How To Track Mileage For Taxes

For many small business owners and self-employed individuals, keeping track of mileage is an essential task for tax purposes. Properly recording and documenting mileage not only ensures compliance with tax regulations but also allows for valuable tax deductions. This comprehensive guide will walk you through the ins and outs of mileage tracking, providing you with the tools and knowledge to optimize your mileage deductions and streamline your tax reporting process.

Understanding Mileage Deductions

Mileage deductions can significantly reduce your tax liability, making it a crucial aspect of your financial strategy. These deductions are applicable to a wide range of businesses, from sales representatives covering vast territories to delivery drivers making multiple trips each day. Even professionals who primarily work from home but occasionally travel for business can benefit from tracking their mileage.

The Internal Revenue Service (IRS) offers two primary methods for claiming mileage deductions: the standard mileage rate and the actual expense method. The standard mileage rate, updated annually by the IRS, provides a straightforward calculation for mileage deductions. For the 2023 tax year, the standard mileage rate is $0.625 per mile for business use. This rate covers all costs associated with operating a vehicle for business purposes, including fuel, maintenance, insurance, and depreciation.

On the other hand, the actual expense method requires a more detailed record-keeping approach. With this method, you can deduct the actual costs of operating your vehicle for business purposes. This includes fuel expenses, oil changes, tire replacements, insurance premiums, registration fees, and lease or loan payments. While the actual expense method may offer a higher deduction for some individuals, it requires meticulous record-keeping and can be more time-consuming.

Mileage Tracking Tools and Apps

In today’s digital age, a myriad of tools and apps are available to simplify the mileage tracking process. These tools not only make record-keeping easier but also enhance accuracy and provide valuable insights into your business mileage.

GPS-Based Apps

GPS-based mileage tracking apps are a popular choice among business owners due to their convenience and accuracy. These apps utilize your device’s GPS to automatically record the start and end points of your trips, along with the total mileage. Some advanced apps even categorize trips based on their purpose, such as business, personal, or commuting, ensuring accurate records for tax purposes.

One popular GPS-based app is MileIQ, which offers a simple and intuitive interface. MileIQ automatically tracks your mileage, allowing you to review and categorize trips at the end of each day. It provides detailed reports, making it easy to reconcile your mileage with your tax records. Additionally, the app offers a mileage log feature, enabling you to keep a digital record of all your business trips.

Another highly-rated app is Everlance, which goes beyond basic mileage tracking. Everlance not only tracks your mileage but also captures your expenses, income, and hours worked. This comprehensive app generates detailed reports and integrates seamlessly with popular accounting software, making tax season less stressful.

Manual Mileage Logs

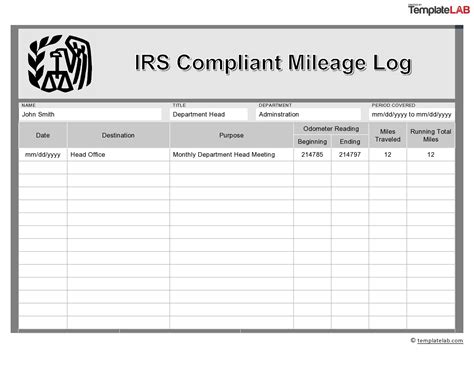

While digital tools are convenient, some business owners prefer the traditional approach of manual mileage logs. These logs provide a tangible record of your business mileage and can be a reliable backup in case of digital failures or data loss.

To create a manual mileage log, start by noting the odometer reading at the beginning and end of each business trip. Record the date, purpose of the trip, and the total mileage. It's essential to maintain a consistent and accurate log, ensuring that all business trips are accounted for. While manual logs may require more effort, they offer a sense of control and can be particularly useful for those who prefer a hands-on approach to record-keeping.

Best Practices for Mileage Tracking

To maximize your mileage deductions and ensure compliance with tax regulations, it’s crucial to follow best practices for mileage tracking.

Accurate Record-Keeping

Maintain accurate and consistent records of your business mileage. Whether you opt for a digital app or a manual log, ensure that your records are up-to-date and detailed. Include all relevant information, such as the date, purpose, and mileage of each trip. Regularly review your records to identify any discrepancies or missing entries.

Categorize Trips

Clearly categorize your business trips to ensure that only eligible mileage is included for tax deductions. The IRS defines business mileage as trips made for work-related purposes, such as meeting with clients, attending conferences, or visiting job sites. Personal mileage, such as commuting to and from your regular place of business, is not deductible.

Track Mileage Consistently

Establish a routine for tracking your mileage to avoid missing any business trips. Whether you choose to record your mileage at the end of each day or week, ensure that you maintain a consistent schedule. Consistency not only simplifies the record-keeping process but also ensures that you don’t overlook any important trips.

Keep Supporting Documentation

In addition to your mileage records, it’s beneficial to keep supporting documentation for your business trips. This can include receipts for fuel purchases, toll road expenses, or parking fees. Having supporting documentation adds credibility to your mileage deductions and provides evidence in case of an IRS audit.

Mileage Deduction Strategies

Maximizing your mileage deductions requires a strategic approach. Here are some strategies to consider when tracking your business mileage.

Utilize the Standard Mileage Rate

For many business owners, the standard mileage rate offered by the IRS is the simplest and most advantageous method for claiming mileage deductions. By using the standard rate, you can quickly calculate your deductions without the need for detailed record-keeping of actual expenses. This method is particularly beneficial for those who travel frequently and incur significant vehicle-related costs.

