Filing Back Tax Returns

For various reasons, whether it be oversight, lack of understanding, or even intentional avoidance, some individuals may find themselves in a situation where they need to file back tax returns. This process, often referred to as "amending past tax returns" or "filing back taxes," is a crucial step to ensure compliance with tax laws and regulations. It is a complex procedure that requires careful consideration and attention to detail.

In this comprehensive guide, we will delve into the world of filing back tax returns, providing an expert-level analysis of the process, its implications, and the steps individuals should take to navigate this often daunting task. By the end of this article, readers will have a thorough understanding of the ins and outs of back tax filing, enabling them to approach the process with confidence and clarity.

Understanding the Necessity of Filing Back Taxes

Filing back tax returns is not a task to be taken lightly. It is often a result of unforeseen circumstances or a lack of awareness regarding tax obligations. Understanding the reasons behind the need to file back taxes is essential to appreciating the significance of this process.

Common Scenarios Leading to Back Tax Filing

-

Overlooked Income or Deductions: In some cases, individuals may have missed reporting certain sources of income or eligible deductions during their initial tax filing. This could be due to a simple oversight or a lack of understanding of tax regulations. For instance, forgetting to report rental income, self-employment earnings, or even certain types of investment gains can lead to the necessity of filing back taxes.

-

Tax Return Amendments: Taxpayers may discover errors or discrepancies in their previously filed returns. This could be due to miscalculations, incorrect application of tax laws, or changes in tax regulations that were not considered at the time of filing. Amending these errors often requires filing back taxes to ensure accurate reporting and compliance.

-

Life Events and Changes: Significant life events such as marriage, divorce, birth or adoption of a child, or changes in employment status can have a substantial impact on an individual’s tax situation. Failing to report these changes accurately in a timely manner may necessitate filing back taxes to rectify any discrepancies.

-

Unreported Income: In certain situations, individuals may have received income that was not reported to the tax authorities. This could be intentional tax evasion or an honest mistake. Regardless, unreported income must be disclosed through the filing of back taxes to avoid potential legal repercussions.

The Impact of Non-Compliance

Failing to file back tax returns when necessary can have serious consequences. These may include:

-

Legal Penalties: Tax authorities impose penalties for non-compliance, which can include fines, interest charges, and even criminal prosecution in severe cases of tax evasion.

-

Interest Accumulation: Unpaid taxes accumulate interest over time, leading to a growing financial burden for the taxpayer.

-

Audit Risks: Tax authorities may initiate an audit if they suspect inaccuracies or unreported income, which can be a lengthy and stressful process.

-

Financial Instability: The stress and financial strain of dealing with tax debts and penalties can impact an individual’s overall financial stability and creditworthiness.

By understanding the potential consequences of non-compliance, individuals can recognize the importance of taking proactive measures to file back tax returns and resolve any outstanding tax issues.

The Step-by-Step Process of Filing Back Taxes

Filing back taxes is a detailed and meticulous process that requires precision and adherence to tax regulations. The following steps outline the general procedure individuals should follow when preparing to file back tax returns.

Gathering Necessary Information

Before beginning the filing process, it is crucial to gather all relevant documentation and information. This step ensures that the taxpayer has a clear understanding of their financial situation and can accurately complete the necessary tax forms.

-

Financial Records: Collect all financial records for the tax years in question, including bank statements, investment statements, payroll records, and any other income-related documents.

-

Tax Returns: Obtain copies of previously filed tax returns for the years being amended. These can be retrieved from tax preparation software, tax professionals, or the tax authority’s website.

-

Supporting Documents: Gather any additional supporting documents, such as receipts, invoices, or records of deductions and expenses, that may be required to substantiate the amended tax returns.

Assessing the Situation

Once the necessary information has been gathered, it is important to carefully assess the situation to determine the extent of the amendments required.

-

Identify Errors or Omissions: Review the previously filed tax returns and identify any errors, omissions, or discrepancies that need to be addressed. This may involve recalculating tax liabilities, adjusting income or deductions, or adding previously unreported income.

