Dupage County Property Taxes

Dupage County, located in the heart of Illinois, is renowned for its thriving communities, picturesque landscapes, and a thriving real estate market. Property taxes in this county play a significant role in funding essential services and infrastructure, making it an important aspect for both residents and investors to understand. This comprehensive guide aims to shed light on the intricacies of Dupage County property taxes, offering a deep dive into the assessment process, tax rates, payment methods, and strategies to manage and reduce these expenses.

Understanding Property Tax Assessments in Dupage County

The process of property tax assessment in Dupage County is a meticulous one, ensuring fair and accurate taxation. It begins with the DuPage County Assessor’s Office, which is responsible for evaluating all properties within the county. This assessment is crucial as it determines the taxable value of each property, which directly influences the amount of tax owed by the property owner.

The assessment process involves a comprehensive evaluation of the property, taking into account factors such as:

- Property Type: Whether it's residential, commercial, industrial, or agricultural, each category has specific assessment methodologies.

- Location: Properties in different parts of the county may have varying tax rates based on local services and infrastructure.

- Market Value: The assessor considers the property's market value, which is influenced by factors like size, age, condition, and recent sales of comparable properties.

- Improvement Value: Any additions or improvements made to the property, such as renovations or new constructions, can impact the assessment.

Once the assessment is complete, property owners receive a Notice of Proposed Change in Assessment, which details the assessed value of their property. This notice serves as an opportunity for property owners to review and, if necessary, appeal the assessment.

Appeals are an essential part of the process, allowing property owners to ensure they are not overtaxed. The Board of Review in Dupage County hears such appeals, considering factors like accuracy of the assessment, property classification, and any other relevant information presented by the property owner.

Key Takeaway: Property tax assessments in Dupage County are a comprehensive process, considering various factors to ensure fair taxation. Property owners have the right to appeal their assessments, making the system transparent and equitable.

Property Tax Rates and Levies in Dupage County

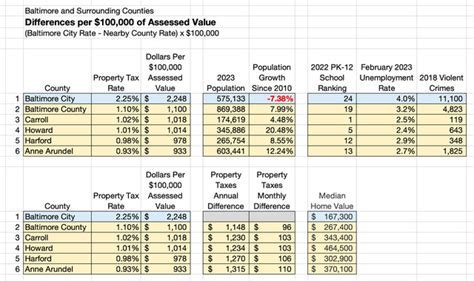

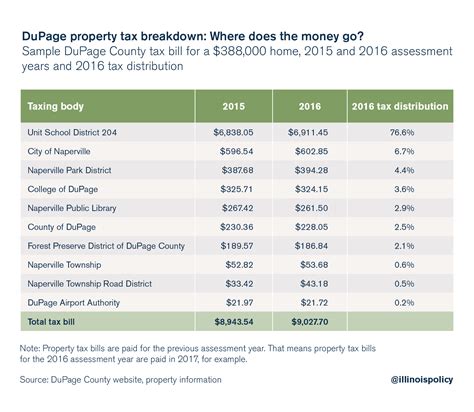

The property tax rate in Dupage County is determined by a combination of factors, primarily the taxing bodies that provide various services to the community. These bodies include the county itself, municipalities, school districts, park districts, and other special-purpose districts.

Each of these entities sets its own tax rate, known as a tax levy, which is then applied to the assessed value of the property. The total tax rate for a property is the sum of all these individual levies. For instance, a property located within the boundaries of a particular school district and municipality would be subject to the tax rates set by both entities.

| Taxing Body | Tax Rate (per $100 of Assessed Value) |

|---|---|

| DuPage County | 2.35 |

| City of Wheaton | 1.58 |

| Community High School District 99 | 2.89 |

| DuPage Forest Preserve District | 1.24 |

| Total Combined Rate | 8.06 |

It's important to note that these rates can vary from year to year, as taxing bodies adjust their levies to meet budgetary needs. Property owners can stay informed about these changes by monitoring local news and the official websites of the respective taxing bodies.

