California Corporate Tax Rate

The corporate tax landscape in California is a topic of great interest, especially for businesses and investors. The state's unique economic environment, characterized by a diverse business climate and a vibrant economy, often leads to questions about its tax policies. California's corporate tax structure is designed to contribute to the state's revenue while encouraging economic growth. Let's delve into the specifics of the California corporate tax rate and its implications.

Understanding the California Corporate Tax Rate

California imposes a franchise tax on corporations operating within its borders. This tax is a privilege tax, levied on the net income of both resident and non-resident corporations. The franchise tax is distinct from federal income taxes, and corporations must pay both to comply with state and federal regulations.

The California corporate tax rate is progressive, meaning it varies based on the corporation's net income. This progressive structure aims to ensure that larger, more profitable corporations contribute a greater share of the state's revenue. Here's a breakdown of the current corporate tax rates in California:

| Net Income | Tax Rate |

|---|---|

| $250,000 or less | 8.84% |

| $250,001 - $500,000 | 9.12% |

| $500,001 - $1,000,000 | 9.39% |

| $1,000,001 - $2,500,000 | 9.62% |

| $2,500,001 and above | 11.33% |

These rates are subject to change and are set by the California Franchise Tax Board. It's important for corporations to stay updated on any modifications to these rates to ensure accurate tax calculations and compliance.

Calculating the Corporate Tax Liability

To determine a corporation’s tax liability, the franchise tax is applied to the corporation’s taxable income, which is typically the net income adjusted for certain deductions and allowances. These adjustments are outlined in California’s Revenue and Taxation Code, and corporations must carefully navigate these regulations to ensure accurate tax calculations.

The process involves a series of calculations and considerations, including:

- Determining the corporation's taxable income, which may differ from its accounting income due to specific tax rules.

- Applying the appropriate tax rate based on the corporation's net income.

- Calculating any additional taxes or credits that may apply, such as the Minimum Franchise Tax or the Net Operating Loss Deduction.

- Filing the necessary tax forms, such as Form 100, to report the corporation's income and tax liability.

The complexity of these calculations underscores the importance of expert tax advice for corporations operating in California. Navigating the state's tax landscape requires a deep understanding of its unique regulations and structures.

Comparing California’s Corporate Tax Rates

When examining California’s corporate tax rates, it’s essential to compare them with other states and the federal tax landscape. This comparative analysis provides a broader perspective on the state’s tax competitiveness and its potential impact on businesses.

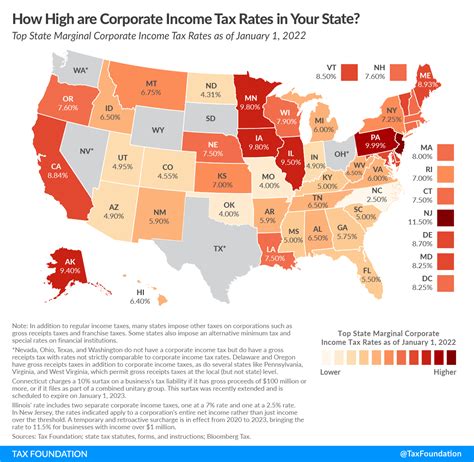

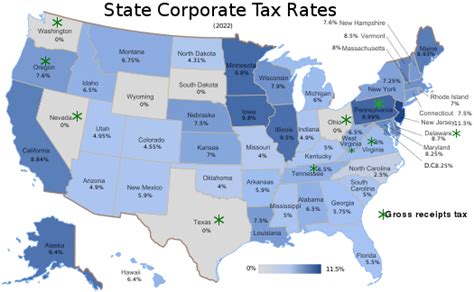

California vs. Other States

California’s corporate tax rates are relatively higher compared to many other states. For instance, states like Wyoming, Nevada, and South Dakota have no corporate income tax, while others like Texas and Washington impose a flat tax rate. This variability in state tax structures can significantly impact a corporation’s tax burden and strategic decisions.

