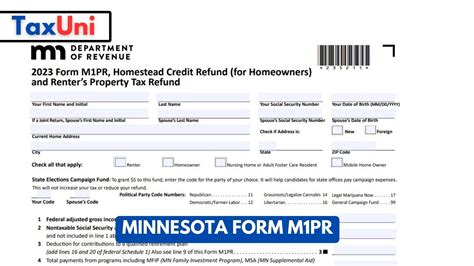

Mn State Property Tax Refund

The Minnesota State Property Tax Refund program is an initiative aimed at providing financial relief to eligible homeowners and renters across the state. This program, often referred to as the Property Tax Refund or the Homestead Credit Refund, is designed to offset some of the property tax burdens faced by Minnesota residents. In this comprehensive guide, we will delve into the intricacies of this program, exploring its benefits, eligibility criteria, application process, and the impact it has on Minnesota's taxpayers.

Understanding the Mn State Property Tax Refund

The Property Tax Refund program in Minnesota is a crucial component of the state’s tax system, offering a form of relief to homeowners and renters who meet specific criteria. This refund is intended to ease the financial strain caused by property taxes, which can be significant, especially for those on fixed incomes or with limited means.

How the Refund Works

Eligible homeowners and renters can receive a refund of a portion of their property taxes paid during the previous year. This refund is calculated based on income, property value, and the amount of property tax paid. The state government allocates a certain amount of funds each year for this purpose, ensuring that a significant number of residents can benefit from this initiative.

| Refund Type | Description |

|---|---|

| Regular Property Tax Refund | This is the standard refund for homeowners and renters. The amount varies based on income and property tax paid. |

| Special Refund for Renters | Renters can qualify for a refund if they meet certain income criteria and pay rent to a property owner who owns four or fewer residential units. |

| Homestead Credit Refund | An additional refund for homeowners who qualify as homestead property owners. This credit can further reduce the property tax burden. |

Benefits of the Property Tax Refund

The Property Tax Refund program offers several advantages to Minnesota residents:

- Financial Relief: It provides a direct refund, helping individuals and families manage their finances more effectively.

- Encourages Homeownership: By offering refunds to homeowners, the program incentivizes and supports homeownership, a key aspect of building wealth.

- Assists Low-Income Residents: Those with lower incomes can receive a larger refund, ensuring that the tax system is more equitable.

- Stimulates Local Economies: The refund program can boost local spending, as recipients are more likely to invest in their communities.

Eligibility Criteria for the Mn State Property Tax Refund

Not all Minnesota residents are eligible for the Property Tax Refund. The program has specific criteria that applicants must meet to qualify for the refund. Understanding these criteria is essential for determining eligibility.

Income Requirements

One of the primary factors determining eligibility is income. The state sets income limits each year, and applicants must fall below these limits to qualify. These limits are based on household size and filing status. For example, the income limit for a single filer might be lower than that for a married couple.

| Filing Status | Income Limit (Example) |

|---|---|

| Single Filer | $35,000 |

| Married Filing Jointly | $45,000 |

| Head of Household | $40,000 |

Property Ownership and Residency

To qualify for the Property Tax Refund, individuals must own or rent a home in Minnesota. The property must be their primary residence, and they must have lived there for the entire year for which they are claiming the refund. This ensures that the refund is targeted at those who are most affected by the property taxes in their local community.

Other Eligibility Factors

Apart from income and residency, there are other factors that can impact eligibility. For instance, certain disabilities or military service can enhance eligibility. Additionally, the program may have specific rules for those who receive Social Security benefits or have other unique financial circumstances.