Key Takeaway: Property tax rates in Dupage County are determined by a combination of local taxing bodies, each with its own rate. Understanding these rates and how they are applied is crucial for effective property tax management.

Strategies for Effective Property Tax Management

Managing property taxes effectively is a crucial aspect of property ownership in Dupage County. Here are some strategies to consider:

Stay Informed

Keep abreast of changes in tax rates, assessment methodologies, and any relevant news or updates from the DuPage County Assessor's Office and other taxing bodies. This information is often available on their official websites and local news platforms.

Understand Your Assessment

Review your property's assessment carefully. If you believe the assessed value is incorrect, consider appealing. The process typically involves submitting an appeal application, providing supporting evidence, and possibly attending a hearing.

Explore Tax Incentives and Exemptions

Dupage County offers various tax incentives and exemptions to eligible property owners. These can include:

- Homestead Exemption: Reduces the assessed value of a property for homeowners who use it as their primary residence.

- Senior Citizen Exemption: Provides tax relief to homeowners aged 65 and older.

- Veteran's Exemption: Offers reduced property taxes to honorably discharged veterans and their surviving spouses.

Be sure to research and apply for any exemptions or incentives you may qualify for.

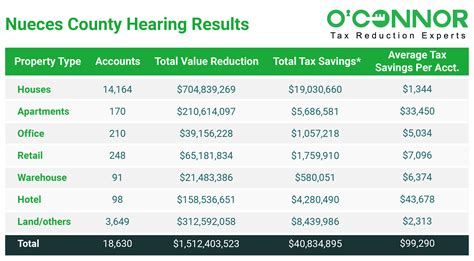

Consider a Tax Appeal

If you believe your property taxes are disproportionately high compared to similar properties in the area, consider appealing. This process can be complex, so it's often beneficial to seek guidance from a professional tax consultant or attorney.

Key Takeaway: Effective property tax management in Dupage County involves staying informed, understanding your assessment, exploring tax incentives, and considering appeals when necessary. These strategies can help reduce the financial burden of property taxes and ensure fair taxation.

Payment Options and Deadlines for Dupage County Property Taxes

Dupage County offers several convenient options for property tax payments, ensuring flexibility for property owners. Here’s an overview of the payment methods and deadlines to keep in mind:

Online Payment

The most convenient method is to pay your property taxes online through the DuPage County Treasurer's Office website. This option allows for secure payment using a credit or debit card, or even an electronic check. You'll need your Property Index Number (PIN) to complete the transaction.

Mail-In Payment

If you prefer a more traditional approach, you can mail your payment to the DuPage County Treasurer's Office. Include your payment stub from the tax bill along with a check or money order made payable to the DuPage County Treasurer. Ensure you allow sufficient time for mailing to avoid late fees.

In-Person Payment

For those who prefer a personal touch, you can visit the DuPage County Treasurer's Office during regular business hours to make your payment. This option allows for immediate confirmation and receipt of payment. The office is located at 421 N. County Farm Road, Wheaton, IL 60187.

Payment Deadlines

Property taxes in Dupage County are due in two installments, with specific deadlines:

- First Installment Deadline: Typically due in March. Failure to pay by this date may result in a penalty.

- Second Installment Deadline: Usually due in September. Again, late payments may incur additional fees.

It's important to note that these deadlines are subject to change, so it's advisable to check the official DuPage County Treasurer's website for the most up-to-date information.

Key Takeaway: Dupage County offers a range of payment options for property taxes, including online, mail-in, and in-person methods. Understanding the payment deadlines and staying organized can help property owners avoid late fees and penalties.

The Impact of Property Taxes on Real Estate Transactions

Property taxes play a significant role in real estate transactions in Dupage County, influencing both buyers and sellers. Here’s how they can impact the process:

Buyer's Perspective

When considering a property purchase, buyers often factor in the property taxes as part of their long-term financial planning. High property taxes can deter potential buyers, especially if they perceive the tax burden as excessive relative to the property's value. Therefore, understanding the tax implications is crucial for buyers, helping them make informed decisions.

