South Carolina Auto Sales Tax

Welcome to an in-depth exploration of the South Carolina Auto Sales Tax, a topic that is essential for anyone considering purchasing a vehicle in the Palmetto State. This comprehensive guide will delve into the intricacies of this tax, its implications, and how it affects both residents and prospective vehicle buyers. With a unique blend of expert analysis and practical insights, we aim to provide a clear understanding of this important financial aspect of vehicle ownership in South Carolina.

Understanding the South Carolina Auto Sales Tax

The South Carolina auto sales tax is a vital component of the state’s revenue stream and a crucial consideration for anyone planning to purchase a vehicle. This tax, levied on the purchase price of a vehicle, contributes significantly to the state’s financial stability and infrastructure development. It is an essential part of the economic framework, ensuring that the state can invest in essential services and initiatives.

Unlike some other states, South Carolina applies a uniform sales tax rate to vehicle purchases, making the process straightforward for buyers. However, the rate is subject to periodic adjustments to keep pace with economic changes and ensure the state's financial stability. The current auto sales tax rate in South Carolina is 6%, which is applied to the total purchase price of the vehicle, including any dealer-added accessories or options.

Calculating the Auto Sales Tax

Calculating the auto sales tax in South Carolina is a relatively simple process. The tax is calculated as a percentage of the vehicle’s purchase price, which includes the base cost of the vehicle, any optional equipment, and dealer preparation charges. For instance, if you purchase a vehicle for 30,000</strong> and the sales tax rate is <strong>6%</strong>, the auto sales tax amount would be <strong>1,800. This calculation is a straightforward multiplication of the purchase price by the tax rate.

| Vehicle Purchase Price | Auto Sales Tax Rate | Auto Sales Tax Amount |

|---|---|---|

| $25,000 | 6% | $1,500 |

| $35,000 | 6% | $2,100 |

| $45,000 | 6% | $2,700 |

It's important to note that the auto sales tax is typically not included in the advertised price of the vehicle, and buyers should be prepared to factor this into their budget. This tax is a significant expense that can substantially impact the overall cost of purchasing a vehicle, especially for higher-priced models.

Exemptions and Special Considerations

While the South Carolina auto sales tax is generally applicable to all vehicle purchases, there are certain exemptions and special considerations that can impact the tax liability. These provisions are designed to provide relief in specific situations and ensure fairness in the taxation process.

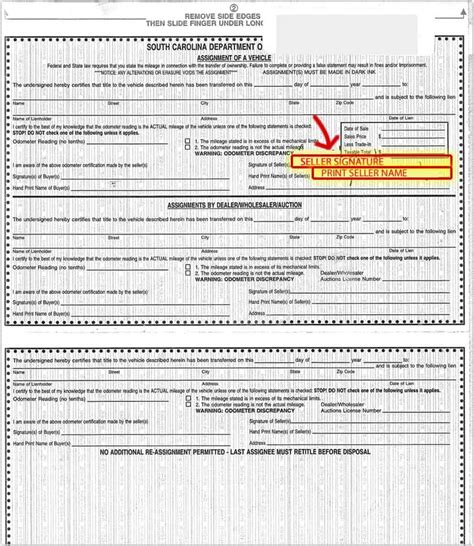

Vehicle Trade-Ins

When trading in an old vehicle as part of a new purchase, the trade-in value can reduce the taxable amount. The trade-in value is subtracted from the purchase price of the new vehicle, effectively lowering the tax liability. For example, if you purchase a new vehicle for 35,000</strong> and trade in your old vehicle for a value of <strong>10,000, the taxable amount would be 25,000</strong>, resulting in a tax savings of <strong>300 based on the 6% tax rate.

Vehicle Type Exemptions

Certain types of vehicles are exempt from the auto sales tax in South Carolina. These include:

- Electric Vehicles (EVs): To encourage the adoption of environmentally friendly vehicles, South Carolina offers a 100% sales tax exemption on the purchase of new EVs. This exemption is a significant incentive for those considering an electric vehicle purchase.

- Hybrid Vehicles: Hybrid vehicles also benefit from a partial sales tax exemption, which can substantially reduce the tax liability. The exemption amount is based on the vehicle's fuel efficiency, with more efficient hybrids qualifying for a higher exemption.

- Vehicles for Disabled Individuals: South Carolina provides a sales tax exemption for vehicles specifically modified for disabled individuals. This exemption is designed to make transportation more accessible and affordable for those with disabilities.

