How To Not Pay Taxes

In the world of finance and taxation, the idea of not paying taxes often carries a certain allure, but it's crucial to approach this topic with a clear understanding of the legal and ethical implications. While there may be legitimate strategies to minimize tax obligations, the notion of entirely avoiding taxes is fraught with risks and potential consequences. This article aims to provide an in-depth exploration of the complexities surrounding tax evasion and offer insights into navigating the tax landscape responsibly.

Understanding the Legal Framework

Taxation is a fundamental component of any functioning society, funding essential services and infrastructure. The legal framework surrounding taxes is intricate and varies across jurisdictions. In most countries, failing to pay taxes is considered a serious offense, often categorized as tax evasion or fraud.

Tax evasion typically involves deliberate actions to avoid paying taxes through illegal means, such as:

- Underreporting income

- Overstating deductions or expenses

- Hiding assets or income from tax authorities

- Using offshore accounts or entities to conceal wealth

The consequences of tax evasion can be severe, including substantial fines, penalties, and even criminal charges leading to imprisonment. Tax authorities worldwide have sophisticated tools and resources to detect and investigate such activities, making it increasingly challenging to evade taxes successfully.

Legitimate Tax Planning and Minimization Strategies

While avoiding taxes altogether is ill-advised, there are legal and ethical ways to minimize tax obligations through careful planning and understanding of tax laws. Here are some strategies to consider:

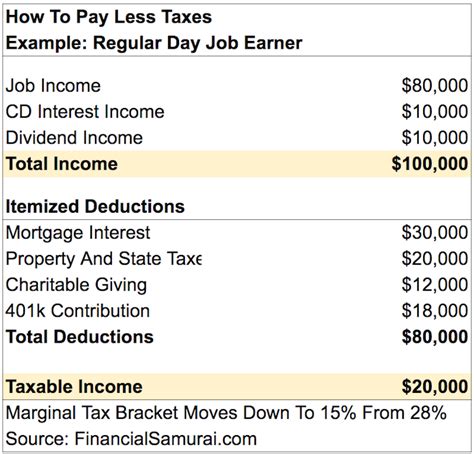

Utilizing Tax Deductions and Credits

Tax deductions and credits are legal mechanisms designed to reduce the taxable income or tax liability. Individuals and businesses can take advantage of these incentives by claiming eligible expenses and investments, such as:

- Mortgage interest deductions

- Education tax credits

- Charitable donation deductions

- Business-related expenses

By optimizing these deductions and credits, taxpayers can lower their tax burden without breaking any laws.

Retirement and Investment Strategies

Certain retirement plans and investment vehicles offer tax advantages. For example, contributing to tax-deferred retirement accounts like 401(k)s or IRAs allows individuals to reduce their taxable income in the present while saving for the future.

Additionally, investing in tax-efficient vehicles such as municipal bonds or certain types of mutual funds can help minimize capital gains taxes.

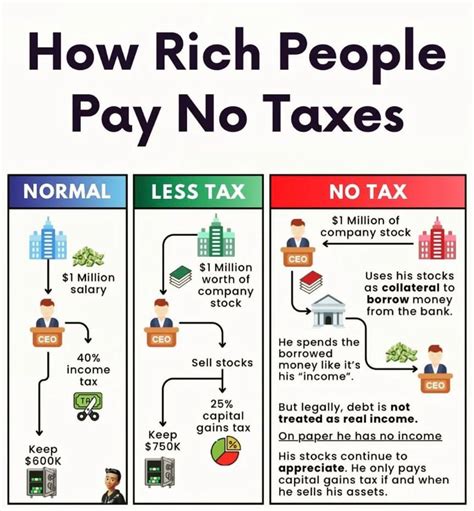

Business Structuring and Optimization

For business owners, the choice of business structure can significantly impact tax obligations. Entities like limited liability companies (LLCs) or S-corporations offer pass-through taxation, where profits are taxed at the individual level rather than the corporate level.

Furthermore, implementing tax-efficient practices, such as cost-effective inventory management or research and development incentives, can help businesses reduce their tax liabilities.