Consider the Actual Expense Method

While the standard mileage rate is convenient, the actual expense method may offer higher deductions for individuals with specific circumstances. If you own a high-value vehicle or incur substantial maintenance and repair costs, the actual expense method can provide a more significant tax benefit. However, it’s important to note that this method requires meticulous record-keeping of all vehicle-related expenses.

Combine Mileage with Other Deductions

Mileage deductions can be combined with other business-related expenses to maximize your tax savings. For instance, if you frequently meet clients for meals or attend industry events, you can claim meal and entertainment expenses alongside your mileage deductions. By bundling these deductions, you can reduce your taxable income and optimize your tax strategy.

Explore Mileage Deductions for Mixed-Use Vehicles

If you use your vehicle for both business and personal purposes, you can still claim mileage deductions for your business trips. The IRS allows you to allocate a portion of your vehicle expenses based on the percentage of business use. For example, if you use your vehicle for business 75% of the time, you can deduct 75% of your vehicle-related expenses. This method ensures that you receive tax benefits for your business mileage while accurately accounting for personal use.

Preparing for Tax Season

As tax season approaches, it’s essential to have your mileage records organized and ready for submission. Here’s a step-by-step guide to preparing your mileage deductions for tax season.

Review and Reconcile Records

Start by reviewing your mileage records for the entire tax year. Ensure that all business trips are accounted for and that the information is accurate and complete. Reconcile any discrepancies or missing entries to ensure the integrity of your records.

Calculate Deductions

Calculate your mileage deductions using the appropriate method. If you’ve been tracking your mileage using a GPS app or manual log, you can easily calculate your deductions based on the total business miles driven. For the actual expense method, you’ll need to total your vehicle-related expenses and calculate the percentage of business use.

Prepare Supporting Documentation

Gather all supporting documentation for your mileage deductions. This includes your mileage records, fuel receipts, toll expenses, and any other relevant documents. Having this information readily available will streamline the tax preparation process and ensure that you have the necessary evidence to support your deductions.

Seek Professional Advice

If you have complex mileage deductions or are unsure about the best approach for your situation, consider seeking professional advice from a tax accountant or financial advisor. They can provide personalized guidance based on your business needs and help you navigate the intricacies of tax regulations.

Future Implications and Trends

As technology continues to advance, the landscape of mileage tracking is evolving. Here’s a glimpse into the future of mileage tracking and its potential impact on tax deductions.

Smart Vehicle Technology

The integration of smart vehicle technology, such as built-in GPS systems and telematics, is set to revolutionize mileage tracking. These systems can automatically capture and record mileage data, providing accurate and detailed records with minimal effort. With the widespread adoption of electric vehicles, smart technology will play an even more significant role in tracking mileage and optimizing tax deductions.

Digital Record-Keeping Platforms

Digital record-keeping platforms are becoming increasingly sophisticated, offering seamless integration with other financial tools and software. These platforms can automate mileage tracking, expense management, and tax reporting, providing a comprehensive solution for small business owners. With real-time data analysis and automated reporting, these platforms will simplify the tax preparation process and enhance accuracy.

Enhanced IRS Regulations

The IRS is continually updating its regulations to adapt to the changing landscape of business operations. As more businesses rely on remote work and digital technologies, the IRS may introduce new guidelines and requirements for mileage tracking and deductions. Staying informed about these updates is essential to ensure compliance and maximize your tax benefits.

Alternative Fuel Vehicles

The growing popularity of alternative fuel vehicles, such as electric and hybrid cars, is set to impact mileage deductions. The IRS is currently exploring new regulations to accommodate these vehicles, recognizing their unique operational costs. As the market for alternative fuel vehicles expands, it’s crucial to stay informed about any changes to tax regulations to ensure accurate deductions.

| Standard Mileage Rate | $0.625 per mile |

|---|---|

| Tax Year | 2023 |

| Actual Expense Method | Deduct actual vehicle-related expenses |

| Mileage Tracking Apps | MileIQ, Everlance |

| Best Practice: Accurate Record-Keeping | Maintain detailed and consistent records |

| Deduction Strategy: Combine Mileage with Other Expenses | Bundle mileage deductions with meal and entertainment expenses |

Can I claim mileage deductions for commuting to and from my regular place of business?

+No, the IRS does not allow mileage deductions for commuting between your home and your regular place of business. However, you can claim deductions for any additional business trips made during the day, such as meeting clients or running business errands.

How often should I review my mileage records?

+It’s recommended to review your mileage records at least once a month to ensure accuracy and completeness. Regular reviews help identify any discrepancies or missing entries, allowing you to make necessary adjustments before tax season.

Can I use both the standard mileage rate and the actual expense method for different trips?

+No, you must choose one method for all your business mileage deductions. The standard mileage rate and the actual expense method cannot be mixed for different trips. However, you can change your deduction method from year to year based on your business needs.

What if I don’t have all my supporting documentation for my mileage deductions?

+It’s important to keep supporting documentation for your mileage deductions. However, if you’re missing some receipts or records, you can still claim your mileage deductions. The IRS understands that documentation may be lost or misplaced, but it’s crucial to maintain accurate and consistent records for all your business trips.