Luxury Car Tax Changes

In the ever-evolving landscape of the automotive industry, tax policies play a pivotal role in shaping consumer choices and market trends. The Luxury Car Tax (LCT), a key revenue-generating mechanism for governments, has been a subject of interest and debate among car enthusiasts, industry experts, and policymakers alike. With recent changes proposed to this tax regime, it is imperative to delve into the intricacies of these amendments and their potential implications.

Understanding the Luxury Car Tax

The Luxury Car Tax is a sales-based levy imposed on the purchase of new vehicles that exceed a certain price threshold. This threshold, known as the luxury car threshold, varies across jurisdictions and is periodically adjusted to account for inflation and market dynamics. The primary objective of LCT is to generate revenue and, to some extent, influence consumer behavior towards more affordable and environmentally conscious options.

For instance, in Australia, the Luxury Car Tax is applicable to new vehicles priced over AUD $77,565 (as of 2023). The tax rate is 33% of the value above this threshold, making it a significant consideration for buyers in the luxury car segment. However, this tax regime is not without its complexities and has often sparked discussions about its fairness and impact on the automotive market.

Recent Amendments: A New Paradigm

The proposed changes to the Luxury Car Tax aim to address some of the long-standing concerns surrounding this policy. Here’s a breakdown of the key amendments and their potential outcomes:

Threshold Adjustments

One of the most anticipated changes is the adjustment of the luxury car threshold. The idea is to raise the threshold, allowing more vehicles to fall outside the tax net. This move is seen as a response to the increasing prices of vehicles, especially in the premium segment, making the tax more inclusive and less restrictive.

Consider the case of the 2023 BMW X5, which retails for around AUD $100,000. With the current threshold, this vehicle would attract a significant LCT, potentially deterring buyers. However, with a higher threshold, the X5 could fall below the tax radar, making it a more attractive option for those seeking a premium SUV.

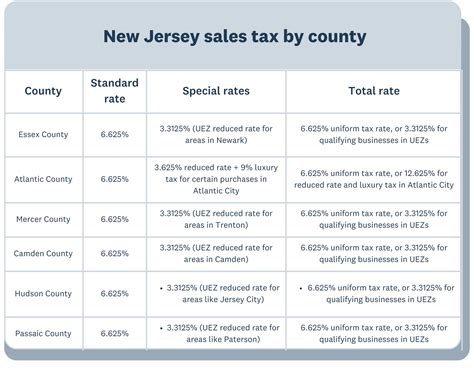

| Vehicle Model | Base Price (AUD) | Current Threshold | Proposed Threshold | LCT Impact |

|---|---|---|---|---|

| BMW X5 | 100,000 | 77,565 | 90,000 (Proposed) | No LCT |

| Mercedes-Benz GLE | 95,000 | 77,565 | 90,000 (Proposed) | No LCT |

| Audi Q8 | 110,000 | 77,565 | 90,000 (Proposed) | Reduced LCT |

As the table illustrates, a higher threshold could significantly reduce the LCT burden for popular luxury SUVs, making them more accessible to a broader audience.

Environmental Considerations

In an era where sustainability is a key focus, the proposed amendments also introduce environmental incentives. Vehicles with lower emissions or those powered by alternative energy sources could be eligible for reduced or waived LCT. This move not only promotes eco-friendly choices but also aligns with global efforts to combat climate change.

For example, the Tesla Model 3, an electric vehicle (EV) with a starting price of around AUD $60,000, would be exempt from LCT under the new proposals. This incentivizes consumers to opt for EVs, which are not only environmentally beneficial but also offer a unique driving experience.

Impact on the Luxury Car Market

The changes to the Luxury Car Tax are expected to have a significant impact on the market dynamics of luxury vehicles. Here’s a glimpse into the potential outcomes:

- Increased Sales: With a reduced tax burden, especially for popular luxury models, sales are likely to increase across the board. This could lead to a boom in the luxury car segment, benefiting both manufacturers and dealerships.

- Competitive Pricing: To remain competitive, manufacturers might adjust their pricing strategies. This could result in more affordable luxury vehicles, further boosting sales and attracting a wider customer base.

- Shift Towards Sustainability: The environmental incentives are poised to drive a shift towards sustainable transportation. As consumers become more aware of the benefits of EVs and hybrid vehicles, the market could witness a rise in demand for these eco-friendly options.

However, it is essential to note that these amendments are still in the proposal stage, and the final decisions could be subject to further modifications. The automotive industry and consumers eagerly await the official announcement to understand the full extent of these changes.

Conclusion: A Balanced Approach

The proposed changes to the Luxury Car Tax signify a move towards a more balanced and inclusive tax regime. By adjusting the threshold and introducing environmental considerations, policymakers aim to strike a chord between revenue generation and consumer satisfaction. As the industry navigates these changes, it is evident that the luxury car market is poised for an exciting transformation, offering a wider range of choices to car enthusiasts.

When are the proposed changes to the Luxury Car Tax expected to come into effect?

+The exact timeline for the implementation of these changes is not yet confirmed. However, industry sources suggest that the amendments could be rolled out in the next fiscal year, providing sufficient time for manufacturers and dealerships to adapt their strategies.

Will these changes apply to used luxury cars as well?

+No, the proposed amendments are solely focused on new vehicles. The tax regime for used luxury cars remains unchanged, ensuring a stable market for pre-owned luxury vehicles.

Are there any concerns about revenue generation with these amendments?

+While the adjustments might result in a slight decrease in LCT revenue, the overall impact is expected to be minimal. The focus on environmental incentives could also lead to increased tax revenue from other sustainable transportation options, balancing out any potential losses.