Alexandria Va Property Tax

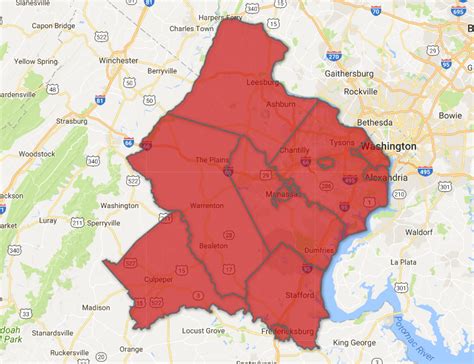

Property taxes are an essential component of local government revenue, funding various public services and infrastructure projects. In Alexandria, Virginia, understanding the property tax landscape is crucial for both residents and prospective homeowners. This comprehensive guide delves into the specifics of Alexandria's property tax system, offering an in-depth analysis of how it works, what factors influence tax rates, and how taxpayers can navigate the process.

Understanding Alexandria’s Property Tax Structure

Alexandria, known for its vibrant culture and historical significance, has a unique property tax system that reflects the city’s commitment to providing quality public services while maintaining a competitive tax environment. The city’s property tax is based on the assessed value of real estate properties, including both residential and commercial properties.

The Assessment Process

Property assessment in Alexandria is conducted by the Department of Real Estate Assessments, which determines the value of each property every year. This value is crucial as it forms the basis for calculating property taxes. The assessment process considers various factors, including:

- Market Value: The property’s current market value is a key consideration. The assessor analyzes recent sales of similar properties to estimate the fair market value of each property.

- Physical Characteristics: The size, age, condition, and unique features of the property are taken into account. For instance, a newly renovated home might have a higher assessment than an older, similar-sized home in need of repairs.

- Location: The property’s location plays a significant role. Properties in desirable neighborhoods or with convenient access to amenities might have higher assessments.

Once the assessment is complete, property owners receive a Notice of Value, which outlines the assessed value of their property for the upcoming tax year. This notice is typically sent out in late spring or early summer, allowing homeowners ample time to review and appeal the assessment if they believe it is inaccurate.

| Assessment Timeline | Key Dates |

|---|---|

| Assessment Notices Mailed | May - June |

| Appeal Deadline | June - July |

| Tax Rate Determination | August |

Tax Rate Determination

After the assessment process is complete, the City Council sets the property tax rate for the upcoming fiscal year. This rate, expressed in cents per 100 of assessed value, is applied uniformly to all properties within the city. For instance, if the tax rate is set at 0.95 per 100 of assessed value, a property with an assessed value of 500,000 would have a tax liability of $4,750 for that year.

The tax rate is determined based on the city's revenue needs for the upcoming fiscal year, taking into account the budget requirements for various public services, such as education, public safety, infrastructure maintenance, and more. The City Council aims to balance the tax rate to ensure sufficient revenue while keeping the tax burden manageable for residents.

Taxpayer Resources and Support

Alexandria offers a range of resources to assist taxpayers in understanding and managing their property tax obligations. The city’s website provides a wealth of information, including:

- Online Tax Calculator: A user-friendly tool that allows taxpayers to estimate their property taxes based on the assessed value of their property and the current tax rate.

- Payment Options: Taxpayers have the flexibility to pay their property taxes online, by mail, or in person. The city also offers options for taxpayers to pay their taxes in installments.

- Tax Relief Programs: Alexandria recognizes the potential burden of property taxes, especially for certain segments of the population. The city offers several tax relief programs, including the Homestead Exemption, which reduces the assessed value of a homeowner's primary residence, and the Real Estate Tax Relief Program, which provides assistance to qualifying low-income homeowners.

In addition to these resources, the city's Department of Real Estate Assessments and the Commissioner of the Revenue's office are available to answer questions and provide guidance to taxpayers. They offer assistance with understanding assessment notices, navigating the appeals process, and ensuring taxpayers are aware of all available tax relief options.

Online Services for Taxpayers

Alexandria has embraced digital transformation to enhance the taxpayer experience. The city’s online portal, Alexandria eServices, offers a range of convenient features, including:

- Online Account Management: Taxpayers can create an account to view their property tax information, track payments, and receive important notifications.

- Email and Text Alerts: Taxpayers can opt to receive email or text alerts for important deadlines, such as tax due dates or assessment notices.

- Secure Payment Gateway: The portal provides a secure platform for taxpayers to make online payments, ensuring their financial information is protected.

