Sales Tax Austin Texas

Sales tax is an essential component of the revenue system in the United States, and understanding its intricacies is crucial for both businesses and consumers. In Austin, Texas, the sales tax landscape is a fascinating blend of state, county, and city taxes, offering a unique perspective on how these taxes impact the local economy and daily transactions.

The Breakdown of Sales Tax in Austin, Texas

The sales tax in Austin, like any other city in Texas, is composed of several layers. The state of Texas imposes a sales tax rate of 6.25%, which serves as the base rate for all transactions. However, this is just the beginning of the story. Austin, being a vibrant city with a thriving economy, has its own set of additional taxes that contribute to the overall sales tax burden.

City Sales Tax

Austin imposes a 2% city sales tax, bringing the total tax to 8.25% for most goods and services. This additional tax is a significant contributor to the city’s revenue, helping fund essential services and infrastructure projects.

Special Taxing Districts

Austin, being located in Travis County, also has to consider county-wide taxes. Travis County adds an additional 0.25% to the sales tax, taking the total to 8.5% for many purchases. But that’s not all; certain areas within Austin may fall under special taxing districts, which can further increase the sales tax rate. These districts are typically created to fund specific projects or services and can add up to 1.5% or more to the sales tax.

For instance, the Capital Metro transit authority, which serves the greater Austin area, levies an additional 0.5% sales tax to support public transportation initiatives. This means that in certain areas of Austin, the sales tax could climb to a maximum of 10% for some transactions.

A Real-World Example

Let’s consider a hypothetical scenario: Sarah, a resident of Austin, decides to purchase a new laptop worth 1,500. With the standard <strong>6.25%</strong> state tax and the <strong>2%</strong> city tax, she would pay a total of <strong>142.50 in sales tax, bringing her total purchase price to 1,642.50</strong>. However, if she happens to make this purchase in an area within a special taxing district, her sales tax could increase to <strong>10%</strong>, resulting in a tax bill of <strong>180 and a final purchase price of $1,680.

| Sales Tax Category | Tax Rate (%) |

|---|---|

| State Sales Tax | 6.25 |

| City Sales Tax | 2.0 |

| County Sales Tax | 0.25 |

| Special Taxing District | 1.5 |

| Total Sales Tax | 10.0 |

Impact on Businesses and Consumers

The complex sales tax structure in Austin can have a significant impact on both businesses and consumers. For businesses, especially those with online sales or multiple physical locations, managing these varying tax rates can be a challenge. They must ensure they are charging the correct tax rates and remitting them accurately to the respective tax authorities.

From a consumer perspective, understanding the sales tax rates can be crucial for financial planning and budgeting. With the potential for such a wide range of sales tax rates within the city, consumers may need to factor in these variations when making significant purchases. It's also important for consumers to be aware of potential tax incentives or exemptions, such as those for certain types of businesses or industries, which could impact their purchasing decisions.

Sales Tax Compliance and Reporting

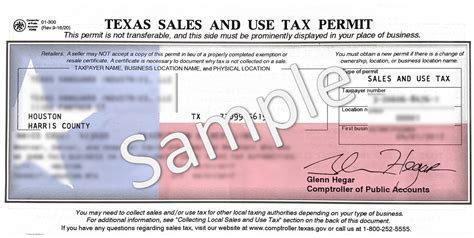

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Austin. Businesses must accurately collect and remit sales tax to the appropriate authorities, which can be a complex process given the varying tax rates. This often involves regular reporting and remittance to the Texas Comptroller of Public Accounts, the state agency responsible for sales tax administration.

The Comptroller's office provides resources and guidelines to help businesses navigate the sales tax landscape, including information on registration, tax rates, and filing requirements. Non-compliance can result in penalties and interest charges, making accurate sales tax management a key aspect of financial operations for businesses in Austin.

Future Outlook and Potential Changes

The sales tax landscape in Austin is subject to potential changes and developments. As the city’s economy evolves and new initiatives are proposed, there may be shifts in the tax structure. For instance, discussions around transportation funding or infrastructure projects could lead to adjustments in the sales tax rates or the creation of new special taxing districts.

Additionally, the ongoing debate around sales tax fairness and equity could impact the future of sales tax in Austin. Some advocate for a more simplified tax structure, while others push for changes to ensure a fair distribution of tax burden. Keeping an eye on these developments is crucial for both businesses and consumers to stay informed and adapt to any potential changes in the sales tax landscape.

Conclusion

In conclusion, understanding the sales tax landscape in Austin, Texas, is a crucial aspect of doing business or making informed consumer choices in the city. The combination of state, city, county, and potential special district taxes creates a complex but essential revenue system. By being aware of these varying tax rates and staying informed about potential changes, businesses and consumers can navigate the Austin sales tax environment with confidence.

How often do sales tax rates change in Austin, Texas?

+Sales tax rates can change periodically, typically as a result of legislative actions or local initiatives. While there is no set schedule, changes tend to occur less frequently at the state level compared to local tax districts, which may adjust rates more regularly to fund specific projects or services.

Are there any items or services exempt from sales tax in Austin?

+Yes, certain items and services are exempt from sales tax in Texas. This includes most groceries, prescription drugs, and certain types of manufacturing equipment. Additionally, some cities, including Austin, offer exemptions for certain types of businesses or industries, such as manufacturers or nonprofits.

How do I calculate sales tax for my business in Austin?

+Calculating sales tax involves multiplying the total taxable sale by the applicable tax rate. For businesses in Austin, this would typically involve applying the state tax rate of 6.25%, the city tax rate of 2%, and any additional county or special district taxes. It’s important to consult the Texas Comptroller of Public Accounts for specific guidance and to ensure compliance with reporting requirements.