-

Calculate Tax Differences: Determine the tax difference between the original return and the amended return. This calculation will help in understanding the potential financial impact of the amendments.

-

Consider Tax Consequences: Understand the tax implications of the amendments. Some adjustments may result in additional tax liabilities, while others could lead to tax refunds or credits. Consider seeking professional advice to navigate these consequences effectively.

Preparing Amended Tax Returns

With the necessary information and understanding of the amendments, the next step is to prepare the amended tax returns.

-

Choose the Right Forms: Depending on the tax year and the nature of the amendments, select the appropriate tax forms. This may include Form 1040X for individual income tax returns or specific schedules and forms for business taxes.

-

Complete the Forms Accurately:

Carefully fill out the amended tax forms, ensuring that all relevant information is included. Pay close attention to detail, as errors in this step can lead to further complications.

-

Attach Supporting Documentation: Include all supporting documents and financial records that substantiate the amendments. This provides transparency and helps tax authorities understand the basis for the changes.

-

Review and Verify: Before submitting the amended returns, thoroughly review them for accuracy. Consider having a trusted tax professional or accountant review the forms to ensure compliance and accuracy.

Filing and Payment Options

Once the amended tax returns are prepared, the taxpayer must decide on the filing and payment options that best suit their situation.

-

Electronic Filing: Many tax authorities offer electronic filing options for amended returns. This method is often faster and more secure than traditional mail filing.

-

Mail Filing: If electronic filing is not an option, taxpayers can choose to mail their amended returns to the appropriate tax authority.

-

Payment Methods: Determine the payment method for any outstanding tax liabilities. This could include direct payment, installment agreements, or offers in compromise. Consider the tax authority’s guidelines and eligibility criteria for these options.

Post-Filing Considerations

After filing the amended tax returns, there are several important considerations to keep in mind.

-

Response Time: Understand the tax authority’s response time for processing amended returns. This information can be found on their website or by contacting their support services.

-

Follow-Up: If there are any discrepancies or additional information required, the tax authority may contact the taxpayer. It is essential to respond promptly to any such requests to avoid delays in processing.

-

Record-Keeping: Maintain copies of the amended returns, supporting documents, and any correspondence with the tax authority for future reference. These records can be crucial in case of an audit or further inquiries.

Expert Insights and Best Practices

Navigating the process of filing back taxes can be complex and challenging. Here are some expert insights and best practices to ensure a smoother and more efficient experience.

Seek Professional Assistance

Tax laws and regulations can be intricate and difficult to navigate, especially when dealing with back taxes. Consider seeking the assistance of a qualified tax professional or accountant who can provide guidance and support throughout the process.

Stay Informed about Tax Laws

Tax laws and regulations are subject to change, and staying informed about these changes is crucial. Regularly review tax updates and consult reliable sources to ensure compliance with the latest tax requirements.

Organize and Maintain Records

Effective record-keeping is essential when dealing with back taxes. Organize financial records, tax returns, and supporting documents in a systematic manner to facilitate easy access and reference during the filing process.

Understand Payment Options

Taxpayers have various payment options available when filing back taxes. Understand these options, including installment agreements, offers in compromise, and penalty abatement, to choose the most suitable method based on their financial situation.

Be Proactive and Timely

Addressing back tax issues promptly is crucial. Being proactive and timely in filing amended returns demonstrates good faith and can potentially reduce penalties and interest charges. Tax authorities often appreciate timely action and may be more lenient in such cases.

Consider Tax Credits and Refunds

Filing back taxes may lead to additional tax credits or refunds. Stay informed about eligible tax credits and deductions that can offset tax liabilities or result in refunds. Properly claiming these credits can provide financial relief and improve overall tax compliance.

Future Implications and Long-Term Strategies

Filing back taxes is not just about resolving past tax issues; it is also an opportunity to establish better tax practices for the future. Here are some considerations for long-term tax planning and compliance.

