Roth Ira Tax Form

The Roth IRA, or Individual Retirement Account, is a popular retirement savings plan in the United States. One of the key aspects of this financial tool is its tax treatment, which can greatly impact an individual's retirement planning strategy. This comprehensive guide will delve into the Roth IRA tax form, exploring its intricacies, benefits, and potential pitfalls.

Understanding the Roth IRA Tax Form

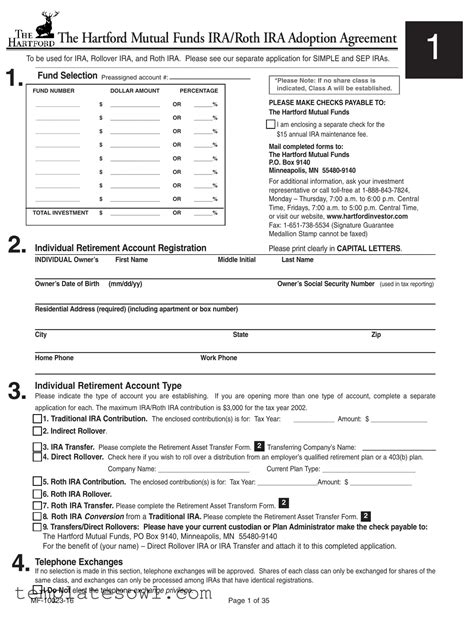

The Roth IRA tax form, officially known as IRS Form 5498, is used to report contributions made to Roth IRAs during the tax year. It serves as a crucial document for both taxpayers and the Internal Revenue Service (IRS) to track and verify contributions, ensuring compliance with the applicable tax laws.

This form is typically provided by financial institutions, such as banks or brokerage firms, where individuals hold their Roth IRA accounts. It is essential to note that the Roth IRA tax form is not the same as the tax return forms (e.g., Form 1040) individuals use to file their annual taxes. The Roth IRA form is an additional reporting requirement specific to this type of retirement account.

Key Information on the Roth IRA Tax Form

The Roth IRA tax form contains vital details about the account holder’s contributions. Here are some of the key pieces of information included:

- Account Holder's Information: This includes the taxpayer's name, address, and social security number, ensuring accurate identification.

- Roth IRA Contributions: The form reports the total amount of contributions made to the Roth IRA during the tax year. It distinguishes between traditional contributions and any conversions made from other retirement accounts.

- Account Number: The Roth IRA account number is listed, allowing for easy reference and tracking.

- Tax Year: The applicable tax year is clearly indicated, ensuring proper reporting.

- Financial Institution's Details: The name and contact information of the financial institution holding the Roth IRA account are provided.

It is important to carefully review the information on the Roth IRA tax form to ensure accuracy. Any discrepancies or errors should be addressed promptly to avoid potential tax complications.

| Form Section | Information Provided |

|---|---|

| Account Holder's Details | Name, Address, SSN |

| Contributions | Total Contributions, Type (Traditional/Conversion) |

| Account Number | Unique Roth IRA Account Number |

| Tax Year | Applicable Tax Year |

| Financial Institution | Name, Contact Details |

Benefits of the Roth IRA Tax Treatment

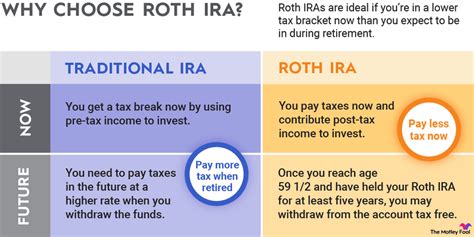

The Roth IRA offers a unique tax advantage that can significantly impact an individual’s retirement savings. Unlike traditional IRAs, where contributions may be tax-deductible but withdrawals are taxed, the Roth IRA provides tax-free withdrawals under certain conditions.

Tax-Free Growth and Withdrawals

One of the primary benefits of the Roth IRA is the potential for tax-free growth and withdrawals. Contributions to a Roth IRA are made with after-tax dollars, meaning there is no immediate tax deduction. However, this allows for tax-free growth of the investments within the account.

