St Louis Sales Tax

Welcome to an in-depth exploration of the St. Louis sales tax, a critical aspect of doing business in this vibrant city. Understanding the intricacies of local sales tax is essential for any business owner, as it directly impacts your bottom line and compliance with state and local regulations.

In this comprehensive guide, we will delve into the specifics of St. Louis sales tax, providing you with the knowledge and tools to navigate this complex landscape with ease. From the basic rates to the specific items taxed, we'll cover it all, ensuring you have the information you need to make informed decisions and stay compliant.

Understanding the St. Louis Sales Tax Landscape

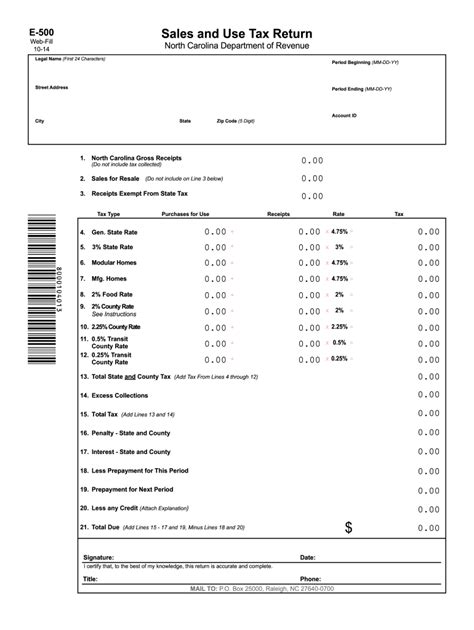

St. Louis, with its rich history and diverse economy, has a unique sales tax structure that combines state, county, and city taxes. This layered system can be complex, but with the right insights, it becomes manageable. Here’s a breakdown of the key components:

The State Sales Tax

Missouri, the state in which St. Louis is located, imposes a state sales tax rate of 4.225%. This rate is consistent across the state and applies to most tangible personal property and some services.

| State Sales Tax | Rate |

|---|---|

| Missouri | 4.225% |

St. Louis County Sales Tax

In addition to the state sales tax, St. Louis County levies its own tax. The St. Louis County sales tax rate is 1.5%, bringing the total county and state sales tax to 5.725%.

| St. Louis County Sales Tax | Rate |

|---|---|

| St. Louis County | 1.5% |

| Total County and State Tax | 5.725% |

The City of St. Louis Sales Tax

The city of St. Louis has its own sales tax rate, which varies based on the type of goods or services being sold. The base city sales tax rate is 3.25%, but there are additional taxes for certain items. For example, the city imposes a 0.5% tax on prepared food and a 1% tax on car rentals.

| City of St. Louis Sales Tax | Rate |

|---|---|

| Base City Sales Tax | 3.25% |

| Prepared Food Tax | 0.5% |

| Car Rental Tax | 1% |

With these varying rates, it's crucial for businesses to understand the specific tax obligations for their industry and products. Let's explore some real-world examples to illustrate these points.

A Real-World Example: Sales Tax for a St. Louis Restaurant

Consider a restaurant located within the city limits of St. Louis. This restaurant serves a variety of dishes, including prepared meals and alcoholic beverages. Here’s a breakdown of the sales tax obligations for this business:

- Meals: For prepared meals, the restaurant must charge a 9.725% sales tax, which includes the state, county, and city tax, plus the additional 0.5% prepared food tax imposed by the city.

- Alcoholic Beverages: Alcohol sales are subject to a higher tax rate. In this case, the restaurant would charge a 11.975% sales tax, incorporating the state, county, and city tax, as well as a 2.25% tax on alcoholic beverages levied by the city.

This example demonstrates the complexity of sales tax obligations, even within a single business type. It's essential for businesses to stay informed and up-to-date with these regulations to avoid penalties and ensure a smooth operation.

