Sale Tax In Ny

Sales tax is an essential component of the tax system in New York State, impacting businesses and consumers alike. It is a crucial revenue source for the state, funding various public services and infrastructure projects. Understanding the intricacies of sales tax in New York is vital for businesses to ensure compliance and for consumers to make informed decisions about their purchases.

Understanding Sales Tax in New York

Sales tax in New York is a percentage-based tax imposed on the sale of goods and certain services. It is a critical aspect of the state’s tax structure, with revenues collected from sales tax contributing significantly to the state’s budget. The tax is levied at the point of sale, meaning it is typically paid by the consumer to the retailer, who then remits the tax to the state.

The New York State Department of Taxation and Finance is responsible for administering and enforcing sales tax regulations. They provide guidelines, resources, and support to help businesses navigate the complexities of sales tax compliance. The department also works to educate consumers about their rights and responsibilities regarding sales tax.

Sales Tax Rates

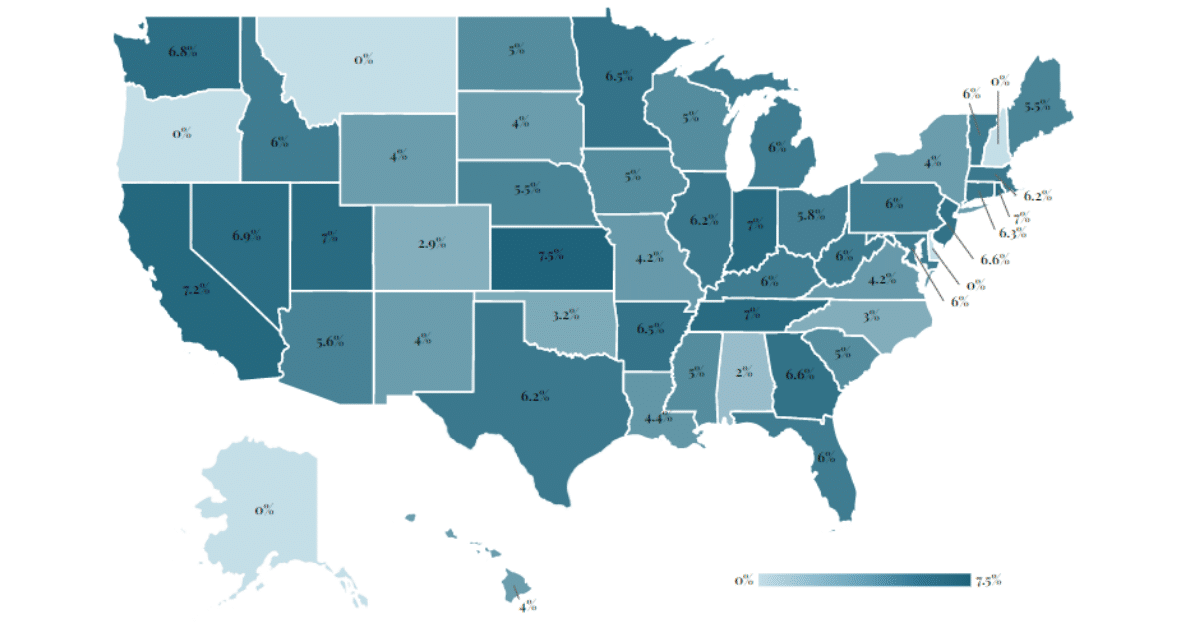

New York operates with a statewide sales tax rate that applies uniformly across the state. As of [current date], the statewide sales tax rate is 4%. However, it is important to note that local governments in New York can impose additional sales taxes, resulting in a combined sales tax rate that may vary from one location to another within the state.

| Location | Combined Sales Tax Rate |

|---|---|

| New York City | 8.875% |

| Albany County | 8% |

| Buffalo | 8% |

| Rochester | 8% |

| Long Island | 6% |

These local sales tax rates are often used to fund specific projects or initiatives within a particular municipality. For instance, in New York City, the additional sales tax helps finance the city's Metropolitan Transportation Authority (MTA), which operates the city's extensive public transportation system.

Taxable and Exempt Items

Not all goods and services are subject to sales tax in New York. The state maintains a list of taxable items, which includes most tangible personal property, such as clothing, electronics, and furniture. Certain services, like repairs and installations, are also taxable.

However, there are also exempt items, which are not subject to sales tax. These typically include essential goods like food, medications, and certain medical devices. Additionally, some services, such as legal and professional services, are also exempt from sales tax. The state provides a detailed guide to help businesses and consumers understand what is taxable and what is exempt.

Sales Tax Registration and Compliance

Businesses operating in New York State are required to register for a sales tax certificate if they meet certain criteria, such as having a physical presence in the state or conducting a specific level of business activity. The registration process involves completing an application and providing relevant business information.