Over time, as the investments grow, the earnings and gains are not subject to taxes. This means that when an individual retires and starts withdrawing funds from their Roth IRA, they do not owe any taxes on the distributions. This can be a significant advantage, especially for those in higher tax brackets, as it provides a tax-efficient way to access retirement funds.

Flexibility and Withdrawal Rules

The Roth IRA also offers flexibility in terms of withdrawal rules. While there are certain requirements and restrictions, the Roth IRA generally provides more leniency compared to other retirement accounts.

For instance, individuals can withdraw their contributions at any time without penalty. This allows for access to funds in case of emergencies or other financial needs. Additionally, there is no mandatory withdrawal requirement for Roth IRAs, unlike traditional IRAs, which require distributions starting at a certain age.

The flexibility of the Roth IRA makes it an attractive option for those who want control over their retirement funds and the ability to adapt to changing financial circumstances.

Potential for Estate Planning

The Roth IRA can also be a valuable tool for estate planning. Unlike traditional IRAs, which are subject to required minimum distributions (RMDs) and may be taxed upon the owner’s death, the Roth IRA provides more flexibility for beneficiaries.

Beneficiaries of a Roth IRA can choose to take distributions over their lifetime, stretching out the tax-free benefits. This can be particularly advantageous for heirs, as it allows them to continue enjoying the tax advantages of the account. The Roth IRA's potential for estate planning adds another layer of financial security and tax efficiency.

Potential Pitfalls and Considerations

While the Roth IRA offers numerous benefits, there are also some considerations and potential pitfalls to be aware of when utilizing this retirement savings tool.

Income Limits and Eligibility

One of the primary limitations of the Roth IRA is the income eligibility requirements. The IRS sets income limits for who can contribute to a Roth IRA directly. For single filers, the phase-out range begins at 129,000 and ends at 144,000 for the 2023 tax year. Married couples filing jointly have a broader phase-out range, starting at 204,000 and ending at 214,000.

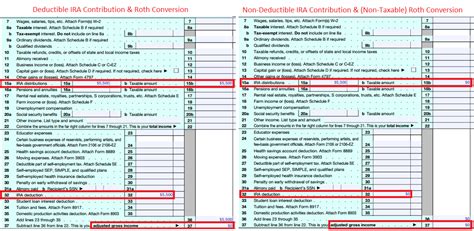

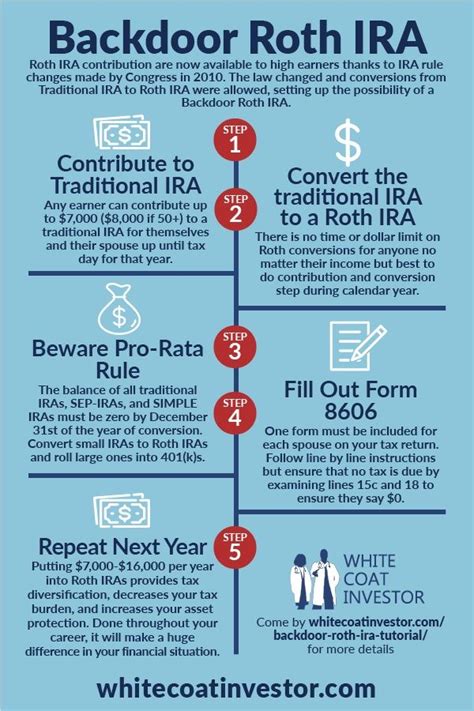

If an individual's income exceeds these limits, they may not be eligible to make direct contributions to a Roth IRA. However, there are strategies, such as the backdoor Roth IRA method, which can be used to contribute to a Roth IRA indirectly, bypassing the income limits.

Contribution Limits

Another consideration is the contribution limits for Roth IRAs. For the 2023 tax year, the maximum annual contribution is 6,000 for individuals under the age of 50, and 7,000 for those aged 50 and above. These limits apply to both direct and indirect contributions, ensuring that individuals do not exceed the allowed amount.

