Pay Il Taxes

Understanding and Navigating the Process of Paying IL Taxes

Navigating the world of taxes can be a complex and often daunting task, especially when it comes to complying with the tax regulations of specific states like Illinois (IL). In this comprehensive guide, we will delve into the intricacies of paying IL taxes, offering you a step-by-step breakdown, valuable insights, and practical tips to ensure a seamless tax-paying experience.

The Importance of Understanding IL Tax Laws

Illinois, like any other state, has its own unique set of tax laws and regulations that residents and businesses must adhere to. From income taxes to sales taxes and property taxes, the state's tax system can be intricate. Understanding these laws is crucial to ensure you meet your tax obligations accurately and on time, avoiding potential penalties and legal issues.

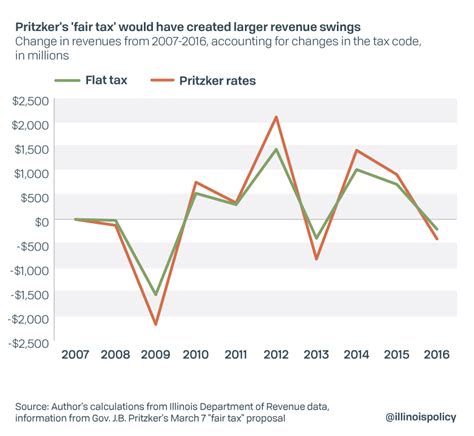

For instance, Illinois has a progressive income tax system, with rates varying based on income brackets. As of 2023, the state has implemented a new flat tax rate structure, replacing the previous graduated rates. This change is a significant development that all taxpayers should be aware of, as it could impact their tax liabilities.

Step-by-Step Guide to Paying IL Taxes

Paying your IL taxes involves several steps, from gathering the necessary information to making the actual payment. Here's a detailed guide to help you through the process:

Step 1: Gather Your Tax Documents

Before you begin, ensure you have all the necessary documents and information. This includes your federal tax return, W-2 forms, 1099 forms, and any other income statements. If you're a business owner, you'll need additional records such as sales reports, invoices, and expense receipts.

For instance, if you're an independent contractor, you should have all your 1099-MISC forms that show your earnings from various clients. These forms are crucial for accurately reporting your income and calculating your tax liability.

Step 2: Determine Your Tax Liability

Using the information from your tax documents, calculate your total income and deductions. Illinois allows certain deductions, such as the standard deduction or itemized deductions for specific expenses. You can also take advantage of tax credits, which reduce the amount of tax you owe directly.

Let's say you're eligible for the Illinois Earned Income Tax Credit (EITC). This credit could significantly reduce your tax liability, especially if you have a low to moderate income. It's important to check your eligibility and claim this credit if applicable.

Step 3: Choose Your Payment Method

Illinois offers several payment methods to accommodate different preferences and needs. You can pay by credit or debit card, electronic check, or even by mail using a check or money order. Online payment systems like the Illinois Taxpayer Portal also provide a convenient way to make payments.

If you prefer the traditional method, you can download and print the necessary forms from the Illinois Department of Revenue website. These forms will guide you through the payment process and ensure you include all the required information.

Step 4: Make Your Payment

Once you've chosen your payment method, it's time to make the actual payment. If you're using the online portal, follow the step-by-step instructions to input your payment details securely. For manual payments, ensure you include the correct form and payment amount in your envelope.

Remember to keep a copy of your payment confirmation or receipt for your records. This will serve as proof of payment in case of any future inquiries or audits.

Step 5: Stay Informed and Updated

Tax laws and regulations can change over time, so it's essential to stay informed about any updates or amendments. The Illinois Department of Revenue website is a valuable resource, providing the latest information on tax rates, deadlines, and any new initiatives or programs.

For example, Illinois offers a Tax Amnesty Program periodically, which allows taxpayers to settle their past-due tax liabilities with reduced penalties and interest. Staying informed about such programs can provide opportunities to save money and resolve outstanding tax issues.

Key Considerations and Tips for IL Taxpayers

Paying your IL taxes efficiently and accurately requires attention to detail and a proactive approach. Here are some key considerations and tips to keep in mind:

-

File on Time: Illinois has specific tax deadlines, and missing them can result in penalties. Ensure you're aware of the filing dates and plan accordingly.

-

Utilize Tax Software: Consider using tax preparation software to streamline the process. These tools can guide you through the filing process, calculate your tax liability, and even help you identify potential deductions and credits.

-

Seek Professional Help: If you're unsure about any aspect of your tax situation, it's advisable to consult a tax professional. They can provide personalized advice and ensure you're complying with all the necessary regulations.

-

Stay Organized: Keep your tax documents and records organized throughout the year. This will make the filing process smoother and easier to manage.

-

Understand Tax Breaks: Illinois offers various tax breaks and incentives for individuals and businesses. Research and understand these opportunities to reduce your tax burden and boost your savings.

The Impact of IL Taxes on Individuals and Businesses

Illinois taxes play a significant role in the state's economy and the financial well-being of its residents and businesses. The tax system impacts various aspects, from personal finances to business operations and economic development.

For individuals, the tax burden can affect their disposable income and overall financial planning. Higher tax rates can reduce the amount of money available for savings, investments, or discretionary spending. On the other hand, tax credits and deductions can provide much-needed relief and improve financial stability.

Businesses, too, are significantly influenced by IL taxes. The tax structure can impact a company's profitability and its ability to invest in growth and expansion. Tax incentives and credits can attract new businesses to the state, promoting economic growth and job creation.

| Tax Type | Rate |

|---|---|

| Income Tax | 4.95% (flat rate as of 2023) |

| Sales Tax | 6.25% (statewide rate) |

| Property Tax | Variable, set by local municipalities |

Future Outlook and Potential Changes

As with any tax system, Illinois's tax landscape is subject to change. The state's tax policies can be influenced by economic conditions, political shifts, and the needs of its residents and businesses.

For example, the recent implementation of the flat income tax rate was a significant change, aiming to simplify the tax system and provide stability for taxpayers. However, there are ongoing debates about further reforms, including the potential for additional tax credits or adjustments to the tax structure.

Staying informed about these potential changes is crucial for taxpayers to adapt their financial strategies and ensure compliance with any new regulations.

What is the Illinois Taxpayer Portal, and how can I use it?

+The Illinois Taxpayer Portal is an online platform that allows taxpayers to file their returns, make payments, and manage their tax accounts. You can register for an account on the portal, where you can access a range of services, including viewing your tax records, updating your personal information, and making payments. It’s a convenient way to manage your tax obligations digitally.

Are there any tax credits or deductions available in Illinois?

+Yes, Illinois offers various tax credits and deductions. These include the Illinois Earned Income Tax Credit (EITC), which provides a credit for low- to moderate-income taxpayers, the Property Tax Credit, which can reduce your property tax burden, and deductions for certain expenses like medical costs and mortgage interest.

What happens if I miss the tax filing deadline in Illinois?

+If you miss the tax filing deadline, you may be subject to late filing penalties and interest charges. It’s important to file your return as soon as possible to minimize these penalties. You can also request an extension to file your return, but this does not extend the deadline for paying any taxes owed.