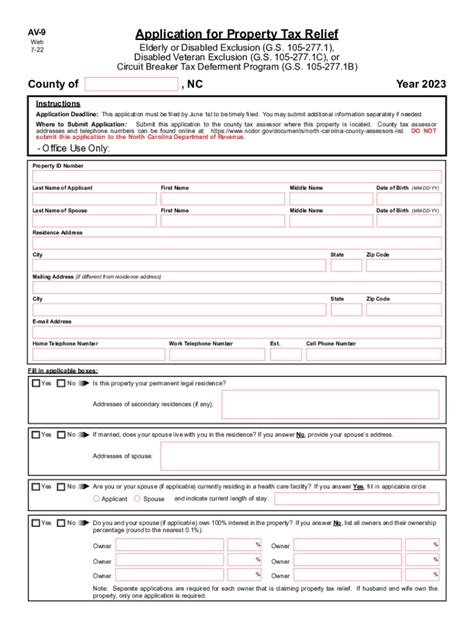

Nc Tax Exempt Form

The North Carolina (NC) Tax Exempt Form is a crucial document for businesses and individuals seeking tax-exempt status within the state. This form plays a vital role in ensuring compliance with state tax laws and regulations, allowing qualified entities to make purchases without incurring sales and use taxes. In this comprehensive guide, we will delve into the intricacies of the NC Tax Exempt Form, exploring its purpose, eligibility criteria, application process, and the benefits it offers.

Understanding the NC Tax Exempt Form

The NC Tax Exempt Form, officially known as the Form E-500, is a legally binding document that grants tax-exempt status to eligible entities for the purchase of goods and services. It serves as a declaration of the entity’s qualification for tax exemption, as outlined by the North Carolina Department of Revenue (NCDOR). This form is a critical tool for businesses, non-profit organizations, and government entities to navigate the state’s tax landscape and ensure compliance with relevant tax laws.

Eligibility Criteria

To be eligible for tax-exempt status in North Carolina, entities must fall under one of the following categories, as defined by the NCDOR:

- Non-profit Organizations: Charities, religious organizations, educational institutions, and other entities recognized as tax-exempt by the Internal Revenue Service (IRS) are typically eligible for NC tax exemption.

- Government Entities: Federal, state, and local government agencies, as well as their authorized representatives, are generally exempt from sales and use taxes in North Carolina.

- Certain Businesses: Specific businesses, such as those involved in manufacturing, agriculture, or research and development, may qualify for tax-exempt status under certain conditions.

Benefits of Tax-Exempt Status

Obtaining tax-exempt status through the NC Tax Exempt Form offers several advantages, including:

- Sales and Use Tax Exemption: Qualified entities can make purchases without incurring the standard sales and use tax, resulting in significant cost savings.

- Streamlined Procurement: Tax-exempt status simplifies the procurement process, as businesses and organizations can focus on their core operations without the administrative burden of tax compliance.

- Competitive Advantage: Tax-exempt entities may have a cost advantage over their taxable counterparts, potentially enhancing their market position and competitiveness.

- Compliance and Reputation: Maintaining tax-exempt status demonstrates a commitment to ethical business practices and compliance with state regulations, which can enhance an entity’s reputation and credibility.

The Application Process

Applying for the NC Tax Exempt Form involves a series of steps to ensure a smooth and accurate submission. Here’s a detailed breakdown of the process:

Step 1: Determine Eligibility

Before initiating the application process, it is crucial to assess whether your entity qualifies for tax-exempt status. Review the eligibility criteria outlined by the NCDOR and consult with tax professionals or legal advisors if needed. This step ensures that your application is based on a solid foundation of understanding and compliance.

Step 2: Gather Required Documentation

To complete the NC Tax Exempt Form, you will need to gather specific documentation to support your application. This may include, but is not limited to:

- Proof of Tax-Exempt Status: Documents such as IRS determination letters, state agency certifications, or other official documentation confirming your entity’s tax-exempt status.

- Business Registration: Valid business registration documents, such as Articles of Incorporation or Formation, for entities seeking tax exemption as businesses.

- Government Agency Identification: Official identification documents for government agencies, such as letters of authorization or agency-specific tax exemption certificates.

- Supporting Statements: Additional documentation or statements explaining the nature of your entity’s activities and how they align with the eligibility criteria.