The city's commitment to digital services not only improves convenience but also enhances transparency, allowing taxpayers to have real-time access to their property tax information and ensuring they are well-informed about their obligations and rights.

Navigating the Appeals Process

If a property owner believes their assessed value is inaccurate, they have the right to appeal. The appeals process in Alexandria is designed to be fair and accessible, ensuring that taxpayers can have their concerns heard and resolved impartially.

Steps to Appeal

The appeal process typically involves the following steps:

- Review of Assessment Notice: Property owners should carefully review their assessment notice, noting any discrepancies or factors they believe were not adequately considered.

- Informal Review: Before filing a formal appeal, property owners can request an Informal Review with the Department of Real Estate Assessments. This provides an opportunity to discuss the assessment with an assessor and potentially resolve the issue without proceeding to a formal appeal.

- Formal Appeal: If the Informal Review does not resolve the issue, property owners can file a Formal Appeal with the Board of Equalization. This board, comprised of local residents, hears and decides on property tax appeals.

- Hearing and Decision: The Board of Equalization will schedule a hearing, where the property owner can present their case. The Board's decision is final and binding.

It's important for property owners to prepare thoroughly for their appeal, gathering relevant evidence and documenting any factors that support their case. The city's website provides detailed guidelines and resources to assist taxpayers through the appeals process.

Success Stories and Case Studies

While every case is unique, there are several notable instances where property owners have successfully appealed their assessments. For example, a homeowner who recently renovated their kitchen and bathroom might see a significant increase in their assessment. However, if the renovations did not align with the overall market value of similar properties in the area, an appeal could result in a more accurate assessment.

Another scenario could involve a commercial property owner who believes the assessment does not reflect the current market conditions. If the property's revenue has decreased due to economic factors, an appeal could lead to a reduction in the assessed value, resulting in lower tax liability.

Future Outlook and Potential Changes

As Alexandria continues to grow and evolve, the property tax landscape is likely to see some changes and developments. The city’s commitment to maintaining a competitive tax environment while funding essential public services will continue to shape the property tax system.

Potential Reforms and Initiatives

Some potential areas of focus for the future include:

- Assessment Accuracy: The city may invest in advanced technologies and data analytics to enhance the accuracy and efficiency of the assessment process. This could involve using advanced algorithms to analyze property data and market trends, ensuring more precise assessments.

- Tax Relief Expansion: As the city's population and cost of living continue to rise, there may be a need to expand tax relief programs to assist a wider range of residents. This could involve increasing the income thresholds for existing programs or introducing new initiatives to support vulnerable populations.

- Digital Transformation: Alexandria's commitment to digital services is likely to continue, with potential enhancements to the online portal and the introduction of new features to further improve the taxpayer experience.

By staying informed about these potential changes and engaging with the city's initiatives, taxpayers can ensure they are well-prepared to navigate the evolving property tax landscape in Alexandria.

Conclusion

Understanding and managing property taxes is a crucial aspect of homeownership in Alexandria, VA. By familiarizing themselves with the assessment process, tax rate determination, and available resources, taxpayers can ensure they are active participants in the city’s fiscal health while protecting their financial interests. As Alexandria continues to thrive, its property tax system will remain a vital component of the city’s economic fabric, funding the public services and infrastructure that make Alexandria a desirable place to live and work.

How often are property assessments conducted in Alexandria, VA?

+Property assessments in Alexandria are conducted annually. The Department of Real Estate Assessments evaluates the value of each property every year to ensure the tax burden is fairly distributed among all property owners.

Can I appeal my property assessment if I disagree with it?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. Alexandria provides a fair and accessible appeals process, including Informal Reviews and Formal Appeals to the Board of Equalization.

What are the payment options for property taxes in Alexandria?

+Taxpayers in Alexandria have several payment options, including online payments through the Alexandria eServices portal, payments by mail, and in-person payments. The city also offers the flexibility of paying taxes in installments.

Are there any tax relief programs available for homeowners in Alexandria?

+Yes, Alexandria offers several tax relief programs to assist homeowners. These include the Homestead Exemption, which reduces the assessed value of a homeowner’s primary residence, and the Real Estate Tax Relief Program, which provides assistance to qualifying low-income homeowners.

How can I stay informed about changes or updates to Alexandria’s property tax system?

+The best way to stay informed is to regularly visit the city’s official website, which provides up-to-date information about property taxes, assessment processes, and any changes or initiatives. You can also sign up for email or text alerts to receive notifications about important deadlines and updates.