Special Considerations: Exemptions and Special Tax Rates

It’s important to note that not all items are taxed at the same rate, and some may be exempt from sales tax altogether. For instance, certain grocery items, prescription drugs, and non-prepared food are typically exempt from sales tax in Missouri.

Additionally, there are special tax rates for specific industries and situations. For example, the Missouri Department of Revenue has outlined special tax rates for various sectors, including telecommunications, transient guest, and bad debt.

Navigating Sales Tax Compliance in St. Louis

Compliance with sales tax regulations is crucial for any business operating in St. Louis. Here are some key considerations and strategies to ensure your business remains compliant:

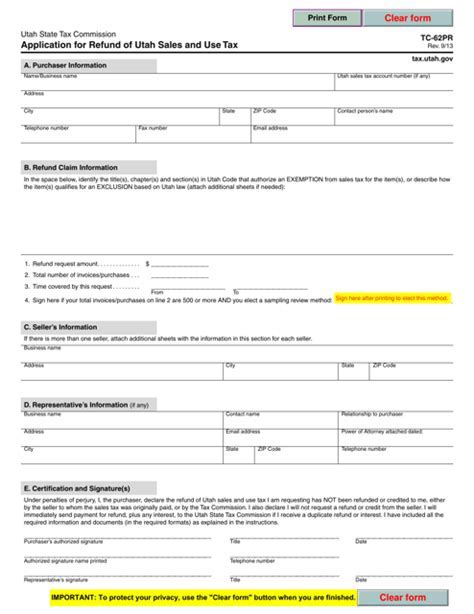

Registering for Sales Tax

To collect and remit sales tax, businesses must first register with the Missouri Department of Revenue. This process involves providing business details and obtaining a sales tax license, which allows you to collect and report sales tax.

Calculating and Collecting Sales Tax

Once registered, businesses must accurately calculate the sales tax for each transaction. This involves applying the correct tax rate based on the location of the sale and the nature of the goods or services being sold. It’s crucial to use the correct rates to avoid undercharging or overcharging customers, which can lead to compliance issues.