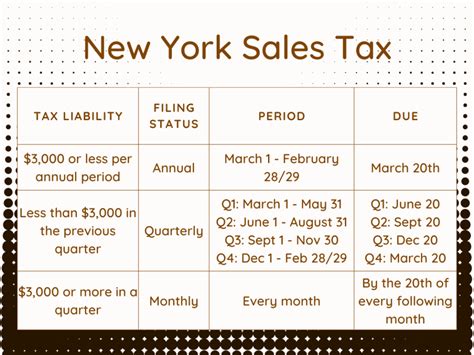

Once registered, businesses must collect and remit sales tax on all taxable sales. This involves integrating sales tax calculations into their point-of-sale systems and ensuring accurate tax collection. Businesses must also file sales tax returns periodically, reporting their taxable sales and remitting the collected tax to the state.

Compliance with sales tax regulations is crucial to avoid penalties and legal issues. The Department of Taxation and Finance offers resources and guidance to help businesses understand their obligations and maintain compliance.

The Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in New York State. For businesses, sales tax compliance adds a layer of complexity to their operations, requiring careful management of tax calculations, collection, and reporting.

On the consumer side, sales tax affects purchasing decisions and the overall cost of goods and services. Consumers must factor in the sales tax when budgeting for purchases, especially for larger items. The variability in sales tax rates across the state can also influence consumer behavior, with some choosing to shop in areas with lower tax rates.

Strategies for Businesses

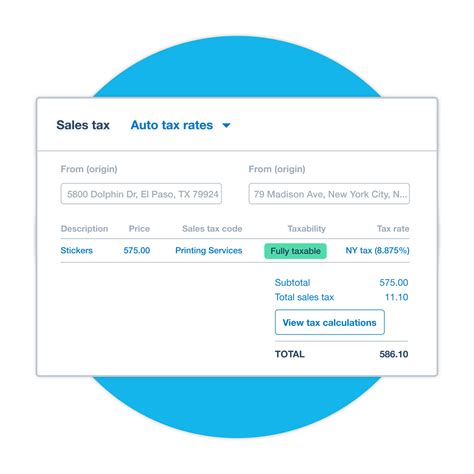

To navigate the complexities of sales tax, businesses can employ various strategies. Utilizing sales tax automation software can streamline the process of calculating, collecting, and reporting sales tax. This technology ensures accuracy and reduces the risk of errors, which is especially beneficial for businesses with a large volume of transactions.

Additionally, staying informed about sales tax regulations and updates is crucial. The Department of Taxation and Finance regularly publishes updates and guidelines, and businesses should subscribe to these resources to ensure they are aware of any changes that may impact their operations.

Consumer Awareness and Advocacy

For consumers, understanding sales tax is essential for making informed purchasing decisions. Being aware of the sales tax rate in their area can help consumers budget effectively and compare prices across different retailers.

Consumer advocacy groups often play a role in influencing sales tax policies. They may advocate for changes in sales tax rates or for certain items to be exempted from taxation. By engaging with these groups, consumers can have a say in how sales tax is implemented and used in their communities.

Future Implications and Potential Changes

The landscape of sales tax in New York is not static, and there are ongoing discussions and proposals for potential changes. One area of focus is the fairness and equity of sales tax distribution. There are concerns that the current system may disproportionately benefit certain areas or industries, leading to calls for reform.

Additionally, the rise of e-commerce has presented new challenges for sales tax collection. With online retailers often operating across state lines, there is a need to develop strategies to ensure these businesses comply with sales tax regulations. This includes the potential implementation of economic nexus rules, which would require out-of-state sellers to collect and remit sales tax if they meet certain thresholds of business activity in the state.

Furthermore, discussions around sales tax holidays, where certain items are exempted from sales tax for a limited time, are ongoing. These holidays are designed to stimulate consumer spending and provide temporary relief from sales tax, but their effectiveness and impact on state revenues are subjects of debate.

Looking Ahead

As New York State continues to evolve and adapt to changing economic and technological landscapes, the sales tax system will likely undergo further transformations. Staying informed about these developments is crucial for both businesses and consumers to ensure they can navigate the tax system effectively and make the most of their purchasing power.

What is the sales tax rate in New York State for online purchases?

+Online purchases in New York State are subject to the same sales tax rates as in-store purchases. This means that the combined sales tax rate, including the state and local taxes, applies to online sales as well. Businesses selling online must ensure they are compliant with sales tax regulations, including collecting and remitting the appropriate taxes.

Are there any sales tax exemptions for certain types of businesses?

+Yes, certain types of businesses may be eligible for sales tax exemptions or reduced rates. These typically apply to specific industries or sectors, such as nonprofit organizations or certain agricultural businesses. It’s important for businesses to research and understand any applicable exemptions or special tax considerations.

How often do sales tax rates change in New York State?

+Sales tax rates in New York State can change periodically, typically as a result of legislative decisions or local initiatives. While the statewide sales tax rate has remained stable for some time, local governments have the authority to adjust their local sales tax rates. It’s important for businesses and consumers to stay informed about any changes to ensure accurate tax calculations and compliance.