Ct Property Tax

Welcome to an in-depth exploration of the Connecticut Property Tax system, a topic that impacts countless homeowners and real estate investors in the Nutmeg State. Understanding the ins and outs of property taxation is crucial for anyone with a stake in Connecticut's vibrant real estate market. This comprehensive guide will delve into the specifics of how property taxes are calculated, assessed, and levied in Connecticut, offering valuable insights for both residents and prospective buyers.

The Connecticut Property Tax System: An Overview

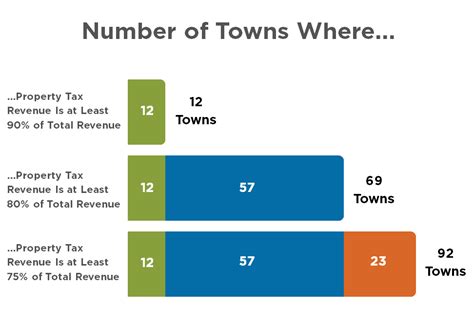

Connecticut’s property tax system is a complex but essential component of the state’s economy and real estate landscape. It is a primary source of revenue for local governments, including towns, cities, and school districts, allowing them to fund essential services and infrastructure. As a homeowner or property investor, it’s vital to grasp the intricacies of this system to make informed decisions and effectively manage your financial obligations.

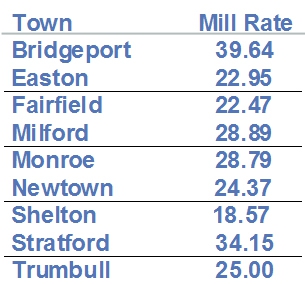

The property tax in Connecticut is based on the assessed value of your property and the mill rate set by your local government. The mill rate is a crucial factor, as it determines the tax rate per thousand dollars of assessed property value. This rate can vary significantly between different municipalities, even within the same county.

Here's a simplified breakdown of the property tax calculation process in Connecticut:

- Assessment: Properties are assessed by municipal assessors, who estimate the market value of each property as of October 1st of the preceding year.

- Mill Rate Determination: Local governments set the mill rate based on the amount of revenue they need to raise for the upcoming fiscal year. This rate is usually expressed in mills, where one mill equals $1 of tax liability for every $1,000 of assessed value.

- Tax Bill Calculation: Your property tax bill is then calculated by multiplying the assessed value of your property by the mill rate. For instance, if your property is assessed at $200,000 and the mill rate is 25 mills, your annual property tax would be $5,000 ($200,000 x 0.025 = $5,000).

Understanding Property Assessment in Connecticut

Property assessment is a critical step in the Connecticut property tax process, as it directly impacts the amount of tax you’ll pay. Assessors aim to determine the fair market value of each property, which is the price it would likely sell for in an open market. This value is then used as the basis for taxation.

Connecticut law requires that all real property be revalued at least every five years, with some towns opting for more frequent assessments. During the assessment process, municipal assessors visit properties, inspect them, and compare them to similar properties that have recently sold. They consider factors such as location, size, age, condition, and any recent improvements or additions.

While the assessment process is designed to be fair and accurate, discrepancies can occur. If you believe your property has been overvalued, you have the right to appeal the assessment. This process involves providing evidence to support your claim, such as recent sales of similar properties in your area. It's essential to understand the appeal process and your rights as a property owner to ensure a fair assessment.

Key Factors Affecting Property Assessments

Several factors can influence the assessed value of your property, including:

- Location: Properties in desirable neighborhoods or with convenient access to amenities often command higher values.

- Size and Features: Larger properties, those with more bedrooms or bathrooms, or unique features like a pool or a finished basement, tend to have higher assessments.

- Age and Condition: Older properties may require more maintenance and updates, which can impact their value. Well-maintained properties generally fetch higher assessments.

- Recent Sales: The sale prices of similar properties in your area are crucial indicators of your property's potential value.

| Assessment Type | Description |

|---|---|

| Full and Physical | A detailed, on-site inspection and valuation of the property. |

| Limited or Internal | An assessment based on a drive-by inspection or review of existing data, without a full physical inspection. |

| Reassessment | A revaluation of properties within a municipality to update values and ensure fairness. |

The Role of Mill Rates in Connecticut Property Taxation

The mill rate, as mentioned earlier, is a critical determinant of your property tax bill. It’s a rate set by local governments to raise the revenue they need to fund their operations and services. Mill rates can vary widely across Connecticut, even between neighboring towns.

For example, in 2022, the mill rate in Hartford, CT, was 71.45, while the rate in the nearby town of West Hartford was 39.60. This significant difference means that a homeowner with a property assessed at $200,000 in Hartford would pay $14,290 in property taxes ($200,000 x 0.07145 = $14,290), while the same homeowner in West Hartford would pay $7,920 ($200,000 x 0.0396 = $7,920). This illustrates the importance of understanding local mill rates when considering a property purchase or assessing your tax obligations.

How Mill Rates are Determined

Local governments determine mill rates based on their budget needs for the upcoming fiscal year. They consider the revenue they require to fund schools, roads, public safety, and other essential services. The mill rate is then set to raise the necessary funds, taking into account the total assessed value of all properties in the municipality.

It's important to note that mill rates can change from year to year. Governments may adjust the rate to account for changing economic conditions, shifts in property values, or fluctuations in the cost of providing services. Therefore, it's beneficial to stay informed about local mill rate changes to budget effectively for your property taxes.

| Town | 2022 Mill Rate | 2023 Mill Rate |

|---|---|---|

| Hartford | 71.45 | 74.60 |

| West Hartford | 39.60 | 41.10 |

| New Haven | 39.30 | 40.20 |

Property Tax Exemptions and Credits in Connecticut

Connecticut offers various property tax exemptions and credits to eligible homeowners, providing relief from the financial burden of property taxes. These incentives are designed to support specific groups, such as veterans, seniors, and those with disabilities, and to encourage homeownership. Understanding these exemptions can help you take advantage of potential savings.

