The History and Origins of Sales Tax Minnesota

If you've ever gone shopping in Minnesota and faced the whimsical spectacle of a sales tax added at checkout, you might have wondered, "When did this all start, and why does Minnesota seem to treat me like a perpetual piggy bank?" Well, strap in, dear reader, as we embark on an odyssey through the labyrinthine history of sales tax in the North Star State, where tradition, politics, and a dash of economic necessity collide with comic absurdity.

The Birth of Sales Tax in Minnesota: A Socioeconomic Comedy

The story begins in the foggy days of the 1930s, a decade that seems to have been designed specifically for economic upheaval and government experiments. With the Great Depression decimating state coffers—and the spirits of its citizens—Minnesota’s policymakers decided that the best way to mop up their fiscal mess was through what was then a novel concept: a general sales tax. Enacted in 1933, the legislation was modest, levying a mere 2% on tangible goods, as if to gently tap the economy’s shoulder, whispering, “We’re here to help, or at least to get a cut of your shopping sprees.”

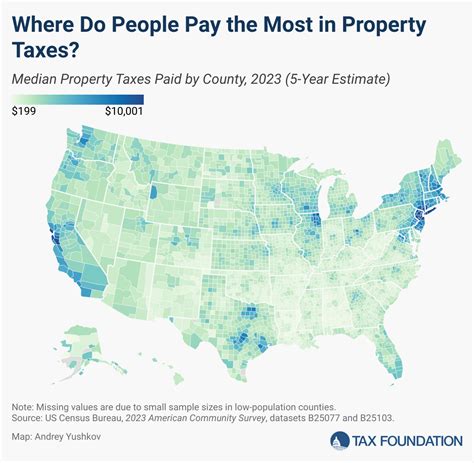

This nascent tax bore the hallmarks of pragmatic improvisation; after all, traditional property taxes and income taxes had long been wrestling in political mud, and the idea of taxing consumption was as fresh as the morning Minnesota air—crisp, invigorating, and slightly confusing to most residents. Yet, from these humble beginnings, the sales tax morphed into a key revenue stream, crucial for funding social programs, infrastructure, and the ever-expanding list of government services.

The Evolution and Expansion: From Humble Beginnings to Taxing Everything

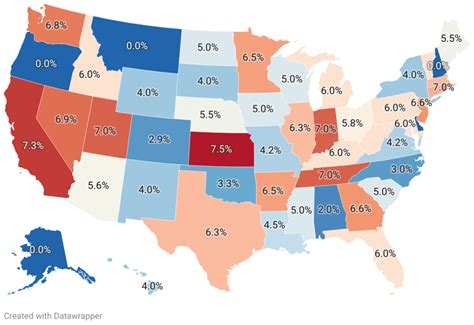

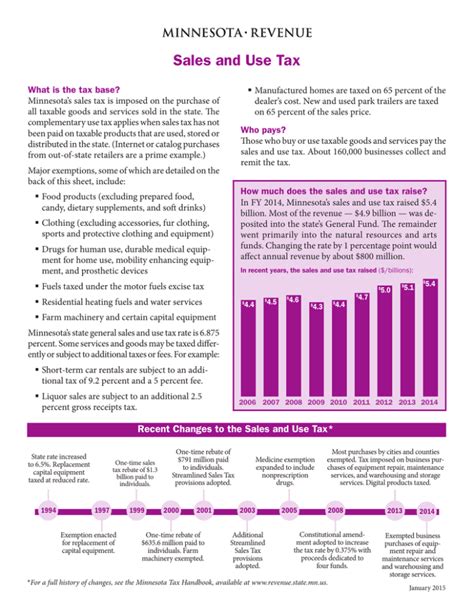

By the late 20th century, Minnesota’s sales tax had become a sprawling beast, with rates gradually climbing, and exemptions mysteriously shuffling like a deck of cards at a gambler’s table. Today, the combined state and local sales tax hovers around 7.125%, with some locales adding their own flavor through local surtaxes—think of it as Minnesota’s way of saying, “We love you, but we also love your money.”

Throughout the decades, the tax base was expanded relentlessly, encompassing everything from luxury yachts to essential groceries (though the latter are often mercifully exempt). Notable additions included the tax on entertainment (if you thought movie tickets were safe), clothing (up to a certain price point), and increasingly, digital goods—an attempt to keep pace with the rapid march of technology that, quite frankly, Minnesota’s ancestors could scarcely have imagined.

