Sales Tax Miami

Sales tax is an essential aspect of doing business in any location, and understanding the nuances of local tax regulations is crucial for both consumers and businesses alike. In Miami, Florida, the sales tax system is a complex interplay of state, county, and municipal taxes, which can significantly impact your purchases. This article aims to provide an in-depth analysis of the sales tax structure in Miami, offering a comprehensive guide for those looking to navigate this crucial aspect of financial transactions in the region.

Understanding Sales Tax in Miami

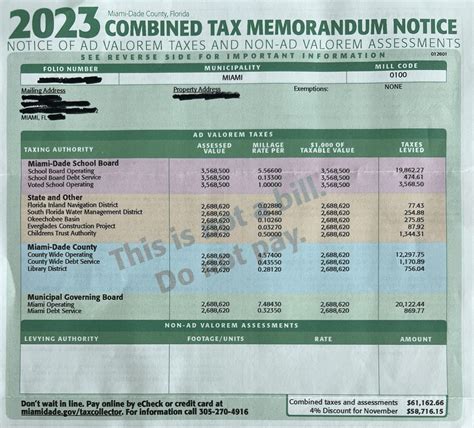

Sales tax in Miami is a combination of the state sales tax rate, the Miami-Dade County sales surtax, and any applicable municipal taxes set by individual cities within the county. This layered tax structure means that the total sales tax rate can vary depending on the location of the purchase within Miami-Dade County.

State Sales Tax

The Florida Department of Revenue sets the state sales tax rate, which is applicable across the state, including Miami. As of the time of writing, the state sales tax rate is 6%, a standard rate that is consistent across Florida. This tax is applied to most tangible personal property and certain types of services.

Miami-Dade County Sales Surtax

On top of the state sales tax, Miami-Dade County imposes an additional sales surtax. This surtax is currently set at 1.5%, bringing the total sales tax rate for purchases within the county to 7.5%. The revenue generated from this surtax is allocated towards specific county projects and initiatives, such as transportation infrastructure and environmental programs.

Municipal Taxes

In addition to the state and county taxes, certain cities within Miami-Dade County have the authority to impose their own municipal sales taxes. These city-specific taxes can further increase the total sales tax rate for purchases made within those municipalities. For example, the city of Miami Beach currently has an additional 1% sales tax, bringing the total sales tax rate within Miami Beach to 8.5%.

Here's a table summarizing the sales tax rates for different locations in Miami-Dade County:

| Location | Total Sales Tax Rate |

|---|---|

| Miami-Dade County | 7.5% |

| Miami Beach | 8.5% |

| Other Cities (e.g., Miami, Hialeah) | 7.5% |

Exemptions and Special Considerations

While the sales tax system in Miami applies to most purchases, there are certain exemptions and special considerations to be aware of. These can significantly impact the total cost of specific transactions, so it’s crucial to understand them.

Exemptions

Certain items and transactions are exempt from sales tax in Florida. These exemptions can be broad, such as sales tax exemptions for specific industries like agriculture or manufacturing, or they can be more specific, such as exemptions for certain types of food, clothing, or prescription drugs.

For example, in Miami, groceries are generally exempt from sales tax, providing a significant savings for households on essential food items. However, it's important to note that certain prepared foods or items sold in convenience stores may not qualify for this exemption, so the specifics can be crucial.

Special Considerations

In addition to exemptions, there are special considerations for certain types of purchases. For instance, when purchasing a vehicle in Miami, the sales tax is calculated based on the purchase price, and the total tax due is split between the Florida Department of Highway Safety and Motor Vehicles and the local tax collector. This process can be complex, and understanding the specific rules for vehicle purchases is essential to ensure compliance.

Another special consideration is the tourist development tax, which is imposed on short-term rentals in Miami-Dade County. This tax is in addition to the standard sales tax and is often overlooked by visitors. Understanding this additional tax is crucial for those planning vacations or business trips to Miami.

