Tax Calculator Oregon

Welcome to this comprehensive guide on the Oregon tax calculator, a vital tool for residents and businesses navigating the state's unique tax landscape. Oregon is known for its progressive tax system, and understanding how it works is essential for accurate financial planning and compliance. In this article, we'll delve into the intricacies of the Oregon tax calculator, providing you with the knowledge and insights to make informed decisions regarding your tax obligations.

Understanding the Oregon Tax Calculator: A Comprehensive Overview

The Oregon tax calculator is a sophisticated tool designed to assist individuals and businesses in computing their state tax liabilities accurately. Oregon's tax system is notably complex, with various brackets, rates, and deductions, making it crucial to have a reliable calculator at hand. This section will provide an in-depth look at the key features and benefits of the Oregon tax calculator.

Key Features of the Oregon Tax Calculator

The Oregon tax calculator offers a range of features tailored to the state's tax regulations. Here's an overview of its key functionalities:

- Personalized Calculations: The calculator allows users to input their personal details, such as income, marital status, and number of dependents, to generate a tailored tax estimate. This ensures that the calculation takes into account the unique circumstances of each taxpayer.

- Up-to-Date Tax Rates: The calculator is regularly updated with the latest tax rates, ensuring accuracy. Oregon's tax rates can change annually, so having access to current information is crucial for precise tax planning.

- Deduction and Credit Support: It provides a comprehensive list of deductions and credits available to Oregon taxpayers. This includes standard deductions, itemized deductions, and various tax credits, such as the Oregon Child and Dependent Care Tax Credit and the Oregon Earned Income Tax Credit.

- Bracket Analysis: The calculator helps users understand which tax bracket they fall into based on their income. Oregon has multiple tax brackets with progressive rates, and this feature ensures taxpayers are aware of their bracket and the corresponding tax rate.

- Estimated Tax Payment Guidance: For those who owe quarterly estimated taxes, the calculator provides guidance on calculating and paying these estimates accurately. This feature is especially useful for self-employed individuals and businesses.

- Interactive Tax Forms: The calculator often includes digital versions of Oregon's tax forms, allowing users to fill them out directly and receive real-time calculations. This streamlines the tax preparation process and reduces the risk of errors.

By utilizing these features, taxpayers can navigate Oregon's tax system with confidence, ensuring they meet their obligations and maximize any available deductions or credits.

Benefits of Using the Oregon Tax Calculator

The advantages of employing the Oregon tax calculator are significant, offering both convenience and accuracy in tax management. Here are some key benefits:

- Time Efficiency: The calculator saves users valuable time by automating complex tax calculations. Instead of manually working through formulas and tax tables, individuals and businesses can quickly generate accurate tax estimates.

- Accuracy: With regular updates and a user-friendly interface, the calculator minimizes the risk of errors in tax calculations. This is crucial for avoiding penalties and ensuring compliance with Oregon's tax laws.

- Financial Planning: By providing a clear picture of tax liabilities, the calculator assists in financial planning. Taxpayers can make informed decisions about their finances, such as adjusting withholding amounts or planning for quarterly estimated tax payments.

- Deduction Maximization: The calculator helps users identify and claim all eligible deductions and credits, ensuring they minimize their tax burden. This is especially beneficial for taxpayers who may not be aware of all the deductions available to them.

- Compliance Assurance: Accurate tax calculations lead to compliance with Oregon's tax regulations. By using the calculator, taxpayers can be confident that they are meeting their legal obligations and avoiding potential audits or penalties.

Incorporating the Oregon tax calculator into your tax management strategy is a wise decision, offering peace of mind and ensuring a smooth tax filing process.

How the Oregon Tax Calculator Works: A Step-by-Step Guide

Using the Oregon tax calculator is a straightforward process, designed to be accessible to taxpayers of all levels of financial expertise. This section will provide a detailed, step-by-step guide on how to utilize the calculator effectively.

Step 1: Access the Calculator

The first step is to locate and access the official Oregon tax calculator. You can typically find it on the website of the Oregon Department of Revenue or through reputable tax preparation software providers. Ensure you are using an official and secure source to guarantee accuracy and data protection.

Step 2: Input Personal Information

Once you have accessed the calculator, you'll be prompted to input your personal details. This typically includes your name, address, social security number, and filing status (single, married filing jointly, etc.). The calculator may also ask for information about your dependents, such as the number and ages of any qualifying children.

