Connecticut Sales Tax Car

When purchasing a vehicle in Connecticut, it's important to understand the state's sales tax laws and how they apply to car sales. The sales tax rate and the process of paying it can impact your overall purchase, so let's delve into the specifics.

Understanding Connecticut’s Sales Tax on Cars

Connecticut, like many other states, imposes a sales tax on the purchase of vehicles. This tax is applied to the total purchase price of the car, including any optional equipment, accessories, and delivery charges. It’s important to note that the sales tax rate can vary depending on the specific location within the state.

As of the latest update, the statewide sales tax rate in Connecticut stands at 6.35%. However, this rate is subject to change, so it's advisable to check with the Connecticut Department of Revenue Services for the most current information.

Additionally, some municipalities in Connecticut may have their own local sales tax rates, which are added on top of the state rate. These local taxes can increase the overall sales tax burden on vehicle purchases. For instance, the city of Bridgeport has an additional 1.5% local sales tax, bringing the total sales tax rate to 7.85% within that specific municipality.

Here's a table outlining the sales tax rates for a few major cities in Connecticut:

| City | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Bridgeport | 6.35% | 1.5% | 7.85% |

| Hartford | 6.35% | 0.5% | 6.85% |

| New Haven | 6.35% | 1.0% | 7.35% |

Exemptions and Special Considerations

While the majority of vehicle purchases in Connecticut are subject to sales tax, there are certain scenarios where the tax may be reduced or exempted. For instance, if you’re purchasing a vehicle for resale, you may be eligible for a reduced tax rate or even an exemption. However, this typically requires specific documentation and compliance with state regulations.

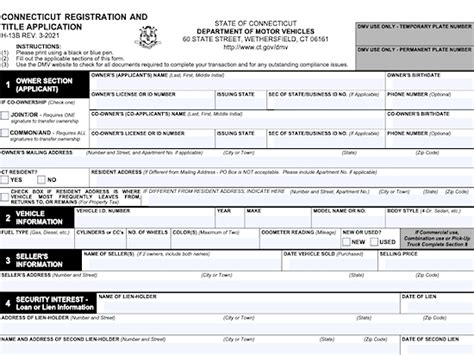

Additionally, some vehicles are classified as "exempt" from sales tax. This includes certain types of vehicles like motorcycles, mopeds, and electric bicycles. It's important to consult the official guidelines provided by the Connecticut Department of Motor Vehicles (DMV) to understand which vehicles fall under this category.

The Sales Tax Process

When purchasing a car in Connecticut, the sales tax is typically collected by the seller at the time of the transaction. The dealer or seller will calculate the tax based on the total purchase price and the applicable tax rate for the specific location. This tax is then remitted to the state and local authorities by the seller.

It's worth noting that in some cases, especially with private sales or out-of-state purchases, the buyer may be responsible for paying the sales tax directly to the state. This is often the case when the seller is not a registered dealer or when the vehicle is being registered for the first time in Connecticut.

Strategies for Minimizing Sales Tax Impact

While the sales tax on car purchases is a necessary part of doing business in Connecticut, there are strategies that buyers can employ to minimize its impact on their overall cost.

Negotiate the Purchase Price

The sales tax in Connecticut is calculated based on the purchase price of the vehicle. By negotiating a lower price with the seller, you can effectively reduce the amount of tax you’ll owe. This strategy is particularly effective when dealing with private sellers or independent dealerships.

Utilize Sales Tax Holidays

Connecticut, like many states, occasionally offers sales tax holidays. During these periods, the state suspends or reduces the sales tax on certain types of purchases, including vehicles. These tax holidays are usually short-lived and often have specific conditions and limitations. It’s important to stay updated on these events to take advantage of them.

Consider Leasing Options

Leasing a vehicle instead of purchasing it can offer some tax advantages. While the specifics can be complex, leasing typically involves lower upfront costs and the sales tax is often included in the monthly lease payments. This can provide a more predictable financial commitment and potentially reduce the overall tax burden.

Explore Trade-In Opportunities

Trading in your old vehicle when purchasing a new one can have tax benefits. The trade-in value can reduce the total purchase price of the new vehicle, which in turn lowers the sales tax amount. It’s important to carefully evaluate the trade-in offer and compare it to other options, such as selling the vehicle privately.

Performance Analysis and Case Studies

To illustrate the impact of sales tax on car purchases, let’s examine a few real-world examples. These case studies will provide concrete insights into how sales tax affects the overall cost of vehicle ownership in Connecticut.

Example 1: Private Sale

Imagine you’re purchasing a used car from a private seller in Hartford, Connecticut. The purchase price of the vehicle is 20,000. With the state sales tax rate of <strong>6.35%</strong> and a local tax rate of <strong>0.5%</strong>, the total sales tax amounts to 1,317.50. This tax is typically paid by the buyer directly to the state.

Example 2: Dealer Purchase

Now, let’s consider a scenario where you’re buying a new car from a dealership in Bridgeport, Connecticut. The vehicle has a purchase price of 35,000. With the combined state and local sales tax rate of <strong>7.85%</strong>, the total sales tax comes to 2,772.50. In this case, the dealer will collect the tax and remit it to the appropriate authorities.

Example 3: Resale and Tax Exemption

Suppose you’re a business owner in New Haven, Connecticut, and you’re purchasing a vehicle for resale purposes. The purchase price is 40,000, and the state and local sales tax rates total <strong>7.35%</strong>. However, due to your resale status, you're eligible for a tax exemption. This exemption saves you 2,940 in sales tax, a significant cost savings.

Future Implications and Considerations

The sales tax landscape in Connecticut, like in many states, is subject to change. As economic conditions evolve and new legislation is enacted, the sales tax rates and regulations may shift. It’s important for both buyers and sellers to stay informed about these changes to ensure compliance and make informed financial decisions.

Additionally, the rise of online vehicle sales and the potential for remote purchases introduces new complexities to the sales tax equation. Buyers and sellers should be aware of the tax implications of cross-border transactions and ensure they comply with the appropriate tax laws.

As the automotive industry continues to evolve, with advancements in electric vehicles and autonomous technology, the tax landscape may also adapt. Governments may introduce new incentives or regulations to encourage the adoption of these technologies, which could impact the sales tax rates and processes.

Are there any sales tax exemptions for specific types of vehicles in Connecticut?

+Yes, certain types of vehicles, such as motorcycles, mopeds, and electric bicycles, are exempt from sales tax in Connecticut. It’s important to consult the official guidelines from the Connecticut DMV to understand which vehicles fall under this category.

How often do sales tax rates change in Connecticut?

+Sales tax rates in Connecticut can change annually or even more frequently. It’s important to check with the Connecticut Department of Revenue Services for the most current rates to ensure compliance.

What documentation is required for a reduced tax rate or exemption when purchasing a vehicle for resale?

+To qualify for a reduced tax rate or exemption when purchasing a vehicle for resale, you’ll typically need to provide a valid Resale Certificate from the Connecticut Department of Revenue Services. This certificate verifies your status as a registered reseller and entitles you to reduced or exempt sales tax rates.