Compliance and Filing Requirements

For businesses operating in Miami, understanding the sales tax regulations and compliance requirements is essential to avoid penalties and maintain a positive relationship with tax authorities. The Florida Department of Revenue provides comprehensive guidelines and resources to help businesses navigate the sales tax system.

Registration and Licensing

Businesses that make taxable sales in Florida must register with the Department of Revenue and obtain a sales tax permit. This permit allows the business to collect and remit sales tax on behalf of the state and county. The registration process involves providing specific business information and may require additional licenses or permits depending on the nature of the business.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is then remitted to the Department of Revenue on a regular basis, typically monthly or quarterly, depending on the business’s sales volume. The remittance process involves filing sales tax returns and providing detailed sales reports.

Recordkeeping and Audits

Proper recordkeeping is essential for sales tax compliance. Businesses must maintain records of all sales transactions, including the date, amount, and type of transaction, as well as the applicable tax rate. These records are crucial for preparing accurate sales tax returns and can also be requested during audits conducted by the Department of Revenue.

Audits are a standard part of the sales tax system and are conducted to ensure compliance. During an audit, businesses may be required to provide detailed records and may face penalties for any discrepancies or non-compliance issues identified.

Future Implications and Potential Changes

The sales tax system in Miami, like any tax system, is subject to potential changes and evolutions. These changes can be driven by a variety of factors, including economic shifts, political decisions, and technological advancements.

Potential Rate Changes

Sales tax rates in Miami, as in any jurisdiction, are not set in stone. They can be adjusted through legislative decisions or referendums. While it’s challenging to predict future rate changes, it’s essential for businesses and consumers to stay informed about any proposed changes and their potential impact.

Technological Advancements

The rise of e-commerce and online sales has significantly impacted the sales tax landscape. In Miami, as in many other locations, the collection and remittance of sales tax for online sales can be complex. However, technological advancements, such as automated tax calculation software and improved online payment systems, can streamline this process and ensure compliance.

Economic Considerations

Economic factors, such as inflation, can also influence the sales tax system. For instance, during periods of high inflation, the real value of a fixed sales tax rate can decrease, potentially impacting government revenue. In such cases, policymakers may consider adjusting tax rates or implementing additional taxes to maintain revenue streams.

Conclusion

Understanding the sales tax system in Miami is a crucial aspect of both personal financial planning and business operations in the region. From the state sales tax rate to the Miami-Dade County surtax and municipal taxes, the layered tax structure can significantly impact the total cost of purchases. By understanding the exemptions, special considerations, and compliance requirements, individuals and businesses can navigate this complex system effectively.

Staying informed about potential changes and future developments in the sales tax landscape is essential. As Miami continues to evolve, both economically and technologically, the sales tax system will likely adapt to meet new challenges and opportunities. Whether you're a consumer looking to minimize your tax burden or a business aiming for compliance, keeping up with these changes is key to successful financial management in Miami.

What is the total sales tax rate in Miami, Florida as of 2024?

+The total sales tax rate in Miami, Florida as of 2024 is 7.5%. This includes the state sales tax rate of 6% and the Miami-Dade County surtax of 1.5%. Some cities within the county may have additional municipal taxes, which can increase the total rate further.

Are there any items or transactions exempt from sales tax in Miami?

+Yes, there are certain exemptions in Miami. Groceries are generally exempt from sales tax, providing a significant savings on essential food items. Additionally, there are exemptions for specific industries like agriculture and manufacturing, as well as for certain types of food, clothing, and prescription drugs.

How do I register my business for sales tax in Miami, Florida?

+To register your business for sales tax in Miami, you must obtain a sales tax permit from the Florida Department of Revenue. This involves completing a registration process that includes providing specific business information and may require additional licenses or permits depending on the nature of your business. Visit the Department’s website for detailed instructions and forms.

What happens if I don’t collect and remit sales tax correctly in Miami?

+Failure to collect and remit sales tax correctly in Miami can result in significant penalties and legal consequences. It’s crucial to understand the applicable sales tax rates, exemptions, and compliance requirements to avoid these issues. Seek professional advice if you’re unsure about any aspect of sales tax collection and remittance.