Sales Tax Exemption Form Texas

Sales tax exemption forms are an essential part of doing business in Texas, allowing qualified entities and individuals to make tax-exempt purchases. Understanding the process and requirements for obtaining a sales tax exemption certificate is crucial for businesses to navigate the complex tax landscape effectively.

Navigating Sales Tax Exemption in Texas

In the Lone Star State, sales tax exemption forms play a pivotal role in ensuring compliance with tax regulations. These forms are legal documents that provide proof of an entity’s or individual’s eligibility for tax-exempt purchases. By obtaining a sales tax exemption certificate, businesses can avoid paying sales tax on certain transactions, which can significantly impact their bottom line.

Eligibility and Qualifications

The eligibility criteria for sales tax exemption in Texas are defined by the Texas Comptroller of Public Accounts. Here’s a breakdown of the primary qualifications:

- Entities: Various types of entities, including government agencies, non-profit organizations, and educational institutions, are often eligible for sales tax exemption. Each entity type has specific requirements, and understanding these is crucial for a successful application.

- Individuals: Certain individuals, such as those with qualifying disabilities or those making purchases for personal use that are exempt under state law, may also be eligible for sales tax exemption. The requirements and documentation needed can vary significantly.

It's important to note that while many entities and individuals may be eligible, the specific qualifications can be detailed and complex. Misunderstanding or misrepresenting eligibility can lead to significant legal and financial consequences, so it's essential to seek professional guidance when navigating this process.

The Application Process

Applying for a sales tax exemption certificate in Texas involves a comprehensive and detailed process. Here’s a step-by-step guide:

- Determine Eligibility: Begin by thoroughly reviewing the eligibility criteria provided by the Texas Comptroller's office. Understand the specific requirements for your entity or individual situation.

- Gather Documentation: Collect all necessary documents to support your application. This may include articles of incorporation, tax-exempt status verification, and other relevant legal documents. Ensure all documentation is up-to-date and accurate.

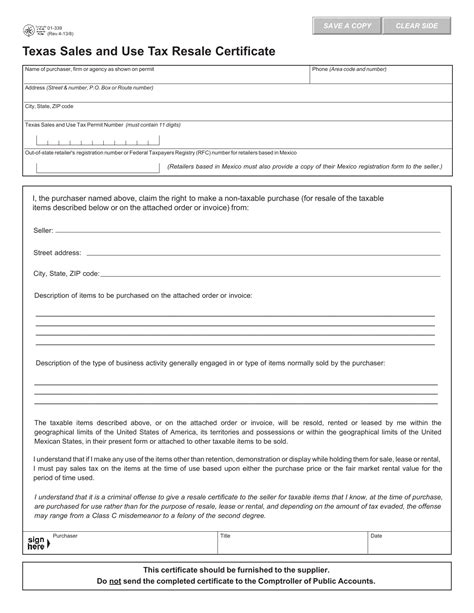

- Complete the Form: Download and fill out the appropriate sales tax exemption form from the Comptroller's website. Pay close attention to the instructions and provide all required information. Incomplete or inaccurate forms may lead to delays or rejection.

- Submit the Application: Submit your completed form and supporting documentation to the Texas Comptroller's office. This can typically be done online or by mail, depending on the specific form and your preference.

- Wait for Approval: Once submitted, the Comptroller's office will review your application. The processing time can vary, but it's essential to be patient and ensure you have all the necessary follow-up information ready.

- Receive and Renew: If your application is approved, you will receive your sales tax exemption certificate. Remember that these certificates are not permanent and must be renewed periodically to remain valid. Keep track of renewal deadlines to avoid lapses in your tax-exempt status.

The application process can be intricate, and seeking guidance from tax professionals or legal advisors can be beneficial to ensure a smooth and successful outcome.

Sales Tax Exemption Benefits and Implications

Obtaining a sales tax exemption certificate in Texas offers several advantages, including reduced costs and increased financial flexibility. By avoiding sales tax on eligible purchases, businesses can reinvest those savings into their operations, research and development, or pass the savings on to their customers.

However, it's important to note that sales tax exemption also comes with responsibilities. Entities and individuals must maintain strict compliance with their tax-exempt status. This includes accurately tracking and reporting exempt purchases, ensuring that the exemption is only applied to eligible transactions, and staying informed about any changes in tax laws or regulations that may impact their status.

In conclusion, navigating the sales tax exemption process in Texas requires a meticulous understanding of eligibility criteria, a comprehensive approach to the application process, and a commitment to ongoing compliance. By obtaining a sales tax exemption certificate, businesses can optimize their financial strategies and contribute to their overall success in the dynamic Texas market.

Frequently Asked Questions

How often do I need to renew my sales tax exemption certificate in Texas?

+The renewal period for sales tax exemption certificates in Texas varies based on the type of entity and the specific certificate. Generally, certificates are valid for a period of one to five years and must be renewed before their expiration date. It’s important to keep track of renewal deadlines to maintain uninterrupted tax-exempt status.

Can I apply for a sales tax exemption certificate online in Texas?

+Yes, the Texas Comptroller’s office provides online application options for many sales tax exemption certificates. However, some certificates may require additional documentation or specific processing methods. It’s recommended to review the application instructions carefully and reach out to the Comptroller’s office for guidance if needed.

What happens if I make a taxable purchase with my sales tax exemption certificate in Texas?

+If you make a taxable purchase using your sales tax exemption certificate, you may be subject to penalties and interest. It’s crucial to carefully review each purchase to ensure it is eligible for tax exemption. If you make a mistake, it’s important to rectify it promptly by paying the applicable taxes and seeking guidance from tax professionals to avoid further complications.