Tax Credit 2025

The concept of tax credits has been an integral part of fiscal policies worldwide, offering individuals and businesses financial incentives to encourage certain behaviors or investments. As we approach the year 2025, it is crucial to understand the evolving landscape of tax credits and their potential impact on economic decisions.

Unveiling Tax Credits for 2025: A Comprehensive Guide

Tax credits are set to undergo significant transformations in the coming years, shaping the financial strategies of taxpayers and influencing economic growth. This guide aims to delve into the intricacies of tax credits for the year 2025, providing a comprehensive understanding of the opportunities and challenges they present.

Understanding the Fundamentals of Tax Credits

Tax credits, in essence, are monetary benefits provided by governmental bodies to reduce an individual’s or entity’s tax liability. Unlike deductions, which merely reduce taxable income, credits directly offset the tax amount owed. This distinction makes credits a powerful tool for policymakers to incentivize specific actions, such as investments in renewable energy or educational expenses.

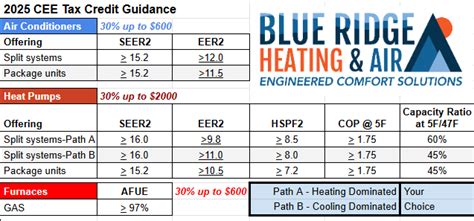

For instance, consider the Residential Energy Efficient Property Credit, which offers a credit of up to $500 for qualified energy-efficient improvements to a principal residence. This credit, by encouraging homeowners to adopt eco-friendly technologies, not only benefits the environment but also stimulates the green energy sector.

The Evolving Landscape of Tax Credits in 2025

As we progress towards 2025, tax credits are expected to play an even more pivotal role in economic policies. Here’s a glimpse at some of the key trends and developments:

-

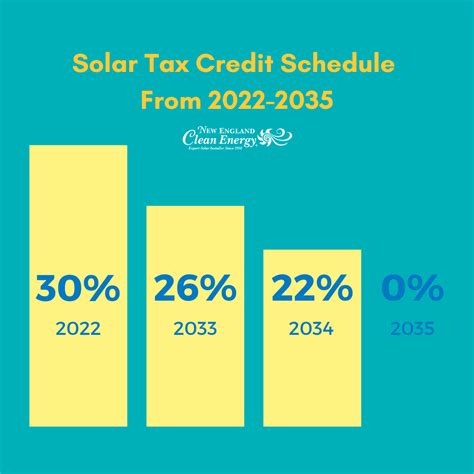

Expansion of Renewable Energy Credits: With a global push towards sustainable practices, tax credits for renewable energy projects are anticipated to expand significantly. Governments may offer enhanced credits for solar and wind energy installations, aiming to accelerate the transition to cleaner energy sources.

-

Educational Credits: A Focus on Skill Development: In an era of rapid technological advancement, educational tax credits are likely to encourage lifelong learning. Credits could be extended for courses and certifications in emerging fields like artificial intelligence, blockchain, and cybersecurity, fostering a skilled workforce.

-

Incentivizing Small Businesses: To promote economic growth, governments might introduce or expand tax credits for small businesses. These could include credits for research and development, employee training, or even credits based on the number of employees hired.

| Tax Credit Category | Expected Impact in 2025 |

|---|---|

| Renewable Energy | Expanded credits, driving investment in clean energy projects. |

| Education | Credits focused on skill enhancement for a digitally advanced workforce. |

| Small Business | Incentives for research, training, and employment to boost economic growth. |

Maximizing the Benefits of Tax Credits

For individuals and businesses, understanding and strategically utilizing tax credits can lead to substantial financial advantages. Here are some key strategies:

-

Stay Informed: Keep abreast of the latest tax credit announcements and changes. Governments often introduce new credits or modify existing ones to align with economic priorities.

-

Plan Ahead: Tax credits are often time-bound, so planning your financial strategies to align with credit eligibility can be beneficial. For instance, if you're considering a large-scale renewable energy project, timing it with the availability of enhanced credits can significantly reduce costs.

-

Seek Professional Advice: Navigating the complexities of tax credits can be challenging. Consulting with tax professionals or financial advisors can ensure you're maximizing your benefits while adhering to the legal requirements.

The Future of Tax Credits: A Glimpse Beyond 2025

Looking beyond 2025, tax credits are expected to continue evolving, adapting to the changing economic landscape and global challenges. Here are some potential future developments:

-

Carbon Offset Credits: With a growing focus on carbon neutrality, credits could be introduced or expanded for businesses and individuals contributing to carbon offset projects.

-

Digital Economy Credits: As the digital economy continues to expand, tax credits could be designed to encourage innovation and entrepreneurship in this sector.

-

Healthcare Innovation Credits: Tax incentives could be offered for investments in healthcare research and development, particularly in areas like personalized medicine and precision health.

The landscape of tax credits is dynamic and responsive to societal and economic needs. By staying informed and strategically planning, individuals and businesses can leverage these incentives to their advantage, contributing to both personal financial health and broader economic development.

How can I determine my eligibility for tax credits in 2025?

+Eligibility for tax credits is typically based on specific criteria outlined by the governing body. This could include factors like income level, the type of investment or activity, or even geographic location. It’s advisable to consult the official guidelines or seek professional advice to determine your eligibility accurately.

Are there any limitations or restrictions on tax credits in 2025?

+Yes, tax credits often come with certain limitations and restrictions. These could include caps on the amount of credit available, specific timeframes for eligibility, or requirements for maintaining the credited activity or investment for a certain period. It’s crucial to understand these restrictions to ensure compliance and maximize benefits.

Can tax credits be carried forward or transferred to future years?

+The carryforward or transferability of tax credits depends on the specific credit and the governing jurisdiction. Some credits can be carried forward or transferred, allowing taxpayers to utilize them in future tax years if they exceed their current tax liability. However, it’s important to consult the relevant tax laws and regulations for precise information.