How To Calculate Capital Gains Tax

Capital gains tax is an important aspect of personal finance and investment strategies, impacting individuals and businesses alike. Understanding how to calculate capital gains tax is crucial for ensuring compliance with tax regulations and optimizing one's financial planning. This comprehensive guide aims to provide an in-depth analysis of capital gains tax calculation, covering various scenarios and offering valuable insights for investors and taxpayers.

Understanding Capital Gains Tax

Capital gains tax is a levy imposed by governments on the profits earned from the sale of capital assets, such as stocks, bonds, real estate, collectibles, and even certain types of personal property. The tax is typically calculated based on the difference between the purchase price (or basis) and the selling price of the asset, known as the capital gain. It’s essential to note that capital gains tax regulations can vary significantly between countries and even within different jurisdictions, so it’s crucial to consult local tax authorities or financial advisors for specific guidance.

Capital gains are generally categorized into two types: short-term capital gains and long-term capital gains. Short-term capital gains refer to profits made on assets held for a shorter duration, often one year or less, while long-term capital gains are profits derived from assets held for a more extended period, usually exceeding one year. The tax treatment for these two types of gains can differ, with long-term capital gains often benefiting from more favorable tax rates.

Calculating Capital Gains Tax

The process of calculating capital gains tax involves several steps, each crucial for an accurate determination of tax liability. Here’s a step-by-step guide to help you navigate through the calculation process:

Step 1: Determine the Asset Type and Holding Period

The first step is to identify the type of asset being sold and the duration for which it was held. This information is essential for classifying the capital gain as short-term or long-term and applying the appropriate tax rates.

Step 2: Calculate the Cost Basis

The cost basis represents the original investment amount, including any additional costs incurred during the acquisition of the asset. It can include the purchase price, commissions, fees, and any other related expenses. The cost basis is crucial for determining the capital gain or loss.

For example, if you purchased a stock for $1,000 and paid a $20 commission, your cost basis for that stock would be $1,020.

Step 3: Determine the Selling Price

The selling price of the asset is the amount received upon its sale, including any additional income or expenses related to the transaction. It’s essential to account for all relevant costs to accurately calculate the capital gain.

Let's say you sold the same stock for $1,200 and incurred a $10 fee for the transaction. Your selling price would be $1,190 ($1,200 - $10 fee).

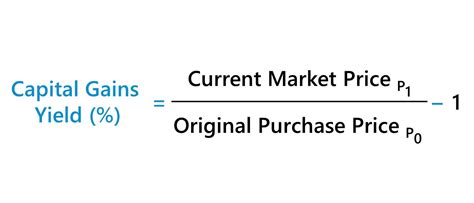

Step 4: Calculate the Capital Gain or Loss

Subtract the cost basis from the selling price to determine the capital gain or loss. If the result is positive, it’s a capital gain; if negative, it’s a capital loss.

In our example, the capital gain would be $170 ($1,190 selling price - $1,020 cost basis).

Step 5: Apply Capital Gains Tax Rates

The tax rate applicable to your capital gain depends on whether it’s classified as short-term or long-term and your overall tax bracket. Short-term capital gains are typically taxed at ordinary income tax rates, while long-term capital gains often benefit from lower, preferential tax rates.

For instance, if you're in the 22% tax bracket and have a long-term capital gain, you might be eligible for a 15% tax rate on that gain. Consult the tax regulations of your jurisdiction for the specific tax rates applicable to your situation.

| Asset Type | Holding Period | Tax Rate |

|---|---|---|

| Stocks | Long-term (held for more than 1 year) | 15% for most assets |

| Real Estate | Short-term (held for less than 1 year) | Ordinary income tax rates |

| Collectibles | Long-term (held for more than 1 year) | 28% for collectibles |

Step 6: Consider Tax Deductions and Credits

Taxpayers may be eligible for various deductions and credits that can reduce their overall tax liability. These can include capital losses, tax credits for investments in specific industries, or deductions for certain expenses related to the asset.

Step 7: File and Pay Capital Gains Tax

Once you’ve calculated your capital gains tax liability, it’s time to file your tax return and make the necessary payments. Ensure you adhere to the deadlines set by your local tax authority to avoid penalties.

Strategies for Optimizing Capital Gains Tax

Understanding capital gains tax calculation is just the first step. There are several strategies investors can employ to optimize their tax liability and maximize their returns. Here are some expert insights and tips to consider:

Tax-Loss Harvesting

Tax-loss harvesting is a strategy where investors sell assets at a loss to offset capital gains from other investments. This strategy can help reduce overall tax liability and improve after-tax returns. However, it’s essential to consult a financial advisor to ensure compliance with wash sale rules, which prevent taxpayers from immediately repurchasing the same asset.

Long-Term Capital Gains

Holding assets for the long term can provide significant tax advantages. Long-term capital gains often benefit from lower tax rates, making it a more tax-efficient strategy. Additionally, certain asset types, like real estate or qualified small business stock, may offer additional tax incentives for long-term holding.

Tax-Efficient Investment Vehicles

Certain investment vehicles, such as retirement accounts like 401(k)s or IRAs, offer tax-deferred or tax-free growth. By utilizing these vehicles, investors can defer or avoid capital gains tax altogether, making them powerful tools for long-term wealth accumulation.

Cost Basis Strategies

Understanding how to adjust your cost basis can impact your capital gains tax liability. For instance, if you receive additional shares as a dividend, your cost basis per share decreases, potentially reducing your tax liability when you sell the shares. Consulting a financial advisor can help you navigate these strategies effectively.

Conclusion

Calculating capital gains tax requires a careful consideration of various factors, including asset type, holding period, and tax rates. By understanding the calculation process and employing strategic tax planning, investors can optimize their tax liability and maximize their returns. Remember, it’s always advisable to consult professional tax advisors or financial planners to ensure compliance and make the most of your investment opportunities.

Are capital gains taxed differently for different asset types?

+

Yes, capital gains tax rates can vary based on the type of asset. For instance, long-term capital gains on stocks are typically taxed at lower rates compared to collectibles or short-term gains on real estate. It’s essential to understand the specific tax rates applicable to each asset class.

Can I deduct capital losses from my taxes?

+

Yes, you can use capital losses to offset capital gains and reduce your tax liability. However, there are limits to how much you can deduct, and it’s crucial to consult a tax advisor to ensure compliance with the rules.

What is the difference between short-term and long-term capital gains?

+

Short-term capital gains refer to profits made on assets held for a shorter period, often one year or less, and are taxed at ordinary income tax rates. Long-term capital gains are profits from assets held for a more extended period, usually exceeding one year, and often benefit from more favorable tax rates.

How do I adjust my cost basis for dividends received?

+

When you receive dividends, your cost basis per share decreases. To calculate the new cost basis, divide the total cost basis by the total number of shares, including the dividend shares. This adjustment impacts your capital gains tax liability when you sell the shares.