Horry County Sc Tax Records

Welcome to an in-depth exploration of the Horry County, South Carolina, tax records, a crucial resource for homeowners, investors, and anyone with an interest in the real estate market of this vibrant county. With its diverse landscape ranging from coastal beaches to inland forests, Horry County offers a unique blend of natural beauty and economic opportunities. As such, understanding the tax landscape is essential for navigating property ownership and investment in this region.

Navigating the Horry County Tax Records

The Horry County tax records serve as a comprehensive database, providing insights into the property values, tax assessments, and ownership details of real estate properties within the county. These records are publicly accessible, offering a transparent view of the local real estate market and its dynamics. Whether you’re a resident seeking information on your property taxes or an investor researching potential opportunities, delving into these records can offer valuable insights.

The tax records are maintained by the Horry County Assessor's Office, which is responsible for appraising and assessing the value of all taxable properties within the county. This process ensures that property taxes are levied fairly and accurately, reflecting the current market value of each property.

Key Features of Horry County Tax Records

Here’s a closer look at what you can expect to find within the Horry County tax records:

- Property Details: Comprehensive information about each property, including its physical address, legal description, square footage, and number of rooms.

- Ownership Information: Details about the current owner, including their name, mailing address, and contact information. Historical ownership records can also be traced, offering a timeline of ownership changes.

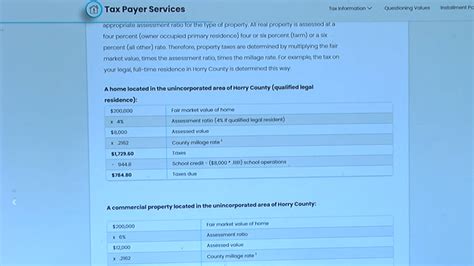

- Tax Assessments: The assessed value of the property, which is determined by the county assessor and used as the basis for calculating property taxes. This value reflects the property's estimated market value.

- Tax Rates and Amounts: The tax rates applicable to the property, which are set by local authorities, and the resulting tax amount owed for the current and previous years.

- Exemptions and Deductions: Information on any exemptions or deductions applied to the property, such as homestead exemptions or veteran's exemptions, which can reduce the taxable value of the property.

- Sale History: Records of any recent or historical sales of the property, including the sale date, sale price, and buyer information. This data can provide valuable insights into the property's value and market trends.

- Building Permits and Improvements: Details on any recent improvements or additions made to the property, such as renovations or new constructions, which may impact the property's assessed value.

| Property Type | Number of Properties | Average Assessed Value |

|---|---|---|

| Residential | 35,672 | $189,500 |

| Commercial | 4,120 | $475,200 |

| Agricultural | 1,325 | $160,000 |

Utilizing Horry County Tax Records for Research and Planning

The Horry County tax records are an invaluable resource for a variety of purposes. Real estate professionals, investors, and prospective homebuyers can use these records to analyze market trends, identify potential investment opportunities, and make informed decisions about property purchases.

Real Estate Market Analysis

By examining the tax records, you can gain insights into the overall health and trends of the Horry County real estate market. Analyzing the assessed values, sale prices, and tax rates can help identify areas of growth or decline, as well as potential undervalued properties.

For instance, a sudden increase in assessed values for a particular neighborhood could indicate a surge in property demand, potentially leading to a seller's market. On the other hand, consistently low assessed values might suggest an area ripe for investment and development.

Property Investment and Research

When considering a property investment in Horry County, the tax records become an essential tool. They provide a wealth of information about a property’s value, tax obligations, and recent sale history, all of which are critical factors in the decision-making process.

For example, if you're researching a commercial property, you can use the tax records to understand its tax liability, compare it to similar properties, and assess its potential for income generation. The records can also highlight any recent improvements or renovations, which may impact the property's value and appeal to tenants.

Homeownership and Tax Planning

For homeowners in Horry County, the tax records are a key resource for understanding their property’s value and tax obligations. Regularly reviewing these records can help ensure that property taxes are calculated accurately and fairly.

Additionally, the records can help homeowners qualify for certain exemptions or deductions, such as the homestead exemption, which can reduce their taxable value and lower their annual tax bill. Keeping abreast of these opportunities is crucial for effective tax planning.

Conclusion

The Horry County tax records are a powerful tool for anyone with an interest in the local real estate market. Whether you’re a seasoned investor, a prospective homeowner, or a real estate professional, understanding and utilizing these records can provide a competitive edge and ensure well-informed decisions.

By exploring the wealth of information within these records, you can navigate the diverse and dynamic landscape of Horry County's real estate market with confidence and precision.

How often are Horry County tax records updated?

+The Horry County Assessor’s Office typically updates tax records annually, with the assessed values reflecting the market conditions as of January 1st of each year. However, certain changes, such as recent property sales or significant improvements, may be recorded throughout the year.

Can I access Horry County tax records online?

+Yes, Horry County offers an online tax records database that provides access to property information and tax assessment details. The online platform is user-friendly and allows users to search by property address or owner name.

What if I disagree with the assessed value of my property?

+If you believe the assessed value of your property is inaccurate, you have the right to appeal. The Horry County Assessor’s Office provides a formal process for appealing property assessments. It’s recommended to gather supporting evidence, such as recent appraisals or sales data of comparable properties, to strengthen your case.