Maryland Taxes Payment

Welcome to this comprehensive guide on understanding and managing your Maryland Taxes Payment obligations. As a resident or business owner in Maryland, it's crucial to navigate the state's tax system effectively. This article will provide you with expert insights, real-world examples, and practical tips to ensure a smooth tax payment process. Whether you're a seasoned taxpayer or new to the Maryland tax landscape, this guide will equip you with the knowledge and strategies to stay compliant and optimize your tax payments.

Unraveling Maryland’s Tax Landscape

Maryland, known for its diverse economy and vibrant communities, has a unique tax system that requires careful attention. With a range of taxes, from income tax to sales tax and property tax, understanding your obligations is essential. This section will break down the key taxes in Maryland and provide a comprehensive overview of the tax landscape.

Income Tax: Navigating Personal and Business Income

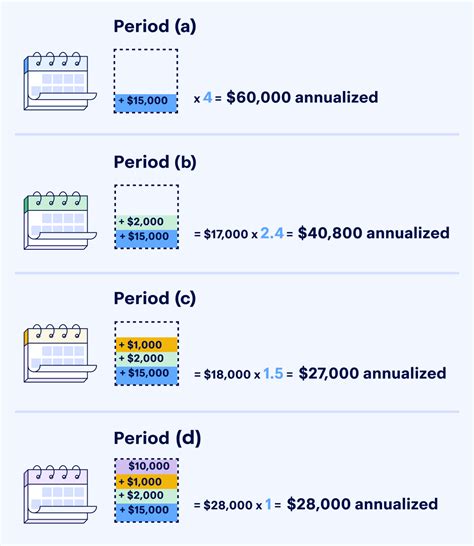

Maryland’s income tax system is structured to accommodate both personal and business income. For individuals, the state offers a progressive tax rate structure, meaning the tax rate increases as income rises. The current tax brackets range from 2% to 5.75%, with specific thresholds for each bracket. Businesses, on the other hand, face a flat corporate income tax rate of 8.25%.

To illustrate, consider a hypothetical scenario where an individual, let’s call them John Smith, resides in Maryland and earns an annual income of 60,000. Based on the state's tax brackets, John's income would fall within the 4.75% tax bracket, resulting in a taxable amount of 2,850. For businesses, a corporation with an annual income of 500,000 would be subject to the 8.25% corporate tax rate, totaling 41,250 in tax liability.

It’s important to note that Maryland also offers tax credits and deductions to reduce the tax burden. These incentives can significantly impact the final tax liability, making it crucial for taxpayers to understand and utilize them effectively.

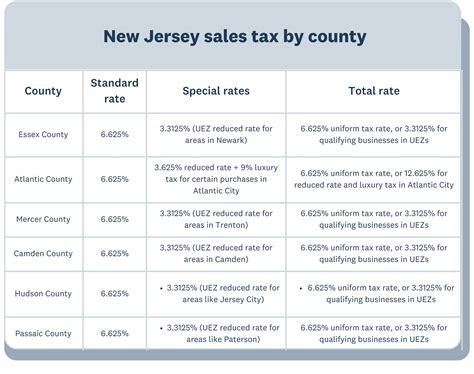

Sales and Use Tax: Unlocking Savings

Maryland’s sales and use tax is a key component of the state’s revenue stream. The general sales tax rate is set at 6%, which applies to most tangible personal property and certain services. However, there are exemptions and special rates for specific items, such as food, clothing, and prescription drugs.

For instance, if you purchase a new laptop in Maryland, the sales tax would typically be 6% of the purchase price. However, if the laptop is for business use, you might be eligible for a sales tax exemption, saving you a significant amount. Understanding these nuances can help businesses and individuals make informed decisions and maximize their savings.

Additionally, Maryland offers a use tax for out-of-state purchases. This ensures that even if you buy goods online or from a vendor outside Maryland, you still pay the appropriate tax. The use tax rate mirrors the sales tax rate, providing a consistent tax structure for all purchases.

Property Tax: Assessing Your Real Estate Obligations

Property tax is a critical component of Maryland’s tax landscape, especially for homeowners and real estate investors. The state’s property tax is primarily a local tax, with rates varying across counties and municipalities. These rates are often expressed as a percentage of the assessed value of the property.

Let’s consider an example. If you own a residential property in Montgomery County, Maryland, with an assessed value of 300,000, and the county's property tax rate is 0.85%, your annual property tax liability would be 2,550. This calculation is a straightforward multiplication of the assessed value and the tax rate.