Step 3: Enter Income Details

In this step, you'll provide information about your income. This includes wages, salaries, and any other sources of income, such as interest, dividends, or business income. Be sure to have all your tax documents, such as W-2s and 1099 forms, readily available to ensure accurate reporting.

Step 4: Deductions and Credits

The calculator will then guide you through the process of claiming deductions and credits. This is where you can input information about eligible deductions, such as mortgage interest, state and local taxes, and charitable contributions. It will also prompt you to enter details about any applicable tax credits, such as the Child Tax Credit or the Oregon Heritage Tax Credit.

Step 5: Calculate and Review

After entering all the necessary information, the calculator will generate your tax estimate. It will display the total amount of tax you owe or, if you're eligible for a refund, the amount you can expect to receive. Review the calculation carefully, ensuring all the information is accurate and up-to-date.

Step 6: Adjust Withholdings (Optional)

If you find that your tax liability is higher than expected, you may want to consider adjusting your tax withholdings. The calculator can assist you in determining the necessary adjustments to your W-4 form to better align your withholdings with your tax obligations.

Step 7: Save and Print

Once you are satisfied with the calculation, save a copy of the results for your records. You may also have the option to print a summary of your tax estimate, which can be useful for reference or for including with your tax return.

By following these steps, you can effectively utilize the Oregon tax calculator to navigate the state's tax landscape with confidence and precision.

Oregon Tax Calculator: A Comparison with Other States

Oregon's tax system is distinct, and its tax calculator reflects the state's unique approach to taxation. To provide context and help taxpayers understand the differences, this section compares the Oregon tax calculator with those of other states, highlighting the key variations.

Tax Bracket Differences

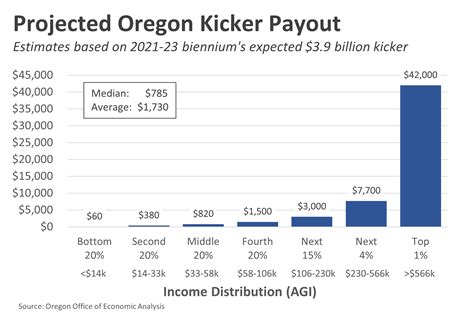

One of the most notable differences between states is the number and structure of tax brackets. Oregon has a progressive tax system with five income tax brackets, ranging from 5% to 9.9%. In contrast, some states, like Florida, have a flat tax rate, while others, like California, have more brackets with higher top rates.

Deduction and Credit Availability

The availability and types of deductions and credits also vary widely between states. Oregon offers a range of deductions, including the standard deduction, which can be adjusted for inflation, and itemized deductions for expenses like medical costs and property taxes. Additionally, Oregon has specific credits, such as the Residential Energy Tax Credit and the Workforce Training Tax Credit, which may not be available in other states.

Tax Calculator Features

The features and user interfaces of tax calculators can differ significantly. While many states provide basic calculators that estimate tax liability based on income and deductions, Oregon's calculator goes a step further. It offers interactive forms, estimated tax payment guidance, and a personalized approach, making it a more comprehensive tool for taxpayers.

Tax Rates and Revenues

Oregon's tax rates and the revenue they generate are also distinct. The state's progressive tax system aims to distribute the tax burden fairly, with higher-income earners paying a larger share. This approach differs from states with flat tax rates, where everyone pays the same percentage regardless of income.

Compliance and Penalties

Compliance requirements and penalties for non-compliance can vary between states. Oregon, like most states, imposes penalties for late tax payments or incorrect filings. However, the specific rules and amounts can differ, so it's essential to understand the regulations in your state to avoid unnecessary penalties.

By comparing Oregon's tax calculator with those of other states, taxpayers can gain a better understanding of the unique aspects of Oregon's tax system and how it differs from the rest of the country. This knowledge is crucial for effective tax planning and compliance.

The Future of Tax Calculations: Oregon's Ongoing Initiatives

As technology advances and tax regulations evolve, the future of tax calculations in Oregon holds exciting possibilities. The state is actively working on initiatives to enhance the tax calculation process, making it more efficient, accurate, and accessible to taxpayers.

Digital Transformation

Oregon is committed to digitizing its tax systems to improve efficiency and reduce administrative burdens. The state is investing in modernizing its tax infrastructure, including the tax calculator, to ensure it can handle the increasing complexity of tax laws and the growing volume of electronic tax returns.