Step 3: Complete the Form E-500

Once you have gathered the necessary documentation, you can proceed to complete the Form E-500. This form can be accessed and submitted electronically through the NCDOR’s online portal. Ensure that you provide accurate and detailed information, as any discrepancies or errors may delay the processing of your application.

| Form E-500 Sections | Key Information |

|---|---|

| Applicant Information | Provide your entity's name, address, contact details, and tax registration number (if applicable) |

| Tax-Exempt Status | Select the appropriate category (non-profit, government, or business) and provide supporting documentation as attachments |

| Signature and Verification | Sign and date the form, certifying the accuracy of the information provided |

Step 4: Submit and Track Your Application

After completing the Form E-500, submit it through the NCDOR’s online portal. You will receive a confirmation of submission, which includes a unique reference number. Use this reference number to track the status of your application. The NCDOR aims to process applications within a reasonable timeframe, typically within 30 days from the date of submission.

Step 5: Receive and Utilize Your Tax Exempt Certificate

Upon approval of your application, the NCDOR will issue a Tax Exempt Certificate, which serves as official documentation of your tax-exempt status. This certificate should be retained and presented to vendors or suppliers whenever you make tax-exempt purchases. It is crucial to keep this certificate up-to-date and ensure that it remains valid throughout your entity’s operations.

Maintaining Tax-Exempt Status

Once your entity has obtained tax-exempt status through the NC Tax Exempt Form, it is essential to maintain compliance with the relevant regulations to avoid any legal consequences. Here are some key considerations for maintaining tax-exempt status:

Regular Review and Renewal

Tax-exempt status is not permanent and may need to be renewed periodically. The NCDOR provides guidance on the renewal process, which typically involves submitting an updated Form E-500 and supporting documentation. Stay informed about renewal deadlines and ensure that your entity’s tax-exempt status remains current.

Compliance with Tax Laws

Even with tax-exempt status, your entity must still comply with other tax laws and regulations. This includes filing any required tax returns, such as income tax returns or payroll tax returns, as applicable. Failure to comply with these obligations may result in the revocation of your tax-exempt status and potential penalties.

Proper Use of Tax Exempt Certificate

When making purchases as a tax-exempt entity, it is crucial to present your Tax Exempt Certificate to vendors or suppliers. Ensure that you understand the appropriate procedures for using the certificate and provide it in a timely manner. Misuse of the certificate or making taxable purchases without proper documentation can lead to legal consequences.

FAQs

What happens if my NC Tax Exempt Form is denied?

+If your NC Tax Exempt Form is denied, you will receive a notification from the NCDOR explaining the reasons for the denial. In such cases, it is essential to review the provided reasons and consult with tax professionals or legal advisors to understand the next steps. You may need to gather additional documentation or make adjustments to your application to address the concerns raised.

Can I apply for tax-exempt status if my organization is not registered as a non-profit in North Carolina?

+Yes, entities that are not registered as non-profits in North Carolina may still be eligible for tax-exempt status. However, it is crucial to demonstrate that your organization meets the criteria for tax exemption as outlined by the NCDOR. This may involve providing additional documentation, such as IRS determination letters or state agency certifications, to support your application.

Are there any penalties for misuse of the Tax Exempt Certificate?

+Yes, misuse of the Tax Exempt Certificate can result in significant penalties. Vendors and suppliers are required to report instances of suspected tax exemption misuse to the NCDOR. If your entity is found to have misused the certificate, you may face fines, revocation of tax-exempt status, and other legal consequences. It is crucial to use the certificate responsibly and only for eligible tax-exempt purchases.

How often do I need to renew my tax-exempt status in North Carolina?

+The renewal frequency for tax-exempt status in North Carolina varies depending on the type of entity. Non-profit organizations and certain businesses typically need to renew their tax-exempt status every three years. Government entities may have different renewal requirements, so it is advisable to consult the NCDOR’s guidelines or seek professional advice to ensure compliance with the specific renewal timeline applicable to your entity.

The NC Tax Exempt Form is a vital tool for entities seeking tax-exempt status in North Carolina. By understanding the eligibility criteria, completing the application process accurately, and maintaining compliance with tax regulations, entities can benefit from sales and use tax exemption, streamline their operations, and enhance their market position. Remember to consult with tax professionals or legal advisors for expert guidance throughout the process.