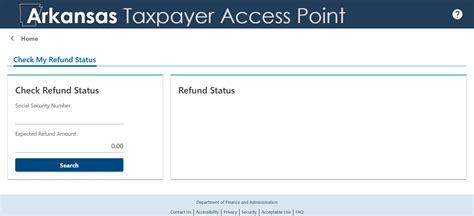

Can I check the status of my AR Tax Return online?

+Yes, many tax authorities provide online portals or websites where taxpayers can check the status of their AR tax returns. These portals often require login credentials or specific reference numbers to access individual return information.

What happens if there are errors in my tax return after receiving the AR status?

+If errors are discovered after receiving the AR status, it is crucial to address them promptly. Taxpayers should contact the tax authorities and provide the necessary corrections. The authorities may require additional documentation or explanations to process the amendments.

Is the AR status the same for all types of tax returns (e.g., personal, business, etc.)?

+Yes, the AR status is a generic acknowledgment receipt that applies to all types of tax returns. Whether it's a personal income tax return, business tax return, or any other type, the AR status indicates that the tax authorities have received and accepted the submission.

Conclusion

The AR Tax Return Status is a critical aspect of the tax return process, providing taxpayers with assurance, clarity, and a foundation for further tax-related actions. It serves as a confirmation of receipt, facilitating the subsequent processing and calculation of tax liabilities or refunds. Understanding the AR status and its implications is essential for individuals and businesses to navigate the tax landscape effectively.

By recognizing the significance of the AR status and following the proper procedures, taxpayers can ensure a smoother tax return journey. Whether it's filing on time, amending returns, or managing complex tax situations, the AR status plays a vital role in guiding taxpayers through the tax process.

Stay informed, stay organized, and make the most of your tax obligations with the knowledge of the AR Tax Return Status.