AI and Machine Learning Integration

The Oregon Department of Revenue is exploring the use of artificial intelligence (AI) and machine learning to enhance the tax calculation process. These technologies can analyze vast amounts of data, identify patterns, and make accurate predictions, potentially streamlining the calculation of tax liabilities and identifying areas where taxpayers may be eligible for additional deductions or credits.

Tax Simplification Initiatives

Oregon is also working towards simplifying its tax system to make it more user-friendly for taxpayers. This includes reviewing and streamlining tax laws, forms, and regulations to reduce complexity and confusion. A simpler tax system can benefit both taxpayers and tax administrators, leading to increased compliance and reduced administrative costs.

Mobile App Development

To improve accessibility, Oregon is considering the development of a mobile app for its tax calculator. A mobile app would allow taxpayers to access the calculator on their smartphones or tablets, making it more convenient to calculate taxes on the go. This initiative would align with the state's goal of providing user-friendly tax services.

Data Security Enhancements

With the increasing prevalence of cyber threats, Oregon is dedicated to enhancing data security measures for its tax systems. This includes implementing robust encryption protocols, two-factor authentication, and other security measures to protect taxpayers' sensitive information. Ensuring data security is a top priority to maintain the trust and confidence of Oregon's taxpayers.

Collaboration with Tax Professionals

The state is actively engaging with tax professionals and industry experts to gather feedback and insights on improving the tax calculator and overall tax administration. By collaborating with these stakeholders, Oregon can ensure that its tax systems meet the needs of taxpayers and tax professionals alike.

Conclusion: Empowering Taxpayers with Knowledge

The Oregon tax calculator is a powerful tool that empowers taxpayers to navigate the state's tax landscape with confidence and precision. By providing accurate calculations, personalized guidance, and up-to-date tax information, the calculator ensures that taxpayers can make informed decisions about their financial obligations.

As Oregon continues to innovate and improve its tax systems, taxpayers can expect even more advanced and user-friendly tools to assist with their tax management. The state's commitment to digital transformation, AI integration, and tax simplification initiatives will further enhance the tax calculation process, making it more accessible and efficient for all.

Whether you're a resident, a business owner, or a tax professional, understanding and utilizing the Oregon tax calculator is essential for compliance and financial planning. By staying informed and leveraging the calculator's features, you can ensure you're meeting your tax obligations and taking advantage of any available deductions or credits.

In conclusion, the Oregon tax calculator is a valuable resource that plays a crucial role in the state's tax administration. It empowers taxpayers to take control of their financial responsibilities, making the tax filing process less daunting and more manageable. As Oregon continues to lead the way in tax innovation, taxpayers can look forward to a brighter and more streamlined tax future.

What are the tax rates in Oregon for 2023?

+Oregon has five tax brackets for the 2023 tax year, with rates ranging from 5% to 9.9%. The brackets are as follows: 5% (up to 4,125), 5.5% (4,125 to 7,500), 7% (7,500 to 12,500), 8.95% (12,500 to 250,000), and 9.9% (over 250,000). These rates are subject to change, so it’s essential to consult the Oregon Department of Revenue for the most current information.

How do I calculate my Oregon state tax refund?

+To calculate your Oregon state tax refund, you’ll need to file your tax return using the official forms provided by the Oregon Department of Revenue. The refund amount, if any, will be calculated based on your income, deductions, and credits. The tax calculator can assist in estimating your refund, but it’s important to file your return accurately to receive the correct refund amount.

Are there any special tax credits available in Oregon?

+Yes, Oregon offers various tax credits to eligible taxpayers. These include the Oregon Heritage Tax Credit, the Residential Energy Tax Credit, and the Oregon Child and Dependent Care Tax Credit, among others. The availability and requirements for these credits can vary, so it’s advisable to consult the Oregon Department of Revenue’s website for detailed information.

Can I use the Oregon tax calculator for business taxes?

+Yes, the Oregon tax calculator can be used for both personal and business taxes. It provides tailored calculations for businesses, taking into account business income, expenses, and applicable deductions. However, it’s essential to have accurate financial records and consult with a tax professional if you have complex business tax scenarios.

What if I have questions about using the Oregon tax calculator?

+If you have questions or need assistance with using the Oregon tax calculator, you can contact the Oregon Department of Revenue’s Taxpayer Services division. They provide support and guidance to help taxpayers navigate the calculator and understand their tax obligations. You can reach them by phone, email, or through their website’s contact form.