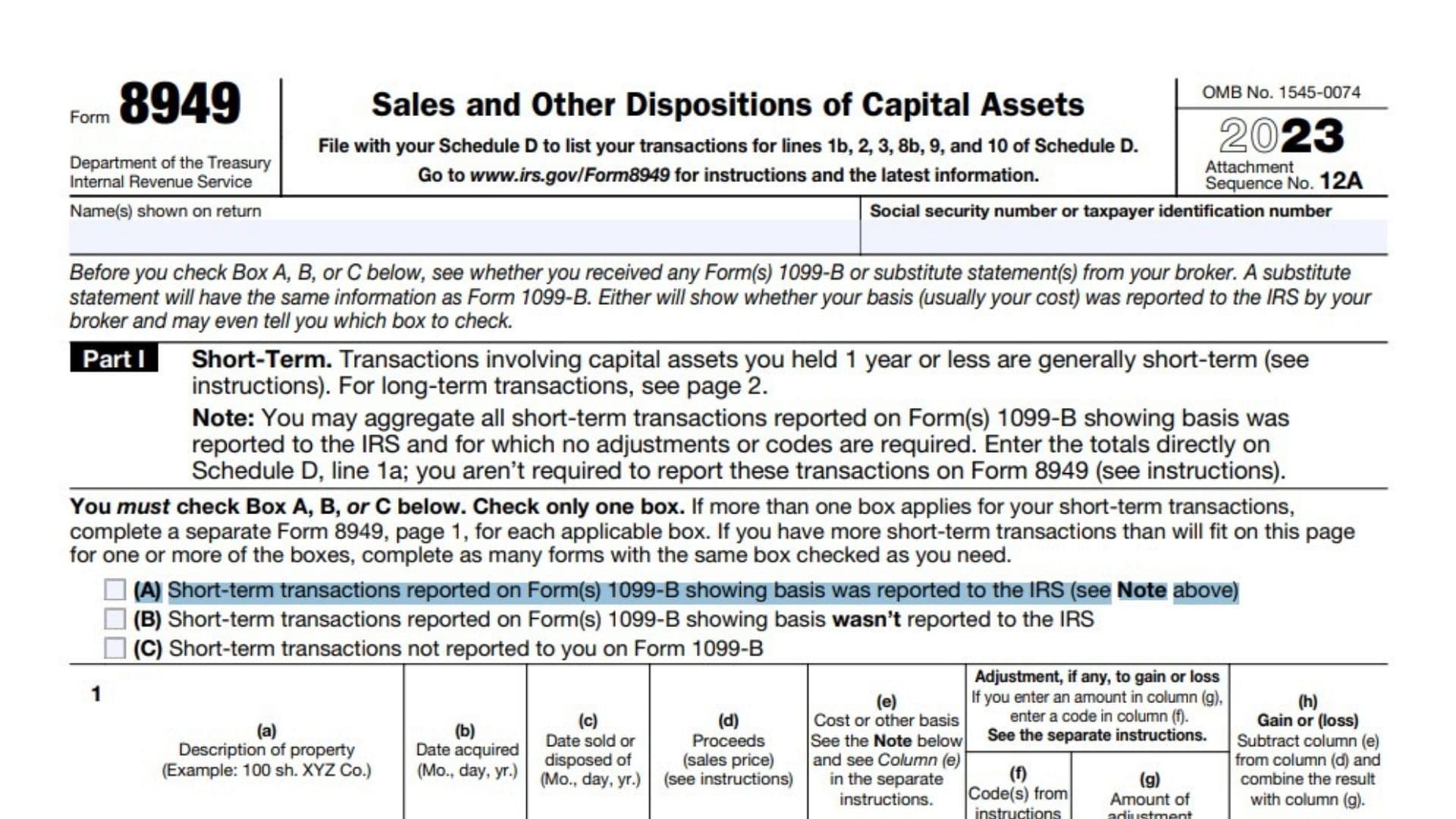

8949 Tax Form

The 8949 Tax Form is a critical document in the United States tax system, serving as a comprehensive guide for taxpayers to report and calculate capital gains and losses from various investments and transactions. This form is an essential tool for individuals and businesses alike, helping them navigate the complex world of capital gains taxation and ensure compliance with IRS regulations. In this article, we will delve into the intricacies of the 8949 Tax Form, exploring its purpose, structure, and significance in the tax landscape.

