New York State Tax Extension

Navigating the complex world of taxes is a challenge for many individuals and businesses, especially when unexpected circumstances arise. One common situation that taxpayers face is the need to request an extension for filing their taxes. In New York State, the process of obtaining a tax extension involves a few key steps and considerations. Let's delve into the specifics of a New York State tax extension, exploring the requirements, procedures, and implications for taxpayers.

Understanding the New York State Tax Extension

A tax extension, often referred to as a filing extension, is a temporary relief measure granted by the Internal Revenue Service (IRS) and state tax authorities, allowing taxpayers additional time to complete and submit their tax returns. While an extension provides a crucial breathing space for taxpayers, it's important to note that it only extends the filing deadline, not the payment deadline.

In New York State, the standard filing deadline for individual income tax returns is April 15th. However, if you find yourself unable to meet this deadline due to extenuating circumstances, you can request an extension to push the due date to October 15th.

Who Can Request a Tax Extension in New York State?

The tax extension in New York State is available to a wide range of taxpayers, including individuals, businesses, and entities. Whether you're a sole proprietor, a small business owner, or an individual with complex financial affairs, you may qualify for an extension.

It's important to note that while an extension provides valuable time, it doesn't absolve you from your tax obligations. You still need to estimate your tax liability accurately and make any necessary payments by the original due date to avoid penalties and interest charges.

Benefits of a Tax Extension

- Time to Gather Information: A tax extension provides valuable time to gather all the necessary financial records, documents, and information required to complete your tax return accurately.

- Reduced Stress: For individuals and businesses facing complex tax situations, an extension can alleviate the pressure of meeting tight deadlines, allowing for a more thorough and accurate filing process.

- Avoidance of Penalties: In certain circumstances, requesting an extension can help taxpayers avoid late filing penalties, especially if they're unable to meet the standard filing deadline.

The Process of Requesting a New York State Tax Extension

The process of obtaining a tax extension in New York State is straightforward but requires careful attention to detail. Here's a step-by-step guide to help you navigate the process:

Step 1: Determine Your Eligibility

Before initiating the extension request, ensure that you meet the eligibility criteria. In most cases, taxpayers who are unable to file their returns by the original due date due to extenuating circumstances can request an extension.

Step 2: Estimate Your Tax Liability

Even if you're requesting an extension, it's crucial to estimate your tax liability accurately. This estimation will determine the amount of tax you need to pay by the original due date to avoid penalties and interest.

To estimate your tax liability, you can use online tax calculators or consult with a tax professional. Ensure that you consider all applicable deductions, credits, and expenses to arrive at an accurate estimate.

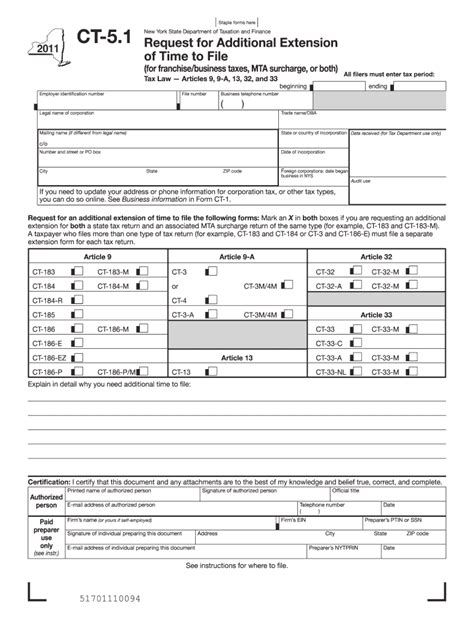

Step 3: Complete and Submit Form IT-380

The official form for requesting a tax extension in New York State is Form IT-380, titled Automatic Extension of Time to File New York State Individual Income Tax Return. This form is available on the New York State Department of Taxation and Finance's website.

When filling out the form, provide accurate and complete information, including your personal details, estimated tax liability, and the reason for requesting the extension. Common reasons for requesting an extension include:

- Complex financial affairs or business operations.

- Waiting for additional income or expense documentation.

- Illness or injury that prevented timely filing.

