Hampton Property Tax

Hampton, a picturesque coastal town nestled in the heart of New Hampshire's Rockingham County, is renowned for its charming seaside ambiance, pristine beaches, and vibrant community spirit. As one of the most sought-after destinations in the region, Hampton boasts a unique blend of historic charm and modern amenities, making it an ideal place to call home. However, as with any desirable location, the question of property taxes often arises. In this comprehensive guide, we will delve into the intricacies of Hampton's property tax landscape, shedding light on the factors that influence tax rates, the assessment process, and the various strategies homeowners can employ to navigate the property tax landscape effectively.

Understanding Hampton's Property Tax Structure

Hampton, like many municipalities in New Hampshire, operates under a local property tax system designed to fund essential services such as education, public safety, infrastructure, and community development. This system ensures that residents contribute proportionally to the town's overall budget, based on the assessed value of their properties.

The Assessment Process: Unveiling Property Values

At the heart of Hampton's property tax system lies the assessment process, a meticulous procedure conducted by the town's assessors. These professionals are tasked with determining the fair market value of each property within the town's boundaries. The assessment process typically involves physical inspections, analysis of recent sales data, and consideration of various factors such as location, size, condition, and recent improvements.

Hampton's assessors aim for accuracy and fairness in their assessments, striving to ensure that property values are reflective of the current real estate market. This process is typically carried out on a cyclical basis, with revaluations conducted every few years to account for changing market conditions and property improvements.

| Assessment Cycle | Year |

|---|---|

| Last Revaluation | 2022 |

| Next Anticipated Revaluation | 2025 (estimated) |

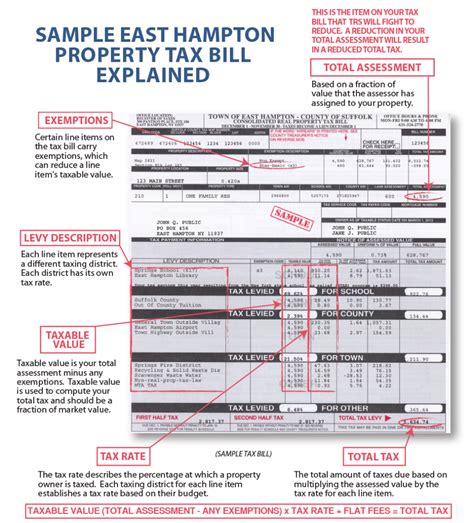

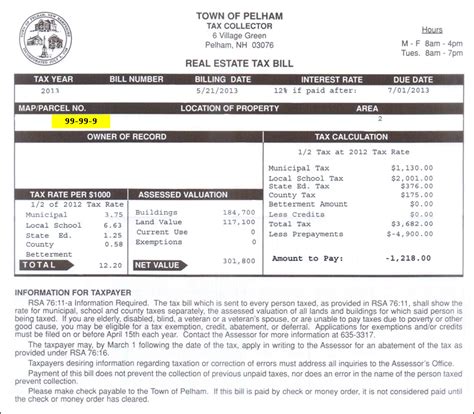

Tax Rates and Levies: Deciphering the Numbers

Once property assessments are finalized, the town of Hampton determines the tax rate, often referred to as the "mill rate" or "tax levy." This rate is expressed in mills, where one mill represents $1 of tax for every $1,000 of assessed property value. For instance, if Hampton's tax rate is set at 20 mills, a homeowner with a property assessed at $500,000 would owe $10,000 in property taxes ($500,000 x 0.020 = $10,000). The tax rate is determined annually by the town's budget committee, taking into account the town's financial needs and the assessed value of all taxable properties.

It's important to note that Hampton, like many towns, also levies additional taxes on specific properties or activities. These may include taxes on vehicles, boats, or certain business operations. Understanding these additional levies is crucial for homeowners to accurately calculate their total tax liability.

Property Tax Bills: Breaking Down the Components

Property tax bills in Hampton are typically issued annually and consist of several components. These include the assessed value of the property, the tax rate, and any applicable exemptions or credits. The bill also outlines the due dates and payment options available to homeowners. It's essential for residents to carefully review their tax bills to ensure accuracy and to take advantage of any applicable exemptions or deductions.

Navigating Hampton's Property Tax Landscape

Understanding Hampton's property tax structure is just the first step. Homeowners in Hampton have various strategies and resources at their disposal to navigate the property tax landscape effectively and ensure they are paying their fair share.

Assessing Your Property: A Critical Step

As a Hampton homeowner, it's crucial to stay informed about the assessment process and your property's value. Regularly monitoring the real estate market and keeping abreast of recent sales in your neighborhood can provide valuable insights into your property's potential value. Additionally, conducting a thorough inspection of your property and maintaining a record of improvements and upgrades can be beneficial when the assessors conduct their evaluations.

If you believe your property's assessed value is inaccurate, you have the right to appeal. Hampton provides a formal appeals process, which typically involves submitting documentation and evidence to support your case. It's advisable to consult with a tax professional or legal expert to guide you through the appeals process effectively.

Exemptions and Deductions: Reducing Your Tax Burden

Hampton, like many municipalities, offers a range of exemptions and deductions that can help reduce your property tax liability. These may include:

- Homestead Exemption: Available to homeowners who use their property as their primary residence, the homestead exemption provides a reduction in the assessed value of the property.