It’s important to note that property tax rates can change annually, and assessments may be subject to appeal. Staying informed about these changes and understanding the assessment process is crucial for effective property tax management.

Maryland Taxes Payment: A Step-by-Step Guide

Now that we’ve explored the key taxes in Maryland, let’s delve into the process of making your tax payments efficiently and effectively. This section will provide a detailed, step-by-step guide to ensure a seamless experience.

Step 1: Understanding Your Tax Liability

The first step in the tax payment process is to accurately determine your tax liability. This involves calculating your income tax, sales tax, and property tax obligations. Utilize the tax calculators and resources provided by the Maryland Comptroller’s Office to ensure precision.

For instance, the Maryland Income Tax Calculator can help you estimate your income tax liability based on your filing status, income, and deductions. Similarly, the Sales and Use Tax Calculator simplifies the process of calculating sales tax for your business or personal purchases.

Once you have a clear understanding of your tax liability, you can move forward with the payment process, ensuring that you are compliant with the state’s requirements.

Step 2: Choosing the Right Payment Method

Maryland offers a range of payment methods to accommodate different preferences and needs. The state accepts payments through various channels, including online, by phone, and through traditional mail.

For those who prefer the convenience of online payments, the Maryland Tax Service portal provides a secure platform to make payments for various taxes, including income tax, sales tax, and property tax. This method offers real-time confirmation and a streamlined process.

If you prefer a more traditional approach, you can opt to pay by phone or through the mail. The state provides dedicated phone lines for tax payments, and you can also send a check or money order to the appropriate address, as outlined on the Maryland Comptroller’s Office website.

Step 3: Timely Payment and Penalty Avoidance

Timely payment of your taxes is crucial to avoid penalties and interest. Maryland imposes penalties for late payments, which can accumulate quickly. To ensure you meet the deadlines, mark your calendar with the due dates for each tax type.

For instance, income tax returns are generally due on April 15th of each year. Sales tax payments are due on the 20th of the month following the taxable period. Property tax bills are typically sent out in July, with the payment due by September 30th. Staying aware of these deadlines will help you avoid unnecessary penalties.

In addition to penalties, interest may also accrue on late payments. The interest rate is typically based on the federal short-term rate, and it can compound the financial burden. To mitigate this, consider setting up automatic payments or utilizing the state’s payment plan options if you anticipate difficulty meeting the deadline.

Step 4: Maximizing Tax Benefits and Credits

Maryland offers a variety of tax credits and incentives to encourage economic growth and support its residents. These benefits can significantly reduce your tax liability, making it crucial to explore and understand the available options.

For example, the Maryland Earned Income Tax Credit (EITC) provides a refundable tax credit for low- to moderate-income working individuals and families. This credit can provide a substantial boost to your tax refund, making it an important consideration during tax season.

Additionally, Maryland offers tax credits for energy-efficient improvements, historic preservation, and various business incentives. Exploring these credits and understanding your eligibility can lead to significant savings on your tax payments.

Maryland Taxes Payment: Expert Insights and Strategies

As you navigate the Maryland tax landscape, it’s beneficial to gain insights from industry experts and experienced taxpayers. This section will provide practical strategies and tips to optimize your tax payments and ensure a smooth experience.

Tip 1: Stay Informed and Updated

The tax landscape is dynamic, with frequent changes and updates. To stay compliant and avoid surprises, it’s essential to stay informed about tax law changes, new regulations, and emerging trends. Subscribe to the Maryland Comptroller’s Office newsletter and follow their social media channels for the latest updates.

Additionally, attend tax seminars, workshops, and webinars to deepen your understanding of Maryland’s tax system. These events often provide valuable insights and allow you to network with other taxpayers and industry professionals.

Tip 2: Utilize Tax Preparation Software

Tax preparation software can simplify the process of filing your tax returns and managing your payments. These tools often integrate with the state’s tax system, ensuring accuracy and ease of use.

For instance, TurboTax and H&R Block are popular tax preparation software options that offer user-friendly interfaces and step-by-step guidance. These platforms can help you navigate the complexities of Maryland’s tax system and ensure you take advantage of all eligible deductions and credits.

Tip 3: Explore Payment Plans and Options

If you anticipate difficulty paying your taxes in full by the due date, Maryland offers payment plan options to help manage your obligations. These plans allow you to pay your taxes over time, with flexible terms and conditions.

