2025 Tax Season

As the world progresses into a new era, tax systems and regulations continue to evolve, impacting individuals and businesses alike. With the year 2025 fast approaching, it's essential to stay informed about the upcoming tax season and the potential changes it may bring. In this comprehensive guide, we delve into the world of tax, exploring the key aspects of the 2025 tax season, offering insights, and helping you navigate the financial landscape with confidence.

Navigating the 2025 Tax Season: A Comprehensive Guide

The tax landscape is ever-changing, and staying abreast of the latest developments is crucial for effective financial planning. As we approach the 2025 tax season, several significant factors come into play, shaping the way individuals and businesses approach their tax obligations.

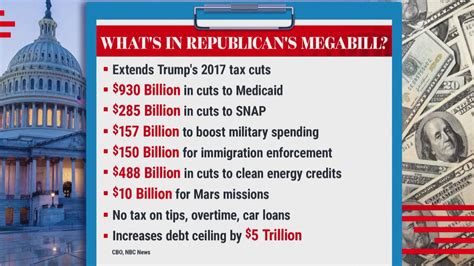

Key Tax Policy Updates for 2025

The year 2025 marks a pivotal moment in tax policy, with several notable updates and adjustments. Here's an overview of the key changes you should be aware of:

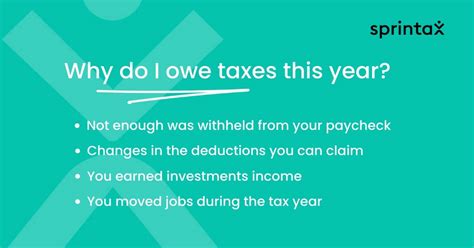

- Income Tax Rates: The federal government has proposed a slight increase in income tax rates for certain brackets. This adjustment aims to address inflationary concerns and maintain a balanced revenue stream for the government. For instance, the top marginal tax rate is expected to rise from 37% to 39%, impacting high-income earners.

- Standard Deduction: To provide some relief to taxpayers, the standard deduction is set to increase across all filing statuses. This means that individuals and families can deduct a larger amount from their taxable income, reducing their overall tax liability. The new standard deductions are projected to be as follows: $12,500 for single filers, $19,000 for married filing jointly, and $11,500 for head of household.

- Child Tax Credit: The child tax credit, a valuable benefit for families with children, has been extended and enhanced. The credit amount has been increased to $3,500 per qualifying child under the age of 6 and $3,000 per child aged 6 to 17. Additionally, the income threshold for claiming the full credit has been raised, ensuring more families can benefit from this provision.

- Business Tax Incentives: To encourage economic growth, the government has introduced several tax incentives for businesses. These include expanded research and development tax credits, enhanced deductions for equipment purchases, and favorable tax treatment for certain start-up expenses. These measures aim to stimulate innovation and investment.

- Estate and Gift Tax: There have been subtle changes to the estate and gift tax thresholds. The federal estate tax exemption has been slightly increased, allowing individuals to pass on a larger portion of their estate tax-free. Similarly, the gift tax exemption has also been adjusted, providing more flexibility for generous gift-giving.

Understanding these policy updates is crucial for effective tax planning. Whether you're an individual taxpayer or a business owner, staying informed about these changes will help you make strategic financial decisions.

Technology and Tax Preparation: A Seamless Partnership

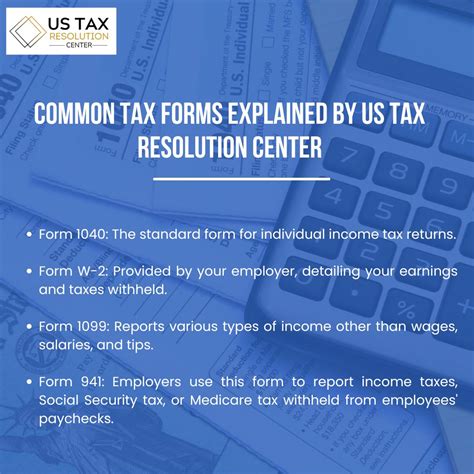

In today's digital age, technology plays a pivotal role in simplifying tax preparation. As we look ahead to the 2025 tax season, the integration of technology in tax management is set to reach new heights.

One of the most significant advancements is the widespread adoption of cloud-based tax software. These platforms offer a secure and efficient way to store and manage tax-related documents, ensuring easy access and collaboration between taxpayers and their tax professionals. Additionally, these software solutions often come equipped with intuitive interfaces and smart features, making the tax preparation process more streamlined and user-friendly.

