Unrealized Capital Gains Tax

The concept of capital gains tax is an essential aspect of financial planning and investing, and it becomes particularly intriguing when we delve into the realm of unrealized capital gains tax. This type of tax is unique as it focuses on the potential gains an investor might have made on their assets, even if those gains haven't yet been realized through a sale or disposition.

In this comprehensive guide, we will explore the intricacies of unrealized capital gains tax, understanding its definition, how it works, and its implications for investors. We will also provide insights into strategies to manage and potentially reduce this type of tax liability. By the end of this article, you should have a clear understanding of this complex financial topic and be equipped with the knowledge to make informed decisions regarding your investments and tax obligations.

Understanding Unrealized Capital Gains Tax

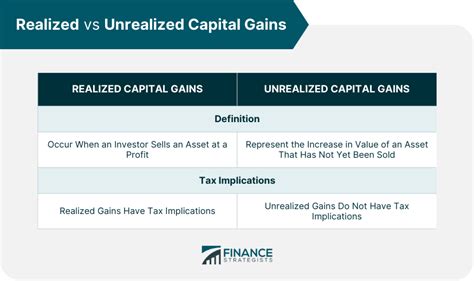

Capital gains represent the profit an investor makes when they sell an asset for a higher price than they originally paid for it. This could apply to a wide range of assets, including stocks, bonds, real estate, and even collectibles. When an investor holds onto these assets without selling them, the potential profit, or capital gain, remains unrealized, hence the term unrealized capital gains.

While unrealized capital gains are not immediately taxed, they still represent potential tax obligations for the future. This is because tax authorities in many jurisdictions consider these gains as income, which is taxable when the asset is eventually sold. It's this potential future tax liability that we refer to as unrealized capital gains tax.

Let's illustrate this with an example. Suppose an investor buys 100 shares of Company A's stock at $50 per share, totaling an initial investment of $5,000. Over the years, the stock price increases to $75 per share. Although the investor hasn't sold the shares, they now have an unrealized capital gain of $2,500 (100 shares * $25 increase per share). This gain is what we refer to as an unrealized capital gain.

Tax Implications of Unrealized Capital Gains

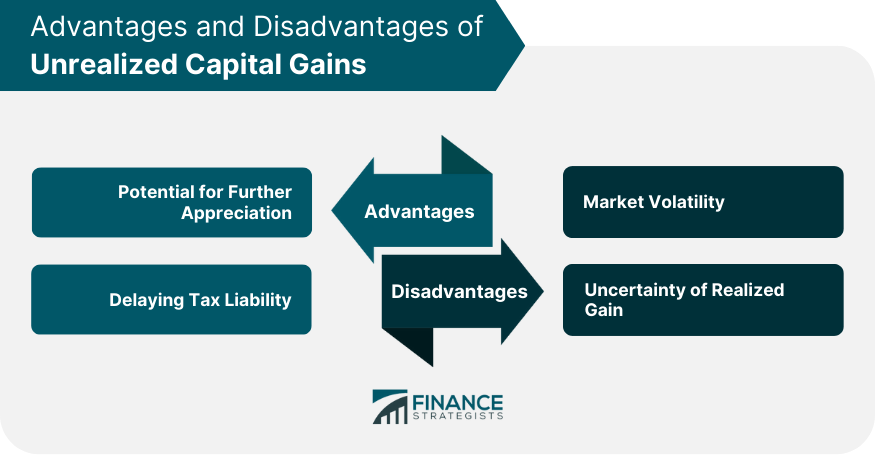

The tax implications of unrealized capital gains can be complex and vary depending on jurisdiction and the type of asset. In many countries, capital gains are taxed at a different rate than ordinary income, often at a lower rate to encourage long-term investments. However, the tax treatment can become more complex when dealing with unrealized gains.

For instance, in the United States, capital gains are generally taxed at a lower rate than ordinary income. The tax rate depends on an investor's income bracket and the holding period of the asset. Short-term capital gains, from assets held for a year or less, are taxed at the investor's ordinary income tax rate, which can be as high as 37%. Long-term capital gains, from assets held for more than a year, are taxed at a maximum rate of 20% for most assets, but certain assets like collectibles can have a maximum tax rate of 28%.

| Asset Type | Maximum Tax Rate |

|---|---|

| Long-Term Capital Gains (Most Assets) | 20% |

| Long-Term Capital Gains (Collectibles) | 28% |

| Short-Term Capital Gains | 37% |

It's important to note that these tax rates can vary based on the investor's income bracket and the specific laws in their jurisdiction. Additionally, some countries may not distinguish between short-term and long-term capital gains, taxing all capital gains at a single rate.