Here's a comparison of California's corporate tax rates with a few other states:

| State | Tax Rate |

|---|---|

| California | Progressive rates up to 11.33% |

| Texas | 0.475% flat rate |

| New York | 6.5% flat rate |

| Florida | 5.5% flat rate |

| Illinois | 7% flat rate |

The differences in tax rates can influence a corporation's choice of location, especially when considering expansion or relocation. States with lower tax rates may be more attractive to businesses, offering potential cost savings and a competitive advantage.

California and Federal Corporate Tax Rates

Comparing California’s corporate tax rates with federal rates provides another layer of insight. The federal corporate tax rate is currently set at 21%, a significant reduction from previous rates. This federal rate applies to all corporations, regardless of their state of operation.

The disparity between California's highest corporate tax rate (11.33%) and the federal rate (21%) is notable. Corporations operating in California may face a higher overall tax burden when considering both state and federal taxes. However, it's important to note that federal tax laws and regulations can also impact a corporation's tax strategies and decisions.

Implications for Businesses and Investors

The California corporate tax rate has significant implications for businesses and investors alike. For businesses, especially those considering expansion or relocation, the tax rate can be a critical factor in decision-making. A higher tax rate may increase operational costs and affect profitability, potentially influencing strategic choices.

Investors, too, are impacted by the corporate tax rate. Higher taxes can reduce a corporation's net income, impacting its ability to distribute dividends or invest in growth initiatives. This, in turn, can affect the corporation's stock performance and investor returns.

Additionally, the progressive nature of California's corporate tax rate means that larger, more profitable corporations contribute a larger share of the state's revenue. This structure can influence investment strategies, as investors may seek to understand how a corporation's tax liability could impact its financial performance and long-term viability.

Tax Planning and Strategies

Given the complexities of California’s corporate tax landscape, tax planning and strategy become crucial for businesses. Corporations must carefully navigate the state’s tax regulations to optimize their tax liability while remaining compliant.

Some common tax planning strategies include:

- Maximizing allowable deductions and credits to reduce taxable income.

- Structuring business operations to optimize tax efficiency, such as utilizing different legal entities or tax-efficient financing structures.

- Exploring tax incentives and credits offered by the state, which can provide significant tax savings.

- Staying updated on tax law changes and consulting with tax professionals to ensure compliance and strategic tax planning.

Effective tax planning can help corporations manage their tax liability, improve cash flow, and enhance their overall financial performance.

Future Outlook and Considerations

Looking ahead, the future of California’s corporate tax rate is a topic of ongoing debate and speculation. While the current rates are relatively stable, various factors can influence future changes.

The state's economic climate, policy priorities, and the political landscape all play a role in shaping tax policies. Changes in leadership or economic conditions can lead to tax reform initiatives, potentially impacting corporate tax rates.

Additionally, the ongoing debate about tax fairness and competitiveness at the national level can influence state tax policies. California, being a prominent state in the national economy, often finds itself at the center of these discussions. Any changes to federal tax policies can have ripple effects on state tax structures, including California's corporate tax rate.

As such, corporations and investors must stay informed about potential changes and their implications. Being proactive in tax planning and strategy can help businesses navigate any future shifts in tax policies and maintain their financial health.

Are there any tax incentives or credits available for corporations in California?

+Yes, California offers various tax incentives and credits to attract businesses and support economic growth. These include the Research and Development Tax Credit, the Net Operating Loss Deduction, and the California Competes Tax Credit. Corporations should explore these incentives to potentially reduce their tax liability.

How often are California’s corporate tax rates updated or revised?

+California’s corporate tax rates are typically reviewed and updated annually by the Franchise Tax Board. Changes can be influenced by economic conditions, legislative actions, and the state’s budgetary needs. It’s essential for businesses to stay informed about any updates to ensure compliance.

What are the consequences for non-compliance with California’s corporate tax regulations?

+Non-compliance with California’s corporate tax regulations can result in significant penalties and interest charges. The state takes tax compliance seriously, and businesses should ensure accurate reporting and payment of taxes to avoid these penalties. Consulting with tax professionals can help businesses navigate the complex tax landscape and ensure compliance.