The Maryland Taxpayer Installment Payment Plan is a popular option, providing a structured approach to repaying your tax debt. This plan can be tailored to your financial situation, offering relief and a manageable payment schedule.

Additionally, consider exploring tax relief programs, such as the Offer in Compromise program, which allows you to settle your tax debt for less than the full amount owed. These programs can provide much-needed relief for taxpayers facing financial hardship.

Maryland Taxes Payment: Real-World Scenarios and Case Studies

To further illustrate the concepts and strategies discussed, let’s explore some real-world scenarios and case studies involving Maryland taxpayers.

Case Study 1: Small Business Tax Management

Imagine a small business owner, Sarah Johnson, who operates a local bakery in Baltimore. Sarah faces the challenge of managing her business’s tax obligations while keeping her operations efficient and profitable.

By utilizing tax preparation software, Sarah was able to streamline her tax filing process, ensuring accuracy and compliance. She took advantage of the state’s tax incentives for small businesses, such as the Maryland Small Business Tax Credit, which provided a substantial boost to her bottom line.

Additionally, Sarah explored payment plan options to manage her quarterly tax payments, ensuring she could meet her obligations without straining her cash flow. This strategic approach allowed her to focus on growing her business while maintaining tax compliance.

Case Study 2: Individual Taxpayer Success Story

Let’s consider the story of David Miller, a Maryland resident who recently received a substantial tax refund. David’s success was a result of careful tax planning and a thorough understanding of the state’s tax system.

David utilized the Maryland EITC to maximize his tax refund, taking advantage of the credit’s benefits for low- to moderate-income earners. He also explored other tax credits, such as the Child and Dependent Care Credit, which further reduced his tax liability.

By staying informed about tax law changes and utilizing tax preparation software, David was able to navigate the complexities of Maryland’s tax system with ease. His proactive approach resulted in a significant tax refund, providing him with financial relief and a sense of accomplishment.

Maryland Taxes Payment: Future Implications and Outlook

As we look ahead, it’s essential to consider the future implications and potential changes in Maryland’s tax landscape. This section will provide an analysis of emerging trends and potential policy shifts that could impact taxpayers.

Potential Tax Reform and Changes

Maryland’s tax system is subject to ongoing discussions and potential reforms. As the state aims to balance its budget and support economic growth, tax policy is often a key area of focus.

Currently, there are proposals to reform the state’s income tax structure, aiming to make it more progressive and equitable. These reforms could impact tax rates and brackets, potentially shifting the tax burden among different income levels.

Additionally, there is a growing emphasis on tax simplification, with efforts to streamline the tax code and reduce complexity. These changes could impact the way taxpayers file their returns and make payments, making the process more efficient and user-friendly.

Economic Impact and Growth Opportunities

Maryland’s tax system plays a crucial role in supporting the state’s economy and fostering growth. The state’s tax revenue is used to fund essential services, infrastructure, and initiatives that drive economic development.

By offering tax incentives and credits, Maryland aims to attract businesses and encourage investment. These incentives can create jobs, stimulate economic activity, and enhance the overall economic landscape. As a result, taxpayers benefit from a thriving economy and a robust tax base.

However, it’s important to strike a balance between tax incentives and revenue generation. The state must carefully consider the impact of tax policy on its residents and businesses, ensuring that the tax system remains fair and sustainable.

What is the deadline for filing Maryland income tax returns?

+The deadline for filing Maryland income tax returns is typically April 15th of each year. However, it’s important to note that this deadline may be extended due to various circumstances, such as tax filing holidays or special provisions. Stay updated with the Maryland Comptroller’s Office for the latest information.

Are there any tax incentives for renewable energy projects in Maryland?

+Yes, Maryland offers tax incentives for renewable energy projects. The state provides tax credits for solar energy systems, wind energy systems, and other eligible renewable energy technologies. These credits can significantly reduce the tax liability for businesses and individuals investing in renewable energy. Stay informed about the specific requirements and eligibility criteria for these incentives.

How can I dispute my property tax assessment in Maryland?

+If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. The process typically involves submitting an appeal to the local assessment office within a specified timeframe. It’s advisable to gather evidence, such as comparable property values or expert appraisals, to support your case. Consult with a tax professional or seek guidance from the Maryland Department of Assessments and Taxation for detailed instructions on the appeal process.