Sdc Tax Refund

In the complex world of taxes, every individual and business entity strives to optimize their financial strategies. One such strategy is the Sdc Tax Refund, a mechanism that can provide substantial benefits to eligible taxpayers. This article aims to demystify the process, exploring its intricacies, eligibility criteria, and the potential advantages it offers.

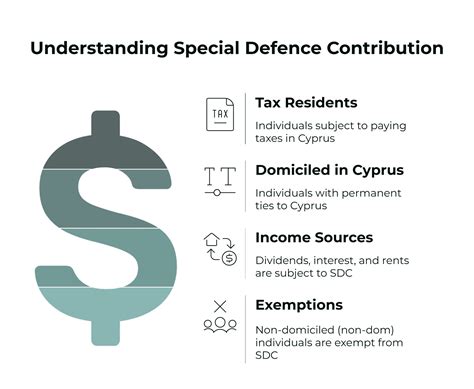

Understanding Sdc Tax Refund

The Sdc Tax Refund is a provision within the tax code that allows eligible taxpayers to reclaim certain expenses or overpaid taxes. This refund mechanism is a crucial tool for businesses and individuals to manage their cash flow effectively and ensure compliance with tax regulations.

The process involves a thorough review of the taxpayer's financial records, identifying eligible expenses, and calculating the potential refund. This can include a wide range of expenses, from business-related costs to specific investments or losses.

Eligible Expenses and Criteria

The eligibility criteria for the Sdc Tax Refund vary based on jurisdiction and the nature of the taxpayer. Generally, businesses can claim a refund for expenses incurred in the course of their operations, provided they meet specific conditions. These expenses could range from research and development costs to employee training programs.

For individuals, the Sdc Tax Refund often focuses on overpaid taxes or specific investments that qualify for tax benefits. For instance, contributions to certain retirement accounts or investments in renewable energy projects might qualify for tax refunds.

| Expense Category | Eligible Criteria |

|---|---|

| Business Expenses | Must be directly related to business operations and supported by documentation. |

| Research & Development | Eligible for refund if the expenses are innovative and aimed at improving products or services. |

| Investment Refunds | Specific investments like green energy or approved startup investments qualify. |

It's important to note that the eligibility criteria can be complex and vary greatly, so seeking professional advice is crucial for a successful Sdc Tax Refund claim.

The Process: From Claim to Refund

The Sdc Tax Refund process involves several key steps, each requiring careful attention to detail. This ensures that the taxpayer’s claim is accurate, valid, and compliant with tax regulations.

Documentation and Preparation

The first step is to gather all relevant financial documents and records. This includes receipts, invoices, bank statements, and any other proof of eligible expenses. It’s crucial to ensure that these documents are organized and easily accessible for the tax preparer or accountant.

Once the documentation is in order, the taxpayer or their representative can begin preparing the tax refund claim. This involves a detailed analysis of the financial records to identify eligible expenses and calculate the potential refund amount.

Submission and Review

The prepared Sdc Tax Refund claim is then submitted to the relevant tax authority. This process can be done online or through traditional mail, depending on the jurisdiction’s requirements.

Upon submission, the tax authority reviews the claim. This review process can take varying amounts of time, depending on the complexity of the claim and the workload of the tax authority. During this time, the taxpayer might be required to provide additional documentation or clarification if the claim is deemed incomplete or unclear.

Approval and Disbursement

If the Sdc Tax Refund claim is approved, the taxpayer will receive a notification from the tax authority. The refund amount will then be disbursed, typically via the taxpayer’s preferred method of payment (e.g., direct deposit or check).

It's important to note that some jurisdictions might require additional steps or have specific timelines for disbursement. Taxpayers should stay informed about these processes to ensure a smooth and timely refund.

Maximizing Your Sdc Tax Refund

While the Sdc Tax Refund process is intricate, there are strategies to maximize the potential refund. These strategies involve a combination of careful financial planning, record-keeping, and understanding of tax regulations.