Understanding the Purpose of the 8949 Tax Form

The primary purpose of the 8949 Tax Form is to facilitate the accurate reporting of capital gains and losses from the sale or exchange of assets, such as stocks, bonds, real estate, and other investment properties. It is a companion form to the IRS Schedule D, which summarizes the total gains and losses for the tax year. The 8949 provides a detailed breakdown of each transaction, allowing taxpayers to accurately calculate and report their capital gains tax liability.

Capital gains and losses are a result of the difference between the purchase price (basis) of an asset and its sale price. These gains and losses can significantly impact an individual's or business's tax obligations. By using the 8949 Tax Form, taxpayers can track and report these transactions accurately, ensuring they meet their tax responsibilities and take advantage of any available tax benefits.

Structure and Components of the 8949 Tax Form

The 8949 Tax Form is divided into multiple sections, each designed to capture specific details of capital gains and losses transactions. Here’s an overview of the key components:

-

Part I: Transactions - This section requires taxpayers to list each transaction, including the date of acquisition, date of sale, description of the property, and its fair market value. It also prompts taxpayers to indicate the type of transaction, such as a sale, exchange, or involuntary conversion.

-

Part II: Basis and Identification of Property - Here, taxpayers provide information about the basis of the property, including the cost or other basis, adjustments to basis, and any available information to identify the property, such as its location or unique identifier.

-

Part III: Gain or Loss - In this section, taxpayers calculate the gain or loss from each transaction by comparing the sale price to the adjusted basis. The form guides taxpayers through this calculation, taking into account factors like depreciation and special rules for certain types of property.

-

Part IV: Summary of Transactions - This part summarizes the total gains and losses from all transactions reported on the form. It calculates the net capital gain or loss, which is then carried over to Schedule D and eventually to the taxpayer's Form 1040.

The 8949 Tax Form also includes additional worksheets and instructions to address specific situations, such as wash sales, like-kind exchanges, and installment sales. These provisions ensure that taxpayers can accurately report even the most complex transactions.

Navigating the 8949 Tax Form: Tips and Considerations

Completing the 8949 Tax Form accurately can be a complex task, especially for taxpayers with multiple transactions or complex investment strategies. Here are some tips and considerations to keep in mind:

-

Maintain Proper Records - Accurate record-keeping is essential when it comes to capital gains and losses. Keep detailed records of all transactions, including purchase and sale dates, prices, and any relevant documents. This will simplify the process of completing the 8949 and ensure you have the necessary information to support your calculations.

-

Understand Basis Calculations - The basis of an asset can be influenced by various factors, including purchase price, improvements, and depreciation. It's crucial to understand how to calculate the basis accurately, as it directly impacts the calculation of capital gains and losses.

-

Consider Tax Strategies - The 8949 Tax Form provides an opportunity to implement tax strategies to minimize your capital gains tax liability. For example, taxpayers can offset capital gains with capital losses or utilize long-term capital gains tax rates, which are generally more favorable. Consulting with a tax professional can help you identify the most beneficial strategies for your situation.

-

Stay Informed about Tax Laws - Tax laws and regulations can change from year to year, so it's essential to stay updated on any relevant changes that may impact your capital gains reporting. The IRS website and reputable tax resources can provide the latest information and guidance.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to better understand how the 8949 Tax Form is applied in practice:

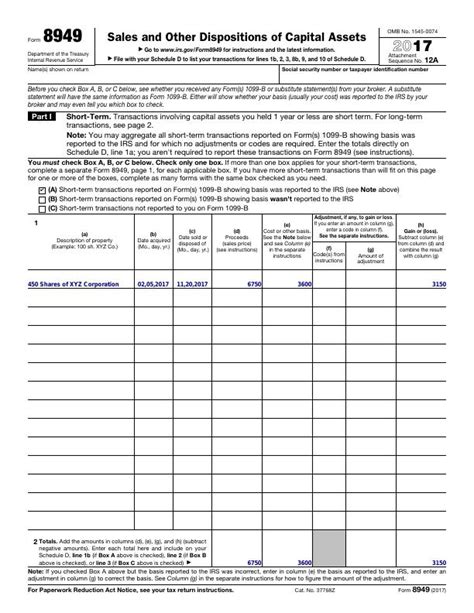

Scenario 1: Stock Investment and Sale

Imagine an individual investor, Sarah, who purchased 100 shares of a company’s stock for 50 per share in 2020. In 2022, Sarah decides to sell her shares when the stock price reaches 75 per share. To report this transaction accurately, Sarah will use the 8949 Tax Form.