Managing and Reducing Unrealized Capital Gains Tax

Managing and reducing unrealized capital gains tax is a strategic aspect of financial planning, especially for investors with substantial portfolios. Here are some strategies to consider:

Tax-Loss Harvesting

Tax-loss harvesting is a strategy where investors sell assets at a loss to offset capital gains. This strategy can be particularly beneficial for investors with unrealized capital gains. By selling assets that have decreased in value, investors can use these losses to offset their capital gains, potentially reducing their tax liability.

For example, if an investor has an unrealized capital gain of $5,000 from their stocks and also has an unrealized capital loss of $3,000 from other stocks, they can sell the losing stocks to realize the loss. This $3,000 loss can then be used to offset $3,000 of their capital gains, reducing their overall tax liability.

Asset Allocation and Diversification

A well-diversified portfolio can help manage unrealized capital gains tax. By spreading investments across different asset classes and sectors, investors can reduce the concentration of gains in any one area. This diversification can potentially reduce the overall tax liability, as gains and losses from different assets may offset each other.

Additionally, certain asset classes, like municipal bonds or real estate investment trusts (REITs), offer tax advantages. Municipal bonds, for instance, are typically exempt from federal income tax, and depending on the jurisdiction, may also be exempt from state and local taxes. This can provide a significant tax benefit for investors.

Cost Basis Adjustments

The cost basis of an asset is the original price paid for it, adjusted for any improvements or depreciation. When an asset is sold, the difference between the sale price and the adjusted cost basis is the capital gain or loss. By accurately tracking and adjusting the cost basis, investors can more effectively manage their capital gains and potential tax liability.

For example, if an investor made improvements to a rental property, they can increase the cost basis of the property, which in turn can reduce the capital gain (and tax liability) when the property is eventually sold.

Strategic Asset Sales

Strategic asset sales involve timing the sale of assets to optimize tax benefits. This could mean selling assets with unrealized capital gains in years when an investor’s income is lower, thus falling into a lower tax bracket. Alternatively, it could involve selling assets with losses in years when income is higher, to offset the gains from other assets.

For instance, if an investor has a year where their income is significantly lower than usual, they might consider selling assets with unrealized capital gains to take advantage of a lower tax rate. Conversely, in a year where their income is high, they might sell assets with unrealized losses to offset those gains and reduce their overall tax liability.

Retirement Accounts and Tax-Advantaged Plans

Retirement accounts, such as 401(k)s and IRAs, offer tax advantages that can help manage unrealized capital gains tax. Contributions to these accounts are often tax-deductible, and any gains within the account are tax-deferred until withdrawal, typically in retirement when an investor may be in a lower tax bracket.

For instance, if an investor contributes $5,000 to a 401(k) account, this contribution reduces their taxable income for that year. Additionally, any gains made on investments within the 401(k) account are not taxed until the investor withdraws the funds, often decades later when they might be in a lower tax bracket.

Conclusion: The Complex World of Unrealized Capital Gains Tax

Unrealized capital gains tax is a complex aspect of financial planning, requiring a deep understanding of tax laws and investment strategies. While it can seem daunting, with the right knowledge and strategies, investors can effectively manage and potentially reduce their unrealized capital gains tax liability.

By employing strategies like tax-loss harvesting, asset allocation, cost basis adjustments, and utilizing tax-advantaged accounts, investors can optimize their tax positions and maximize their returns. It's always recommended to consult with a qualified tax advisor to ensure compliance with the latest tax laws and to develop a personalized tax strategy that aligns with your financial goals.

Frequently Asked Questions

How are unrealized capital gains different from realized capital gains?

+Unrealized capital gains refer to the potential profit an investor would make if they sold an asset, but they have not yet sold it. In contrast, realized capital gains occur when an investor actually sells the asset, and the profit is realized.

Are unrealized capital gains taxable?

+In most jurisdictions, unrealized capital gains are not taxable until the asset is sold. However, they represent a potential future tax liability, and investors should plan accordingly.

How can I reduce my unrealized capital gains tax liability?

+Strategies to reduce unrealized capital gains tax liability include tax-loss harvesting, strategic asset allocation, cost basis adjustments, and utilizing tax-advantaged accounts like 401(k)s and IRAs.

What is the tax rate for capital gains?

+The tax rate for capital gains varies depending on jurisdiction, the type of asset, and the holding period. In the US, long-term capital gains (assets held over a year) are taxed at a maximum rate of 20% for most assets, but collectibles can have a maximum tax rate of 28%. Short-term capital gains are taxed at the investor’s ordinary income tax rate, which can be as high as 37%.

Can I defer paying taxes on unrealized capital gains?

+Yes, as long as you don’t sell the asset, you can defer paying taxes on unrealized capital gains. However, it’s important to consider the potential tax implications and plan accordingly.