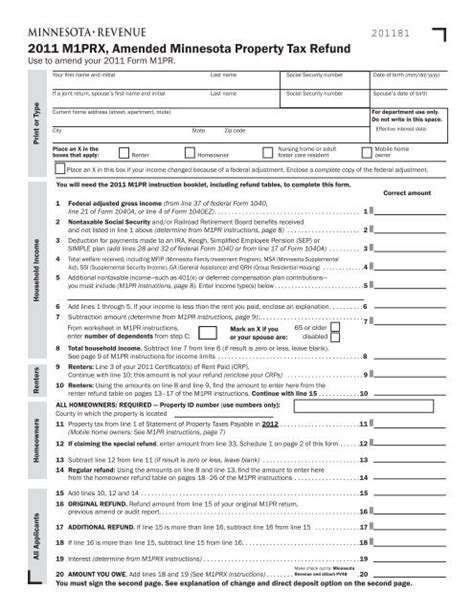

Applying for the Mn State Property Tax Refund

The application process for the Property Tax Refund is designed to be straightforward and accessible to all eligible applicants. The state provides clear guidelines and resources to assist residents in navigating the process.

Online Application

The preferred method of application is through the state’s online portal. This portal is user-friendly and guides applicants through the process step by step. It requires basic personal information, details about the property, and financial information to calculate the refund amount.

Paper Application

For those who prefer traditional methods or have limited access to the internet, the state also offers a paper application. This application can be obtained from local government offices or downloaded from the state’s website. Once completed, it can be mailed or delivered to the appropriate office.

Required Documentation

Applicants will need to provide supporting documentation to verify their eligibility. This typically includes:

- Proof of residency, such as a utility bill or lease agreement.

- Property tax statement or receipt.

- Income verification, which can be a pay stub, W-2 form, or tax return.

- Bank statements or other financial records, if applicable.

Calculating Your Refund

The amount of the Property Tax Refund varies depending on individual circumstances. The state uses a formula that considers income, property value, and the amount of property tax paid. Generally, lower-income individuals and those with higher property taxes are eligible for larger refunds.

Online Refund Calculator

To estimate the potential refund amount, the state provides an online calculator on its website. This tool allows applicants to input their income, property tax, and other relevant details to get an idea of the refund they might receive. It’s a useful tool for budgeting and financial planning.

Refund Schedule

The state releases the refund schedule annually, outlining the dates when refunds are expected to be issued. Refunds are typically issued in the form of a check or direct deposit, depending on the applicant’s preference.

Impact and Future of the Program

The Mn State Property Tax Refund program has a significant impact on the lives of Minnesota residents. It provides much-needed financial support, especially for those who are struggling to make ends meet. The program’s effectiveness is evident in the positive feedback and the number of residents who benefit from it each year.

Community Impact

The Property Tax Refund program has a ripple effect on local communities. When residents receive a refund, they are more likely to spend it locally, supporting local businesses and stimulating the economy. This can lead to job creation and a boost in community development.

Program Evolution

Over the years, the program has evolved to better serve the needs of Minnesota residents. The state has made efforts to simplify the application process, increase awareness, and improve the overall experience for applicants. Additionally, the program’s funding has increased, allowing for a larger number of refunds to be issued each year.

Looking Ahead

As the cost of living continues to rise, the Property Tax Refund program will remain a crucial component of Minnesota’s tax system. The state is committed to ensuring that the program remains accessible and beneficial to those who need it most. Ongoing improvements and adjustments will ensure that the program stays relevant and effective in the face of changing economic conditions.

How often can I apply for the Property Tax Refund?

+You can apply annually for the Property Tax Refund. The program is designed to provide relief for the previous year’s property taxes, so you’ll need to apply each year to receive the refund.

Can I receive the refund if I own multiple properties?

+Yes, you can receive the refund for each property you own as long as they meet the eligibility criteria and are your primary residences.

What happens if I don’t receive my refund by the scheduled date?

+If you don’t receive your refund by the scheduled date, it’s advisable to contact the Minnesota Department of Revenue. They can provide updates on the status of your refund and assist with any issues.

Are there any penalties for claiming the refund if I’m not eligible?

+Yes, falsely claiming the Property Tax Refund can result in penalties, including fines and legal consequences. It’s important to ensure you meet all eligibility criteria before applying.

Can I receive the refund if I rent an apartment or a house?

+Absolutely! Renters can qualify for the Property Tax Refund as long as they meet the income criteria and pay rent to a property owner who owns four or fewer residential units.