Pittsburgh City Tax

The City of Pittsburgh, Pennsylvania, is a vibrant and diverse metropolis known for its rich history, cultural attractions, and thriving economy. As with many cities, understanding and managing the tax obligations within Pittsburgh is crucial for both residents and businesses. In this comprehensive guide, we delve into the intricacies of Pittsburgh City Tax, exploring its various components, rates, and implications for individuals and enterprises alike.

Unraveling the Complexities of Pittsburgh City Tax

Pittsburgh, with its unique blend of industrial heritage and modern innovation, has a tax system that reflects its complex urban landscape. This system encompasses a range of taxes designed to support the city’s infrastructure, services, and initiatives. Let’s navigate through these tax categories to gain a clearer understanding of their impact on Pittsburgh’s residents and businesses.

1. Income Tax: A Key Component of Pittsburgh’s Revenue

Pittsburgh imposes an earned income tax on residents and non-residents who work within the city limits. This tax is a significant source of revenue for the city, contributing to essential services such as education, public safety, and infrastructure development. The current rate for earned income tax in Pittsburgh is 3%, which is levied on wages, salaries, commissions, and other forms of earned income.

It's worth noting that Pittsburgh offers a tax credit for individuals who pay income tax in multiple jurisdictions. This credit, known as the Pittsburgh Tax Credit, aims to alleviate the burden on residents who are taxed by both the city and their home municipality. The credit is equal to 50% of the amount paid to the city, up to a maximum of $50.

| Earned Income Tax Rate | 3% |

|---|---|

| Pittsburgh Tax Credit | 50% of amount paid, up to $50 |

2. Business Privilege Tax: Supporting Pittsburgh’s Economic Growth

Pittsburgh levies a Business Privilege Tax on businesses operating within the city. This tax is calculated based on the gross receipts of the business and is designed to contribute to the city’s economic development initiatives. The current rate for the Business Privilege Tax is 1.5% of the business’s gross receipts.

For businesses with multiple locations, Pittsburgh offers a business tax credit to reduce the burden of paying taxes in multiple jurisdictions. The credit is equal to 50% of the amount paid to the city, up to a maximum of $200 for each tax period.

| Business Privilege Tax Rate | 1.5% of gross receipts |

|---|---|

| Business Tax Credit | 50% of amount paid, up to $200 per tax period |

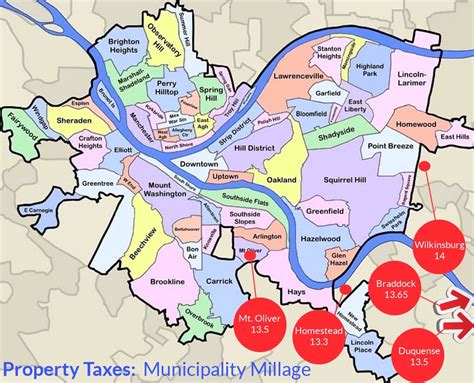

3. Real Estate Tax: Investing in Pittsburgh’s Future

Pittsburgh’s real estate tax is a vital component of the city’s revenue stream, contributing to the maintenance and improvement of public services and infrastructure. The tax is assessed on the assessed value of real property within the city limits. The current millage rate for real estate tax in Pittsburgh is 10.5 mills, which translates to $0.0105 per dollar of assessed value.

To provide relief for homeowners, Pittsburgh offers a homestead/farmstead exclusion, which reduces the assessed value of residential properties by $30,000. This exclusion is available to homeowners who occupy their property as their primary residence and have not been convicted of certain criminal offenses. Additionally, Pittsburgh offers a senior citizen discount of 10% for homeowners who are aged 65 or older and meet specific income requirements.

| Real Estate Tax Rate | 10.5 mills ($0.0105 per dollar of assessed value) |

|---|---|

| Homestead/Farmstead Exclusion | $30,000 reduction in assessed value |

| Senior Citizen Discount | 10% discount for eligible seniors |

4. Other Taxes: A Comprehensive Overview

In addition to the taxes mentioned above, Pittsburgh imposes various other taxes to fund specific initiatives and services. These include:

- Wage Tax: A tax on wages, salaries, and other forms of compensation earned by individuals within the city limits. The current rate is 1%.

- Net Profits Tax: A tax on the net profits of businesses operating within the city. The rate varies depending on the type of business and is typically 1.25% of net profits.

- Amusement Tax: A tax levied on admission fees to certain entertainment events, such as concerts, movies, and sporting events. The rate is 5% of the admission price.

