Texas Sales Tax Rate 2025

The sales tax rate in Texas is a crucial piece of information for businesses and consumers alike. While the base sales tax rate in Texas remains consistent across the state, it's important to note that there are additional local taxes that can vary by city and county, making the overall sales tax rate dynamic and location-specific. As we look ahead to 2025, it's essential to have a clear understanding of the current sales tax landscape and its potential future trajectory.

Understanding the Texas Sales Tax Structure

Texas has a unique sales tax system compared to many other states. The base sales tax rate in Texas is 6.25%, which is applied to most tangible goods and some services. However, it’s the local sales tax rates that add complexity and can significantly impact the total sales tax burden.

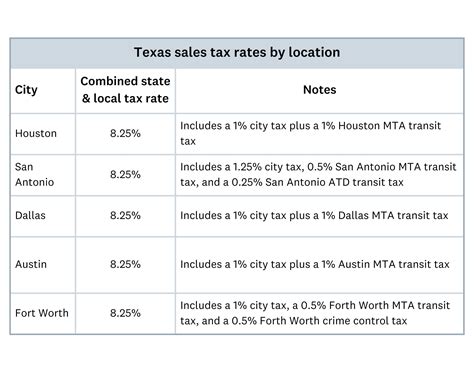

Local Sales Tax Variations

In addition to the base rate, local jurisdictions, such as cities and counties, have the authority to impose their own sales taxes. These local add-on rates can range from 0% to 2%, depending on the location. For instance, in Houston, the local sales tax rate is 1.25%, while in Dallas, it’s 2%.

| City | Local Sales Tax Rate |

|---|---|

| Houston | 1.25% |

| Dallas | 2% |

| San Antonio | 1.5% |

| Austin | 1% |

| Fort Worth | 2% |

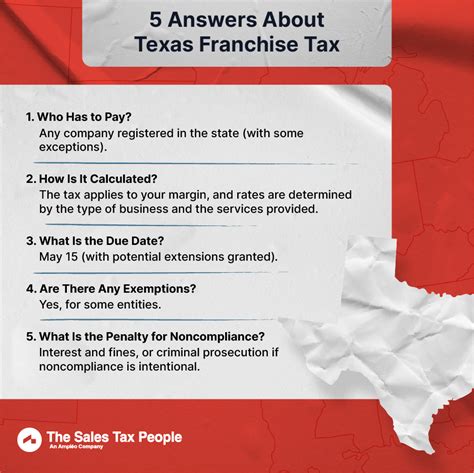

Special Tax Districts and Exemptions

Texas also has special tax districts, which are geographic areas with unique tax rates. These districts are typically created to fund specific projects or infrastructure improvements. Additionally, certain goods and services are exempt from sales tax, such as most groceries, prescription drugs, and some agricultural products.

Projecting the 2025 Sales Tax Rate

Predicting the sales tax rate for 2025 involves considering various economic and political factors. While the base sales tax rate of 6.25% is unlikely to change, local governments might adjust their local add-on rates based on their budgetary needs and economic conditions.

Economic Impact and Budget Considerations

The Texas economy is diverse and resilient, with a strong focus on energy, technology, and healthcare sectors. Economic growth can influence tax revenue and, consequently, local tax rates. If certain areas experience significant economic development, local governments might propose tax rate adjustments to fund infrastructure projects or public services.

Political Landscape and Tax Policy

The political climate also plays a significant role in sales tax rates. Local governments may propose tax rate changes during their legislative sessions, which typically occur biennially. These proposals can be influenced by public opinion, economic forecasts, and the political agenda of the governing body.

Historical Trends and Projections

Analyzing historical sales tax rate changes can provide insights into potential future trends. Over the past decade, local sales tax rates in Texas have generally remained stable, with only a few minor adjustments. However, it’s important to note that these rates can fluctuate based on local economic conditions and policy decisions.

| Year | Base Rate | Average Local Rate |

|---|---|---|

| 2015 | 6.25% | 1.4% |

| 2020 | 6.25% | 1.5% |

| Projected 2025 | 6.25% | 1.5%-1.7% |

Conclusion: Navigating the Texas Sales Tax Landscape

Understanding the Texas sales tax structure and its potential future trajectory is vital for businesses and consumers. While the base sales tax rate is consistent, the local variations add complexity. As we look ahead to 2025, businesses should stay informed about local tax rate changes and their potential impact on their operations and pricing strategies. Consumers, too, can benefit from this knowledge to make more informed purchasing decisions.

FAQ

How often do sales tax rates change in Texas?

+Sales tax rates can change periodically, typically during the legislative sessions held every two years. However, major rate changes are relatively rare, and minor adjustments are more common.

Are there any special tax rates for certain industries or products in Texas?

+Yes, Texas has specific tax rates for certain industries and products. For example, there are special tax rates for alcoholic beverages, hotel occupancy, and telecommunications services.

How can businesses stay updated on sales tax rate changes in Texas?

+Businesses can subscribe to updates from the Texas Comptroller of Public Accounts, which provides regular notifications on tax rate changes and other tax-related news. Staying informed ensures compliance and accurate tax collection.