- Senior Citizen Exemption: Hampton offers exemptions for senior citizens based on age and income criteria. This exemption can significantly reduce the tax burden for eligible homeowners.

- Veteran's Exemption: Hampton extends tax relief to veterans who meet specific criteria, such as service-connected disabilities or combat service.

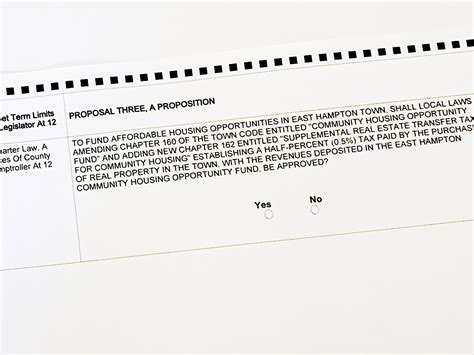

- Property Tax Credits: The town may offer credits to homeowners who meet certain energy efficiency standards or make improvements that enhance the community's sustainability.

It's essential to stay informed about the availability and criteria for these exemptions and credits. Consult with the town's tax office or a tax professional to ensure you are taking advantage of all applicable benefits.

Tax Planning and Strategies: Maximizing Savings

Effective tax planning can help Hampton homeowners minimize their property tax liability and optimize their financial situation. Some strategies to consider include:

- Timing of Purchases: If you're planning to purchase a property in Hampton, timing your purchase strategically can impact your tax liability. Consider purchasing before or after the assessment cycle to potentially influence the assessed value.

- Home Improvements: While improvements can increase your property's value, they may also qualify you for certain tax credits or deductions. Consult with a tax professional to understand the potential tax implications of home improvements.

- Long-Term Planning: Developing a long-term tax strategy, especially if you plan to reside in Hampton for an extended period, can help you optimize your tax position over time. This may involve considering the timing of major purchases, improvements, and potential changes in tax rates.

The Future of Hampton's Property Taxes

As Hampton continues to thrive as a desirable coastal community, its property tax landscape is likely to evolve in response to changing economic conditions, demographic shifts, and the town's ongoing commitment to providing quality services. Here are some key considerations and potential future implications:

Economic Factors and Property Values

Hampton's real estate market is influenced by various economic factors, including interest rates, employment trends, and overall economic conditions. As the market fluctuates, property values may experience shifts, which, in turn, can impact tax assessments. Homeowners should stay attuned to these economic indicators to anticipate potential changes in their tax liability.

Demographic Shifts and Community Development

Hampton's demographic composition is an essential factor in shaping the town's future. As the community continues to attract residents seeking its unique blend of coastal charm and modern amenities, the town's infrastructure and services may experience growing demands. This could influence the town's budgetary needs and, consequently, property tax rates.

Sustainable Practices and Tax Incentives

Hampton's commitment to sustainability and environmental stewardship may drive the development of tax incentives for homeowners who adopt eco-friendly practices. These incentives could take the form of tax credits for energy-efficient upgrades, solar panel installations, or other green initiatives. Such programs not only benefit the environment but also provide financial incentives for homeowners.

Community Engagement and Transparency

Hampton's strong community spirit is a cornerstone of its success. As the town continues to engage with its residents, transparency in the property tax process will likely remain a priority. This includes clear communication about assessment methodologies, tax rates, and the availability of exemptions and deductions. Active community involvement can foster trust and ensure that Hampton's property tax system remains fair and equitable.

FAQs: Unraveling Common Property Tax Queries

How often are property assessments conducted in Hampton?

+Property assessments in Hampton are typically conducted on a cyclical basis, with revaluations every few years. The last revaluation occurred in 2022, and the next is estimated to take place in 2025.

Can I appeal my property's assessed value if I disagree with it?

+Yes, Hampton provides a formal appeals process for homeowners who believe their property's assessed value is inaccurate. It's recommended to gather evidence and consult with a tax professional or legal expert to guide you through the process.

What are the eligibility criteria for the senior citizen exemption in Hampton?

+The senior citizen exemption in Hampton is available to homeowners who are at least 65 years old and meet specific income criteria. It's advisable to check with the town's tax office for the most up-to-date eligibility requirements.

Are there any tax incentives for energy-efficient upgrades in Hampton?

+Yes, Hampton may offer tax credits or deductions for homeowners who make energy-efficient upgrades to their properties. These incentives can vary, so it's recommended to consult with the town's tax office or a tax professional for the latest information.

How can I stay informed about changes in Hampton's property tax rates and policies?

+To stay informed, attend town meetings, subscribe to official newsletters or websites, and engage with local community forums. These sources provide valuable updates on property tax rates, assessments, and any changes in policies or exemptions.

Hampton’s property tax landscape is a complex yet essential aspect of community life, funding the services and amenities that make the town a desirable place to live. By understanding the assessment process, tax rates, and available exemptions, homeowners can navigate this landscape with confidence. Moreover, by staying engaged with the community and actively participating in the democratic process, residents can shape the future of Hampton’s property tax system, ensuring it remains fair, equitable, and aligned with the town’s vibrant spirit and unique character.