- Hotel Room Tax: A tax on the rental of hotel rooms within the city. The current rate is 3% of the room rate.

| Tax Type | Rate |

|---|---|

| Wage Tax | 1% |

| Net Profits Tax | 1.25% of net profits |

| Amusement Tax | 5% of admission price |

| Hotel Room Tax | 3% of room rate |

Compliance and Resources: Navigating Pittsburgh’s Tax Landscape

Understanding and adhering to Pittsburgh’s tax obligations is essential for both individuals and businesses. The city provides various resources and support to ensure compliance and assist taxpayers in navigating the tax landscape.

1. Tax Filing and Payment Options

Pittsburgh offers convenient online tax filing and payment options through its official website. Residents and businesses can access their tax accounts, view tax bills, and make payments securely online. Additionally, the city provides guidance on filing requirements and deadlines to ensure timely and accurate tax submissions.

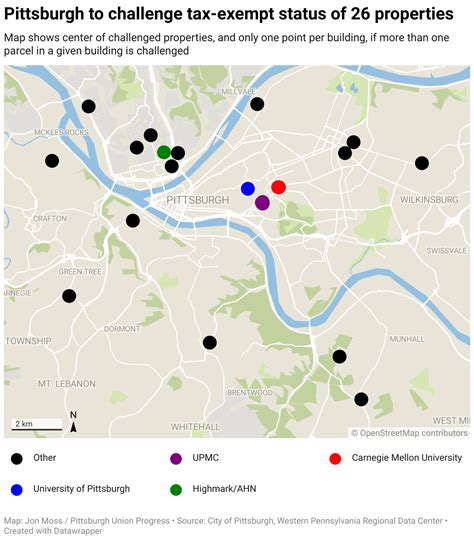

2. Tax Exemptions and Credits

Pittsburgh recognizes the importance of supporting certain sectors and individuals through tax exemptions and credits. These measures aim to promote economic growth, encourage entrepreneurship, and provide relief to eligible taxpayers. Some key exemptions and credits include:

- Veterans and Active Duty Military: Pittsburgh offers a 50% discount on real estate taxes for eligible veterans and active-duty military personnel.

- Low-Income Homeowners: A 50% discount on real estate taxes is available to low-income homeowners who meet specific income and residency requirements.

- First-Time Homebuyers: Pittsburgh provides a 10% discount on real estate taxes for first-time homebuyers who purchase a property within the city limits.

- Green Building Incentives: Tax credits are offered to homeowners and businesses that invest in energy-efficient improvements, promoting sustainability and environmental responsibility.

3. Tax Appeals and Dispute Resolution

In cases where taxpayers disagree with their tax assessments or believe they have been unfairly taxed, Pittsburgh provides a process for tax appeals and dispute resolution. Taxpayers can file an appeal with the Board of Assessment Appeals, which reviews and decides on tax-related disputes. The process involves submitting documentation, attending hearings, and presenting evidence to support their case.

Conclusion: A Comprehensive Approach to Pittsburgh’s Fiscal Responsibility

Pittsburgh’s tax system is a carefully crafted framework designed to support the city’s economic growth, infrastructure development, and the provision of essential services. By understanding the various taxes, rates, and incentives, individuals and businesses can navigate their tax obligations with confidence and contribute to the city’s vibrant future.

As Pittsburgh continues to evolve and adapt to the changing needs of its residents and businesses, the tax landscape may also undergo updates and revisions. Staying informed about tax regulations and utilizing the resources provided by the city is crucial for maintaining compliance and ensuring a fair and equitable tax system.

With its blend of traditional and innovative tax measures, Pittsburgh strives to strike a balance between supporting its citizens and fostering a thriving business environment. As we've explored, the city's tax system is a crucial aspect of its fiscal responsibility, contributing to its long-term sustainability and the well-being of its residents.

How can I determine if I am eligible for tax credits or exemptions in Pittsburgh?

+

To determine your eligibility for tax credits or exemptions in Pittsburgh, you can refer to the city’s official tax guidelines and resources. These guidelines outline the specific criteria and requirements for each tax credit or exemption. Additionally, consulting with a tax professional or the city’s tax office can provide personalized guidance based on your unique circumstances.

What are the consequences of non-compliance with Pittsburgh’s tax obligations?

+

Non-compliance with Pittsburgh’s tax obligations can result in various consequences, including penalties, interest charges, and legal actions. The city may impose late payment fees, assess penalties for non-filing or underpayment, and pursue legal remedies to collect outstanding taxes. It’s crucial to stay informed about tax deadlines, file accurately, and seek assistance if needed to avoid potential penalties.

How often are Pittsburgh’s tax rates reviewed and adjusted?

+

Pittsburgh’s tax rates are reviewed and adjusted periodically to ensure they align with the city’s fiscal needs and priorities. The city’s government and relevant departments conduct regular assessments to evaluate the effectiveness of the tax system and make adjustments as necessary. While the timing of these reviews can vary, they typically occur at specific intervals to maintain a balanced and responsive tax structure.