It is important to stay informed about these limits and plan contributions accordingly to maximize the benefits of the Roth IRA while remaining compliant with tax laws.

Early Withdrawal Penalties

While the Roth IRA offers flexibility in terms of withdrawals, there are certain penalties for early distributions. If an individual withdraws funds from their Roth IRA before the age of 59 1⁄2, they may incur a 10% penalty on the amount withdrawn, unless certain exceptions apply.

These exceptions include qualified first-time homebuyer expenses, higher education costs, disability, or distributions taken as part of a series of substantially equal periodic payments. Understanding these exceptions and the potential penalties is crucial to avoid unnecessary financial setbacks.

Complex Tax Rules

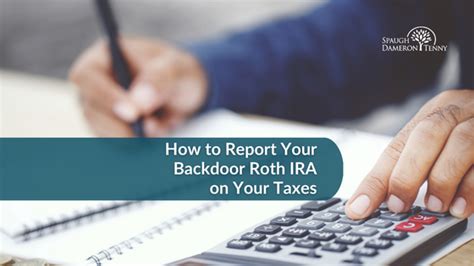

The tax rules surrounding Roth IRAs can be complex, especially when it comes to conversions and recharacterizations. Converting a traditional IRA to a Roth IRA, for instance, may have tax implications and should be carefully considered.

Additionally, individuals should be aware of the "five-year rule" for Roth IRAs. This rule states that distributions from a Roth IRA must be made at least five years after the first contribution to the account to qualify for tax-free treatment. Understanding these rules and their potential impact is essential for effective retirement planning.

Maximizing the Benefits of the Roth IRA

To fully leverage the advantages of the Roth IRA, individuals should consider the following strategies:

- Start Early: The power of compound interest is significant in retirement savings. Starting contributions to a Roth IRA early in one's career can lead to substantial growth over time.

- Maximize Contributions: Aim to contribute the maximum allowed amount each year. This can be particularly beneficial for those with higher incomes, as it allows for tax-free growth and withdrawals in retirement.

- Understand Conversion Strategies: For those with high incomes or who wish to convert traditional IRAs to Roth IRAs, understanding the tax implications and strategies involved is crucial. Working with a financial advisor can help navigate these complex decisions.

- Plan for Withdrawals: Develop a strategic withdrawal plan to ensure the most tax-efficient use of retirement funds. Consider the timing and amount of distributions to maximize benefits.

Conclusion

The Roth IRA tax form is an essential component of retirement planning, providing transparency and compliance with tax laws. By understanding the benefits, potential pitfalls, and strategies associated with the Roth IRA, individuals can make informed decisions to maximize their retirement savings. With careful planning and awareness of the tax rules, the Roth IRA can be a powerful tool for achieving financial security in retirement.

Can I contribute to a Roth IRA if I have a high income?

+Yes, individuals with high incomes can still contribute to a Roth IRA through the backdoor Roth IRA method. This involves making non-deductible contributions to a traditional IRA and then converting those funds to a Roth IRA. However, it’s important to consider the potential tax implications and seek professional advice.

Are there any age restrictions for contributing to a Roth IRA?

+No, there are no specific age restrictions for contributing to a Roth IRA. However, individuals must have earned income to make contributions. Additionally, there is a mandatory distribution requirement starting at age 72 for traditional IRAs, but not for Roth IRAs.

What happens if I withdraw funds from my Roth IRA early?

+If you withdraw funds from your Roth IRA before the age of 59 1⁄2, you may incur a 10% early withdrawal penalty. However, there are certain exceptions, such as qualified first-time homebuyer expenses, higher education costs, or disability, that may exempt you from this penalty.

Can I convert my traditional IRA to a Roth IRA?

+Yes, you can convert a traditional IRA to a Roth IRA, but it’s important to consider the tax implications. Converting a traditional IRA to a Roth IRA triggers a taxable event, as the conversion amount is considered taxable income. It’s advisable to consult a financial advisor to understand the potential benefits and drawbacks.