Pigouvian Taxes

In the realm of economic policy, the concept of Pigouvian taxes stands as a significant tool aimed at addressing market failures and promoting efficient resource allocation. This article delves into the intricacies of Pigouvian taxes, exploring their definition, purpose, and real-world applications. By examining specific examples and their impact, we aim to provide a comprehensive understanding of this economic mechanism and its role in shaping policy decisions.

Understanding Pigouvian Taxes: A Definition and Purpose

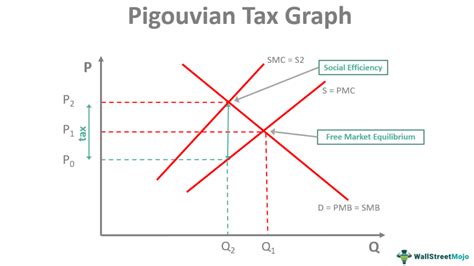

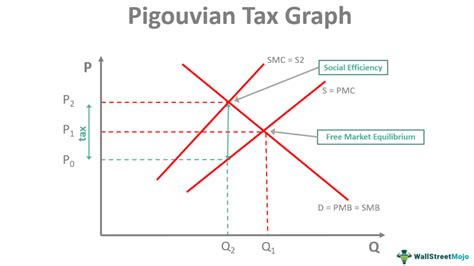

Pigouvian taxes, named after the economist Arthur Cecil Pigou, are a type of tax imposed on activities that generate negative externalities. Negative externalities occur when an economic activity imposes costs on third parties who are not directly involved in the transaction. These costs, often referred to as social costs, arise when the private costs of an activity differ from the social costs it imposes on society.

The primary purpose of Pigouvian taxes is to internalize the external costs associated with certain activities, thereby encouraging market participants to consider the full social impact of their actions. By doing so, Pigouvian taxes aim to correct market failures and promote more efficient and sustainable economic outcomes.

For instance, consider the case of pollution generated by industrial activities. The private cost of production for a factory may not account for the environmental damage caused by its emissions. However, the social cost includes the harm inflicted on public health, ecosystem degradation, and the long-term consequences for future generations. A Pigouvian tax on pollution aims to make the factory bear the social cost, thus incentivizing it to reduce emissions and adopt cleaner production methods.

Key Characteristics of Pigouvian Taxes

Pigouvian taxes exhibit several distinctive features that set them apart from other tax policies:

- Targeted Approach: Pigouvian taxes are designed to address specific market failures or negative externalities. They are not a blanket tax applied to all economic activities but rather a precise tool tailored to the particular issue at hand.

- Internalizing External Costs: The primary objective is to ensure that the price of a good or service reflects its true social cost. This involves imposing a tax that equals the external cost, thus encouraging producers and consumers to account for these costs in their decision-making.

- Incentivizing Behavior Change: By making certain activities more costly, Pigouvian taxes aim to deter behaviors that generate negative externalities. For example, a tax on carbon emissions discourages excessive use of fossil fuels and encourages the adoption of renewable energy sources.

- Revenue Generation: While not the primary purpose, Pigouvian taxes can generate revenue for governments. This revenue can be used to fund environmental protection measures, research and development of sustainable technologies, or compensate those affected by the negative externalities.

Real-World Applications of Pigouvian Taxes

Pigouvian taxes have been implemented across various sectors to address a range of negative externalities. Let’s explore some notable examples:

Environmental Protection

One of the most prominent applications of Pigouvian taxes is in environmental policy. Countries around the world have implemented carbon taxes to reduce greenhouse gas emissions and combat climate change. For instance, the European Union’s Emissions Trading System (EU ETS) sets a cap on carbon emissions and allows companies to trade emissions allowances. This system effectively puts a price on carbon, incentivizing industries to reduce their carbon footprint.

Similarly, Norway has implemented a carbon tax on fossil fuels, with the revenue generated being used to fund renewable energy projects and support the transition to a low-carbon economy.

| Country | Carbon Tax Rate ($/tonne) |

|---|---|

| Sweden | 125 |

| Switzerland | 87 |

| Finland | 60 |

Congestion Charges

Another notable application of Pigouvian taxes is in addressing traffic congestion. London’s Congestion Charge is a prime example. Implemented in 2003, this scheme imposes a daily fee on vehicles entering the central London congestion charging zone. The revenue generated is used to improve public transport and reduce traffic-related air pollution.

Similar congestion charges have been implemented in cities like Singapore, Milan, and Stockholm, with positive outcomes in reducing traffic congestion and improving air quality.