Seller's Perspective

Sellers, on the other hand, need to be transparent about the property's tax history and any potential tax liabilities. Failure to disclose this information accurately can lead to legal issues and may even result in the sale being voided. Sellers should also consider the tax implications of the sale itself, as proceeds from the sale may be subject to capital gains tax.

Impact on the Real Estate Market

Property taxes can significantly influence the overall real estate market in Dupage County. Areas with lower tax rates may experience higher demand, leading to increased property values. Conversely, high tax rates can lead to slower market growth or even price corrections. Therefore, tax rates are a critical consideration for both buyers and sellers, impacting the dynamics of the local real estate market.

Key Takeaway: Property taxes are a crucial factor in real estate transactions, influencing both buyers and sellers. Transparency and accurate understanding of tax implications are essential for a smooth and successful transaction.

Future Outlook: Trends and Developments in Dupage County Property Taxes

The landscape of property taxes in Dupage County is continually evolving, influenced by various factors such as economic trends, political decisions, and demographic changes. Here’s a glimpse into some of the potential future developments:

Economic Growth and Property Values

As Dupage County's economy continues to thrive, it's likely that property values will rise. This growth could lead to higher property taxes, as assessments are directly linked to market values. However, the county's strong economy may also attract new businesses and residents, potentially leading to increased tax revenue and the ability to maintain or even reduce tax rates.

Changing Tax Policies

Tax policies are subject to change, and Dupage County may see shifts in tax rates or assessment methodologies in the future. These changes could be influenced by factors such as budget constraints, political priorities, or shifts in the distribution of tax revenue among various taxing bodies.

Population Growth and Infrastructure Needs

Dupage County's population is projected to grow, which will place increased demands on infrastructure and services. To meet these needs, taxing bodies may need to adjust their tax rates or explore new revenue streams. This could impact property taxes, with potential increases to fund necessary infrastructure upgrades and service enhancements.

Key Takeaway: The future of property taxes in Dupage County is dynamic, influenced by economic growth, changing tax policies, and population trends. Staying informed about these developments can help property owners and investors make strategic decisions regarding their real estate holdings.

Conclusion: Navigating Property Taxes in Dupage County

Property taxes are an integral part of owning real estate in Dupage County, and understanding their intricacies is crucial for both residents and investors. From the assessment process to payment options and future outlook, this comprehensive guide has provided an in-depth look at the world of Dupage County property taxes.

By staying informed, understanding the assessment process, and exploring strategies to manage and reduce taxes, property owners can effectively navigate the tax landscape. Whether it's appealing an assessment, claiming eligible exemptions, or simply staying on top of payment deadlines, proactive management can lead to significant savings and a more positive real estate experience.

As Dupage County continues to evolve, so too will its property tax system. Staying engaged and aware of these changes will ensure property owners can adapt and thrive in this dynamic environment.

How often are property assessments conducted in Dupage County?

+Property assessments in Dupage County are conducted every three years. This triennial assessment cycle ensures that property values are updated regularly, reflecting any changes in the market.

What happens if I miss the deadline for property tax payments?

+Missing the deadline for property tax payments can result in late fees and penalties. It’s important to stay organized and plan your payments to avoid these additional costs. If you anticipate difficulties with payment, consider reaching out to the DuPage County Treasurer’s Office for guidance.

Can I appeal my property tax assessment if I disagree with it?

+Absolutely! If you believe your property tax assessment is incorrect or unfair, you have the right to appeal. The process involves submitting an appeal application and providing supporting evidence. It’s recommended to seek professional guidance to ensure a successful appeal.

Are there any tax incentives or exemptions available for homeowners in Dupage County?

+Yes, Dupage County offers several tax incentives and exemptions to eligible homeowners. These include the Homestead Exemption, Senior Citizen Exemption, and Veteran’s Exemption. It’s worth exploring these options to reduce your property tax burden.