Strategic Financial Planning

One of the key strategies is to plan financial activities with tax implications in mind. This could involve timing certain expenses or investments to maximize their eligibility for the Sdc Tax Refund. For instance, deferring certain business expenses to a year with higher revenue can result in a larger refund.

Additionally, understanding the specific criteria for eligible expenses can help businesses and individuals strategically allocate their funds to maximize their refund potential. This might involve investing in approved projects or restructuring business operations to focus on eligible expenses.

Efficient Record-Keeping

Efficient record-keeping is another crucial aspect of maximizing the Sdc Tax Refund. This involves maintaining detailed and accurate financial records, ensuring that all eligible expenses are properly documented and categorized. This not only facilitates the refund claim process but also provides a clear audit trail in case of any queries from the tax authority.

Digital tools and software can greatly assist in this regard, offering streamlined methods for record-keeping and documentation. These tools can help organize and categorize expenses, making the refund claim process more efficient and accurate.

The Impact and Future of Sdc Tax Refunds

The Sdc Tax Refund has a significant impact on the financial health of businesses and individuals, providing a boost to their cash flow and offering a reward for compliant financial practices. For businesses, this refund can be reinvested into the company, helping to fuel growth and innovation.

For individuals, the Sdc Tax Refund can provide a substantial financial boost, especially for those who have overpaid taxes or made eligible investments. This refund can be a welcome relief, helping to manage personal finances and achieve financial goals.

Policy and Regulatory Changes

The future of the Sdc Tax Refund is closely tied to policy and regulatory changes. Tax laws are subject to frequent revisions, and any changes can significantly impact the refund process and eligibility criteria.

Taxpayers and professionals need to stay updated on these changes to ensure they remain compliant and can effectively navigate the tax landscape. This includes understanding any new eligibility criteria, changed refund processes, or potential tax breaks.

Advancements in Technology

Advancements in technology are also shaping the future of the Sdc Tax Refund process. Digital tools and software are becoming increasingly sophisticated, offering more efficient methods for record-keeping, expense tracking, and refund claim preparation.

These tools can automate many aspects of the process, reducing the time and effort required for taxpayers and professionals. This not only improves efficiency but also reduces the risk of errors, leading to more accurate and timely refund claims.

Conclusion: Embracing the Benefits of Sdc Tax Refunds

The Sdc Tax Refund is a powerful tool for taxpayers, offering a potential financial windfall and a reward for compliant financial practices. By understanding the process, eligibility criteria, and strategies for maximizing the refund, taxpayers can effectively utilize this mechanism to their advantage.

As the tax landscape evolves, staying informed and adaptable is key. This includes keeping abreast of policy changes, regulatory updates, and advancements in technology that can streamline the Sdc Tax Refund process.

With careful planning, efficient record-keeping, and professional guidance, taxpayers can navigate the Sdc Tax Refund process successfully, reaping the benefits of this important tax provision.

How often can I claim the Sdc Tax Refund?

+The frequency of claiming the Sdc Tax Refund depends on the specific jurisdiction and the nature of the taxpayer’s expenses. Generally, businesses can claim eligible expenses annually, while individuals might have different timelines based on their investment or tax payment schedules.

Are there any penalties for claiming ineligible expenses in the Sdc Tax Refund?

+Yes, claiming ineligible expenses in the Sdc Tax Refund can result in penalties. These penalties can include fines, interest on the overclaimed amount, and in severe cases, criminal charges. It’s crucial to ensure that all claimed expenses are eligible and supported by proper documentation.

Can I hire a professional to help with my Sdc Tax Refund claim?

+Absolutely! Hiring a tax professional, such as a certified public accountant (CPA) or tax attorney, can be beneficial for several reasons. They can help identify eligible expenses, ensure compliance with tax regulations, and maximize your refund potential. Their expertise can be invaluable, especially for complex tax situations.