Tobacco and Alcohol Taxes

Pigouvian taxes are also employed to tackle the negative externalities associated with tobacco and alcohol consumption. Taxes on cigarettes and alcohol aim to discourage their use, improve public health, and generate revenue for healthcare and addiction treatment programs.

For instance, France has implemented a progressive tax on tobacco products, with the revenue being allocated to fund healthcare and tobacco prevention campaigns. Similarly, the United States imposes federal and state excise taxes on alcohol, with the funds often directed towards alcohol education and treatment initiatives.

Evaluating the Effectiveness of Pigouvian Taxes

The effectiveness of Pigouvian taxes depends on several factors, including their design, implementation, and the specific context in which they are applied. While Pigouvian taxes can be powerful tools for addressing market failures, they are not without their challenges and potential drawbacks.

Advantages of Pigouvian Taxes

- Market Efficiency: By internalizing external costs, Pigouvian taxes can lead to more efficient resource allocation. They encourage producers and consumers to consider the social costs of their actions, promoting sustainable and socially responsible behavior.

- Revenue Generation: As mentioned earlier, Pigouvian taxes can generate significant revenue for governments. This revenue can be utilized to address the negative externalities directly, such as funding environmental protection measures or public health initiatives.

- Incentives for Innovation: By making certain activities more costly, Pigouvian taxes can drive innovation and technological advancements. For instance, carbon taxes encourage the development of cleaner technologies and renewable energy sources.

Challenges and Considerations

- Complexity and Administrative Costs: Designing and implementing Pigouvian taxes can be complex, requiring careful analysis of the specific negative externality and its magnitude. Additionally, administrative costs associated with tax collection and enforcement can be significant.

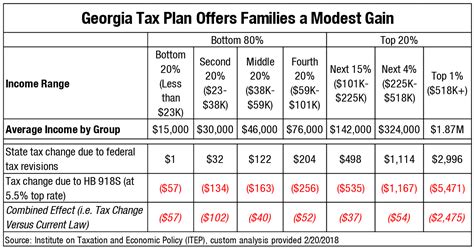

- Equity Concerns: Pigouvian taxes can disproportionately affect certain groups, such as low-income individuals or industries, potentially leading to social and economic inequalities. Careful consideration of the distribution of costs and benefits is essential to ensure fairness.

- Rebound Effects: In some cases, Pigouvian taxes may lead to unintended consequences. For example, a tax on a particular good might induce consumers to substitute it with a cheaper, but equally harmful, alternative.

Future Implications and Policy Considerations

As the world faces increasingly complex environmental, social, and economic challenges, the role of Pigouvian taxes in shaping policy decisions becomes even more crucial. Here are some key implications and considerations for the future:

- Addressing Climate Change: With the urgent need to mitigate climate change, Pigouvian taxes on carbon emissions are expected to play a significant role. However, the effectiveness of such taxes will depend on global cooperation and the ability to implement them across different countries and sectors.

- Innovative Policy Approaches: Policy makers may explore innovative combinations of Pigouvian taxes with other instruments, such as subsidies, regulations, and market-based mechanisms, to address negative externalities more comprehensively.

- Fairness and Equity: Ensuring that Pigouvian taxes are designed and implemented in a way that promotes fairness and social justice will be essential. This includes considering the distribution of costs and benefits, as well as providing support to vulnerable communities affected by the taxes.

In conclusion, Pigouvian taxes represent a powerful economic tool for addressing market failures and promoting sustainable development. By internalizing external costs and incentivizing behavior change, they have the potential to shape a more efficient and environmentally conscious society. However, careful consideration of their design, implementation, and potential impacts is crucial to maximize their effectiveness and minimize unintended consequences.

What are some examples of negative externalities that Pigouvian taxes aim to address?

+Negative externalities addressed by Pigouvian taxes include pollution, congestion, and the social costs associated with tobacco and alcohol consumption. These externalities often impose costs on society that are not reflected in the private costs of production or consumption.

How are Pigouvian taxes different from traditional taxes?

+Pigouvian taxes are designed to correct market failures and internalize external costs, whereas traditional taxes are often levied for revenue generation purposes. Pigouvian taxes are targeted towards specific activities that generate negative externalities, while traditional taxes may apply to a broader range of economic activities.

Can Pigouvian taxes be effective in reducing negative externalities?

+Yes, Pigouvian taxes can be effective in reducing negative externalities by making the activities that generate them more costly. This encourages producers and consumers to consider the full social impact of their actions and adopt more sustainable behaviors. However, the effectiveness depends on various factors, including the design, implementation, and context of the tax.