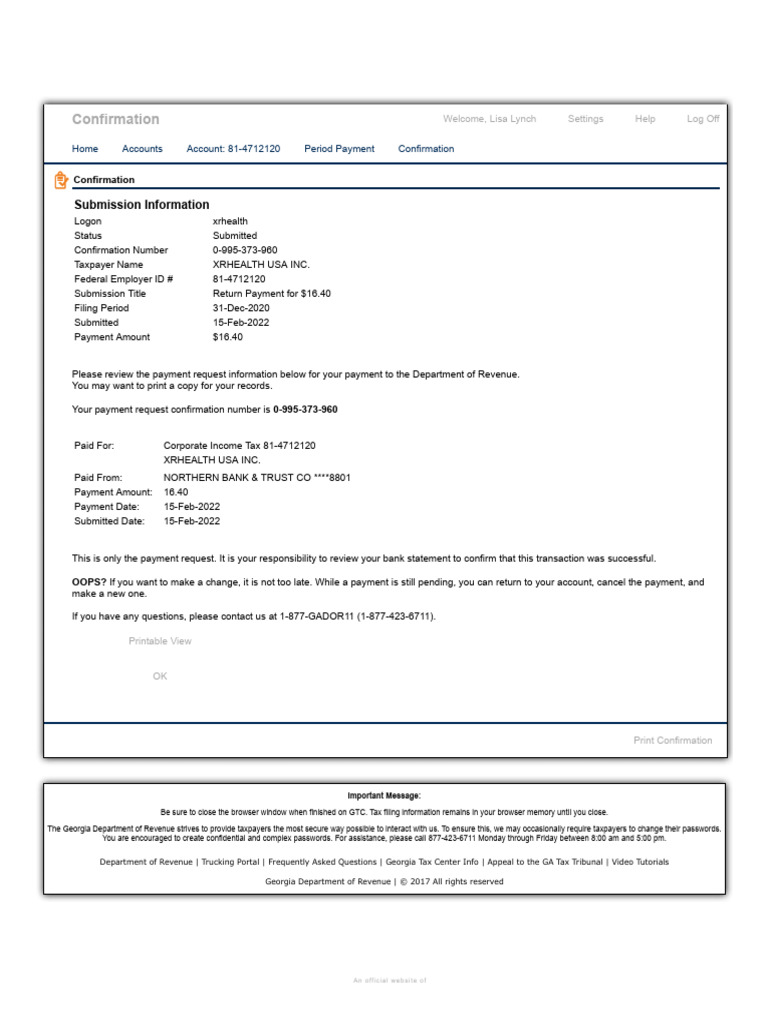

Remitting Sales Tax

Businesses are typically required to remit sales tax to the state on a regular basis, often monthly or quarterly. This process involves filing sales tax returns and paying the collected tax to the state. Failure to remit sales tax can result in penalties and interest charges.

Sales Tax Software and Tools

To simplify the sales tax process, many businesses utilize specialized sales tax software. These tools can help with tax calculation, filing, and compliance, ensuring that your business stays on top of its sales tax obligations.

Future Implications and Trends in St. Louis Sales Tax

The world of sales tax is constantly evolving, and St. Louis is no exception. Here are some key trends and potential future developments to watch out for:

Online Sales Tax Collection

With the rise of e-commerce, the collection of sales tax on online sales has become a growing concern. The Missouri Department of Revenue has guidelines for collecting sales tax on online sales, and businesses must stay updated with these regulations to ensure compliance.

Potential Tax Rate Changes

Sales tax rates can fluctuate over time due to various factors, including economic conditions and legislative decisions. Businesses should stay informed about potential rate changes to adapt their pricing and budgeting strategies accordingly.

Technology-Driven Solutions

As technology advances, we can expect to see more innovative solutions for sales tax compliance. From AI-powered tax calculation tools to blockchain-based tax remittance systems, the future of sales tax may be increasingly digital and efficient.

Conclusion: Staying Ahead of the Curve in St. Louis Sales Tax

Understanding and navigating the St. Louis sales tax landscape is a crucial aspect of doing business in this dynamic city. By staying informed about the current tax rates, exemptions, and compliance requirements, businesses can ensure they operate within the law and maintain a positive relationship with their customers and the state.

As we've explored in this comprehensive guide, the St. Louis sales tax system is complex but manageable with the right knowledge and tools. Whether you're a seasoned business owner or just starting out, staying ahead of the curve on sales tax regulations is essential for long-term success.

What is the current sales tax rate in St. Louis city?

+The current sales tax rate in St. Louis city is 3.25% for most goods and services. However, there are additional taxes for specific items, such as a 0.5% tax on prepared food and a 1% tax on car rentals.

Are there any sales tax exemptions in St. Louis?

+Yes, certain items are exempt from sales tax in St. Louis, including most grocery items, prescription drugs, and non-prepared food. It’s important to consult the Missouri Department of Revenue for a comprehensive list of exemptions.

How often do businesses need to remit sales tax in St. Louis?

+Businesses typically remit sales tax to the state on a regular basis, often monthly or quarterly. The frequency can depend on the business’s sales volume and other factors. It’s important to consult the Missouri Department of Revenue for specific guidelines.

What happens if a business fails to remit sales tax in St. Louis?

+Failure to remit sales tax can result in penalties and interest charges. The Missouri Department of Revenue has guidelines for non-compliance, and businesses should be aware of these consequences to ensure timely and accurate tax remittance.

Are there any resources available to help businesses with sales tax compliance in St. Louis?

+Yes, the Missouri Department of Revenue provides extensive resources and guidelines for sales tax compliance. Additionally, businesses can consider using sales tax software or consulting with tax professionals to ensure they meet their sales tax obligations accurately and efficiently.