Establish a Tax Calendar

Create a tax calendar to stay organized and on top of tax deadlines. Mark important dates, such as filing deadlines, payment due dates, and tax-related events, to ensure timely compliance with tax obligations.

Regularly Review Tax Withholdings

Periodically review tax withholdings from employment income or pensions to ensure they align with the taxpayer’s financial situation and expected tax liabilities. Adjusting withholdings can help avoid underpayment penalties and ensure a more accurate tax refund or balance due.

Explore Tax-Saving Strategies

Consult with tax professionals to explore tax-saving strategies that are legally compliant and applicable to the taxpayer’s situation. This could include maximizing deductions, utilizing tax credits, or considering tax-efficient investment options.

Keep Up with Tax Changes

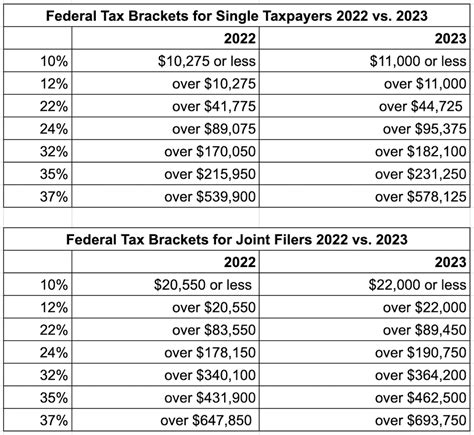

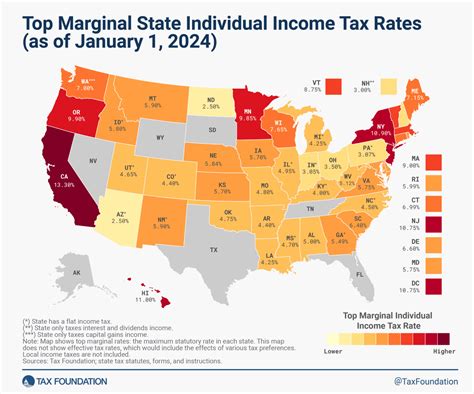

Tax laws and regulations are constantly evolving. Stay informed about tax reforms, new tax provisions, and changes in tax rates to ensure compliance and take advantage of any potential benefits.

Consider Tax Planning Services

For complex tax situations or high net worth individuals, engaging tax planning services can provide specialized advice and strategies to optimize tax liabilities and ensure compliance with applicable laws.

Conclusion: A Fresh Start with Tax Compliance

Filing back tax returns is a challenging but necessary step towards achieving tax compliance and financial stability. By understanding the process, following expert advice, and adopting long-term tax planning strategies, individuals can resolve past tax issues and move forward with confidence. Tax compliance is an ongoing commitment, and by staying informed and proactive, taxpayers can navigate the complex world of taxation with ease and peace of mind.

What happens if I don’t file back taxes when required?

+Failing to file back taxes when necessary can lead to serious consequences, including legal penalties, interest accumulation, audit risks, and financial instability. Tax authorities may impose fines, initiate audits, and pursue legal action against non-compliant taxpayers.

Can I file back taxes on my own, or do I need professional help?

+While it is possible to file back taxes independently, the complexity of tax laws and regulations often warrants professional assistance. Tax professionals, such as accountants or enrolled agents, can provide valuable guidance, ensure accuracy, and help navigate the intricacies of back tax filing.

Are there any tax benefits or credits I should be aware of when filing back taxes?

+Yes, filing back taxes may uncover eligible tax benefits or credits that can offset tax liabilities or result in refunds. These could include tax credits for education expenses, energy-efficient home improvements, or even certain tax breaks for specific life events. It is essential to stay informed about these opportunities to maximize tax savings.

How long do I have to file back taxes, and are there any limitations on amendments?

+The time limit for filing back taxes varies depending on the jurisdiction and the nature of the amendments. Generally, taxpayers have three years from the original filing deadline or the date the tax was paid, whichever is later, to file amended returns. However, it is crucial to consult with tax authorities or professionals to understand the specific limitations and deadlines applicable to their situation.