How Much Is Sales Tax In Nc

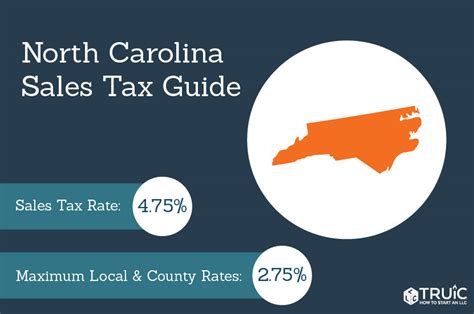

Sales tax in North Carolina is an essential component of the state's revenue system, playing a crucial role in funding various public services and infrastructure projects. The sales tax rate is a key consideration for both consumers and businesses operating within the state. Understanding the current sales tax rates and their application is vital for making informed financial decisions and ensuring compliance with state regulations.

Sales Tax Rates in North Carolina

As of my last update in January 2023, the statewide sales tax rate in North Carolina is 4.75%. This rate is consistent across the state and applies to most tangible personal property and certain services. However, it’s important to note that in addition to the state sales tax, there are also local sales tax rates that vary depending on the county and municipality.

Local Sales Tax Variations

North Carolina allows local governments to impose additional sales taxes, leading to variations in the total sales tax rates across the state. These local sales taxes can be as low as 0% or as high as 2.5%, depending on the jurisdiction. For instance, in the city of Charlotte, the combined state and local sales tax rate is 7.25%, while in Asheville, it’s 7.75%. These variations are crucial for businesses and consumers to consider when making financial plans or comparing prices across different regions.

| City | Total Sales Tax Rate |

|---|---|

| Charlotte | 7.25% |

| Asheville | 7.75% |

| Raleigh | 7.5% |

| Greensboro | 7.5% |

| Winston-Salem | 7.5% |

Sales Tax Exemptions and Special Considerations

While the sales tax in North Carolina applies to a wide range of goods and services, there are certain exceptions and exemptions. These include:

- Grocery items: Certain food items are exempt from sales tax, providing a relief for essential household expenses.

- Prescription drugs: Sales tax does not apply to prescription medications, making healthcare more affordable for residents.

- Educational materials: Books, newspapers, and certain school supplies are exempt, encouraging literacy and education.

- Manufacturing equipment: Machinery and equipment used in manufacturing processes are often exempt, supporting the state's industrial sector.

- Certain services: Services like legal, accounting, and consulting are typically not subject to sales tax, benefiting professional service providers.

It's important to note that while these exemptions exist, there are specific criteria and limitations that apply to each category. Businesses and consumers should consult the official North Carolina Department of Revenue website or seek professional advice to ensure accurate understanding and compliance.

The Impact of Sales Tax on Businesses and Consumers

The sales tax in North Carolina has a significant impact on both businesses and consumers. For businesses, especially those with a physical presence in the state, understanding and managing sales tax obligations is crucial for financial planning and compliance. This includes registering for a sales tax permit, collecting the appropriate tax rates, and remitting the collected taxes to the state on a regular basis.

From a consumer perspective, sales tax adds to the cost of goods and services, impacting purchasing decisions and overall spending power. The variations in sales tax rates across different regions can influence consumer behavior, with some shoppers opting to make purchases in areas with lower tax rates. This dynamic creates a unique landscape for businesses, as they must consider not only their local market but also the potential impact of neighboring jurisdictions' tax rates.

Future Trends and Potential Changes

As with any tax system, the sales tax in North Carolina is subject to potential changes and revisions. These changes can be influenced by various factors, including economic conditions, legislative priorities, and the state’s budgetary needs. While it’s challenging to predict future alterations, staying informed about tax policy discussions and proposals is essential for both businesses and consumers.

One potential area of change is the expansion or modification of sales tax exemptions. As the state's economy evolves and new industries emerge, there may be calls to exempt or reduce sales tax for certain sectors or goods, which could have a significant impact on businesses and consumers alike. Additionally, with the increasing focus on online sales and remote transactions, there may be discussions around adapting the sales tax system to address these changing dynamics.

Conclusion

Understanding the sales tax landscape in North Carolina is crucial for both individuals and businesses operating within the state. With a statewide rate of 4.75% and varying local rates, sales tax can significantly impact financial planning and decision-making. By staying informed about the current rates, exemptions, and potential future changes, businesses and consumers can navigate the tax system effectively and ensure compliance with state regulations.

Are there any upcoming changes to the sales tax rates in North Carolina?

+As of my knowledge cutoff in January 2023, there were no immediate plans for significant changes to the sales tax rates in North Carolina. However, it’s always advisable to stay updated with the latest tax policies and announcements, as unexpected changes can occur. Regularly checking the North Carolina Department of Revenue website or consulting tax professionals can provide the most accurate and up-to-date information.

How often are sales tax rates reviewed and adjusted in North Carolina?

+Sales tax rates in North Carolina are typically reviewed and adjusted as part of the state’s budgetary process, which occurs annually. However, the timing and magnitude of changes can vary, and they are often influenced by economic conditions and legislative decisions. It’s important to monitor official announcements and tax updates to stay informed about any adjustments.

What happens if a business fails to collect or remit sales tax correctly in North Carolina?

+Businesses that fail to comply with sales tax regulations in North Carolina may face penalties and interest charges. The state’s Department of Revenue has strict guidelines for tax compliance, and businesses are expected to register, collect, and remit sales tax accurately. Failure to do so can result in legal consequences and financial penalties, so it’s crucial for businesses to stay informed and seek professional guidance if needed.