On the form, Sarah will list the acquisition date, sale date, and description of the property (the stock). She will calculate her basis, which in this case is the purchase price of $5,000 (100 shares x $50), and then determine her gain by subtracting the basis from the sale price of $7,500 (100 shares x $75). This results in a capital gain of $2,500, which Sarah will report on her 8949 and carry over to her Schedule D.

Scenario 2: Real Estate Investment

Consider a business owner, John, who purchases a commercial property for 500,000 in 2018. Over the years, John makes improvements to the property, increasing its value. In 2023, John decides to sell the property for 700,000.

When completing the 8949 Tax Form, John will need to consider the adjusted basis of the property. In this case, the basis would include the purchase price plus any improvements made, less any depreciation claimed. John will calculate the gain by subtracting the adjusted basis from the sale price, resulting in a capital gain of $200,000. This gain will be reported on the 8949 and affect John's tax liability for the year.

Future Implications and Trends in Capital Gains Taxation

The landscape of capital gains taxation is constantly evolving, and staying informed about potential changes is crucial for taxpayers. Here are some future implications and trends to consider:

-

Tax Rate Changes - Capital gains tax rates can fluctuate based on economic conditions and legislative decisions. Taxpayers should monitor any proposed changes to tax rates, as these can significantly impact the after-tax returns from investment transactions.

-

Capital Gains Tax Reform - There have been ongoing discussions about reforming capital gains taxation to address concerns about fairness and complexity. Proposed reforms may include changes to tax rates, adjustments to holding periods, or modifications to the calculation of basis and gains.

-

Tax Planning Strategies - As tax laws evolve, tax planning strategies may need to be adjusted. Taxpayers should stay informed about emerging strategies that can help minimize capital gains tax liability, such as utilizing tax-efficient investment vehicles or exploring alternative investment options.

-

International Considerations - For taxpayers with international investments or transactions, it's essential to understand the impact of foreign tax laws and treaties. These considerations can affect the reporting and calculation of capital gains and losses, and taxpayers should consult with experts in international tax matters.

Expert Insights and Recommendations

As a tax expert, I recommend that taxpayers approach the 8949 Tax Form with careful attention to detail and a thorough understanding of their transactions. Here are some key insights and recommendations:

-

Seek Professional Guidance - Capital gains taxation can be complex, especially for taxpayers with significant investment portfolios or multiple transactions. Consulting with a tax professional or CPA can provide valuable insights and ensure compliance with the latest tax regulations.

-

Utilize Tax Software - Tax software can simplify the process of completing the 8949 Tax Form by automating calculations and providing guidance on specific transactions. These tools can save time and reduce the risk of errors, especially for taxpayers with a high volume of transactions.

-

Stay Organized

- Proper organization of financial records is essential for an efficient and accurate completion of the 8949. Develop a system for tracking transactions, basis information, and supporting documentation to streamline the reporting process.

Conclusion

The 8949 Tax Form is a powerful tool for taxpayers to navigate the complexities of capital gains and losses reporting. By understanding its purpose, structure, and best practices, individuals and businesses can accurately report their transactions and minimize their tax obligations. Staying informed about tax laws, seeking professional guidance, and utilizing efficient record-keeping practices are key to a successful and compliant tax strategy.

Frequently Asked Questions

How often do I need to complete the 8949 Tax Form?

+

The 8949 Tax Form is typically completed annually, alongside your tax return. However, if you have a significant change in your investment portfolio or sell an asset, you may need to complete the form at that time to accurately report the transaction.

Can I deduct capital losses from my taxes?

+

Yes, capital losses can be deducted from your taxes, but there are limitations. You can deduct capital losses up to the amount of your capital gains, and any excess losses can be carried forward to future tax years.

What is the holding period for long-term capital gains?

+

The holding period for long-term capital gains is generally one year or more. If you hold an asset for longer than one year before selling it, you may qualify for more favorable long-term capital gains tax rates.

Do I need to report all transactions on the 8949 Tax Form?

+

Not all transactions need to be reported on the 8949 Tax Form. Generally, you only need to report transactions that result in a capital gain or loss. However, it’s important to consult the instructions for the form and seek professional advice if you’re unsure.

Can I use the 8949 Tax Form for business transactions?

+

Yes, the 8949 Tax Form can be used to report capital gains and losses from business transactions. However, it’s important to differentiate between personal and business transactions and ensure that you’re reporting them correctly.