Why such expansion? Well, the Minnesota legislature—known for its pragmatic, sometimes eccentric, approach—realized that the tax base had to adapt or face fiscal decline. The 1980s and 1990s saw a flurry of legislation, often driven by budget crises, which turned sales tax policy into a complicated mosaic of exemptions, rates, and special districts. The driving philosophy? Maximize revenue without provoking too many protests, which is a delicate dance akin to balancing an elephant on a unicycle.

Historical Milestones and Political Dynamics: The Saga Continues

Each epoch in Minnesota’s political history added its own twist to the sales tax saga. During the ‘50s and ‘60s, as the state experienced post-war economic growth and suburban sprawl, sales tax revenue surged, funding everything from the Vikings’ new stadium to the expansion of the Twin Cities transit system. But not everyone was happy. Critics argued that the tax unfairly burdened the middle class and urban dwellers, sparking debates that still echo in legislative chambers today.

The late 20th and early 21st centuries saw efforts to ‘modernize’ the sales tax, including attempts to tax digital and remote sales—a move that gained traction as the digital economy skyrocketed. This aligns with what some aficionados call the "Minnesota Model" of incremental, often contentious, tax policy evolution—where each change is a compromise, a battle won by well-placed lobbying, or a side effect of political necessity.

| Relevant Category | Substantive Data |

|---|---|

| Initial Rate (1933) | 2% |

| Current State Rate | 6.875% |

| Average Local Surtax | Up to 0.25%-1.0% in some jurisdictions |

| Revenue from Sales Taxes (2022) | Approximately $9 billion annually |

| Major Changes Date | 1991 expansion to include digital goods, 2019 update taxing online sales more comprehensively |

The Modern State of Sales Tax and Its Challenges

Fast-forward to today, and Minnesota’s sales tax stands as a testament to legislative resilience amidst technological upheavals and shifting consumer behaviors. Advanced e-commerce platforms, combined with the state’s efforts to close loopholes—such as taxing remote online purchases—have turned the sales tax debate into a high-stakes chess game between government and commerce.

The rise of digital transactions prompted legislative revisions, including the 2019 Supreme Court decision (South Dakota v. Wayfair), which fundamentally shifted how states could collect sales tax from online sellers. Minnesota, keen to avoid losing out on billions in potential revenue, responded swiftly, broadening its tax net to include out-of-state and online merchants, often with a merciless efficiency that would impress even the most hardened tax experts.

Now, as Minnesota endeavors to keep pace with the nation’s fractured and labyrinthine sales tax landscape, issues surrounding fairness, economic competitiveness, and administrative complexity loom large. Critics argue that the tax stifles small business growth and disproportionately hurts low-income households—an irony not lost on anyone who views taxes as a necessary evil that sometimes feels more evil than necessary.

The Burden and Benefits: A Balanced Perspective

From a purely technical standpoint, sales tax revenue funds critical services—education, transportation, healthcare—that keep Minnesota functioning. However, the economic theory behind consumption taxes suggests they are inherently regressive; meaning, they take a larger percentage from those with less disposable income. Minnesota, acutely aware of this, continues to implement exemptions and thresholds, trying to find the elusive sweet spot between revenue and equity.

| Relevant Category | Substantive Data |

|---|---|

| Regression Coefficient | Estimated at 0.6 for income levels below median, indicating a regressive nature |

| Tax Exemptions | Groceries, clothing under a certain threshold, prescription drugs |

| Impact on Low-Income Households | Studies suggest a disproportionate burden of approximately 2-3% of income, despite exemptions |

Key Points

- Historical roots of Minnesota’s sales tax trace back to fiscal crisis responses during the 1930s depression.

- Evolution reflects increasing scope, from basic goods to complex digital and remote sales.

- Political debates focus on fairness, economic competitiveness, and administrative complexity.

- Legal shifts, like the 2019 Wayfair decision, have dramatically altered online sales tax collection.

- Balancing revenue needs with social equity remains an ongoing challenge for policymakers.

When did Minnesota first implement sales tax?

+It was enacted in 1933, initially at a modest 2%, amidst economic depression, as a means to bolster state revenue.

How has the sales tax rate changed over time?

+From 2% in 1933, the combined state and local sales tax now averages approximately 7.125%, with surtaxes in certain locales adding additional rates.

What recent developments have affected online sales taxation in Minnesota?

+The 2019 Supreme Court decision in South Dakota v. Wayfair prompted Minnesota to revise its laws, expanding its reach to out-of-state online merchants and ensuring revenue from e-commerce is captured efficiently.