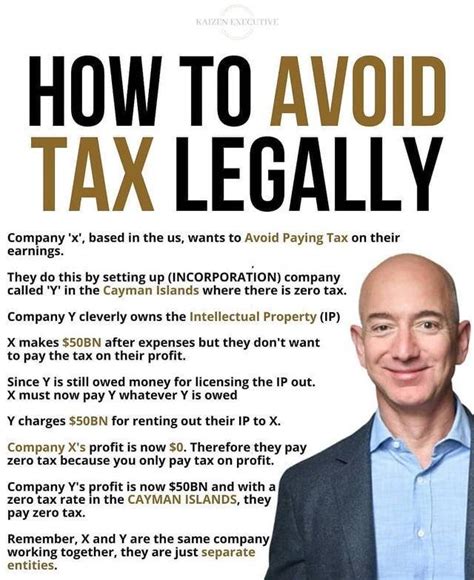

International Tax Planning

In an increasingly globalized world, individuals and businesses may have cross-border tax considerations. International tax planning involves understanding the tax laws of multiple jurisdictions and utilizing legal strategies to minimize the overall tax burden.

For example, some countries offer tax incentives for specific industries or foreign investment, providing opportunities for tax optimization without breaking any laws.

The Risks and Ramifications of Tax Evasion

While tax evasion may seem tempting, the potential consequences are severe and far-reaching. Here are some key considerations to understand the risks:

Financial Penalties

Tax evasion often results in significant financial penalties. Tax authorities can impose fines that are multiples of the unpaid taxes, adding up to a substantial financial burden.

| Violation Type | Penalty Rate |

|---|---|

| Failure to File | 5% of unpaid taxes per month, up to 25% |

| Underpayment of Taxes | 20-75% of unpaid taxes |

| Fraudulent Understatement | 75% of unpaid taxes |

Criminal Charges

Serious cases of tax evasion can lead to criminal charges. Individuals found guilty of tax evasion may face imprisonment, especially if the offense involves fraud, concealment of assets, or other illegal activities.

Damage to Reputation

Beyond the legal and financial consequences, tax evasion can severely damage an individual’s or business’s reputation. News of tax evasion can spread quickly, leading to loss of trust from clients, investors, and the public.

Restricted Future Opportunities

A criminal record resulting from tax evasion can limit future opportunities. Convicted individuals may face difficulties in obtaining loans, securing employment, or even traveling to certain countries.

Responsible Tax Citizenship

Paying taxes is a civic duty and a responsibility of every citizen and business. Taxes fund essential services, infrastructure, and social programs that benefit society as a whole. By paying taxes, individuals and businesses contribute to the collective well-being and sustainability of their communities.

Responsible tax citizenship involves:

- Accurate and timely filing of tax returns

- Honest reporting of income and assets

- Compliance with tax laws and regulations

- Utilizing legal tax planning strategies

Conclusion

While the idea of not paying taxes may be alluring, the risks and consequences of tax evasion far outweigh any potential benefits. It is crucial to approach tax planning with a focus on legality, ethics, and responsibility.

By understanding the legal framework, utilizing legitimate tax minimization strategies, and embracing responsible tax citizenship, individuals and businesses can navigate the tax landscape effectively while contributing to the greater good of society.

What happens if I accidentally underreport my income?

+

Accidental underreporting of income is a common mistake. If you discover an error, it’s best to amend your tax return promptly. Tax authorities often appreciate voluntary corrections and may impose lesser penalties compared to intentional evasion.

Are there any legitimate ways to avoid taxes altogether?

+

While complete tax avoidance is generally illegal, there are certain situations where taxes may not apply. For example, some charitable organizations or religious entities are exempt from certain taxes. However, these cases are highly specific and require thorough understanding of the relevant laws.

How can I ensure I’m paying the right amount of taxes?

+

To ensure you’re paying the correct amount of taxes, consider seeking assistance from tax professionals. They can help you navigate complex tax laws, identify eligible deductions and credits, and ensure compliance with the latest regulations. Regularly updating your knowledge about tax laws and staying informed about any changes can also help you make informed decisions.