Sales Tax Rate New Jersey

Welcome to a comprehensive exploration of the sales tax landscape in the state of New Jersey, a dynamic region with a unique approach to taxation. This in-depth article aims to unravel the intricacies of New Jersey's sales tax system, offering a detailed guide for both residents and businesses alike. From the basics of sales tax rates to the complexities of tax laws and their implications, we will navigate this essential aspect of the state's economy.

Unraveling the Sales Tax Landscape in New Jersey

The Garden State, as New Jersey is affectionately known, boasts a vibrant economy and a robust sales tax system. With a diverse range of industries and a thriving consumer market, understanding the state's sales tax rates and regulations is crucial for financial planning and compliance.

The Basic Sales Tax Rate: A Foundation

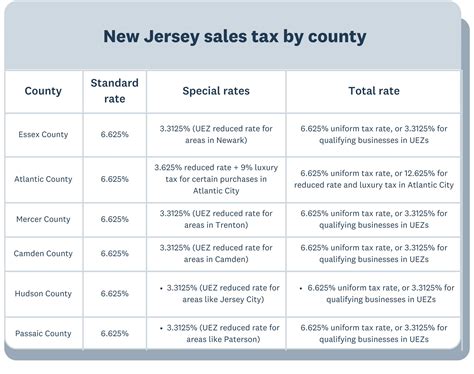

New Jersey's sales tax structure is founded on a base rate of 6.625%, which is applicable to most retail transactions within the state. This base rate is a key component of the state's revenue generation and forms the backbone of the sales tax system.

However, it's essential to note that the 6.625% rate is not a universal constant. New Jersey's sales tax system is designed to be flexible and adaptive, allowing for additional taxes and exemptions based on various factors. These factors include the type of goods or services being purchased, the location of the transaction, and specific exemptions outlined in state tax laws.

| Sales Tax Category | Tax Rate |

|---|---|

| General Sales Tax | 6.625% |

| State and Local Sales Tax | Varies by Municipality |

| Use Tax | Equivalent to Sales Tax |

Exploring the Layers: State and Local Sales Tax

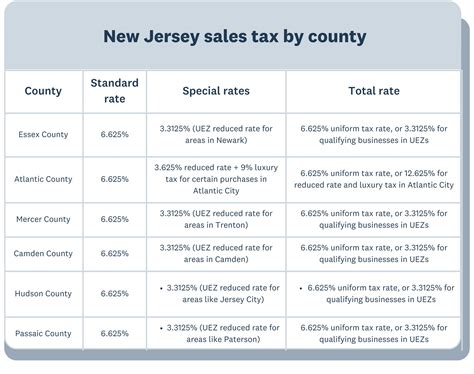

While the 6.625% general sales tax is a statewide standard, New Jersey also imposes local sales taxes that vary depending on the municipality in which the transaction occurs. These local taxes are an additional layer to the state's sales tax structure, making the overall tax rate higher or lower depending on the specific location.

For instance, in the city of Jersey City, the local sales tax rate is 3.5%, which when added to the state's general sales tax, results in an effective rate of 10.125%. On the other hand, in a municipality like Allamuchy Township, the local sales tax rate is 0%, meaning the effective sales tax rate remains at the state's base rate of 6.625%.

This variability in local sales tax rates underscores the importance of understanding the specific tax regulations in each municipality within New Jersey. It is a critical aspect of financial planning and tax compliance for both businesses and consumers.

The Use Tax: A Complementary Mechanism

In addition to sales taxes, New Jersey also imposes a use tax, which is designed to ensure fairness and equity in the state's tax system. The use tax is equivalent to the sales tax, and it applies to purchases made outside of New Jersey but used within the state.

For instance, if a New Jersey resident purchases a product online from a retailer in another state and the purchase is not taxed by the out-of-state retailer, the resident is responsible for paying the use tax to the New Jersey Division of Taxation. This ensures that all purchases made for use in New Jersey are taxed, regardless of where the transaction occurred.

Special Considerations: Exemptions and Discounts

New Jersey's sales tax system also includes exemptions and discounts for certain goods and services. These exemptions are outlined in the state's tax laws and are designed to provide relief and support to specific industries or consumer groups.

For example, New Jersey offers a sales tax exemption for certain food items, such as unprepared foods and beverages. This exemption is a significant benefit for consumers, as it reduces the cost of essential groceries and promotes financial accessibility for residents.

Similarly, there are sales tax discounts for specific services, such as those provided by nonprofit organizations or certain healthcare providers. These discounts are a way for the state to encourage and support these sectors, recognizing their vital role in the community.

Navigating the Future: Implications and Trends

As we look ahead, the future of New Jersey's sales tax system is shaped by several key factors. The continued evolution of e-commerce and online retail presents both challenges and opportunities for the state's tax regulations.

With an increasing number of transactions occurring online, ensuring fair taxation and compliance becomes a complex task. New Jersey, like many other states, will need to adapt its tax laws to keep pace with the dynamic nature of the digital economy.

Additionally, the state's economic growth and development will influence the future of its sales tax system. As New Jersey's economy expands and diversifies, the tax structure may need to evolve to support new industries and maintain revenue stability.

In conclusion, New Jersey's sales tax system is a dynamic and intricate mechanism, designed to support the state's economy while ensuring fairness and compliance. From the basic sales tax rate to the complexities of local taxes and exemptions, understanding this system is essential for both businesses and consumers.

As we navigate the ever-changing landscape of taxation, staying informed and adapting to new regulations is key. For more insights and updates on New Jersey's sales tax system, stay tuned to our platform, where we provide the latest news and analysis on this crucial aspect of the state's economy.

What is the general sales tax rate in New Jersey?

+The general sales tax rate in New Jersey is 6.625%.

Are there additional local sales taxes in New Jersey?

+Yes, New Jersey has local sales taxes that vary by municipality. These local taxes are in addition to the state’s general sales tax.

What is the purpose of New Jersey’s use tax?

+New Jersey’s use tax ensures that all purchases made for use within the state are taxed, even if they were not taxed at the time of purchase. It applies to out-of-state purchases.

Are there any sales tax exemptions in New Jersey?

+Yes, New Jersey offers sales tax exemptions for certain goods and services, such as unprepared food and nonprofit organization services. These exemptions are outlined in the state’s tax laws.

How does New Jersey’s sales tax system adapt to the growth of e-commerce?

+New Jersey, like many states, is adapting its tax laws to address the complexities of e-commerce and online retail. This includes considering how to fairly tax online transactions and ensure compliance.