Washington State Sales Tax Rate

Understanding the sales tax system is crucial for both businesses and consumers in the state of Washington. With a unique approach to taxation, Washington stands out among its neighboring states. In this comprehensive guide, we will delve into the intricacies of the Washington State Sales Tax Rate, exploring its history, current rates, exemptions, and how it impacts various industries and everyday purchases.

A Historical Perspective

The journey of sales tax in Washington began in 1933, amidst the Great Depression. It was implemented as a measure to generate revenue and stabilize the state’s economy. Over the decades, the sales tax rate has undergone several adjustments, reflecting the economic landscape and the state’s fiscal needs.

One notable aspect of Washington's sales tax history is its consistency. Unlike many other states, Washington has maintained a uniform statewide sales tax rate since its inception. This uniformity simplifies tax calculations for businesses and provides a level playing field for retailers across the state.

The Current Landscape

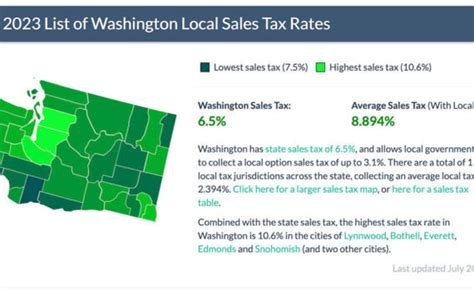

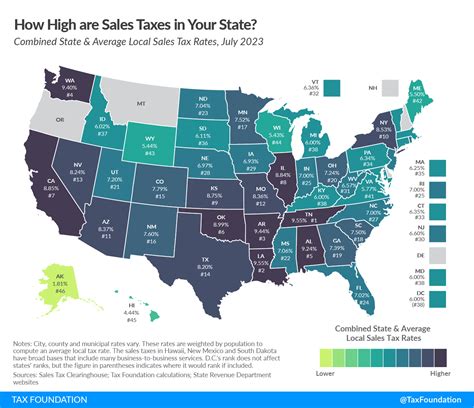

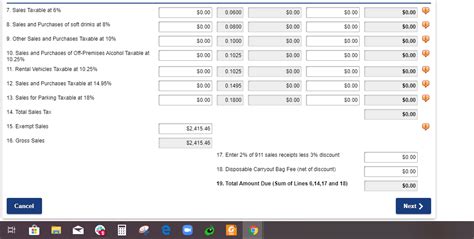

As of the latest update, the Washington State Sales Tax Rate stands at 6.5%. This rate is applicable to most tangible personal property and certain services. It is important to note that sales tax in Washington is a cumulative tax, meaning the rate can vary based on the combination of state, county, and municipal sales tax rates.

The statewide sales tax rate of 6.5% is divided as follows: 6.5% state tax and 0% local tax. While the state rate remains uniform, local jurisdictions have the authority to impose additional sales tax rates, resulting in varying sales tax burdens across the state.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

| Local Sales Tax | 0% |

To illustrate the impact of local taxes, let's consider the city of Seattle. Seattle imposes an additional 2.25% sales tax, bringing the total sales tax rate to 8.75% within city limits. This variation in sales tax rates can influence consumer behavior and business strategies, especially in border towns or cities with distinct local taxes.

Exemptions and Special Considerations

Washington’s sales tax system includes a range of exemptions and special provisions. These exemptions are designed to support specific industries, promote certain behaviors, or alleviate financial burdens on specific goods and services.

Food and Grocery Exemptions

One notable exemption is the grocery tax exemption. In Washington, most unprepared food items, including fresh produce, dairy, and bakery products, are exempt from sales tax. This exemption aims to reduce the tax burden on essential food items, making groceries more affordable for consumers.

However, it's important to note that the exemption does not extend to all food items. Processed foods, snacks, and beverages may be subject to sales tax, depending on their specific categorization.

Manufacturing and Resale Exemptions

Washington offers exemptions for manufacturing and resale purposes. Manufacturers and resellers can apply for a sales tax exemption, allowing them to purchase raw materials and goods tax-free. This exemption is crucial for maintaining the competitiveness of Washington’s manufacturing sector.

Additionally, the state provides a resale exemption, which allows businesses to purchase goods for resale without paying sales tax. This exemption is vital for retailers, ensuring they can acquire inventory without incurring additional costs.

Online Sales and Remote Sellers

With the rise of e-commerce, Washington has implemented regulations for online sales and remote sellers. Online retailers with significant sales in the state are required to collect and remit sales tax to the Washington Department of Revenue. This ensures a level playing field for local businesses and prevents tax evasion.

Impact on Industries and Consumers

The Washington State Sales Tax Rate has a significant impact on various industries and everyday consumer purchases. Let’s explore some specific examples and analyze their implications.

Retail Sector

The retail industry is directly affected by sales tax rates. Retailers must incorporate sales tax into their pricing strategies, ensuring compliance with state and local regulations. The variation in sales tax rates across the state can influence consumer choices, with some shoppers opting for retailers in lower-tax areas.

Additionally, retailers must stay updated on sales tax exemptions and special provisions to ensure accurate pricing and avoid penalties. The complexity of sales tax regulations can pose challenges for small businesses, requiring them to invest in compliance software or seek professional advice.

E-commerce and Online Shopping

The sales tax landscape for e-commerce businesses in Washington is evolving. With the implementation of regulations for online sales, remote sellers must navigate the complexities of sales tax collection and remittance. This includes registering with the state, obtaining a sales tax permit, and integrating sales tax calculation tools into their e-commerce platforms.

For consumers, the introduction of sales tax on online purchases may come as a surprise, especially for those accustomed to tax-free online shopping. However, the state's efforts to collect sales tax from online retailers aim to create a fair and competitive environment for local businesses.

Tourism and Hospitality

The sales tax rate can significantly impact the tourism and hospitality industry. Visitors to Washington may encounter varying sales tax rates depending on their destination. This variation can influence travel plans and spending habits, with tourists potentially favoring lower-tax areas for their accommodations and purchases.

The hospitality industry must ensure accurate sales tax calculations for guest bookings, restaurant bills, and other services. Failure to comply with sales tax regulations can result in penalties and damage the industry's reputation.

Future Outlook and Potential Changes

As Washington’s economy continues to evolve, the sales tax system may undergo further adjustments. Here are some potential developments to watch for:

- Tax Reform Initiatives: The state government may explore tax reform proposals to simplify the sales tax system, reduce rates, or introduce new exemptions.

- Technology Integration: With advancements in technology, Washington may enhance its sales tax collection and compliance systems, making it easier for businesses to stay compliant.

- Local Tax Variations: Local jurisdictions may propose changes to their sales tax rates, impacting the overall sales tax landscape in specific regions.

- E-commerce Focus: The state may continue to refine its regulations for online sales, ensuring fair competition between brick-and-mortar and online retailers.

Frequently Asked Questions

Are there any special sales tax rates for specific industries in Washington?

+Yes, Washington offers special sales tax rates and exemptions for certain industries, such as manufacturing and resale. These exemptions aim to support specific sectors and promote economic growth.

How does Washington handle sales tax for online purchases?

+Washington requires online retailers with significant sales in the state to collect and remit sales tax. This ensures fairness for local businesses and prevents tax evasion.

Are there any plans to simplify the sales tax system in Washington?

+The state government periodically reviews its tax system and may propose reforms to simplify sales tax calculations and reduce administrative burdens for businesses.