Furthermore, the use of artificial intelligence (AI) and machine learning in tax preparation is expected to gain momentum. AI-powered tax tools can analyze vast amounts of data, identify potential deductions and credits, and provide personalized recommendations. This not only enhances accuracy but also saves valuable time during the tax filing process.

For instance, AI algorithms can scan through previous tax returns, financial statements, and other relevant documents to identify patterns and trends. Based on this analysis, they can suggest tax-saving strategies, optimize deductions, and even alert users to potential errors or discrepancies. This level of automation not only benefits individual taxpayers but also proves invaluable for businesses with complex tax structures.

However, it's important to note that while technology can streamline the tax preparation process, human expertise remains indispensable. Tax professionals bring a wealth of knowledge and experience to the table, ensuring that taxpayers receive tailored advice and guidance. A combination of advanced technology and human expertise offers the best of both worlds, providing accurate and efficient tax management.

Industry-Specific Tax Considerations for 2025

Different industries face unique tax challenges and opportunities. As we navigate the 2025 tax season, it's essential to delve into the specific considerations for various sectors.

Healthcare Sector

The healthcare industry often deals with complex tax scenarios due to its unique business model and regulatory environment. For instance, healthcare providers may need to navigate tax implications related to telemedicine services, which have become increasingly popular. Additionally, the industry is subject to various tax incentives and penalties related to patient care quality and outcome metrics.

One notable change for the 2025 tax season is the introduction of a new tax credit for healthcare organizations that invest in patient safety and quality improvement initiatives. This credit aims to incentivize organizations to enhance patient care and reduce medical errors. To qualify for this credit, healthcare providers must meet specific criteria and maintain rigorous quality control measures.

Technology and Innovation Sector

The technology and innovation sector is known for its rapid growth and dynamic nature. Tax considerations for this industry often revolve around research and development (R&D) tax credits, intellectual property rights, and international tax planning.

In 2025, the government has expanded the R&D tax credit program, providing more generous incentives for businesses engaged in innovative activities. This includes a higher credit rate and an extended eligibility period. Additionally, there's a new provision that allows start-ups to carry back R&D tax credits to offset past tax liabilities, providing much-needed cash flow benefits.

Real Estate and Construction Sector

The real estate and construction industry often deals with complex tax issues related to property ownership, development, and leasing. In the context of the 2025 tax season, there are several key considerations.

One notable change is the introduction of a new depreciation schedule for commercial real estate. This schedule allows for faster depreciation of certain types of property, providing tax benefits to investors and developers. Additionally, there's a new provision that allows for the immediate expensing of certain improvements made to existing buildings, encouraging property upgrades and renovations.

Future Implications and Planning Strategies

As we look ahead to the 2025 tax season and beyond, it's crucial to consider the long-term implications of tax policies and develop strategic planning approaches.

One key consideration is the potential impact of tax policies on long-term financial planning. For instance, the increased income tax rates may prompt individuals to explore tax-efficient investment strategies or consider tax-advantaged retirement plans. On the business front, companies may need to reevaluate their tax strategies to optimize cash flow and minimize tax liabilities.

Additionally, the ongoing digital transformation of the tax landscape presents both opportunities and challenges. While technology enhances efficiency and accuracy, it also raises concerns about data security and privacy. Taxpayers and businesses must stay vigilant and adopt robust cybersecurity measures to protect sensitive financial information.

In conclusion, the 2025 tax season is set to be a pivotal moment in tax management. With key policy updates, technological advancements, and industry-specific considerations, taxpayers and businesses must stay informed and adapt their strategies accordingly. By staying abreast of the latest developments and seeking expert guidance, individuals and organizations can navigate the tax landscape with confidence and ensure compliance with the ever-evolving tax regulations.

When is the official deadline for filing taxes in 2025?

+The official deadline for filing taxes in 2025 is April 15th. However, if this date falls on a weekend or a holiday, the deadline may be extended to the following business day. It’s always a good idea to plan and file your taxes well in advance to avoid any last-minute rush.

What are some common tax deductions and credits I should be aware of for 2025?

+Some common tax deductions and credits to consider for the 2025 tax season include the Standard Deduction, which is expected to increase, providing relief to taxpayers. Additionally, the Child Tax Credit has been enhanced, offering more benefits to families with children. Other potential deductions include those for education expenses, healthcare costs, and certain business-related expenses.

How can I stay updated on tax policy changes and ensure compliance with the latest regulations?

+Staying updated on tax policy changes is crucial for compliance. Subscribe to reputable tax newsletters, follow trusted tax websites, and consider attending webinars or workshops hosted by tax professionals. Additionally, consult with a tax advisor who can provide personalized guidance based on your specific circumstances.