Military Personnel

Active-duty military personnel stationed in South Carolina are eligible for a partial sales tax exemption on vehicle purchases. This exemption is a way for the state to show its appreciation for the service and sacrifice of military members. The exemption amount is based on the length of active duty service, with longer service resulting in a higher exemption.

Impact on Vehicle Ownership

The South Carolina auto sales tax has a significant impact on vehicle ownership, influencing purchasing decisions and the overall cost of owning a vehicle. This tax, while necessary for the state’s financial stability, can be a substantial expense for buyers, especially those purchasing high-end vehicles.

Budget Considerations

The auto sales tax is a critical factor in budgeting for a vehicle purchase. Buyers must account for this tax in their financial planning to ensure they can afford the total cost, including the tax liability. For instance, a 50,000</strong> vehicle purchase would result in a <strong>3,000 tax liability, which is a significant additional cost.

Comparison with Other States

South Carolina’s auto sales tax rate is relatively competitive compared to other states. Some states have much higher rates, while others have lower rates or even no sales tax on vehicle purchases. This comparison can be a crucial factor for individuals considering a move or those shopping across state lines. For instance, neighboring states like Georgia have a higher auto sales tax rate of 7%, while North Carolina has a slightly lower rate of 5%.

Long-Term Ownership Costs

The auto sales tax is not a one-time expense. It forms a part of the overall cost of vehicle ownership, which includes maintenance, fuel, insurance, and other ongoing expenses. Understanding the total cost of ownership, including the impact of the sales tax, is essential for making informed decisions about vehicle purchases and long-term financial planning.

Future Implications and Considerations

The South Carolina auto sales tax, like any tax policy, is subject to potential changes and adjustments over time. These changes can be driven by various factors, including economic conditions, political priorities, and the state’s financial needs. Here are some potential future implications and considerations regarding this tax.

Economic Factors

Economic fluctuations can impact the auto sales tax rate. During periods of economic growth, the state may consider increasing the tax rate to capitalize on increased vehicle sales and generate more revenue. Conversely, during economic downturns, the state might consider reducing the tax rate to stimulate vehicle purchases and support the automotive industry.

Political Landscape

Political shifts and priorities can also influence the auto sales tax. For instance, a new administration might prioritize tax reform, which could include changes to the auto sales tax. These changes could take the form of rate adjustments, the introduction of new exemptions, or the removal of existing ones. Staying informed about political developments can help vehicle buyers anticipate potential changes to the tax landscape.

State Revenue Needs

The state’s financial health and revenue needs are key factors in determining the future of the auto sales tax. If the state faces budgetary shortfalls, it may consider increasing the tax rate to generate more revenue. Conversely, if the state has a surplus, it might opt to reduce the tax rate or introduce new incentives to stimulate the economy.

Environmental Initiatives

As environmental concerns continue to grow, the state might expand incentives for environmentally friendly vehicles. This could include increasing the sales tax exemption for electric and hybrid vehicles, further encouraging their adoption. Such initiatives would not only benefit the environment but also provide financial incentives for vehicle buyers.

Conclusion

The South Carolina auto sales tax is a vital component of the state’s fiscal landscape, providing essential revenue for various public services and infrastructure development. While it can be a significant expense for vehicle buyers, understanding the tax, its implications, and potential future changes is crucial for making informed purchasing decisions. This guide has aimed to provide a comprehensive understanding of this tax, its current state, and its potential future trajectory, empowering readers to navigate the vehicle purchasing process with confidence and financial awareness.

What is the current auto sales tax rate in South Carolina?

+

The current auto sales tax rate in South Carolina is 6%.

Are there any exemptions to the auto sales tax in South Carolina?

+

Yes, there are exemptions for certain types of vehicles, including electric and hybrid vehicles, and vehicles for disabled individuals. Additionally, active-duty military personnel are eligible for a partial sales tax exemption.

How is the auto sales tax calculated in South Carolina?

+

The auto sales tax is calculated as a percentage of the vehicle’s purchase price, including any dealer-added accessories or options. The current rate is 6%, so for a 30,000 vehicle, the tax amount would be 1,800.

Can I negotiate the auto sales tax with the dealership?

+

No, the auto sales tax is a mandatory state tax that cannot be negotiated with the dealership. However, you can explore potential exemptions or trade-in options to reduce your tax liability.

How often is the auto sales tax rate adjusted in South Carolina?

+

The auto sales tax rate can be adjusted periodically based on economic conditions and state revenue needs. However, major adjustments are relatively rare, and the state typically maintains a consistent tax rate for extended periods.