Veterans Exemption

Connecticut provides a property tax exemption for veterans who meet certain criteria. To qualify, veterans must have served on active duty during a period of war or national emergency as recognized by the federal government. The exemption applies to the first $100,000 of the assessed value of their primary residence, offering significant savings on property taxes.

Elderly Homeowner and Renter’s Tax Relief

Connecticut’s Elderly Homeowner and Renter’s Tax Relief program provides tax credits to eligible homeowners and renters aged 65 and older. To qualify, applicants must meet certain income and residency requirements. The program offers a credit of up to $1,350 per year, which can be applied to property tax bills, reducing the financial burden for older adults.

Farm and Forest Land Exemption

Connecticut encourages the preservation of farmland and forestland by offering a property tax exemption for these types of land. To qualify, the land must be actively used for agricultural or forestry purposes and meet certain criteria set by the state. This exemption can significantly reduce the tax burden for landowners who use their property for farming or forestry.

| Exemption/Credit | Description | Eligibility |

|---|---|---|

| Veterans Exemption | Exemption on the first $100,000 of assessed value for qualifying veterans. | Veterans who served during a recognized period of war or national emergency. |

| Elderly Homeowner/Renter's Credit | Credit of up to $1,350 for eligible homeowners and renters aged 65+. | Homeowners/renters with limited income and who have resided in CT for at least 4 years. |

| Farm and Forest Land Exemption | Exemption for landowners who actively use their property for agriculture or forestry. | Land used for farming or forestry purposes and meets state criteria. |

Property Tax Appeals: Challenging Your Assessment

If you believe your property has been over-assessed, you have the right to appeal the assessment. This process involves presenting evidence to support your claim that the assessed value is inaccurate. It’s a critical step for homeowners who want to ensure they’re not paying more in property taxes than they should.

The Appeal Process

The first step in appealing your property assessment is to file an informal appeal with your local assessor’s office. This typically involves a meeting or phone call to discuss your concerns and provide supporting evidence. If the assessor agrees that an error has been made, they can adjust the assessment.

If the informal appeal is unsuccessful, you can proceed with a formal appeal to the Board of Assessment Appeals (BAA) in your town. This process involves submitting a formal application, often with supporting documentation such as recent sales of similar properties, and attending a hearing where you can present your case. The BAA will then make a decision on your appeal.

For those who are not satisfied with the BAA's decision, the final step is to appeal to the Superior Court. This is a more complex and costly process, so it's typically pursued when significant sums of money are at stake or when there are compelling reasons to believe the assessment is incorrect.

Tips for a Successful Appeal

- Gather Evidence: Collect recent sales data of comparable properties in your area. Ensure the properties are similar in size, location, and features to yours.

- Stay Organized: Keep all your documentation and correspondence related to the appeal process organized. This will make it easier to refer to during the appeal process.

- Know Your Rights: Understand the appeal process and your rights as a property owner. Be familiar with the deadlines and requirements for each step.

- Seek Professional Help: Consider consulting a tax professional or attorney who specializes in property tax appeals. They can provide valuable guidance and representation.

Future Outlook and Implications

The Connecticut property tax system is an evolving landscape, influenced by economic conditions, policy changes, and shifting real estate trends. While it’s challenging to predict the exact trajectory of property taxes, certain trends and factors can provide insights into potential future developments.

Economic Factors

Economic conditions play a significant role in determining property tax rates. During periods of economic growth, local governments may have increased revenue from other sources, which can lead to lower mill rates as they require less revenue from property taxes. Conversely, during economic downturns, governments may face budget shortfalls, leading to higher mill rates to make up for reduced income.

Population Shifts and Real Estate Trends

Changes in population and real estate trends can also impact property taxes. As certain areas become more desirable, property values may rise, leading to higher assessments and potentially higher tax bills. Conversely, areas experiencing population decline or a shift in demographics may see property values stagnate or decline, which could result in lower assessments and tax bills.

Policy Changes

Policy changes at the state and local levels can have a significant impact on property taxes. For instance, changes to assessment practices or the introduction of new tax incentives or exemptions can affect the overall tax burden for homeowners. It’s essential to stay informed about any proposed or enacted policy changes that could impact your property taxes.

In conclusion, the Connecticut property tax system is a critical component of the state's economy and real estate landscape. By understanding how property taxes are calculated, assessed, and levied, homeowners and investors can make informed decisions and effectively manage their financial obligations. This comprehensive guide has provided an in-depth look at the system, offering valuable insights into assessments, mill rates, exemptions, and the appeal process. As the real estate market and economic conditions continue to evolve, staying informed and proactive is key to navigating the Connecticut property tax landscape.

How often are properties assessed in Connecticut?

+

Properties in Connecticut are required to be revalued at least every five years. However, some towns may choose to conduct assessments more frequently to ensure the values are up-to-date.

What factors can lead to a property tax increase in Connecticut?

+

Property tax increases can occur due to several factors, including an increase in the mill rate set by the local government, an increase in the assessed value of your property, or a combination of both.

Are there any online tools to estimate my property tax in Connecticut?

+

Yes, several online resources and calculators are available to estimate your property tax based on your property’s assessed value and the current mill rate. These tools can provide a rough estimate, but it’s important to verify the accuracy with official sources.