- Natural disasters or other unforeseen circumstances.

Step 4: Make the Required Tax Payment

As mentioned earlier, a tax extension only extends the filing deadline, not the payment deadline. Therefore, you must make the required tax payment by the original due date to avoid penalties and interest.

You can make your tax payment through various methods, including electronic funds transfer (EFT), credit card, or by mailing a check or money order. Ensure that you provide the correct tax year, form number, and payment amount to avoid any processing delays.

Step 5: File Your Tax Return by the Extended Deadline

Once you've obtained your tax extension, you have until October 15th to file your tax return. Use this time wisely to gather all necessary documents and complete your tax return accurately.

Remember to keep a copy of your extension request and any supporting documentation for your records. If you need assistance with filing your tax return, consider seeking help from a tax professional or using reputable tax preparation software.

Important Considerations and Implications

While a tax extension can provide valuable time, it's essential to understand the implications and potential drawbacks:

Interest and Penalties

If you fail to pay the estimated tax liability by the original due date, you may be subject to interest charges and penalties. These additional costs can accumulate over time, so it's crucial to make timely payments to avoid financial burdens.

Limited Extension Period

The tax extension period in New York State is typically six months, extending the filing deadline from April 15th to October 15th. However, it's important to note that this extension is not unlimited. Taxpayers should use the additional time efficiently to complete their tax returns and avoid further delays.

Late Filing Penalties

Even with a tax extension, it's crucial to file your tax return by the extended deadline. Failure to do so may result in late filing penalties, which can be significant. The late filing penalty is usually 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%.

Expert Insights and Tips

To navigate the tax extension process successfully, here are some expert insights and tips to keep in mind:

- Plan Ahead: If you anticipate needing an extension, start planning early. Gather your financial records, estimate your tax liability, and prepare the necessary documentation to streamline the extension request process.

- Seek Professional Advice: Tax laws and regulations can be complex, especially when dealing with extensions and penalties. Consider consulting a tax professional or accountant who can provide tailored advice based on your specific circumstances.

- Stay Informed: Stay updated on any changes or updates to tax laws and regulations, especially those related to extensions and penalties. The tax landscape can evolve, and being aware of these changes can help you make informed decisions.

- Maintain Good Records: Keep accurate and organized financial records throughout the year. This practice will not only simplify the tax filing process but also provide valuable documentation if you need to support your extension request or address any tax-related inquiries.

In conclusion, a New York State tax extension can provide much-needed relief for taxpayers facing challenging circumstances. By understanding the process, eligibility criteria, and implications, you can navigate the extension request effectively and ensure compliance with tax regulations. Remember, while an extension offers valuable time, it's crucial to remain diligent in your tax obligations to avoid penalties and interest charges.

Table: Key Facts about New York State Tax Extension

| Standard Filing Deadline | April 15th |

|---|---|

| Extension Deadline | October 15th |

| Form for Extension Request | IT-380 |

| Payment Due Date | Original due date (April 15th) |

Frequently Asked Questions

Can I request a tax extension if I owe taxes?

+

Yes, you can request a tax extension even if you owe taxes. However, it’s crucial to estimate your tax liability accurately and make the required payment by the original due date to avoid penalties and interest.

What happens if I miss the extended deadline for filing my tax return?

+

If you fail to file your tax return by the extended deadline, you may be subject to late filing penalties. These penalties can be significant, so it’s important to prioritize filing your return by the due date.

Can I request an extension for multiple tax years simultaneously?

+

No, you need to request an extension for each tax year separately. If you require an extension for multiple tax years, you must submit a separate request for each year, following the same process outlined above.

Are there any circumstances where a tax extension may be denied?

+

In most cases, a tax extension will be granted if you provide a valid reason and meet the eligibility criteria. However, if there are concerns about fraud or significant non-compliance with tax laws, the extension request may be denied. It’s important to provide accurate and truthful information when requesting an extension.

Can I request an extension if I’m expecting a tax refund?

+

Yes, you can request a tax extension regardless of whether you’re expecting a tax refund or owe taxes. The extension provides additional time to file your return accurately, and if you’re due a refund, you will receive it once your return is processed.